Allan Graham Pike / Profilo

- Informazioni

|

no

esperienza

|

16

prodotti

|

13

versioni demo

|

|

0

lavori

|

0

segnali

|

0

iscritti

|

Questa convinzione plasma tutto ciò che costruisco. I miei EA sono testati sia nei mercati rialzisti che ribassisti, progettati per resistere quando il mercato diventa instabile. Non sono fatti per sembrare belli solo nei backtest — sono costruiti per durare nel trading reale.

Se condividi l’idea che il trading debba essere coerente, basato su regole e focalizzato su BTC, allora sei nel posto giusto. E lungo la strada, finiamo per creare ottimi EA.

Momentum pullback (M15) + Session breakout box (M5).

Includes a ready-to-load Balanced preset (.set).

Get it here → https://www.mql5.com/en/market/product/149584

Follow the channel for updates/presets → https://www.mql5.com/en/channels/ap-trading-tools

BTC Breakout PRO

• Breakout through structure using pending orders, optional trend/ATR guards, one-set logic, validator-safe.

BTC Breakdown (Retest Short-Only)

• Close below level with volume → Sell Limit on retest, ATR/spread-aware offset, auto-leveling, validator-safe.

Early-bird pricing (first 10 buyers each): $39.99

After that: Rent only — $39.99/month or $399.99/12 months.

⚠️ Trade responsibly; forward-test first.

🔗 Links: https://www.mql5.com/en/market/product/148490

https://www.mql5.com/en/market/product/149598

AP Forex DayTrader (Momentum M15 + Box M5) is still free for the first batch—then it goes paid.

What you get

Balanced preset (.set) included

Quick-start + FAQ on the page

Validator-safe, no DLL/WebRequest

How to claim

Open the Market page ➜ Download

Load the included Balanced preset

Forward-test on low risk first

⚠️ No guarantees—market risk is real. Start small, then tune spreads/filters to your broker.

🔗 Link: https://www.mql5.com/en/market/product/149584

We’re down to the last 34 free downloads of AP Forex DayTrader — FREE75.

A clean, validator-safe day-trading EA that pairs Momentum Pullback (M15) with a Session Breakout (M5) engine. One chart, both engines, sensible guards.

Why traders like it

Runs Momentum + Breakout together (or separately via InpMode)

ATR-aware SL/TP, BE + trail options, spread/ops limits

Validator-safe (no DLL/WebRequest), strict magic filtering

2-minute Quick Start

Attach to your Forex symbol (any chart TF is fine; EA reads its own).

Leave InpMode = MODE_BOTH (Momentum on M15, Box on M5 under the hood).

Keep defaults: ATR stops ON (SL 2.0×ATR, TP 1.5×ATR).

Optional: set RiskPercent = 1.0 if not using fixed lots.

Get it while free: only 34 copies remain.

Search the Market for “AP Forex DayTrader FREE75” or open my MQL5 profile and grab it.

Note: Nothing is guaranteed—start small, forward-test, and manage risk.

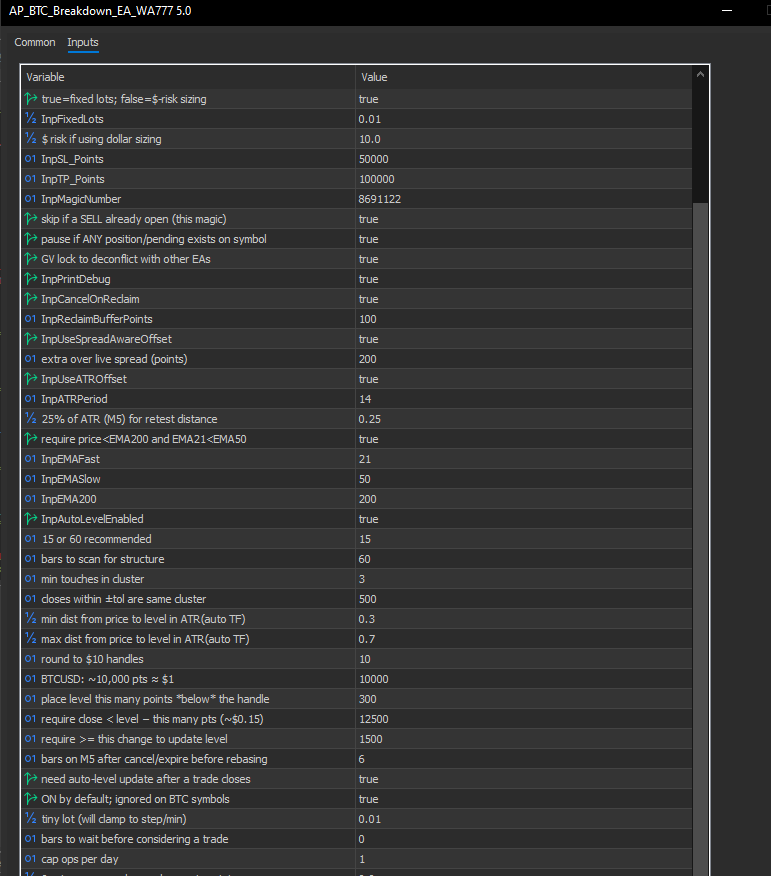

AP BTC Breakdown Retest (MT5) — Launch 🚀

Short-only BTC engine that waits for a confirmed breakdown, then places a SELL LIMIT on the retest with ATR/spread-aware offsets, EMA trend filter, and an Auto-Level Manager that finds fresh breakdown handles on M15/H1. Built validator-safe. No DLL/WebRequest.

Intro offer: $39.99 for the first 10 buyers only, then rent only at $39.99/month or $399.99/12 months.

➡️ Includes a Balanced .set preset and a Quick Start + FAQ below.

Key features

Breakdown → Retest: requires price to beat the handle, then sells the first decent retest.

Auto-Level Manager (M15/H1): auto-finds clustered body lows, enforces min/max ATR distance, $10 handle rounding, and “must-beat” threshold.

Guardrails: one short per magic, cancel on reclaim, same-day pending expiry, EMA trend filter (21/50/200), ATR+spread aware entry offset, margin and stops gates.

Validator-safe tester shim: keeps MQL5 validator happy without changing live behavior.

What you get

Balanced preset (.set)

Quick Start guide

Detailed FAQ

Clean logs, clear inputs, and live status pulse

Reminder: Trading involves risk. Forward-test small and understand the logic before scaling.

Quick Start (2 minutes)

Symbol & account

Attach to your broker’s BTCUSD (or BTC symbol).

Use a live/forward demo first. Default signal TF is M5 (internal).

Load the preset

EA Inputs → Load → pick AP_BTC_BreakdownRetest__Balanced.set.

Download the preset

Keep the defaults (Balanced)

Short-only, EMA trend filter ON, ATR/spread-aware offset ON.

Auto-Level Manager ON (M15), retest offset auto-guards.

Broker sanity checks

BTC point size near 10,000 pts ≈ $1 (common on many brokers).

If your symbol has a suffix (e.g., BTCUSD.a), attach to that exact symbol.

Let it run

It will print “AutoLevel” updates, then on a confirmed breakdown, place a SELL LIMIT on the retest with SL/TP.

Default: pending expires after 2 closed M5 bars if not filled; cancels on reclaim above level.

Risk

Balanced preset uses fixed 0.01 lots. Change to $-risk sizing later if you prefer.

FAQ (detailed)

Q1: What does “Breakdown → Retest” mean here?

A: The EA requires a closed-bar breakdown below an auto/fixed handle (must beat it by a buffer), then places a SELL LIMIT above price (a measured retest). If price re-accepts above the level (“reclaim”), the pending can be cancelled.

Q2: Do I need to keep the chart on M5?

A: You can use any chart TF. The EA internally reads InpTFMinutes (default 5) for signals and InpAutoTFMinutes (default 15) for auto level discovery.

Q3: When will it place orders?

A: Only after:

A handle is set (auto or fixed),

A bar closes below it by InpMustBeatHandlePts,

Trend filter passes (EMA200 + 21/50),

Volume check passes (last bar > avg × InpVolMultiplier),

Then it waits for a retest (offset = max of your min, spread buffer, and ATR fraction).

Q4: It says “created pending,” but nothing fills?

A: That means price never pulled back into the retest limit before expiring. This is normal on strong trends. You can try:

Slightly lower InpMinOffsetPts (e.g., 2000 → 1600),

Raise InpPendingExpireBars (2 → 3),

Reduce InpATROffsetMult (0.25 → 0.20).

Q5: Why short-only? Can it go long?

A: This is the Breakdown Retest variant (short-only by design). If you want upside behavior, use/launch the breakout or “breakout/reclaim-long” counterpart.

Q6: What are the “points” on BTC?

A: Many brokers quote BTC with ~10,000 points ≈ $1. So 50,000 pts ≈ $5. The preset’s SL=50,000 pts ≈ $5 and TP=100,000 pts ≈ $10 (approx).

Q7: The Auto-Level Manager picks levels too close/far.

A: Tune InpAutoMinDistATR / InpAutoMaxDistATR (0.30–0.70 in preset). Lower minimum to allow closer handles, raise maximum to allow further ones.

Q8: How do I reduce missed retests on volatile days?

A: Lower the offset slightly and/or disable ATR offset (InpUseATROffset=false) leaving spread-aware on. Expect more fills but also more noise.

Q9: I see “Daily pulse” logs but no trades.

A: That’s a live heartbeat only. It prints your gate states (TrendOk, VolOk, pending/open counts). If TrendOk/VolOk are “no,” the EA is intentionally idle.

Q10: Margin/“no money” warnings?

A: Lower InpFixedLots or switch to $-risk sizing later. BTC margins can be chunky; the EA checks both pending and hypothetical market margin before placing.

Q11: Tester shows tiny trades on non-BTC symbols.

A: That’s the validator shim (tester-only). It never runs on BTC symbols; it exists to satisfy MQL5’s “there are trading operations” requirement.

Q12: Can I hard-set a level?

A: Yes—set InpAutoLevelEnabled=false and choose InpBreakdownLevel manually.

Q13: Safer vs. spicier?

Safer: raise InpMinOffsetPts (e.g., 3000–4000), widen SL, keep ATR+trend checks ON.

Spicier: lower InpMinOffsetPts (1500–2000), reduce/disable ATR offset, consider tighter SL/TP (but expect more noise).

Q14: Does it cancel on reclaim?

A: Yes if InpCancelOnReclaim=true. If the next bar closes back above the level + InpReclaimBufferPoints, the pending is pulled.

Q15: Will it stack multiple shorts?

A: No. It enforces one short per magic and can pause if InpObserveSymbolWide=true and the symbol already has positions/pendings.

Balanced preset (.set)

Load this into the EA inputs:

EA Inputs → Load → AP_BTC_BreakdownRetest__Balanced.set

Download: AP_BTC_BreakdownRetest__Balanced.set

BTC Breakdown Pro MT5 La maggior parte degli EA cerca di operare su tutte le coppie e configurazioni. Alla fine non offrono risultati consistenti. BTC Breakdown Pro MT5 è stato creato con un unico obiettivo: catturare le maggiori rotture ribassiste del Bitcoin con chiarezza e controllo. Il sistema attende una rottura con alto volume, quindi cerca un retest pulito prima di entrare. Le operazioni sono filtrate dal trend, il rischio è controllato con stop e target predefiniti, e i setup vengono

Some users reported the error “OrderCheck fail 10030” during backtests. This is an invalid-stops condition that appears on brokers or symbols with non-zero Stops Level or Freeze Level.

What changed

• We adjusted order placement so initial trades are sent without SL/TP and levels are applied with a wider safety margin after entry.

• Added fill-mode fallback to avoid invalid fill errors.

• Tightened ownership checks so we only manage positions opened by this EA.

• In tester mode we run with safer defaults.

Action needed

Please re-download and install the latest update. If you previously saw “OrderCheck fail 10030,” this build addresses it.

Apology and offer

Sorry for the hassle and wasted time. To make up for it, we’re extending the free offer from the first 75 downloads to the first 100 downloads. If you hit the error earlier, please try the updated version and leave a review or comment—good or bad, constructive feedback is welcome.

If issues persist, include your broker, symbol, timeframe, initial deposit/leverage, and the exact Journal lines so we can reproduce and fix fast.

Next in the BTC series: tools focused on entry/management with clear rules.

We’re finalising v5.0 for Market release. This update focuses on stability and validation compatibility; BTC trading logic remains unchanged on BTC charts.

Highlights

Deterministic tester compatibility (no impact on live BTC use)

Calm order flow, margin/stop checks, pending expiry

Clear inputs (offsets, trend filter, auto-level manager)

Presets for BTCUSD (Conservative / Balanced / Aggressive)

If you’d like the preset pack and quick notes, send me a message on MQL5.

AP Oil Navigator PRO (MT5) What it is AP Oil Navigator PRO is a rules-based Expert Advisor designed specifically for energy symbols such as XTIUSD (WTI) and UKOIL (Brent). The EA looks for a directional bias using a higher-timeframe trend filter, then times entries on the working timeframe using a volatility gate and a structure break. Orders are placed with broker-safe checks and fixed risk. No martingale, no grid, and no averaging. How it trades • Bias: EMA alignment and swing structure on

AP London Breakout PRO trades the first impulse when Europe hands over and London liquidity hits. It builds a pre-London range (02:00–07:00 server), checks the box height and spread, then posts one clean breakout with fixed risk. No martingale, no grid, no chasing; once filled, it cancels the other side and stands down for the day. Designed for majors and gold on M5–M15, with broker-safe placement (Stops/Freeze aware), lot rounding, and a daily cap. Quick start • Chart: M5 (reads higher TFs

Renters: DM for the Renter Pack (PDF + presets). Reviews appreciated