Auftrag beendet

Ausführungszeit 4 Tage

Bewertung des Entwicklers

Thank you!

Bewertung des Kunden

Great job! Very friendly and develops the strategy together with the customer further. Always again

Spezifikation

Hello,

please for appropriate automation of below strategy of TradingView from Pine code in MT5.

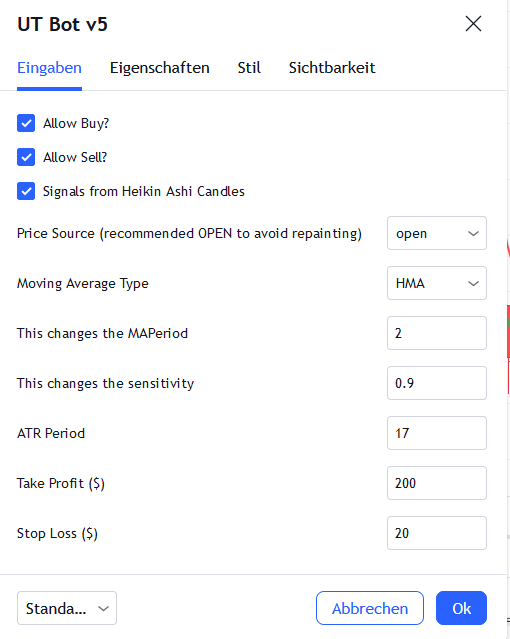

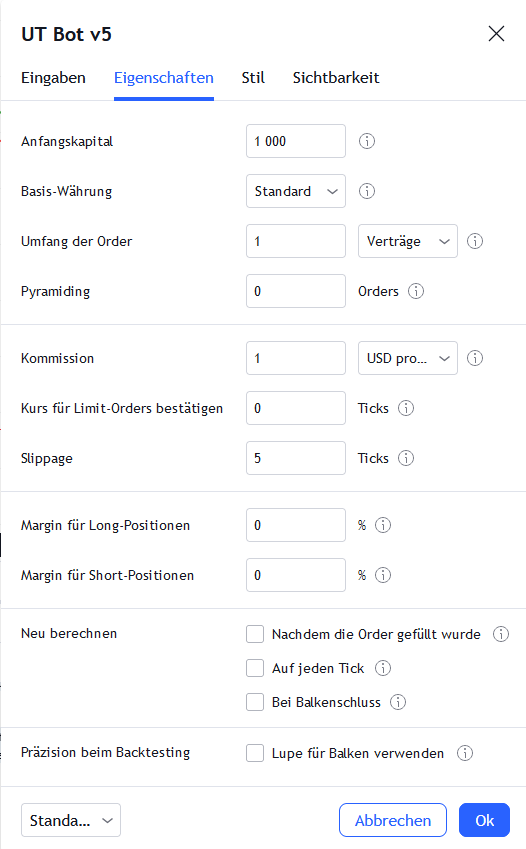

Please generate a settings panel as shown in the screenshot.

Source Code:

//@version=5

strategy(title='UT Bot v5', overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

//CREDITS to HPotter for the orginal code. The guy trying to sell this as his own is a scammer lol.

//Edited and converted to @version=5 by SeaSide420 for Paperina

// Inputs

AllowBuy = input(defval=true, title='Allow Buy?')

AllowSell = input(defval=false, title='Allow Sell?')

h = input(false, title='Signals from Heikin Ashi Candles')

//revclose = input(defval=true, title='Close when reverse signal?')

Price = input(defval=open, title='Price Source (recommended OPEN to avoid repainting)')

smoothing = input.string(title="Moving Average Type", defval="HMA", options=["SMA", "EMA", "WMA", "HMA"])

MA_Period = input(2, title='This changes the MAPeriod')

a = input.float(1, title='This changes the sensitivity',step=0.1)

c = input(11, title='ATR Period')

TakeProfit = input.int(defval=50000, title='Take Profit ($)', minval=1)

StopLoss = input.int(defval=50000, title='Stop Loss ($)', minval=1)

xATR = ta.atr(c)

nLoss = a * xATR

src = h ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, Price, lookahead=barmerge.lookahead_off) : Price

xATRTrailingStop = 0.0

iff_1 = src > nz(xATRTrailingStop[1], 0) ? src - nLoss : src + nLoss

iff_2 = src < nz(xATRTrailingStop[1], 0) and src[1] < nz(xATRTrailingStop[1], 0) ? math.min(nz(xATRTrailingStop[1]), src + nLoss) : iff_1

xATRTrailingStop := src > nz(xATRTrailingStop[1], 0) and src[1] > nz(xATRTrailingStop[1], 0) ? math.max(nz(xATRTrailingStop[1]), src - nLoss) : iff_2

pos = 0

iff_3 = src[1] > nz(xATRTrailingStop[1], 0) and src < nz(xATRTrailingStop[1], 0) ? -1 : nz(pos[1], 0)

pos := src[1] < nz(xATRTrailingStop[1], 0) and src > nz(xATRTrailingStop[1], 0) ? 1 : iff_3

xcolor = pos == -1 ? color.red : pos == 1 ? color.green : color.blue

ma_function(src, MA_Period) =>

switch smoothing

"SMA" => ta.sma(src, MA_Period)

"EMA" => ta.ema(src, MA_Period)

"WMA" => ta.wma(src, MA_Period)

=> ta.hma(src, MA_Period)

thema = ma_function(src, MA_Period)

above = ta.crossover(thema, xATRTrailingStop)

below = ta.crossover(xATRTrailingStop, thema)

buy = src > xATRTrailingStop and above

sell = src < xATRTrailingStop and below

barbuy = src > xATRTrailingStop

barsell = src < xATRTrailingStop

plot(thema,title="The M.A.",color=color.green,linewidth=2)

plot(xATRTrailingStop,title="The M.A.",color=color.red,linewidth=2)

plotshape(buy, title = "Buy", text = "Buy", style = shape.labelup, location = location.belowbar, color= color.green, textcolor = color.white, size = size.tiny)

plotshape(sell, title = "Sell", text = "Sell", style = shape.labeldown, location = location.abovebar, color= color.red, textcolor = color.white, size = size.tiny)

barcolor(barbuy ? color.green : na)

barcolor(barsell ? color.red : na)

strategy.close_all(when=strategy.openprofit>TakeProfit,alert_message="Close- TakeProfit", comment = "TP")

strategy.close_all(when=strategy.openprofit<StopLoss-(StopLoss*2),alert_message="Close- StopLoss", comment = "SL")

strategy.close("buy", when = sell and AllowSell==false , comment = "close buy")

strategy.close("sell", when = buy and AllowBuy==false, comment = "close sell")

strategy.entry("buy", strategy.long, when = buy and AllowBuy)

strategy.entry("sell", strategy.short, when = sell and AllowSell)

Bewerbungen

1

Bewertung

Projekte

56

21%

Schlichtung

12

67%

/

8%

Frist nicht eingehalten

2

4%

Frei

2

Bewertung

Projekte

472

40%

Schlichtung

103

40%

/

23%

Frist nicht eingehalten

78

17%

Überlastet

Veröffentlicht: 2 Beispiele

Projektdetails

Budget

30+ USD