Daniel Stein / Perfil

- Informações

|

12+ anos

experiência

|

30

produtos

|

2185

versão demo

|

|

9

trabalhos

|

1

sinais

|

0

assinantes

|

Founder

em

Stein Investments

Visite a nossa nova página de boas-vindas da Stein Investments

para obter as últimas informações, actualizações e estratégias de negociação.

Clique em https://www.mql5.com/en/blogs/post/755375

Se tiver dúvidas, contacte-nos e teremos todo o gosto em ajudar.

Tudo de bom e boas negociações

Daniel

para obter as últimas informações, actualizações e estratégias de negociação.

Clique em https://www.mql5.com/en/blogs/post/755375

Se tiver dúvidas, contacte-nos e teremos todo o gosto em ajudar.

Tudo de bom e boas negociações

Daniel

Daniel Stein

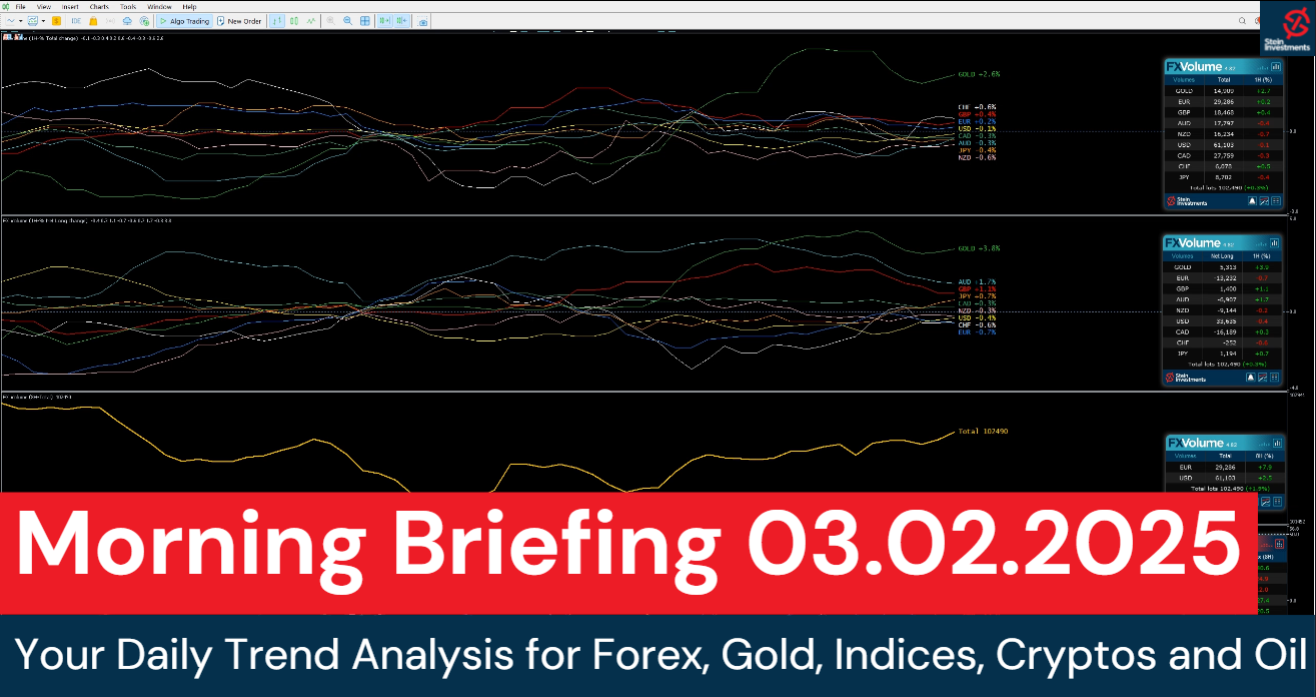

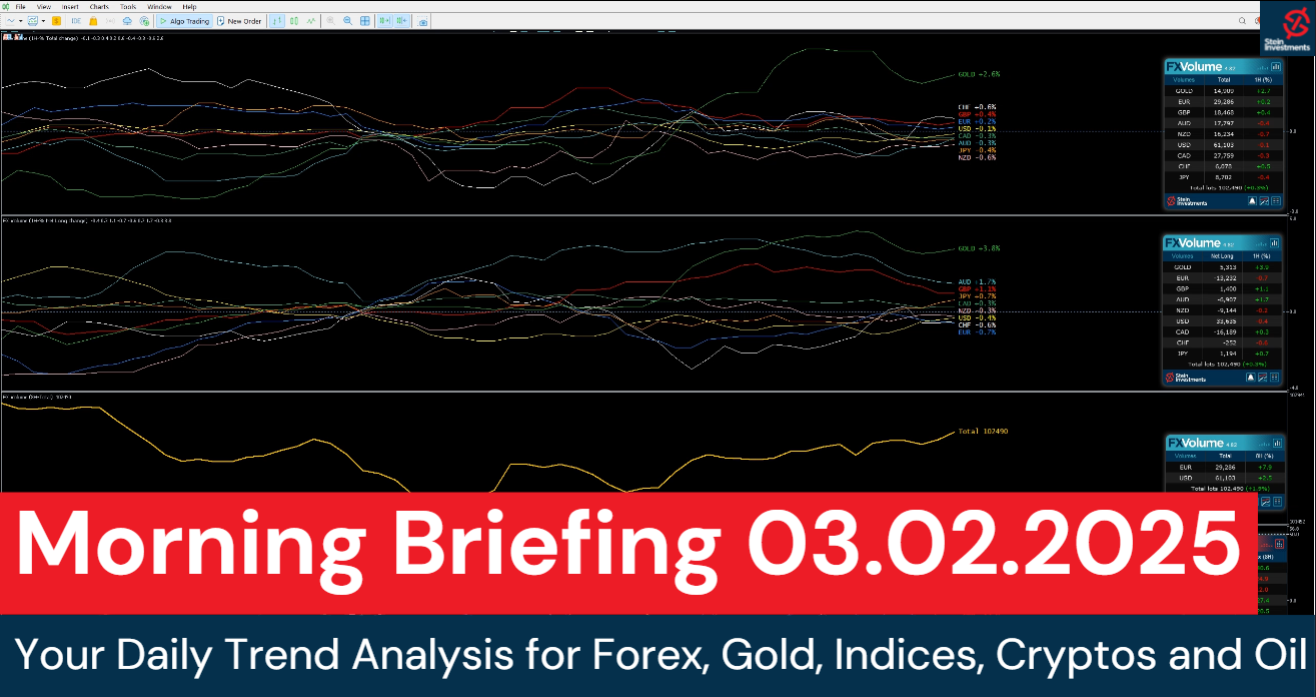

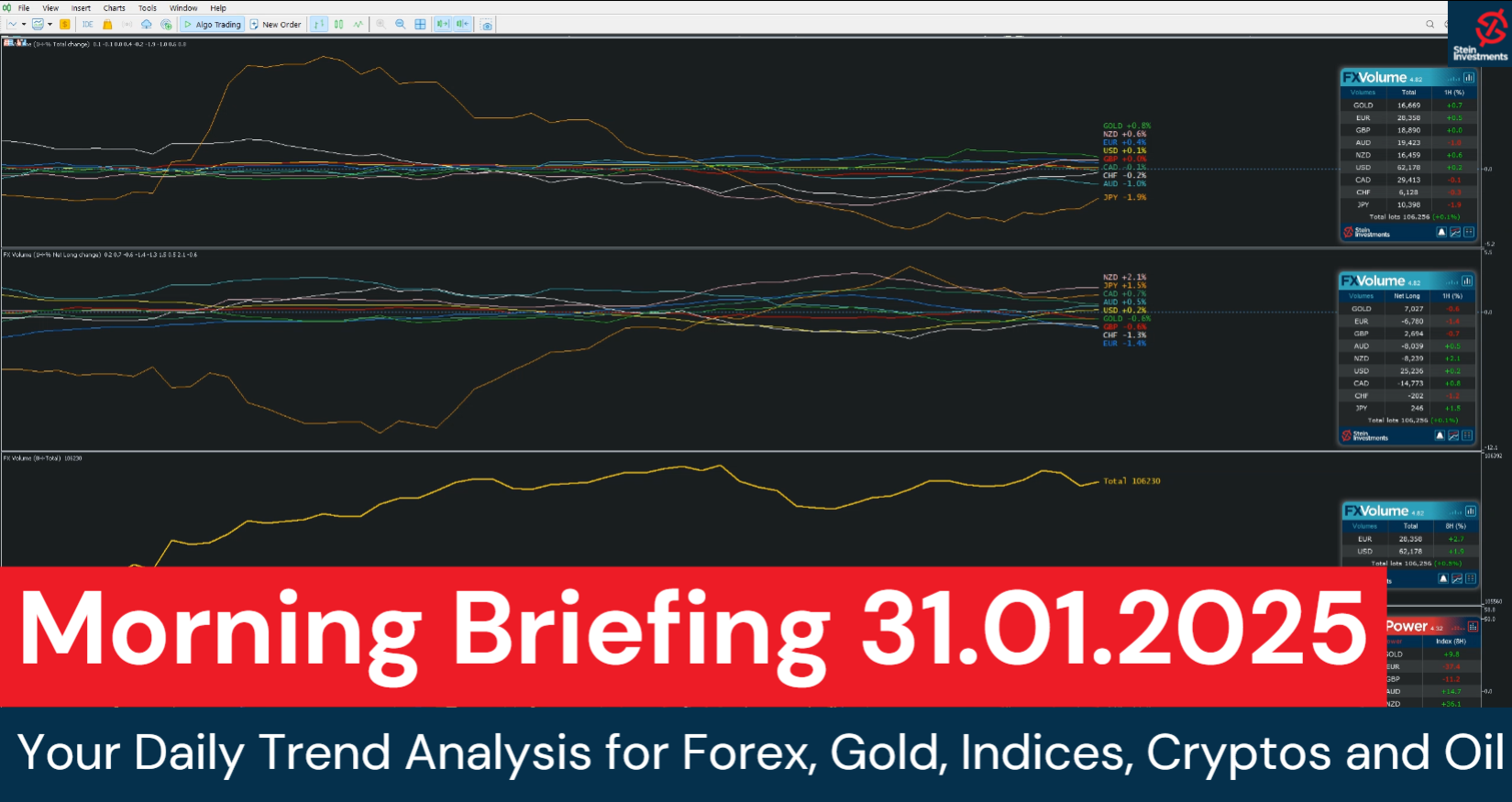

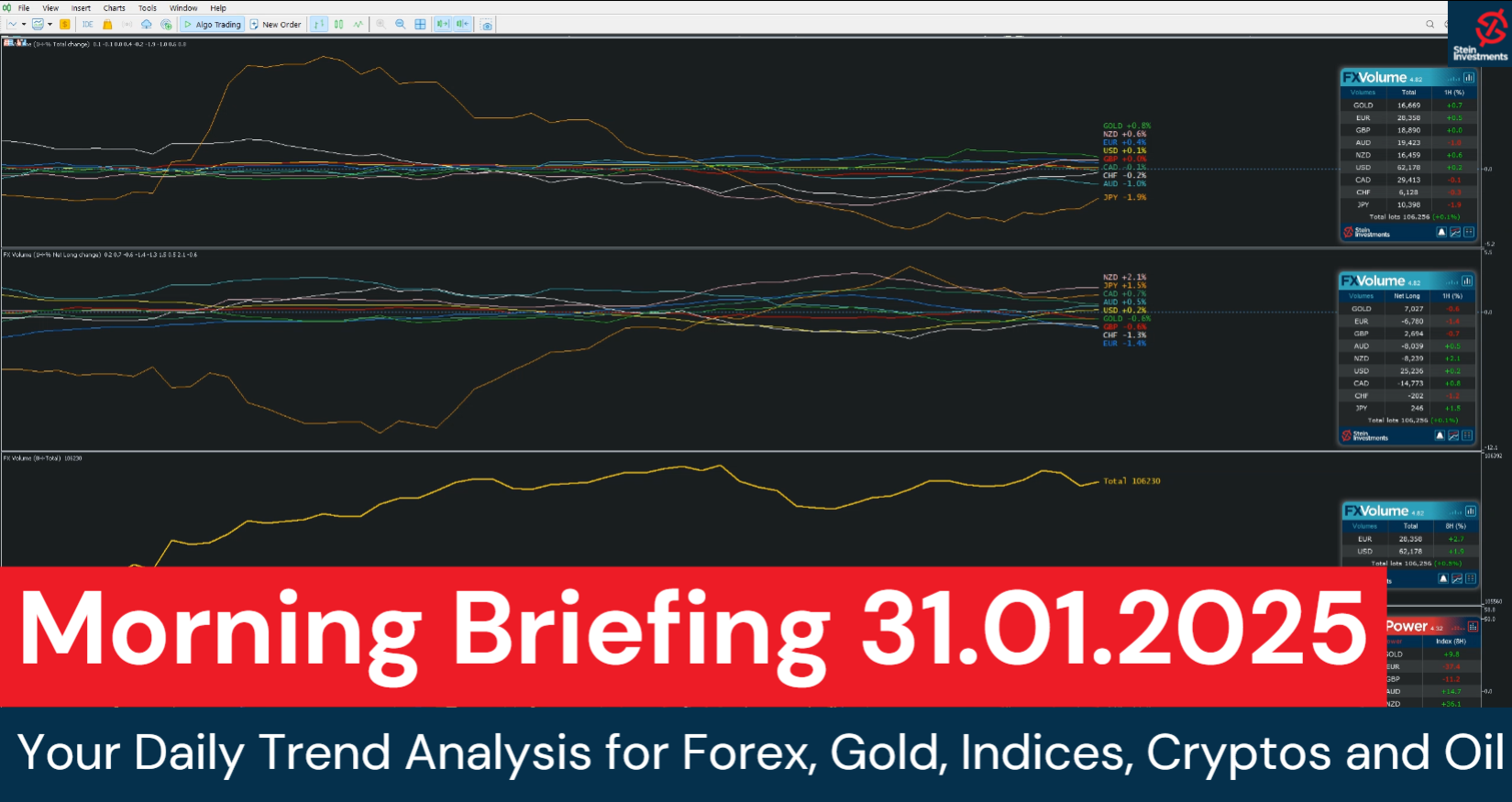

🔥 Welcome to today’s Video Morning Briefing! 🔥

Mondays can be tricky, and timing is everything. Today, I analyze the Gold volume trend, break down the risk-reward situation on XAUUSD, and explain the difference between one- and double-sided dynamics. We also take a close look at the JPY volume trend and its potential before selecting and analyzing two pairs from the Currency Overview.

