Zyra Guardian Pro

Demo indirildi:

57

Yayınlandı:

7 Mayıs 2025

Mevcut sürüm:

1.16

Uygun bir robot bulamadınız mı?

Freelance üzerinden kendi

robotunuzu sipariş edin

Freelance'e git

Freelance üzerinden kendi

robotunuzu sipariş edin

Bir alım-satım robotu veya gösterge nasıl satın alınır?

Uzman Danışmanınızı

sanal sunucuda çalıştırın

sanal sunucuda çalıştırın

Satın almadan önce göstergeyi/alım-satım robotunu test edin

Mağazada kazanç sağlamak ister misiniz?

Satış için bir ürün nasıl sunulur?

Alım-satım fırsatlarını kaçırıyorsunuz:

- Ücretsiz alım-satım uygulamaları

- İşlem kopyalama için 8.000'den fazla sinyal

- Finansal piyasaları keşfetmek için ekonomik haberler

Kayıt

Giriş yap

Gizlilik ve Veri Koruma Politikasını ve MQL5.com Kullanım Şartlarını kabul edersiniz

Hesabınız yoksa, lütfen kaydolun

🚀 Zyra Guardian Pro - Optimized Settings Available 📥

Dear traders,

To help you maximize the performance of Zyra Guardian Pro, I have prepared a collection of optimized settings (.set files) for various symbols and timeframes. You can download them here:

👉 Download Optimized Set Files: https://www.mql5.com/en/blogs/post/762288

🔧 The settings are regularly updated with new configurations based on community feedback. Make sure to check back often for the latest improvements.

💡 If you have any questions or need help, feel free to ask. Wishing you great success with Zyra Guardian Pro! 🚀

Recently, someone asked me if it is possible to disable the grid system in Zyra Guardian Pro and use it with single entries only, without any grid reinforcements.

✅ The answer is yes.

Simply set "Number max of trade" = 1.

This means the EA will only open one position at a time, with no grid reinforcement.

You can then set a Stop Loss (SL) and a Take Profit (TP) (for example, SL 3% and TP 3%) for each entry.

The EA will then focus on finding the best entry points independently, without a grid.

Here is an example of optimization on Gold (XAUUSD) using this method in 2025:

➡️ Keep testing, optimizing, and exploring Zyra Guardian Pro. It can adapt to all strategies! 🚀

🛠 Developer’s Note — Version 1.12

Some users have reported that backtests may take longer with this version. This behavior is expected, as Zyra Guardian Pro performs many internal safety and consistency checks for its protection and recovery systems.

👉 I’m currently working on optimizing the engine to significantly reduce backtest duration without compromising accuracy or trading logic.

A performance update will be released soon once testing and validation are complete.

Thank you all for your feedback and patience 🙏

Your input helps me make Zyra Guardian Pro even more stable and efficient.

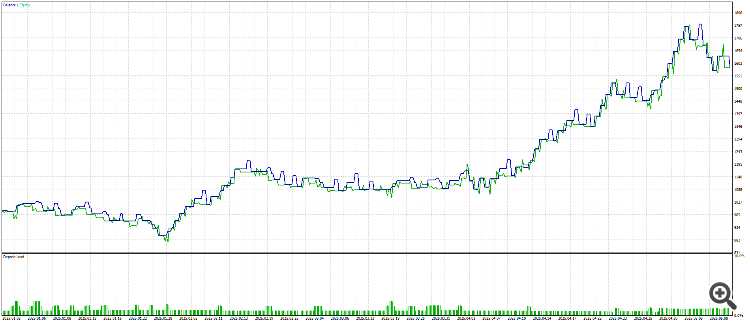

Zyra Guardian Pro — EURUSD M15 (2020-01-01 → today).

Set uses Ichimoku + RSI with consensus-based entries to cut noise.

Equity/balance curve shows a steady climb with contained pullbacks and quick recoveries.

Occasional drawdown spikes, but the long-term slope stays consistent.

Entries/distribution by hours, weekdays, months look well spread (see charts).

Intraday focus on M15; designed for disciplined, rules-based trading.

No aggressive curve-fitting—logic remains simple and readable.

Screens display overview stats plus entry and P&L histograms for clarity.

Use EURUSD M15 to match the test context shown in the images.

Re-validate on your own broker conditions before any live use.

