Eta Nakajima / 个人资料

- 信息

|

1 年

经验

|

0

产品

|

0

演示版

|

|

0

工作

|

5

信号

|

248

订阅者

|

I am a trader with 15 years of experience living in Tokyo. I am meticulous about risk management and profit management.

I read multiple global macroeconomic data points and news articles daily and trade based on fundamentals. For techniques, I only use horizontal lines and OHLC.

Asset management is not easy, so it’s essential to focus not only on fundamentals and technical analysis but also on risk management and mental control.

If you want to copy completely, I recommend this broker that has many trading pairs and free swap fees.

https://one.exnesstrack.org/a/q93nryv195

(GetLambo is about 11000USD minimum, other signal can use more small asset. Each signal requires at least 1/10th of the funds or 2500USD minimum you have in it.)

-update on Sep.30

2025 year end SP500 price is 6800, GOLD touch 4000 in this year, BTCUSD has new ATH in next 1 year.

---update on April.15---

Due to Trump tariffs, I expect the end of the year price of the SP500 to be around $5700. I have a negative outlook on US stocks and won't be buying them for a while. I might buy them if they drop to around 4500 in the short term.

---update on Mar.17---

I think BTCUSD bottom is near 68-72K, SP500 bottom is near 5400, but if market has another signal , I will change my mind. ( ex. put call ratio, bull bear indicator, FOMC powel put,HY spread, , etc..)

---update on Feb.12---

I think GOLD will go up in the long term, but it has been overheated lately and I wouldn't be surprised if it goes up or down.It could go up, but I don't think the odds are good to buy now.

I will trade with caution in February because of the tariff issue and in March because of the government's budget issue.

---update on Jan.7---

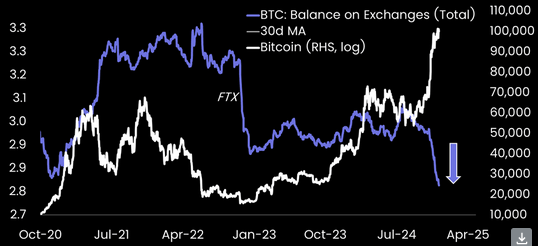

The first quarter of 2025 might see BTC rise around the presidential inauguration if there's positive news, but it could decline around February depending on inflation indicators or if there's no new positive catalysts. FTX creditors' buying might potentially serve as a bottom support.

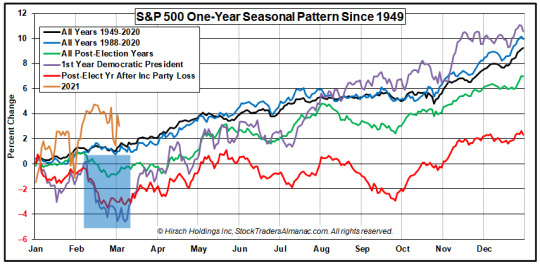

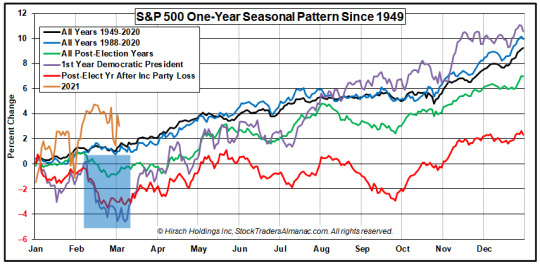

For US stocks, historically, February following a presidential election year and February after the ruling party loses tend to show downward trends. While there's a sense of overvaluation that could lead to a correction, given the market's optimistic outlook, there's about a 50:50 chance between continued upward movement and a correction. February, in particular, requires careful attention (for BTC as well).

Fund management should be prepared for either scenario.

The Fed is likely to implement two rate cuts sometime after March. Since the market had priced in four cuts by the end of last year, the 2025 GOLD price target is predicted to be below $2,900.

While various funds are forecasting the S&P 500 to reach between 6,300 and 7,000, even if this happens, it's unlikely to be a smooth upward trajectory - we should expect to experience corrections along the way.

I plan to monitor economic indicators closely and respond accordingly.

---update on Nov. 26---

Regarding Gold

When a war ends or there is a sense that it might be coming to an end, those who had been buying gold often sell, leading to short-term adjustments. However, the long-term trend remains upward.

As I had anticipated this, I closed my positions near the peak. I am now in the accumulation phase again.

Regarding BTC

The $100,000 mark tends to act as a psychological barrier, so I closed my positions and even went short before reaching that level.

When the market became sideways, I closed my positions again and waited for either a decline or a breakout.

As the price started to drop, it became an excellent phase for accumulation.

Is this a Black Friday sale? While my unrealized losses increase, I continue to accumulate.