📌 What’s Inside Today’s Briefing?

✅ Gold Volume Trend & Risk-Reward on XAUUSD

✅ Understanding One- and Double-Sided Market Dynamics

✅ JPY Volume Trend – Strength or Exhaustion?

✅ Currency Overview – Selecting & Analyzing Two Trade Setups

✅ Why You Should Check the Currency Overview Regularly

✅ Bitcoin, Oil, Dow & DAX – Key Market Insights

✅ The Importance of Timing on Mondays – When to act and when to wait

👉 Watch now: https://youtu.be/TnXbkABN_4c

👉 Upgrade your trading tools – 50% OFF here: https://www.mql5.com/en/blogs/post/755375

Wishing you a profitable trading day!

Daniel

Mondays can be tricky, and timing is everything. Today, I analyze the Gold volume trend, break down the risk-reward situation on XAUUSD, and explain the difference between one- and double-sided dynamics. We also take a close look at the JPY volume trend and its potential before selecting and analyzing two pairs from the Currency Overview.

📌 What’s Inside Today’s Briefing?

✅ Gold Volume Trend & Risk-Reward on XAUUSD

✅ Understanding One- and Double-Sided Market Dynamics

✅ JPY Volume Trend – Strength or Exhaustion?

✅ Currency Overview – Selecting & Analyzing Two Trade Setups

✅ Why You Should Check the Currency Overview Regularly

✅ Bitcoin, Oil, Dow & DAX – Key Market Insights

✅ The Importance of Timing on Mondays – When to act and when to wait

👉 Watch now: https://youtu.be/TnXbkABN_4c

👉 Upgrade your trading tools – 50% OFF here: https://www.mql5.com/en/blogs/post/755375

Wishing you a profitable trading day!

Daniel

Daniel Stein

🚀 Never Miss a High-Quality Trade Again!

Tracking 30+ symbols manually is nearly impossible. Custom Alerts automates the process, notifying you of key market opportunities based on our proven trading strategies.

In this tutorial, we cover:

✅The trade setups we’re looking for

✅The challenge of monitoring multiple symbols

✅ How Custom Alerts works and what it offers

✅ Pre-configured alert setups for FX Volume, FX Power, and IX Power

✅How to define which symbols to monitor

✅Alert filter options and real trade examples

👉 Watch the full tutorial now https://youtu.be/Y1zwwS7_7hU

👉 Get Custom Alerts and all our tools at 50% off at the Stein Investments Central Page -> https://www.mql5.com/en/blogs/post/755375

Tracking 30+ symbols manually is nearly impossible. Custom Alerts automates the process, notifying you of key market opportunities based on our proven trading strategies.

In this tutorial, we cover:

✅The trade setups we’re looking for

✅The challenge of monitoring multiple symbols

✅ How Custom Alerts works and what it offers

✅ Pre-configured alert setups for FX Volume, FX Power, and IX Power

✅How to define which symbols to monitor

✅Alert filter options and real trade examples

👉 Watch the full tutorial now https://youtu.be/Y1zwwS7_7hU

👉 Get Custom Alerts and all our tools at 50% off at the Stein Investments Central Page -> https://www.mql5.com/en/blogs/post/755375

Daniel Stein

🔥 Custom Alerts Update: Bug Fix Released! 🔥

We’ve addressed an important issue to ensure your alerts work flawlessly:

✅ Bug Fix: Resolved the market price display issue in alert messages for accounts with a suffix.

This update guarantees accurate and reliable alert messages, even for customized account setups.

👉 Learn more about Custom Alerts and its powerful features in our FAQ at https://www.mql5.com/en/blogs/post/759435.

Update now and trade with confidence! 💪

We’ve addressed an important issue to ensure your alerts work flawlessly:

✅ Bug Fix: Resolved the market price display issue in alert messages for accounts with a suffix.

This update guarantees accurate and reliable alert messages, even for customized account setups.

👉 Learn more about Custom Alerts and its powerful features in our FAQ at https://www.mql5.com/en/blogs/post/759435.

