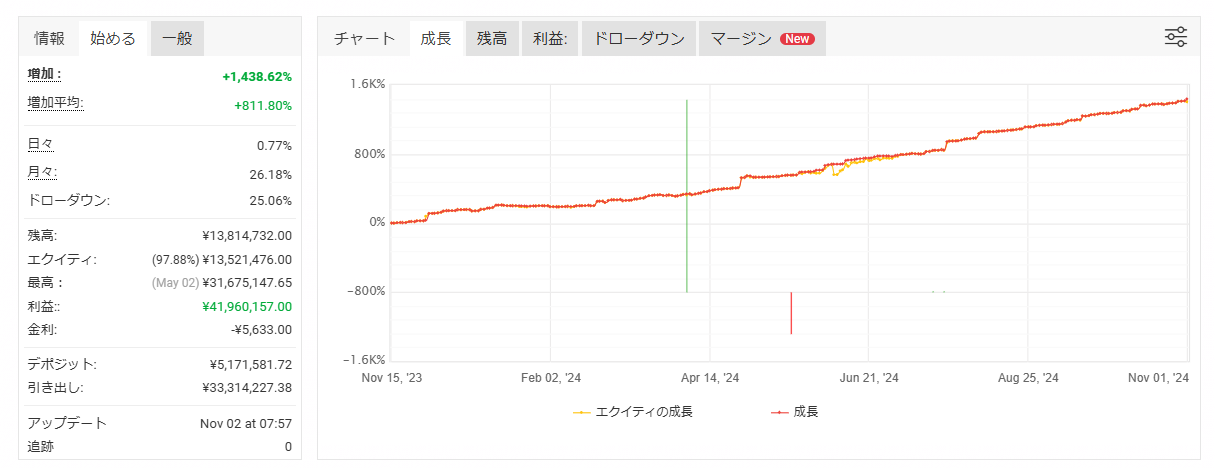

Eta Nakajima / プロファイル

- 情報

|

1 年

経験

|

0

製品

|

0

デモバージョン

|

|

0

ジョブ

|

5

シグナル

|

248

購読者

|

私はグローバルマクロ経済データ、ニュースを毎日何件も読み、ファンダメンタルズでトレードします。

経験は約15年です。 ファンダメンタルメインで、テクニカルは水平ラインとOHLCのみ使います。

資産運用は簡単ではないので、ファンダメンタル、テクニカルだけでなく、資金管理と、あとはメンタルコントロールも大事です。

完全にコピーする場合、取引銘柄が多くてスワップがフリーのこちらの業者がおすすめです。最低デポジット40万円ほどです。 (GetLamboは最低150万円ほどです 各シグナルで、入っている資金の1/10以上は必要です)

https://one.exnesstrack.org/a/q93nryv195

--update on sep.30--

年末のSP500は6800、GOLDは4000タッチ、BTCは1年以内にはATHしている予想です。

---update on April.15---

トランプ関税により、SP500の年末価格は5700ドルあたりを予想します。米株に関してはネガティブ目線で、しばらく買うことはありません。短期で4500あたりまで下げたら買うかもしれません。

---update on Mar.17---

BTCUSD の底は 68-72K 付近、SP500 の底は 5400付近 だと思いますが、市場に別のシグナルがあれば考えが変わります。(例: プットコール比率、ブルベア指標、FOMC パウエル プット、HYスプレッドなど)

---update on Feb.12---

長期的には金が上がると思いますが、最近は過熱気味なので、上がっても下がっても驚かないでしょう。上がる可能性はありますが、今買うのはあまり有利な状況とは思いません。

また、関税問題のため2月は慎重に取引し、3月も政府の予算問題があるため慎重に取引するつもりです。

---update on Jan.7---

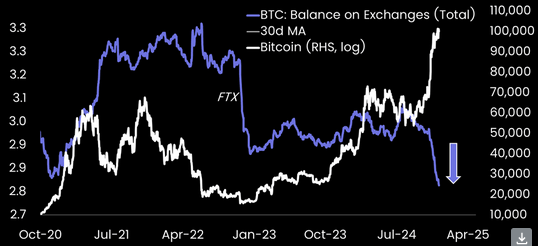

2025年の第1四半期は、大統領就任の前後で良い材料が出ればBTCは上がるでしょうが、インフレ指標によっては、または新しい材料がなければ2月前後には下落するでしょう。

FTX債権者の買いがもしかしたら底打ち材料になるかもしれませんね。

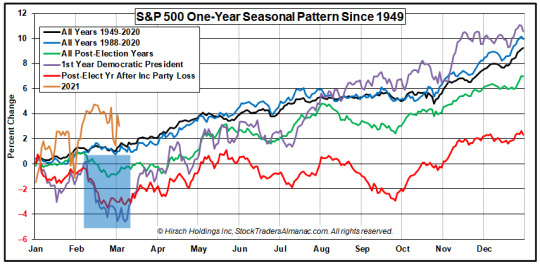

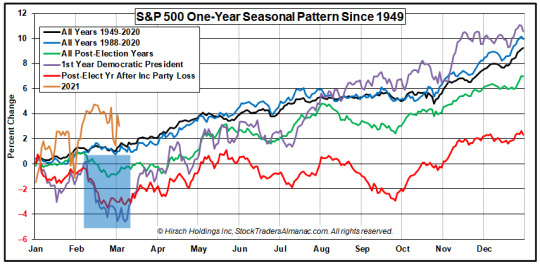

米国株は季節柄、大統領選の翌年2月と、与党が負けた翌年2月は下がる傾向があります。

割高感もあるので、崩れやすいかもしれませんが、市場は楽観視しているので、上がり続ける可能性と、調整する可能性が50:50くらいだと思いますが、特に2月は注意です(BTCも)。

どちらでも対応出来るように資金管理を行います。

FRBの利下げは3月以降のどこかで2回あるでしょう。 昨年末までの折り込みは4回でしたので、25年のGOLDの目標価格は2900ドル以下と予想します。

SP500は各種ファンドは6300~7000で予想していますが、仮にそうだとしても右肩上がりでスムーズに上がる相場ではなく、調整を経験しつつでしょう。

経済指標に注目しつつ、対応していきたいと思います。

経験は約15年です。 ファンダメンタルメインで、テクニカルは水平ラインとOHLCのみ使います。

資産運用は簡単ではないので、ファンダメンタル、テクニカルだけでなく、資金管理と、あとはメンタルコントロールも大事です。

完全にコピーする場合、取引銘柄が多くてスワップがフリーのこちらの業者がおすすめです。最低デポジット40万円ほどです。 (GetLamboは最低150万円ほどです 各シグナルで、入っている資金の1/10以上は必要です)

https://one.exnesstrack.org/a/q93nryv195

--update on sep.30--

年末のSP500は6800、GOLDは4000タッチ、BTCは1年以内にはATHしている予想です。

---update on April.15---

トランプ関税により、SP500の年末価格は5700ドルあたりを予想します。米株に関してはネガティブ目線で、しばらく買うことはありません。短期で4500あたりまで下げたら買うかもしれません。

---update on Mar.17---

BTCUSD の底は 68-72K 付近、SP500 の底は 5400付近 だと思いますが、市場に別のシグナルがあれば考えが変わります。(例: プットコール比率、ブルベア指標、FOMC パウエル プット、HYスプレッドなど)

---update on Feb.12---

長期的には金が上がると思いますが、最近は過熱気味なので、上がっても下がっても驚かないでしょう。上がる可能性はありますが、今買うのはあまり有利な状況とは思いません。

また、関税問題のため2月は慎重に取引し、3月も政府の予算問題があるため慎重に取引するつもりです。

---update on Jan.7---

2025年の第1四半期は、大統領就任の前後で良い材料が出ればBTCは上がるでしょうが、インフレ指標によっては、または新しい材料がなければ2月前後には下落するでしょう。

FTX債権者の買いがもしかしたら底打ち材料になるかもしれませんね。

米国株は季節柄、大統領選の翌年2月と、与党が負けた翌年2月は下がる傾向があります。

割高感もあるので、崩れやすいかもしれませんが、市場は楽観視しているので、上がり続ける可能性と、調整する可能性が50:50くらいだと思いますが、特に2月は注意です(BTCも)。

どちらでも対応出来るように資金管理を行います。

FRBの利下げは3月以降のどこかで2回あるでしょう。 昨年末までの折り込みは4回でしたので、25年のGOLDの目標価格は2900ドル以下と予想します。

SP500は各種ファンドは6300~7000で予想していますが、仮にそうだとしても右肩上がりでスムーズに上がる相場ではなく、調整を経験しつつでしょう。

経済指標に注目しつつ、対応していきたいと思います。

Eta Nakajima

I plan to short SP500 if it goes up.If it goes down, I want to pick it up a bit below 5400. buy quite a bit at 4800, buy strongly at 4500.

I expect BTC to go down with stocks if they go down and recover if the Fed or Trump softens their stance.

SP500は上がったら空売り予定。下がったら、5400以下では少しずつ拾いたい。4800で結構買い、4500だと強く買い。

BTCも株が下がった場合は連れ下げして、Fedまたはトランプが軟化姿勢になると、回復すると思っている。

I expect BTC to go down with stocks if they go down and recover if the Fed or Trump softens their stance.

SP500は上がったら空売り予定。下がったら、5400以下では少しずつ拾いたい。4800で結構買い、4500だと強く買い。

BTCも株が下がった場合は連れ下げして、Fedまたはトランプが軟化姿勢になると、回復すると思っている。

Eta Nakajima

As for German stocks, the expected P/E ratio is 18.8x, which is relatively expensive compared to the average P/E ratio of 12-15x for the last five years, and the "undervaluation" is shrinking as there is not much difference in P/E ratio compared to the US.However, the P/B of 1.68x is more attractive than the U.S. P/B of around 4.2x, and the dividend yield (around 3.2%) is still attractive.

The €1 trillion infrastructure fund (€500 billion over 12 years) will boost orders and margins for construction, capital goods, and renewable energy companies, which is also a tailwind.

ドイツ株については、予想PERは18.8倍と、直近5年平均PER12〜15 倍と比べると割高で、対米比較ではPERに大差がなく「割安感」は縮小。ただP/Bは1.68 倍で米の4.2 倍前後より魅力的であり、配当利回り(3.2%程度)もまだ魅力。

1兆ユーロ規模のインフラ基金(5000億ユーロを12年で投下)は、建設・資本財・再エネ企業の受注とマージンを底上げするので、それも追い風である。

The €1 trillion infrastructure fund (€500 billion over 12 years) will boost orders and margins for construction, capital goods, and renewable energy companies, which is also a tailwind.

ドイツ株については、予想PERは18.8倍と、直近5年平均PER12〜15 倍と比べると割高で、対米比較ではPERに大差がなく「割安感」は縮小。ただP/Bは1.68 倍で米の4.2 倍前後より魅力的であり、配当利回り(3.2%程度)もまだ魅力。

1兆ユーロ規模のインフラ基金(5000億ユーロを12年で投下)は、建設・資本財・再エネ企業の受注とマージンを底上げするので、それも追い風である。

Eta Nakajima

XAUUSD (Gold) took a loss of my funds, not too large but not too small.

(Even if I took a loss, I have a strategy that is profitable this month, so it's about a month's loss.)

I set the lot size taking into account past volatility, but since it was after a 50% rise in a year, I assumed that the rise would move up and down, including profit-taking adjustments, even in the midst of the Trump tariff war.

But in reality, it was a vertical rise like a beam that I have never seen in the past 20 years. Who could have predicted that it would rise further vertically after a 50% consecutive rise in a year? It was unexpected for me.

Even if I had entered a buy position, there is a good chance that I would have been caught up in a large profit-taking drop, and if the headline of tariff easing had come out, I think it would have been a big drop.

In fact, on Saturday, news of easing came out, and GOLD-backed cryptocurrencies such as PAXG were falling, but on Sunday, news of denial came out, and they canceled each other out.

We are in the middle of a tariff war, and we are seeing movements not seen in 20 years, so it is very risky, so if I enter I will reduce the lot size to lower the risk.

I did not expect a rise like Beam's this time, so I am reflecting on it.

I will take a moment to calm down and reflect on the situation.

(Even if I took a loss, I have a strategy that is profitable this month, so it's about a month's loss.)

I set the lot size taking into account past volatility, but since it was after a 50% rise in a year, I assumed that the rise would move up and down, including profit-taking adjustments, even in the midst of the Trump tariff war.

But in reality, it was a vertical rise like a beam that I have never seen in the past 20 years. Who could have predicted that it would rise further vertically after a 50% consecutive rise in a year? It was unexpected for me.

Even if I had entered a buy position, there is a good chance that I would have been caught up in a large profit-taking drop, and if the headline of tariff easing had come out, I think it would have been a big drop.

In fact, on Saturday, news of easing came out, and GOLD-backed cryptocurrencies such as PAXG were falling, but on Sunday, news of denial came out, and they canceled each other out.

We are in the middle of a tariff war, and we are seeing movements not seen in 20 years, so it is very risky, so if I enter I will reduce the lot size to lower the risk.

I did not expect a rise like Beam's this time, so I am reflecting on it.

I will take a moment to calm down and reflect on the situation.

Eta Nakajima

I think GOLD will go up in the long term, but it has been overheated lately and I wouldn't be surprised if it goes up or down.It could go up, but I don't think the odds are good to buy now.

Eta Nakajima

パブリッシュされたMetaTrader 5シグナル

It need minimum 1300USD signal price is dynamic pricing. There are always risks in trading. My strategy, as well as anyone else's strategy, carries the risk of loss and offers no guarantee of profit. No one's strategy can guarantee future profits. You can only look at past history and choose whether you want to subscribe. If you're concerned, I recommend that you stop subscribing

ソーシャルネットワーク上でシェアする · 1

1

Eta Nakajima

I will trade with caution in February because of the tariff issue and in March because of the government's budget issue.

Eta Nakajima

The first quarter of 2025 might see BTC rise around the presidential inauguration if there's positive news, but it could decline around February depending on inflation indicators or if there's no new positive catalysts. FTX creditors' buying might potentially serve as a bottom support.

For US stocks, historically, February following a presidential election year and February after the ruling party loses tend to show downward trends. While there's a sense of overvaluation that could lead to a correction, given the market's optimistic outlook, there's about a 50:50 chance between continued upward movement and a correction. February, in particular, requires careful attention (for BTC as well).

Fund management should be prepared for either scenario.

The Fed is likely to implement two rate cuts sometime after March. Since the market had priced in four cuts by the end of last year, the 2025 GOLD price target is predicted to be below $2,900.

While various funds are forecasting the S&P 500 to reach between 6,300 and 7,000, even if this happens, it's unlikely to be a smooth upward trajectory - we should expect to experience corrections along the way.

I plan to monitor economic indicators closely and respond accordingly.

For US stocks, historically, February following a presidential election year and February after the ruling party loses tend to show downward trends. While there's a sense of overvaluation that could lead to a correction, given the market's optimistic outlook, there's about a 50:50 chance between continued upward movement and a correction. February, in particular, requires careful attention (for BTC as well).

Fund management should be prepared for either scenario.

The Fed is likely to implement two rate cuts sometime after March. Since the market had priced in four cuts by the end of last year, the 2025 GOLD price target is predicted to be below $2,900.

While various funds are forecasting the S&P 500 to reach between 6,300 and 7,000, even if this happens, it's unlikely to be a smooth upward trajectory - we should expect to experience corrections along the way.

I plan to monitor economic indicators closely and respond accordingly.

Eta Nakajima

I don't know if it was due to the MQL5 settings during the maintenance of MT5 at EXNESS on December 21, but it seems that all positions of subscribers were closed.

Still I have all positions.

Still I have all positions.

Eta Nakajima

パブリッシュされたMetaTrader 5シグナル

It trade by global macro analysys. Read fundamental news, economic news, FOMC member speach, etc. signal price is dynamic pricing. 私のストラテジーも、それ以外の誰のストラテジーも、損するリスクもありますし、儲かる保証はされていません。 誰のストラテジーも、将来の利益は確約されていません。過去の履歴を見て、サブスクライブしたいかどうかを選択するのみです。 ご心配なら、サブスクライブを辞めることを推奨します。

ソーシャルネットワーク上でシェアする · 1

1

Eta Nakajima

In November, the market might temporarily see a sell-off due to the presidential election. However, I see this as an opportunity to accumulate, even if it means holding unrealized losses. By the end of the year, I believe prices will be higher than they are at that time.

Eta Nakajima

Since October is before the U.S. elections, stock prices may become unstable, and various risk assets may decline due to profit-taking. However, I believe this could be the best accumulation phase.

I plan to start taking profits as we head into November and the end of the year.

I plan to start taking profits as we head into November and the end of the year.

: