Zigzag Pro MT4

FREE

Publicado:

2 agosto 2022

Versão atual:

1.20

Não encontrou o robô certo? Encomende um para você

no serviço Freelance.

Ir para o Freelance

no serviço Freelance.

Como comprar um robô de negociação ou indicador?

Execute seu EA na

hospedagem virtual

hospedagem virtual

Teste indicadores/robôs de negociação antes de comprá-los

Quer ganhar dinheiro no Mercado?

Como apresentar um produto para o consumidor final?

Você está perdendo oportunidades de negociação:

- Aplicativos de negociação gratuitos

- 8 000+ sinais para cópia

- Notícias econômicas para análise dos mercados financeiros

Registro

Login

Você concorda com a política do site e com os termos de uso

Se você não tem uma conta, por favor registre-se

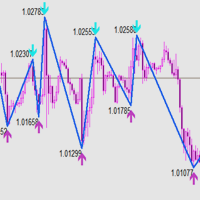

his indicator is based on the Zigzag indicator and has been enhanced with the following features:

Original Indicator Features:

Zigzag Usage Methods:

Method 1: Measuring the Start and End Points of a Trend

Method 2: Drawing Trend Lines

Trend lines are widely used in technical analysis. However, drawing consistent trend lines can be challenging. The Zigzag indicator helps solve this problem by providing clear connection points.

Method 3: Identifying Support and Resistance Levels

Support and resistance levels are fundamental to technical analysis.

Important Notes:

This improved Zigzag indicator with its added features can be a valuable tool for technical analysis, helping traders identify trends, draw trend lines, and find potential support and resistance levels.