Portfolio Signal Update (Demo 100,000€) — 12 Symbols / 12 Set Files

I finally launched a portfolio signal on a 100,000€ demo account, running 12 set files (one per symbol). I will share the set files, explain the full strategy, and post regular updates on the evolution of this portfolio.

Why a demo account?

I am using a demo for a simple reason: I genuinely believe this portfolio approach requires a meaningful starting capital to operate correctly. I also want to be transparent—financially, the last few years have been difficult, and I’m not ready yet to allocate the real capital level I consider appropriate for this setup.

Also, on MQL5, signals can only be created from a real account. Signals based on demo accounts are not allowed and are automatically removed. MQL5

That’s why I’m not publishing it as an official MQL5 Signal right now, but I will share performance updates and tracking from this demo portfolio.

Why 100,000€?

The goal is to demonstrate that my EA is built to handle larger accounts with a portfolio mindset (risk distribution, controlled drawdown, and systematic balancing). I want to be clear: my EA is not designed to “perform miracles” on very small accounts. This is not a lottery-style robot; it’s a portfolio engine.

Portfolio allocation

My target allocation is 5,000€ per symbol. I’m running 12 symbols / 12 set files:

XAUUSD

AUDUSD

EURUSD

USDJPY

NZDUSD

AUDJPY

CADJPY

EURAUD

EURCAD

GBPAUD

EURCHF

EURJPY

Strategy (Strategy 01)

All set files are based on the same core logic:

Ichimoku + RSI

Consensus = 3

Timeframe: M15

The main variable across symbols is the Take Profit (TP) tuning.

Risk model (same logic across the portfolio)

Every set file is aligned on the same proportional SL model:

SL = 1,000€ per 0.01 lot

Example: 0.02 lot → 2,000€ SL, etc.

Monthly auto-rebalancing (portfolio protection)

A key part of my approach is automatic monthly rebalancing across symbols so each instrument manages the same budget every month.

This avoids a situation where a more aggressive pair grows too fast, dominates the equity curve, and creates a portfolio imbalance.

It is fully automated (no manual operations).

Set files built on the last 5 years

These set files were designed and refined using the last 5 years of historical data, with the objective of maintaining consistency across different market regimes.

Backtest snapshot (portfolio metrics)

Here is a quick summary of the portfolio backtest report shown in the screenshots:

“Minimum capital” simulation (12,000€ for 12 symbols)

I also ran a separate simulation to see what happens if someone starts with the strict minimum capital: 12,000€ for 12 symbols (1,000€ per symbol).

The purpose is to show, realistically, how undercapitalization can change the behavior of a multi-symbol portfolio (margin pressure, risk concentration, recovery capacity). I will share more details about that scenario in my next updates.

1-year live monitoring (VPS already paid)

This demo portfolio will stay running for one full year on a paid VPS, and I will provide regular progress updates.

Final objective

The objective is to prove the robustness of the portfolio approach over time, build credibility with transparent tracking, and ultimately sell the EA. Long term, I want to run it on a real account under the capital conditions that make sense for this system.

Disclaimer: This is not financial advice. Demo results and backtests do not guarantee future performance, and real execution conditions (slippage, liquidity, spreads, psychology) can differ.

5-Week Update — Portfolio Signal (Demo 100,000€) | Money Management Adjustment

It has now been 5 weeks since I launched this 12-symbol demo portfolio (12 set files / one per symbol). The system is behaving as expected and the portfolio logic (risk distribution + balancing) is running smoothly.

That said, the current risk profile is too conservative and the performance is too slow to be interesting for the objective of this project.

What I’m changing (Money Management)

Starting now, I am increasing the risk by changing the money management baseline:

Previous allocation: 5,000€ per symbol

New allocation: 1,000€ per symbol

This adjustment is intentional: I want the portfolio to generate a more meaningful growth rate. The trade-off is clear and fully assumed: higher risk, higher volatility, potentially higher drawdown.

Why this change?

With 5,000€ per symbol, the system is extremely stable, but the monthly results are not attractive enough from a portfolio / product perspective. Moving to 1,000€ per symbol increases the exposure and makes the strategy’s performance more representative of what many users actually look for.

Important note

This is still a demo environment and the goal remains transparency and long-term tracking. I will continue to post updates and share observations, especially on drawdown behavior and recovery dynamics under this higher-risk profile.

Disclaimer: This is not financial advice. Demo results do not guarantee future performance. Real trading conditions (spread, slippage, liquidity) can change outcomes.