Update now and trade with confidence! 💪

Daniel Stein

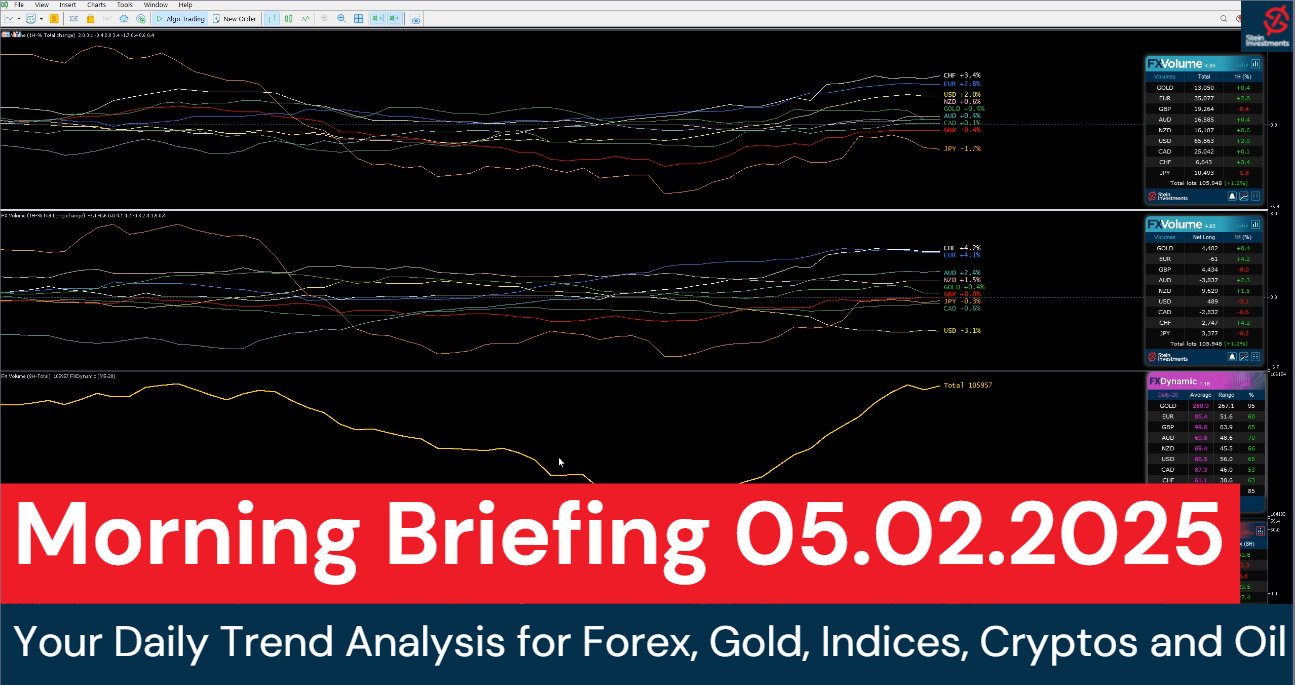

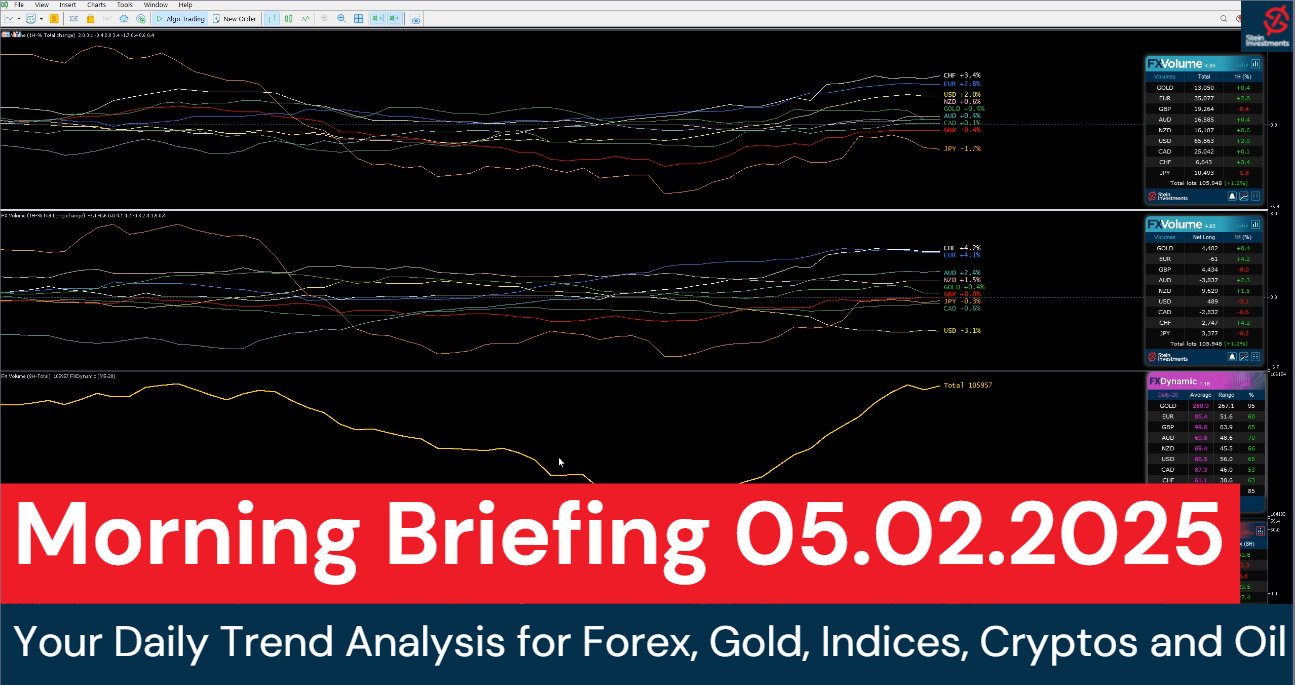

🔥 Welcome to today’s Video Morning Briefing! 🔥

We’re seeing a drop in total trading positions, and my analysis shows that the sell-off already started yesterday. With the weekend approaching, traders are reducing risk, and I don’t expect volume to pick up again before next week.

What’s Inside Today’s Briefing?

✅ Market Sell-Off Analysis – When did it start, and what’s next?

✅ Four Currency Pairs – Selected and analyzed with the Currency Overview

✅ Trade Recap – Reviewing my CADCHF & EURJPY trades

✅ Bitcoin, Oil, Dow & DAX – Key levels and market movements

✅ Final Thoughts & Weekend Outlook

A full breakdown of today’s market conditions, how I approached my trades, and what to watch going into next week.

👉 Watch now: https://youtu.be/859F4mqKnTA

👉 Upgrade your trading tools – 50% OFF here: https://www.mql5.com/en/blogs/post/755375

Enjoy the video and have a great weekend!

Daniel

We’re seeing a drop in total trading positions, and my analysis shows that the sell-off already started yesterday. With the weekend approaching, traders are reducing risk, and I don’t expect volume to pick up again before next week.

What’s Inside Today’s Briefing?

✅ Market Sell-Off Analysis – When did it start, and what’s next?

✅ Four Currency Pairs – Selected and analyzed with the Currency Overview

✅ Trade Recap – Reviewing my CADCHF & EURJPY trades

✅ Bitcoin, Oil, Dow & DAX – Key levels and market movements

✅ Final Thoughts & Weekend Outlook

A full breakdown of today’s market conditions, how I approached my trades, and what to watch going into next week.

👉 Watch now: https://youtu.be/859F4mqKnTA

👉 Upgrade your trading tools – 50% OFF here: https://www.mql5.com/en/blogs/post/755375

Enjoy the video and have a great weekend!

