TSO Top Bottom Divergence

39 USD

Download demo:

535

Publicado:

25 julho 2017

Versão atual:

1.32

Não encontrou o robô certo? Encomende um para você

no serviço Freelance.

Ir para o Freelance

no serviço Freelance.

Como comprar um robô de negociação ou indicador?

Execute seu EA na

hospedagem virtual

hospedagem virtual

Teste indicadores/robôs de negociação antes de comprá-los

Quer ganhar dinheiro no Mercado?

Como apresentar um produto para o consumidor final?

Você está perdendo oportunidades de negociação:

- Aplicativos de negociação gratuitos

- 8 000+ sinais para cópia

- Notícias econômicas para análise dos mercados financeiros

Registro

Login

Você concorda com a política do site e com os termos de uso

Se você não tem uma conta, por favor registre-se

Attaching some more screenshots as requested by some users.

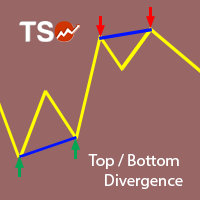

Figure 1 - Independent Mode: Double Top/Bottom and Divergence indicators detect highs and lows separately.

Figure 2 - Combined Mode: Only the highs and lows detected through the Double Top/Bottom indicator are scanned for Divergence

Figure 3 - Combined Mode: Only the highs and lows detected through the Double Top/Bottom indicator are scanned for Divergence

Using demo -- Nice indicator.

What tf? thx

Using demo -- Nice indicator.

Thank you!

What tf? thx

The indicator can be used on any timeframe. In general, larger timeframes produce more reliable results.

hey

one quick question

how does the arrow appear ? beginning of new candle or closing of current candle?

hey

one quick question

how does the arrow appear ? beginning of new candle or closing of current candle?

neither i have just checked when a signal appears there are two arrows that are formed but it comes when the 3rd candle has formed so it lags 3 candles behind

hey

one quick question

how does the arrow appear ? beginning of new candle or closing of current candle?

The arrows appear at the closing of around 2 to 7 candles after the second top/bottom has occurred. This happens because the algorithm has to confirm whether the tops/bottoms detected are valid before showing any arrows. The validation allows for clearer signals and better entry prices.

The arrows appear at the closing of around 2 to 7 candles after the second top/bottom has occurred. This happens because the algorithm has to confirm whether the tops/bottoms detected are valid before showing any arrows. The validation allows for clearer signals and better entry prices.

thanks so much for the clarification.

so RSI divergence signals also have the same principle ?

thanks so much for the clarification.

so RSI divergence signals also have the same principle ?

When in combined mode, divergences appear at the same time as the arrows. When running independently, divergence is calculated based on the "Number of Bars" input. That input's default value is 9, meaning that 4 candles would be required after the high/low candle for it to be detected and show the divergence.

The "Number of Bars" input can be brought down to 3 but this would produce more divergence signals of lower quality.

I haven't tried yet, but is there function for email message?

I haven't tried yet, but is there function for email message?

Not yet, but it will be added very soon.

but am not sure how to use

Why always show two arrows up and two arrows down

And have line blue color

can tell me

Hi >>> I just buy TOS indicators

but am not sure how to use

Why always show two arrows up and two arrows down

And have line blue color

can tell me

Hi,

The arrow pairs show the locations of double tops and bottoms. A double top would be a reversal signal in an uptrend and a double bottom would be a reversal signal in a downtrend.

The blue lines show the locations of divergences between the candlestick graph and the RSI indicator. For example, assume there is a double top in the candlesticks graph, and the second top is higher than the first. If this is translated in the RSI indicator as a double top where the second top is lower than the first, then this signals a trend reversal, from uptrend to downtrend. The opposite applies when the second top is lower than the first for the candlesticks and higher for the RSI.