---update on Nov. 14---

I forecast the Federal Funds Rate to be 4.25% by the end of 2024 and 3.00% by the end of 2025.

I expect the unemployment rate to be 4.2% by the end of 2024 and 4.7% by the end of 2025.

I read multiple global macroeconomic data points and news articles daily and trade based on fundamentals. For techniques, I only use horizontal lines and OHLC.

Asset management is not easy, so it’s essential to focus not only on fundamentals and technical analysis but also on risk management and mental control.

If you want to copy completely, I recommend this broker that has many trading pairs and free swap fees.

https://one.exnesstrack.org/a/q93nryv195

(GetLambo is about 11000USD minimum, other signal can use more small asset. Each signal requires at least 1/10th of the funds or 2500USD minimum you have in it.)

-update on Sep.30

2025 year end SP500 price is 6800, GOLD touch 4000 in this year, BTCUSD has new ATH in next 1 year.

---update on April.15---

Due to Trump tariffs, I expect the end of the year price of the SP500 to be around $5700. I have a negative outlook on US stocks and won't be buying them for a while. I might buy them if they drop to around 4500 in the short term.

---update on Mar.17---

I think BTCUSD bottom is near 68-72K, SP500 bottom is near 5400, but if market has another signal , I will change my mind. ( ex. put call ratio, bull bear indicator, FOMC powel put,HY spread, , etc..)

---update on Feb.12---

I think GOLD will go up in the long term, but it has been overheated lately and I wouldn't be surprised if it goes up or down.It could go up, but I don't think the odds are good to buy now.

I will trade with caution in February because of the tariff issue and in March because of the government's budget issue.

---update on Jan.7---

The first quarter of 2025 might see BTC rise around the presidential inauguration if there's positive news, but it could decline around February depending on inflation indicators or if there's no new positive catalysts. FTX creditors' buying might potentially serve as a bottom support.

For US stocks, historically, February following a presidential election year and February after the ruling party loses tend to show downward trends. While there's a sense of overvaluation that could lead to a correction, given the market's optimistic outlook, there's about a 50:50 chance between continued upward movement and a correction. February, in particular, requires careful attention (for BTC as well).

Fund management should be prepared for either scenario.

The Fed is likely to implement two rate cuts sometime after March. Since the market had priced in four cuts by the end of last year, the 2025 GOLD price target is predicted to be below $2,900.

While various funds are forecasting the S&P 500 to reach between 6,300 and 7,000, even if this happens, it's unlikely to be a smooth upward trajectory - we should expect to experience corrections along the way.

I plan to monitor economic indicators closely and respond accordingly.

---update on Nov. 26---

Regarding Gold

When a war ends or there is a sense that it might be coming to an end, those who had been buying gold often sell, leading to short-term adjustments. However, the long-term trend remains upward.

As I had anticipated this, I closed my positions near the peak. I am now in the accumulation phase again.

Regarding BTC

The $100,000 mark tends to act as a psychological barrier, so I closed my positions and even went short before reaching that level.

When the market became sideways, I closed my positions again and waited for either a decline or a breakout.

As the price started to drop, it became an excellent phase for accumulation.

Is this a Black Friday sale? While my unrealized losses increase, I continue to accumulate.

---update on Nov. 14---

I forecast the Federal Funds Rate to be 4.25% by the end of 2024 and 3.00% by the end of 2025.

I expect the unemployment rate to be 4.2% by the end of 2024 and 4.7% by the end of 2025.

Eta Nakajima

I plan to short SP500 if it goes up.If it goes down, I want to pick it up a bit below 5400. buy quite a bit at 4800, buy strongly at 4500.

I expect BTC to go down with stocks if they go down and recover if the Fed or Trump softens their stance.

SP500は上がったら空売り予定。下がったら、5400以下では少しずつ拾いたい。4800で結構買い、4500だと強く買い。

BTCも株が下がった場合は連れ下げして、Fedまたはトランプが軟化姿勢になると、回復すると思っている。

I expect BTC to go down with stocks if they go down and recover if the Fed or Trump softens their stance.

SP500は上がったら空売り予定。下がったら、5400以下では少しずつ拾いたい。4800で結構買い、4500だと強く買い。

BTCも株が下がった場合は連れ下げして、Fedまたはトランプが軟化姿勢になると、回復すると思っている。

分享社交网络 · 4

Eta Nakajima

As for German stocks, the expected P/E ratio is 18.8x, which is relatively expensive compared to the average P/E ratio of 12-15x for the last five years, and the "undervaluation" is shrinking as there is not much difference in P/E ratio compared to the US.However, the P/B of 1.68x is more attractive than the U.S. P/B of around 4.2x, and the dividend yield (around 3.2%) is still attractive.

The €1 trillion infrastructure fund (€500 billion over 12 years) will boost orders and margins for construction, capital goods, and renewable energy companies, which is also a tailwind.

ドイツ株については、予想PERは18.8倍と、直近5年平均PER12〜15 倍と比べると割高で、対米比較ではPERに大差がなく「割安感」は縮小。ただP/Bは1.68 倍で米の4.2 倍前後より魅力的であり、配当利回り(3.2%程度)もまだ魅力。

1兆ユーロ規模のインフラ基金(5000億ユーロを12年で投下)は、建設・資本財・再エネ企業の受注とマージンを底上げするので、それも追い風である。

The €1 trillion infrastructure fund (€500 billion over 12 years) will boost orders and margins for construction, capital goods, and renewable energy companies, which is also a tailwind.

ドイツ株については、予想PERは18.8倍と、直近5年平均PER12〜15 倍と比べると割高で、対米比較ではPERに大差がなく「割安感」は縮小。ただP/Bは1.68 倍で米の4.2 倍前後より魅力的であり、配当利回り(3.2%程度)もまだ魅力。

1兆ユーロ規模のインフラ基金(5000億ユーロを12年で投下)は、建設・資本財・再エネ企業の受注とマージンを底上げするので、それも追い風である。

分享社交网络 · 3

Eta Nakajima

XAUUSD (Gold) took a loss of my funds, not too large but not too small.

(Even if I took a loss, I have a strategy that is profitable this month, so it's about a month's loss.)

I set the lot size taking into account past volatility, but since it was after a 50% rise in a year, I assumed that the rise would move up and down, including profit-taking adjustments, even in the midst of the Trump tariff war.

But in reality, it was a vertical rise like a beam that I have never seen in the past 20 years. Who could have predicted that it would rise further vertically after a 50% consecutive rise in a year? It was unexpected for me.

Even if I had entered a buy position, there is a good chance that I would have been caught up in a large profit-taking drop, and if the headline of tariff easing had come out, I think it would have been a big drop.

In fact, on Saturday, news of easing came out, and GOLD-backed cryptocurrencies such as PAXG were falling, but on Sunday, news of denial came out, and they canceled each other out.

We are in the middle of a tariff war, and we are seeing movements not seen in 20 years, so it is very risky, so if I enter I will reduce the lot size to lower the risk.

I did not expect a rise like Beam's this time, so I am reflecting on it.

I will take a moment to calm down and reflect on the situation.

(Even if I took a loss, I have a strategy that is profitable this month, so it's about a month's loss.)

I set the lot size taking into account past volatility, but since it was after a 50% rise in a year, I assumed that the rise would move up and down, including profit-taking adjustments, even in the midst of the Trump tariff war.

But in reality, it was a vertical rise like a beam that I have never seen in the past 20 years. Who could have predicted that it would rise further vertically after a 50% consecutive rise in a year? It was unexpected for me.

Even if I had entered a buy position, there is a good chance that I would have been caught up in a large profit-taking drop, and if the headline of tariff easing had come out, I think it would have been a big drop.

In fact, on Saturday, news of easing came out, and GOLD-backed cryptocurrencies such as PAXG were falling, but on Sunday, news of denial came out, and they canceled each other out.

We are in the middle of a tariff war, and we are seeing movements not seen in 20 years, so it is very risky, so if I enter I will reduce the lot size to lower the risk.

I did not expect a rise like Beam's this time, so I am reflecting on it.

I will take a moment to calm down and reflect on the situation.

分享社交网络 · 8

Eta Nakajima

I think GOLD will go up in the long term, but it has been overheated lately and I wouldn't be surprised if it goes up or down.It could go up, but I don't think the odds are good to buy now.

