Hello

I have been using a stregie and it's being playing nicely so far, so I want to try to code it.

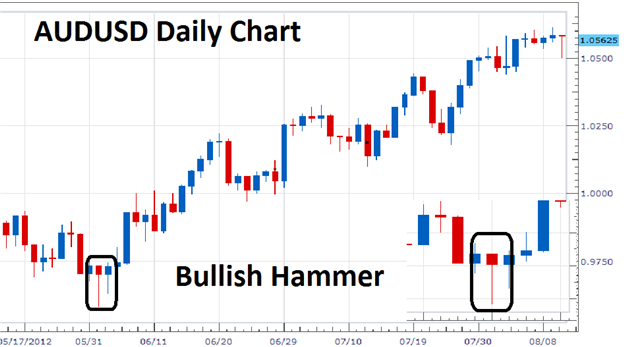

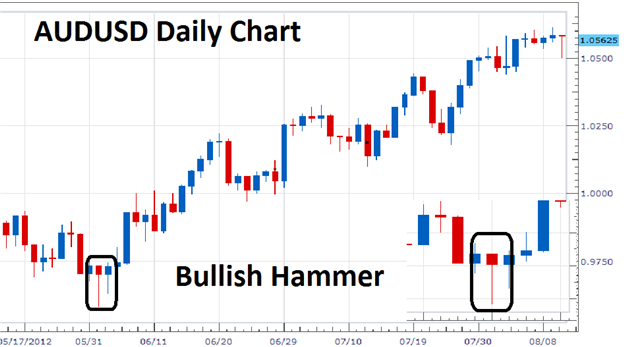

Its based on Hammer Formation: To create a hammer price must first significantly sell off to create a new low for a currency pair. However, after this decline, prices must significantly rally causing prices to have a small body and close near its opening price. It should be noted that hammers should have long wicks at least twice the length of the candle body. As well, the candle itself can either be red or blue depending on the strength of the reversal.

So my strategie is quite simple :

when a hammer appears in D1 timeframe..

Se set a buy stop with 20 pips away from the top of the hammer formation and a stop loss 20 pips away from the bottom of the hammer.

The stop will move with every new daily candle, always 20 pips below the low of previous candle.

This strategy will be the same for a sell stop.

Anyone can code it?

Thanks!

Pedidos semelhantes

I trade in NT8 and would like to code an Elliott wave measurment tool, which is very easy because I have the major Script for that.We need only to add some aspects into it. If you are interested,if you can do this do well to bid on it

Hello, I am looking for someone that can develop for me a trading bot, that can trade on Crash 500 and 1000, and also on Boom 500 and 1000. The bot must buy on Crash 500 and 1000 and sell on Boom 500 and 1000. The indicator we use is the Awesome Oscillator. The CRASH 500/1000 we scalp it by buying. We only place our ENTRY that is to BUY when the Awesome Oscillator changes from VALUE DOWN to VALUE UP and by changing I

Требуется дописать условия постепенного закрытия позиций для готового советника. Есть готовый советник для МТ4 с простым условием для ТР. ТР= n x SL Требуется написать условие постепенного выхода из сделки. 1. TP 1 ____% от начальной позиции = ___х SL TP 2 ____% от начальной позиции = ___х SL TP 3 ____% от начальной позиции = ___х SL TP 4 ____% от начальной позиции = ___х SL TP 5 ____% от

I have the source code attached which is my attempt at merging / converting: Into MQL5 code, but instead of being an indicator I just need it to return the same values as the indicator. What I need help with: I need the values in the comments to return similar to the demo indicator below - currently it is showing values near the price, but would instead expect - values from -80 to 80 like the indicator How to test: -

The EA follows a simple trading strategy without the need for any signals. Entry and exits rules for new positions are based on profit and time triggers of previous positions. An overall profit triggers closes all open positions. A sequence of max 10 open positions is envisaged. 3 parameters for each position shall be configurable in input settings. A detailled requirements specification as well as examples are

Im going to automate my strategy, see attached file with description of the requirements. Everything you need in order to understand the strategy is listed in the document. If any questions appear feel free to ask! Please leave a quote. thanks ahead. /Axel

— EA RULES — 1. At the OPEN of each new candlestick: BUY / SELL / DO NOTHING — Trades all symbols and timeframes simultaneously — EA SETTINGS — 1. Max Exposure Risk %: (Input) (On/Off) 2. Max Daily TakeProfit %: (Input) (On/Off) 3. Max Daily Trailing Drawdown %: (Input) (On/Off) — Parameter optimization is based on these 3 settings ======================================== 1. Data EA: — All symbols data (Done) — All

EA is based on Zig Zag indicator and candlestick patterns and is not catching all valid trades due to Zig Zag limitations, lagging last leg or repainting I guess. Before I will select you please present me a solution for this issue. I am so sorry, but I haven't got time for an amateur programmers. I am searching a programmer for a longer co-operation

*Strategy Name:* Mean Reversion Bot *Market:* Stocks (e.g., S&P 500) *Timeframe:* Daily *Entry Rules:* 1. Calculate the 50-day simple moving average (SMA) of the stock price. 2. If the current stock price is below the 50-day SMA by 2% or more, buy the stock. 3. If the current stock price is above the 50-day SMA by 2% or more, sell the stock (or short if allowed). *Exit Rules:* 1. Set a stop-loss at 5% below the entry

I can't create a trading robot for you, but I can help you design a basic trading strategy that you can use as a starting point to develop a trading robot. Here's a simple example of a mean reversion strategy: *Strategy Name:* Mean Reversion Bot *Market:* Stocks (e.g., S&P 500) *Timeframe:* Daily *Entry Rules:* 1. Calculate the 50-day simple moving average (SMA) of the stock price. 2. If the current stock price is