Daniel

Daniel Stein

🔥 Recap on Today’s Morning Briefing 🔥

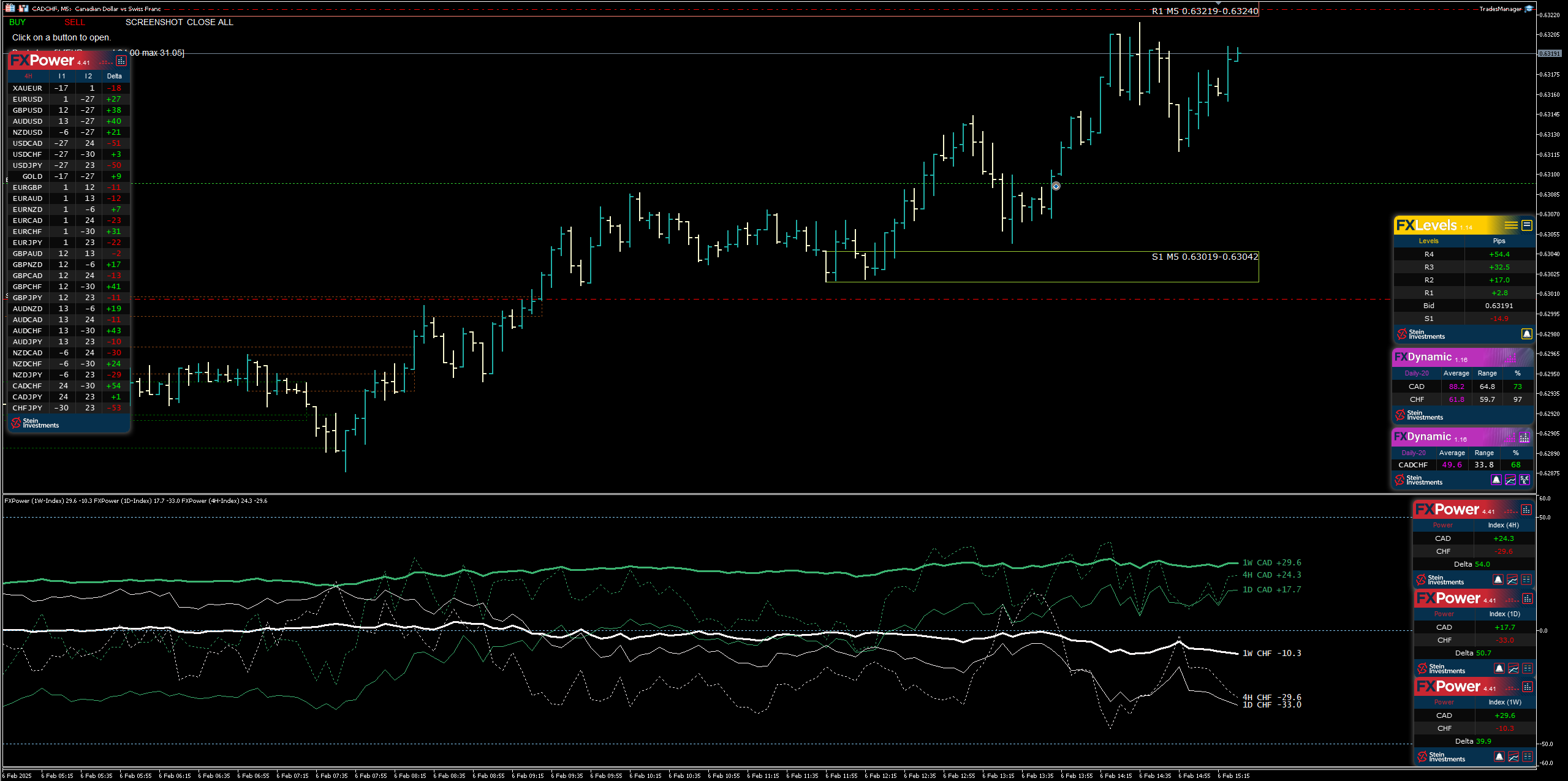

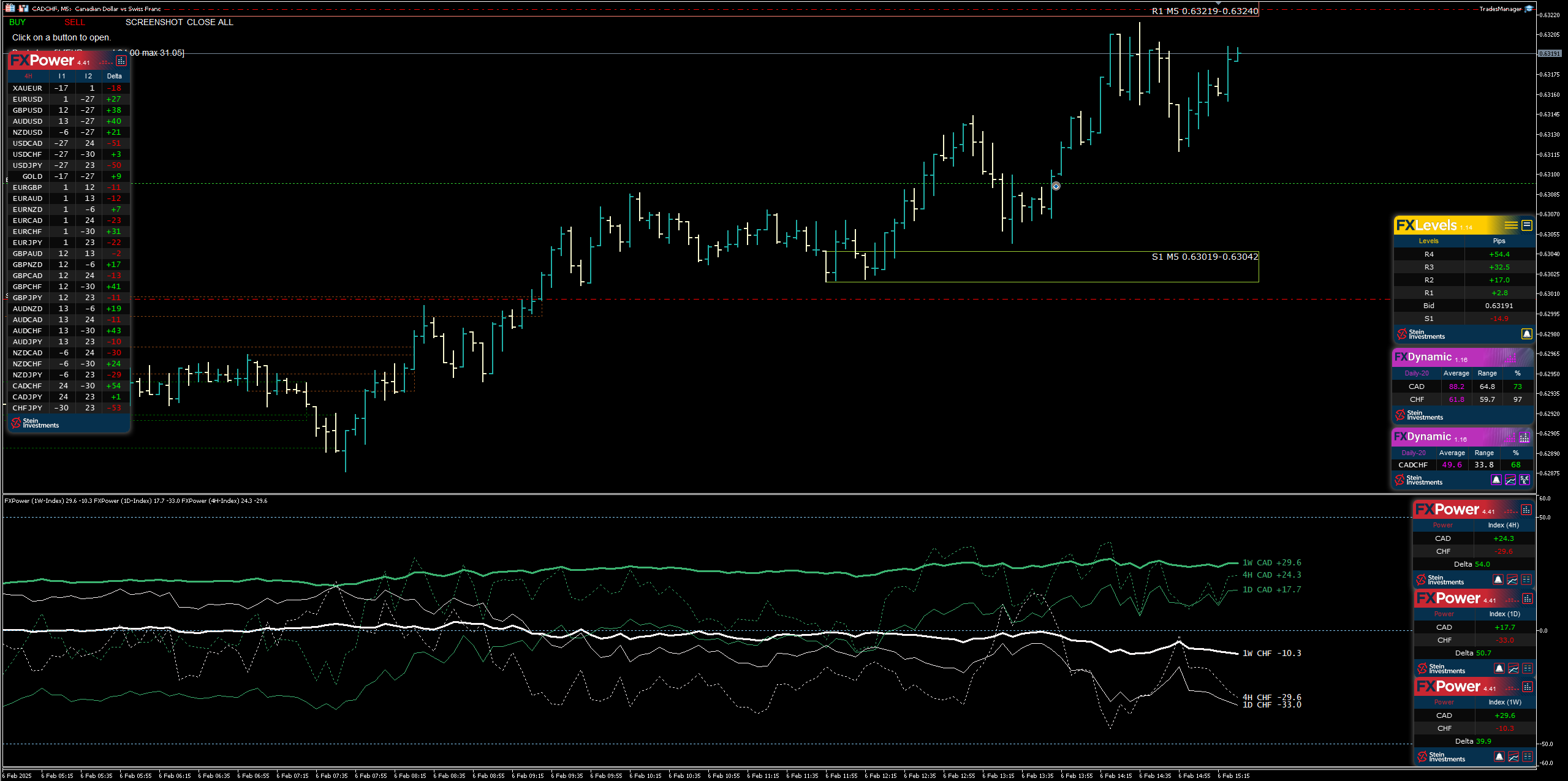

In this screenshot, you can see a new trade position on CADCHF, following the exact approach I discussed in today’s Morning Briefing—waiting for the reversal to achieve a better risk-to-reward ratio. And there it is, executed with precision:

📌 Stop-Loss placed just below the last support

📌 Take-Profit set at the next resistance

A detailed recap of this setup will follow in tomorrow’s Morning Briefing. If you don’t want to miss it, make sure to subscribe to my channel and stay updated!

👉 Subscribe here: https://www.youtube.com/@SteinInvestments

In this screenshot, you can see a new trade position on CADCHF, following the exact approach I discussed in today’s Morning Briefing—waiting for the reversal to achieve a better risk-to-reward ratio. And there it is, executed with precision:

📌 Stop-Loss placed just below the last support

📌 Take-Profit set at the next resistance

A detailed recap of this setup will follow in tomorrow’s Morning Briefing. If you don’t want to miss it, make sure to subscribe to my channel and stay updated!

👉 Subscribe here: https://www.youtube.com/@SteinInvestments

Daniel Stein

🔥 Welcome to today’s Video Morning Briefing! 🔥

Today’s session is packed with insights! We’re diving deep into EUR & USD volume trends, analyzing EUR pairs and major USD pairs, and explaining the relationship between crosspairs and their underlying majors. I’ll also show you how to handle dynamic trends like today’s USD movement, followed by a detailed trade recap, insights on Bitcoin, Oil, Dow & DAX, and a final market conclusion.

What You’ll Discover:

✅ EUR & USD Volume Trends – What’s driving today’s price action?

✅ Crosspair Dynamics – Understanding how majors influence crosses

✅ Handling Dynamic Trends – How to adjust when trends shift fast

✅ Trade Recap – Reviewing yesterday’s setups in detail

✅ Non-Forex Analysis – Bitcoin, Oil, Dow & DAX breakdown

✅ Final Market Conclusion – What’s next for today’s session?

👉 Watch Now: https://youtu.be/guoDpOClaQk

🔥 Limited-Time Offer: Get 50% OFF our premium trading tools and trade with more precision: https://www.mql5.com/en/blogs/post/755375

Let me know your thoughts in the comments or message me on MQL5!