分享社交网络 · 1

Eta Nakajima

发布MetaTrader 5信号

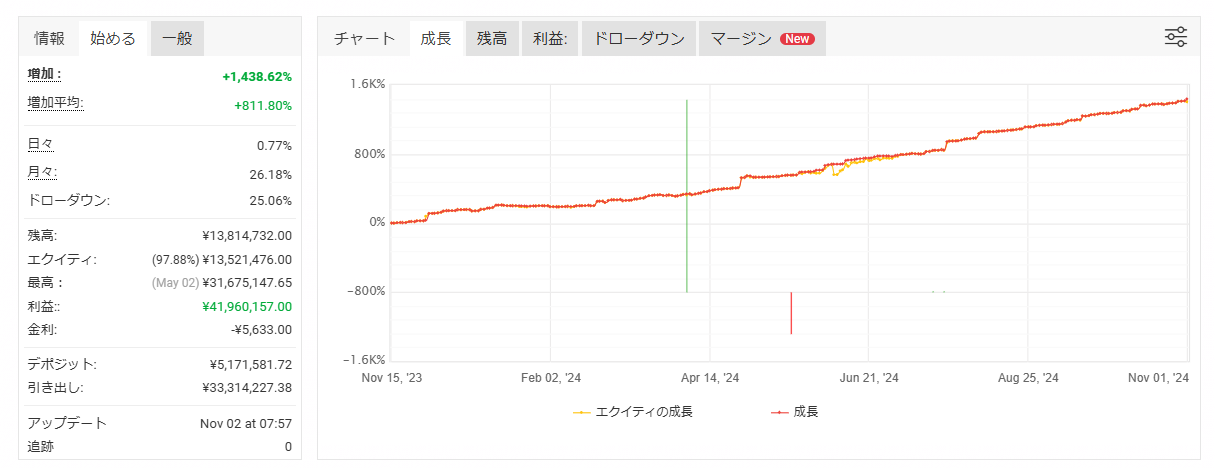

signal price is dynamic pricing. There are always risks in trading. My strategy, as well as anyone else's strategy, carries the risk of loss and offers no guarantee of profit. No one's strategy can guarantee future profits. You can only look at past history and choose whether you want to subscribe. If you're concerned, I recommend that you stop subscribing

分享社交网络 · 1

1

Eta Nakajima

发布MetaTrader 5信号

It need minimum 1300USD signal price is dynamic pricing. There are always risks in trading. My strategy, as well as anyone else's strategy, carries the risk of loss and offers no guarantee of profit. No one's strategy can guarantee future profits. You can only look at past history and choose whether you want to subscribe. If you're concerned, I recommend that you stop subscribing

分享社交网络 · 1

1

Eta Nakajima

I will trade with caution in February because of the tariff issue and in March because of the government's budget issue.

分享社交网络 · 1

Eta Nakajima

https://x.com/tier10k/status/1877176406905356670

some my position was hedge today.

some my position was hedge today.

分享社交网络 · 2

Eta Nakajima

The first quarter of 2025 might see BTC rise around the presidential inauguration if there's positive news, but it could decline around February depending on inflation indicators or if there's no new positive catalysts. FTX creditors' buying might potentially serve as a bottom support.

For US stocks, historically, February following a presidential election year and February after the ruling party loses tend to show downward trends. While there's a sense of overvaluation that could lead to a correction, given the market's optimistic outlook, there's about a 50:50 chance between continued upward movement and a correction. February, in particular, requires careful attention (for BTC as well).

Fund management should be prepared for either scenario.

The Fed is likely to implement two rate cuts sometime after March. Since the market had priced in four cuts by the end of last year, the 2025 GOLD price target is predicted to be below $2,900.

While various funds are forecasting the S&P 500 to reach between 6,300 and 7,000, even if this happens, it's unlikely to be a smooth upward trajectory - we should expect to experience corrections along the way.

I plan to monitor economic indicators closely and respond accordingly.

For US stocks, historically, February following a presidential election year and February after the ruling party loses tend to show downward trends. While there's a sense of overvaluation that could lead to a correction, given the market's optimistic outlook, there's about a 50:50 chance between continued upward movement and a correction. February, in particular, requires careful attention (for BTC as well).

Fund management should be prepared for either scenario.

The Fed is likely to implement two rate cuts sometime after March. Since the market had priced in four cuts by the end of last year, the 2025 GOLD price target is predicted to be below $2,900.

While various funds are forecasting the S&P 500 to reach between 6,300 and 7,000, even if this happens, it's unlikely to be a smooth upward trajectory - we should expect to experience corrections along the way.

I plan to monitor economic indicators closely and respond accordingly.

分享社交网络 · 3

Eta Nakajima

I don't know if it was due to the MQL5 settings during the maintenance of MT5 at EXNESS on December 21, but it seems that all positions of subscribers were closed.

Still I have all positions.

Still I have all positions.

分享社交网络 · 3

Eta Nakajima

发布MetaTrader 5信号

It trade by global macro analysys. Read fundamental news, economic news, FOMC member speach, etc. signal price is dynamic pricing. There are always risks in trading. My strategy, as well as anyone else's strategy, carries the risk of loss and offers no guarantee of profit. No one's strategy can guarantee future profits. You can only look at past history and choose whether you want to subscribe. If you're concerned, I recommend that you stop subscribing

分享社交网络 · 1

Eta Nakajima

In November, the market might temporarily see a sell-off due to the presidential election. However, I see this as an opportunity to accumulate, even if it means holding unrealized losses. By the end of the year, I believe prices will be higher than they are at that time.

分享社交网络 · 2

Eta Nakajima

Since October is before the U.S. elections, stock prices may become unstable, and various risk assets may decline due to profit-taking. However, I believe this could be the best accumulation phase.

I plan to start taking profits as we head into November and the end of the year.

I plan to start taking profits as we head into November and the end of the year.

分享社交网络 · 3

: