코드베이스의 새로운 게재물

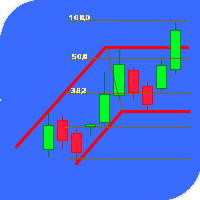

- ChandeQStick The QStick indicator is a simple n-period moving average of the price difference.

- ChandelierStops_v1 A trend indicator implemented in the form of NRTR.

- Chande_Kroll_Stop_v1 An indicator of the trend power drawn in the form of a colored cloud.