By the way – what do you think of the new video intro? 👍 Drop a thumbs up or leave a comment below! Either way, I’d appreciate it if you like and subscribe to stay updated with future videos.

Wishing you a profitable trading day!

Daniel

Today’s session is packed with insights! We’re diving deep into EUR & USD volume trends, analyzing EUR pairs and major USD pairs, and explaining the relationship between crosspairs and their underlying majors. I’ll also show you how to handle dynamic trends like today’s USD movement, followed by a detailed trade recap, insights on Bitcoin, Oil, Dow & DAX, and a final market conclusion.

What You’ll Discover:

✅ EUR & USD Volume Trends – What’s driving today’s price action?

✅ Crosspair Dynamics – Understanding how majors influence crosses

✅ Handling Dynamic Trends – How to adjust when trends shift fast

✅ Trade Recap – Reviewing yesterday’s setups in detail

✅ Non-Forex Analysis – Bitcoin, Oil, Dow & DAX breakdown

✅ Final Market Conclusion – What’s next for today’s session?

👉 Watch Now: https://youtu.be/guoDpOClaQk

🔥 Limited-Time Offer: Get 50% OFF our premium trading tools and trade with more precision: https://www.mql5.com/en/blogs/post/755375

Let me know your thoughts in the comments or message me on MQL5!

By the way – what do you think of the new video intro? 👍 Drop a thumbs up or leave a comment below! Either way, I’d appreciate it if you like and subscribe to stay updated with future videos.

Wishing you a profitable trading day!

Daniel

Daniel Stein

🔥 Welcome to today’s Video Morning Briefing! 🔥

Today’s session is packed with insights! I start with a Volume Analysis, recap yesterday’s trades, and then use the Currency Overview to select new trade opportunities. We’ll analyze these setups in detail, place fresh trades, and of course, break down the usual non-Forex symbols.

What You’ll Discover:

✅ Volume Analysis – Spotting today’s key market movers

✅ Recap of Yesterday’s Trades – What worked & what didn’t

✅ Selecting New Pairs via the Currency Overview – Finding the best setups

✅ In-Depth Trade Analysis & Execution – Placing new trades with precision

✅ Market Trends for Bitcoin, Oil, Dow & DAX – Non-Forex insights

👉 Watch Now: https://youtu.be/NpxBUNZp8ek

🔥 Limited-Time Offer: Get 50% OFF our premium trading tools and refine your trade selection: https://www.mql5.com/en/blogs/post/755375

Let me know your thoughts in the comments or message me on MQL5!

Wishing you a profitable trading day!

Daniel

Today’s session is packed with insights! I start with a Volume Analysis, recap yesterday’s trades, and then use the Currency Overview to select new trade opportunities. We’ll analyze these setups in detail, place fresh trades, and of course, break down the usual non-Forex symbols.

What You’ll Discover:

✅ Volume Analysis – Spotting today’s key market movers

✅ Recap of Yesterday’s Trades – What worked & what didn’t

✅ Selecting New Pairs via the Currency Overview – Finding the best setups

✅ In-Depth Trade Analysis & Execution – Placing new trades with precision

✅ Market Trends for Bitcoin, Oil, Dow & DAX – Non-Forex insights

👉 Watch Now: https://youtu.be/NpxBUNZp8ek

🔥 Limited-Time Offer: Get 50% OFF our premium trading tools and refine your trade selection: https://www.mql5.com/en/blogs/post/755375

Let me know your thoughts in the comments or message me on MQL5!

Wishing you a profitable trading day!

Daniel

Daniel Stein

🔥Profit Target reached🔥

USDCAD reached its profit target exactly at the support level identified by FX Levels, once again proving the outstanding precision of our tools. 🎯

This is why data-driven analysis is crucial—when you trade with the right levels, you’re not guessing but making calculated, high-probability decisions.

👉 Watch today’s full Morning Briefing video here: https://youtu.be/dGJFADqSpSs

If you haven’t yet, explore how FX Levels, FX Power, and FX Volume can transform your trading:

👉 Discover our tools & strategies: https://www.mql5.com/en/blogs/post/755375

Wishing you continued success in trading!

Daniel

USDCAD reached its profit target exactly at the support level identified by FX Levels, once again proving the outstanding precision of our tools. 🎯

This is why data-driven analysis is crucial—when you trade with the right levels, you’re not guessing but making calculated, high-probability decisions.

👉 Watch today’s full Morning Briefing video here: https://youtu.be/dGJFADqSpSs

If you haven’t yet, explore how FX Levels, FX Power, and FX Volume can transform your trading:

👉 Discover our tools & strategies: https://www.mql5.com/en/blogs/post/755375

Wishing you continued success in trading!

Daniel

Daniel Stein

🔥 Welcome to today’s Video Morning Briefing!

The EUR Long Volume Trend might look tempting, but I decided not to trade it because it contradicts the long-term strength trend and was already losing momentum. Instead, I used the Currency Overview to find better trading opportunities—let’s break them down together.

What You’ll Discover:

✅ Why I Avoided the EUR Long Trade – The risks behind this trend

✅ Analyzing Three EUR Pairs – Understanding the market dynamics

✅ Using the Currency Overview – Finding stronger trade setups

✅ Setting Alternative Trade Setups – Where the real opportunities were

✅ Market Trends for Bitcoin, Oil, Dow & DAX – Non-Forex insights

🔗 Watch Now: https://youtu.be/dGJFADqSpSs

🔥 Limited-Time Offer: Get 50% OFF our premium trading tools and sharpen your trade selection: https://www.mql5.com/en/blogs/post/755375

📩 Let me know your thoughts in the comments or message me on MQL5!

Wishing you a profitable trading day!

Daniel

The EUR Long Volume Trend might look tempting, but I decided not to trade it because it contradicts the long-term strength trend and was already losing momentum. Instead, I used the Currency Overview to find better trading opportunities—let’s break them down together.

What You’ll Discover:

✅ Why I Avoided the EUR Long Trade – The risks behind this trend

✅ Analyzing Three EUR Pairs – Understanding the market dynamics

✅ Using the Currency Overview – Finding stronger trade setups

✅ Setting Alternative Trade Setups – Where the real opportunities were

✅ Market Trends for Bitcoin, Oil, Dow & DAX – Non-Forex insights

🔗 Watch Now: https://youtu.be/dGJFADqSpSs

🔥 Limited-Time Offer: Get 50% OFF our premium trading tools and sharpen your trade selection: https://www.mql5.com/en/blogs/post/755375

📩 Let me know your thoughts in the comments or message me on MQL5!

Wishing you a profitable trading day!

Daniel

Daniel Stein

🔥NEW VIDEO - YOUR ALL-IN-ONE TRADING HUB!🔥

Looking for everything you need in one place?

Our Landing Page is your ultimate destination for:

✅ Trading Tools & Indicators – FX Power, FX Volume & more

✅ Morning Briefings & Market Analysis – Stay informed daily

✅ How-To Guides & Strategies – Improve your trading precision

✅ Exclusive Discounts & Offers – Save big on premium tools

🔥 Watch now: https://youtu.be/DGVyNfCKbqU

👉 **Explore the page & claim your 50% OFF discount here: https://www.mql5.com/en/blogs/post/755375

Looking for everything you need in one place?

Our Landing Page is your ultimate destination for:

✅ Trading Tools & Indicators – FX Power, FX Volume & more

✅ Morning Briefings & Market Analysis – Stay informed daily

✅ How-To Guides & Strategies – Improve your trading precision

✅ Exclusive Discounts & Offers – Save big on premium tools

🔥 Watch now: https://youtu.be/DGVyNfCKbqU

👉 **Explore the page & claim your 50% OFF discount here: https://www.mql5.com/en/blogs/post/755375

Daniel Stein

🔥NEW VIDEO! 🔥

No strong trades today? That’s part of the game! A professional trader knows that staying on the sideline is sometimes the best move when conditions aren’t in our favor.

Inside Today’s Briefing:

✅ Why No Clear Trading Opportunities? When patience is key

✅ Gold Volume Trend – Analyzing today’s movement

✅ Currency Overview – A quiet market with no strong signals

✅ Weekend Market Gaps – FX, Indices & Crypto insights

✅ Bitcoin, Oil, Dow & DAX – Key takeaways despite slow conditions

🔥 Watch now: https://youtu.be/Ot33Mk_xe-0

👉 50% OFF all premium tools—get yours here: https://www.mql5.com/en/blogs/post/755375

Do you step aside when the market is unclear? Let me know in the comments! 👇

No strong trades today? That’s part of the game! A professional trader knows that staying on the sideline is sometimes the best move when conditions aren’t in our favor.

Inside Today’s Briefing:

✅ Why No Clear Trading Opportunities? When patience is key

✅ Gold Volume Trend – Analyzing today’s movement

✅ Currency Overview – A quiet market with no strong signals

✅ Weekend Market Gaps – FX, Indices & Crypto insights

✅ Bitcoin, Oil, Dow & DAX – Key takeaways despite slow conditions

🔥 Watch now: https://youtu.be/Ot33Mk_xe-0

👉 50% OFF all premium tools—get yours here: https://www.mql5.com/en/blogs/post/755375

Do you step aside when the market is unclear? Let me know in the comments! 👇

Daniel Stein

🚀 Boost Your Trading with Expert Insights! 🚀

Looking for precise market analysis and profitable trade setups? Our YouTube channel is packed with Morning Briefings, Market Analysis, Volume Trends, and Power-Based Trade Setups—helping you stay ahead of the markets every day.

🎥 Watch our latest videos covering:

✅ Morning Briefings—Daily market insights & trends

✅ Volume Trends—Spotting high-impact moves before they happen

✅ Market Analysis—Breaking down key forex, gold, indices & crypto setups

✅ Power-Based Trade Setups—Trade strong vs. weak currencies with confidence

🔥 Stay ahead, trade smarter, and grow your skills!

👉 Subscribe now: https://www.youtube.com/@SteinInvestments

Which market are you watching today? Drop a comment below! 👇

Looking for precise market analysis and profitable trade setups? Our YouTube channel is packed with Morning Briefings, Market Analysis, Volume Trends, and Power-Based Trade Setups—helping you stay ahead of the markets every day.

🎥 Watch our latest videos covering:

✅ Morning Briefings—Daily market insights & trends

✅ Volume Trends—Spotting high-impact moves before they happen

✅ Market Analysis—Breaking down key forex, gold, indices & crypto setups

✅ Power-Based Trade Setups—Trade strong vs. weak currencies with confidence

🔥 Stay ahead, trade smarter, and grow your skills!

👉 Subscribe now: https://www.youtube.com/@SteinInvestments

Which market are you watching today? Drop a comment below! 👇

Daniel Stein

🔥 NEW VIDEO! 🔥

Friday trading is all about precision. Today, I break down market volume, Gold’s record-breaking move, and the best FX opportunities for the day.

✅ How to use Volume Analysis on a Friday

✅ Gold’s New Record! What’s next?

✅ Trade Selection—Using the Currency Overview for strong setups

✅ EURUSD & USDCHF Detailed Analysis

✅ Why FX Levels Provide Precision Trading

✅ Bitcoin, Oil, Dow, & DAX Analysis

🔥 Watch now: https://youtu.be/KaXu3pC1O7A

👉 50% OFF all premium tools—get yours here: https://www.mql5.com/en/blogs/post/755375

What’s your top trade for today? Let me know in the comments! 👇

Friday trading is all about precision. Today, I break down market volume, Gold’s record-breaking move, and the best FX opportunities for the day.

✅ How to use Volume Analysis on a Friday

✅ Gold’s New Record! What’s next?

✅ Trade Selection—Using the Currency Overview for strong setups

✅ EURUSD & USDCHF Detailed Analysis

✅ Why FX Levels Provide Precision Trading

✅ Bitcoin, Oil, Dow, & DAX Analysis

🔥 Watch now: https://youtu.be/KaXu3pC1O7A

👉 50% OFF all premium tools—get yours here: https://www.mql5.com/en/blogs/post/755375

What’s your top trade for today? Let me know in the comments! 👇

Daniel Stein

🔥 NEW VIDEO! 🔥

Today’s Gold Volume Trend is massive! In our first-ever Video Morning Briefing, I break it down alongside a clear EUR Weakness and show two simple trade setups to benefit.

✅ Learn how to trade these moves with our Currency Overview

✅ Get detailed insights on Bitcoin, Gold, Dow Jones & DAX

✅ Discover how to make precise decisions with our trading tools

🔥 Watch now: https://youtu.be/WfKI2HSkxSs

👉 50% OFF all premium tools—get yours here: https://www.mql5.com/en/blogs/post/755375

What do you think of the video format? Let me know in the comments! 👇

#ForexTrading #Gold #EURUSD #MarketAnalysis #SteinInvestments #TradingTools

Today’s Gold Volume Trend is massive! In our first-ever Video Morning Briefing, I break it down alongside a clear EUR Weakness and show two simple trade setups to benefit.

✅ Learn how to trade these moves with our Currency Overview

✅ Get detailed insights on Bitcoin, Gold, Dow Jones & DAX

✅ Discover how to make precise decisions with our trading tools

🔥 Watch now: https://youtu.be/WfKI2HSkxSs

👉 50% OFF all premium tools—get yours here: https://www.mql5.com/en/blogs/post/755375

What do you think of the video format? Let me know in the comments! 👇

#ForexTrading #Gold #EURUSD #MarketAnalysis #SteinInvestments #TradingTools

Daniel Stein

🔥 Massive Discount Campaign Live Now! 🔥

We’re making high-quality trading tools more accessible than ever!

• 50% OFF all indicators and utilities for a limited time!

• Rewarding review writers with an exclusive bonus indicator, giving you a sneak peek at our next big product.

Don’t miss this chance to expand your trading arsenal at unbeatable prices.

👉 Full details here: https://www.mql5.com/en/blogs/post/760644

Act now—the discounts will gradually decrease!

We’re making high-quality trading tools more accessible than ever!

• 50% OFF all indicators and utilities for a limited time!

• Rewarding review writers with an exclusive bonus indicator, giving you a sneak peek at our next big product.

Don’t miss this chance to expand your trading arsenal at unbeatable prices.

👉 Full details here: https://www.mql5.com/en/blogs/post/760644

Act now—the discounts will gradually decrease!

Daniel Stein

🔥 New FX Dynamic Tutorial: The Smartest Way to Use ATR in Your Trading 🔥

Most traders underestimate the power of ATR, but what if you could use it not just for stop-losses, but also for pinpointing precise entries, exits, and profit targets? That’s exactly what we reveal in our new FX Dynamic tutorial.

What you’ll learn:

• How to read ATR effectively and uncover its hidden insights

• Three powerful methods to improve your trade accuracy

• Using ATR Levels as Profit Targets for optimized exits

• Entry Filters & Exit Triggers based on volatility thresholds

• Spotting early market movements – ideal for scalping

• Unlocking a completely new way to trade with ATR

👉 Watch the full tutorial here: https://youtu.be/I419QEwxqWQ

Instead of just following the market, understand it, predict it, and use volatility to your advantage.

Let us know your thoughts in the comments—how do you use ATR in your trading?

👉 Explore more tools and insights at Stein Investments: https://www.mql5.com/en/blogs/post/755375

Most traders underestimate the power of ATR, but what if you could use it not just for stop-losses, but also for pinpointing precise entries, exits, and profit targets? That’s exactly what we reveal in our new FX Dynamic tutorial.

What you’ll learn:

• How to read ATR effectively and uncover its hidden insights

• Three powerful methods to improve your trade accuracy

• Using ATR Levels as Profit Targets for optimized exits

• Entry Filters & Exit Triggers based on volatility thresholds

• Spotting early market movements – ideal for scalping

• Unlocking a completely new way to trade with ATR

👉 Watch the full tutorial here: https://youtu.be/I419QEwxqWQ

Instead of just following the market, understand it, predict it, and use volatility to your advantage.

Let us know your thoughts in the comments—how do you use ATR in your trading?

👉 Explore more tools and insights at Stein Investments: https://www.mql5.com/en/blogs/post/755375

Daniel Stein

🚀 New FX Power NG Tutorial Video is Live! 🚀

Discover how to:

✅ Analyze markets with precision using FX Power’s unique methods.

✅ Leverage its flexibility with pre-configured periods and triple-instance setups.

✅ Identify BUY/SELL setups and master the Breakout Strategy on EURUSD & GBPUSD.

✅ Navigate panel functions, currency overviews, and much more!

📚 Plus, learn where to find config tutorials, templates, and how to set up powerful single and combined alerts.

🎥 Watch the video here: https://youtu.be/IG5psJkbSLk

🌐 Explore more tools and insights at Stein Investments: https://www.mql5.com/en/blogs/post/755375

💡 Ready to trade smarter? Watch now and transform your strategy! 🔥

Discover how to:

✅ Analyze markets with precision using FX Power’s unique methods.

✅ Leverage its flexibility with pre-configured periods and triple-instance setups.

✅ Identify BUY/SELL setups and master the Breakout Strategy on EURUSD & GBPUSD.

✅ Navigate panel functions, currency overviews, and much more!

📚 Plus, learn where to find config tutorials, templates, and how to set up powerful single and combined alerts.

🎥 Watch the video here: https://youtu.be/IG5psJkbSLk

🌐 Explore more tools and insights at Stein Investments: https://www.mql5.com/en/blogs/post/755375

💡 Ready to trade smarter? Watch now and transform your strategy! 🔥

Daniel Stein

⚠️Custom Alerts Update: Unparalleled Flexibility & Enhanced Resources! ⚠️

We’re excited to share the latest updates to Custom Alerts:

✅ Custom Mode Configurations:

Now you can fully customize all three analysis periods for Forex and Non-Forex symbols. Whether you’re analyzing major currency pairs or alternative markets, FX Power and IX Power adapt perfectly to your trading strategy.

📖 Revamped Product Description:

We’ve completely reworked the product description to provide a clearer overview of all features. Make sure to check it out for a deeper understanding of how Custom Alerts can enhance your trading.

📘 Updated Custom Alerts FAQ:

The FAQ has been updated with additional details about the new Custom Mode Configurations, so you can make the most of this powerful new feature.

👉 Discover the full potential in our Custom Alerts FAQ https://www.mql5.com/en/blogs/post/759435 and start exploring today!

We’re excited to share the latest updates to Custom Alerts:

✅ Custom Mode Configurations:

Now you can fully customize all three analysis periods for Forex and Non-Forex symbols. Whether you’re analyzing major currency pairs or alternative markets, FX Power and IX Power adapt perfectly to your trading strategy.

📖 Revamped Product Description:

We’ve completely reworked the product description to provide a clearer overview of all features. Make sure to check it out for a deeper understanding of how Custom Alerts can enhance your trading.

📘 Updated Custom Alerts FAQ:

The FAQ has been updated with additional details about the new Custom Mode Configurations, so you can make the most of this powerful new feature.

👉 Discover the full potential in our Custom Alerts FAQ https://www.mql5.com/en/blogs/post/759435 and start exploring today!

Daniel Stein

🚀 Morning Briefing exceeds 30,000+ Subscribers! 🚀

Good Morning Everyone,

We are thrilled to share a significant milestone—our Morning Briefing Channel on MQL5 has surpassed 30,000 subscribers! 🔥

This achievement wouldn’t have been possible without your continued support, engagement, and trust in our market insights.

Thank you for being a part of this journey with us! 🙏

Make sure to take full advantage of our ongoing 50% discount campaign. 🤩

It’s the perfect opportunity to equip yourself with the tools and strategies that power our precise market analysis.

For details, visit: https://www.mql5.com/en/blogs/post/755375.

We’re excited to continue delivering valuable insights and resources to enhance your trading success.

Here’s to reaching new heights together! 💪

All the best and have a great day 🙂

Daniel

Good Morning Everyone,

We are thrilled to share a significant milestone—our Morning Briefing Channel on MQL5 has surpassed 30,000 subscribers! 🔥

This achievement wouldn’t have been possible without your continued support, engagement, and trust in our market insights.

Thank you for being a part of this journey with us! 🙏

Make sure to take full advantage of our ongoing 50% discount campaign. 🤩

It’s the perfect opportunity to equip yourself with the tools and strategies that power our precise market analysis.

For details, visit: https://www.mql5.com/en/blogs/post/755375.

We’re excited to continue delivering valuable insights and resources to enhance your trading success.

Here’s to reaching new heights together! 💪

All the best and have a great day 🙂

Daniel

Daniel Stein

⚠️ Second Tutorial Video Online ⚠️

Good Morning Everyone,

Today’s Morning Briefing in its usual form is on pause because the London pre-market session delivered such an outstanding EUR Long trend that I had to focus on it in a detailed video analysis, as requested by our growing community.

I’m confident you’ll enjoy this format and appreciate the deeper dive into the most interesting aspects of the market. Watch the analysis here: https://youtu.be/LHCzXca3PQI.

Let me know your thoughts, and as always, I’m here for any questions!

Wishing you a profitable trading day! 😊

Daniel

Good Morning Everyone,

Today’s Morning Briefing in its usual form is on pause because the London pre-market session delivered such an outstanding EUR Long trend that I had to focus on it in a detailed video analysis, as requested by our growing community.

I’m confident you’ll enjoy this format and appreciate the deeper dive into the most interesting aspects of the market. Watch the analysis here: https://youtu.be/LHCzXca3PQI.

Let me know your thoughts, and as always, I’m here for any questions!

Wishing you a profitable trading day! 😊

Daniel

: