Trabalho concluído

Tempo de execução 4 dias

Comentário do desenvolvedor

Thank you!

Comentário do cliente

Great job! Very friendly and develops the strategy together with the customer further. Always again

Termos de Referência

Hello,

please for appropriate automation of below strategy of TradingView from Pine code in MT5.

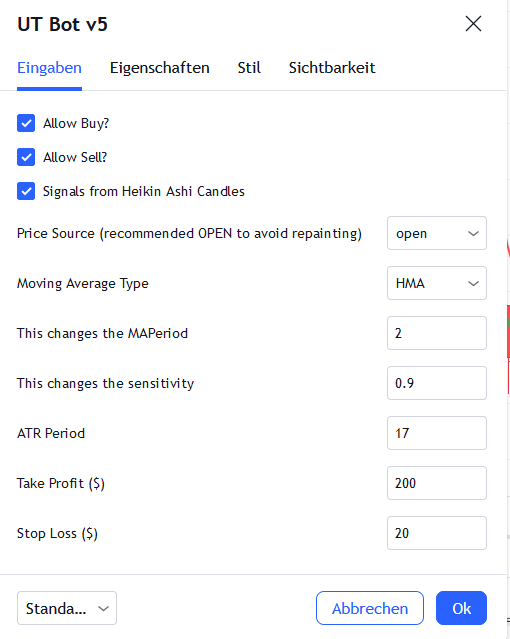

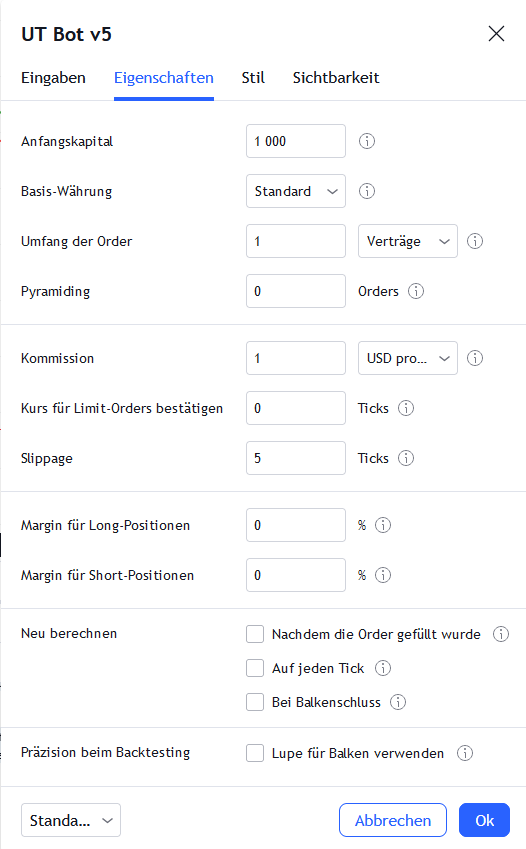

Please generate a settings panel as shown in the screenshot.

Source Code:

//@version=5

strategy(title='UT Bot v5', overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

//CREDITS to HPotter for the orginal code. The guy trying to sell this as his own is a scammer lol.

//Edited and converted to @version=5 by SeaSide420 for Paperina

// Inputs

AllowBuy = input(defval=true, title='Allow Buy?')

AllowSell = input(defval=false, title='Allow Sell?')

h = input(false, title='Signals from Heikin Ashi Candles')

//revclose = input(defval=true, title='Close when reverse signal?')

Price = input(defval=open, title='Price Source (recommended OPEN to avoid repainting)')

smoothing = input.string(title="Moving Average Type", defval="HMA", options=["SMA", "EMA", "WMA", "HMA"])

MA_Period = input(2, title='This changes the MAPeriod')

a = input.float(1, title='This changes the sensitivity',step=0.1)

c = input(11, title='ATR Period')

TakeProfit = input.int(defval=50000, title='Take Profit ($)', minval=1)

StopLoss = input.int(defval=50000, title='Stop Loss ($)', minval=1)

xATR = ta.atr(c)

nLoss = a * xATR

src = h ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, Price, lookahead=barmerge.lookahead_off) : Price

xATRTrailingStop = 0.0

iff_1 = src > nz(xATRTrailingStop[1], 0) ? src - nLoss : src + nLoss

iff_2 = src < nz(xATRTrailingStop[1], 0) and src[1] < nz(xATRTrailingStop[1], 0) ? math.min(nz(xATRTrailingStop[1]), src + nLoss) : iff_1

xATRTrailingStop := src > nz(xATRTrailingStop[1], 0) and src[1] > nz(xATRTrailingStop[1], 0) ? math.max(nz(xATRTrailingStop[1]), src - nLoss) : iff_2

pos = 0

iff_3 = src[1] > nz(xATRTrailingStop[1], 0) and src < nz(xATRTrailingStop[1], 0) ? -1 : nz(pos[1], 0)

pos := src[1] < nz(xATRTrailingStop[1], 0) and src > nz(xATRTrailingStop[1], 0) ? 1 : iff_3

xcolor = pos == -1 ? color.red : pos == 1 ? color.green : color.blue

ma_function(src, MA_Period) =>

switch smoothing

"SMA" => ta.sma(src, MA_Period)

"EMA" => ta.ema(src, MA_Period)

"WMA" => ta.wma(src, MA_Period)

=> ta.hma(src, MA_Period)

thema = ma_function(src, MA_Period)

above = ta.crossover(thema, xATRTrailingStop)

below = ta.crossover(xATRTrailingStop, thema)

buy = src > xATRTrailingStop and above

sell = src < xATRTrailingStop and below

barbuy = src > xATRTrailingStop

barsell = src < xATRTrailingStop

plot(thema,title="The M.A.",color=color.green,linewidth=2)

plot(xATRTrailingStop,title="The M.A.",color=color.red,linewidth=2)

plotshape(buy, title = "Buy", text = "Buy", style = shape.labelup, location = location.belowbar, color= color.green, textcolor = color.white, size = size.tiny)

plotshape(sell, title = "Sell", text = "Sell", style = shape.labeldown, location = location.abovebar, color= color.red, textcolor = color.white, size = size.tiny)

barcolor(barbuy ? color.green : na)

barcolor(barsell ? color.red : na)

strategy.close_all(when=strategy.openprofit>TakeProfit,alert_message="Close- TakeProfit", comment = "TP")

strategy.close_all(when=strategy.openprofit<StopLoss-(StopLoss*2),alert_message="Close- StopLoss", comment = "SL")

strategy.close("buy", when = sell and AllowSell==false , comment = "close buy")

strategy.close("sell", when = buy and AllowBuy==false, comment = "close sell")

strategy.entry("buy", strategy.long, when = buy and AllowBuy)

strategy.entry("sell", strategy.short, when = sell and AllowSell)

Respondido

1

Classificação

Projetos

56

21%

Arbitragem

12

67%

/

8%

Expirado

2

4%

Livre

2

Classificação

Projetos

472

40%

Arbitragem

103

40%

/

23%

Expirado

78

17%

Ocupado

Publicou: 2 códigos

Informações sobre o projeto

Orçamento

30+ USD