Sergey Golubev / Perfil

Newdigital

Amigos

3917

Solicitudes

Enviadas

Sergey Golubev

中国总理李克强:中国赤字率为2.1%,今后将坚持不扩大赤字

Sergey Golubev

Comentario sobre el tema 报刊评论

中国总理李克强:中国赤字率为2.1%,今后将坚持不扩大赤字 星期二, 十一月 05 2013, 04:50 GMT 近期李克强应邀在中国工会第十六次全国代表大会上作了经济形势报告。 面对经济下行的压力,李克强解释,要稳增长、保就业,一种选择是 扩大财政赤字,增加货币供应量。但是,中国赤字率已经达到2.1%。同时,广义货币供应量M2的余额3月末超过了100万亿元,已经是GDP的两倍。“换

Sergey Golubev

Sergey Golubev

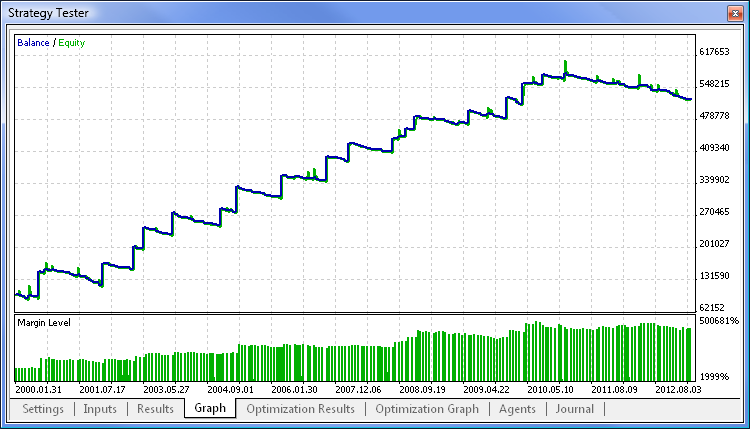

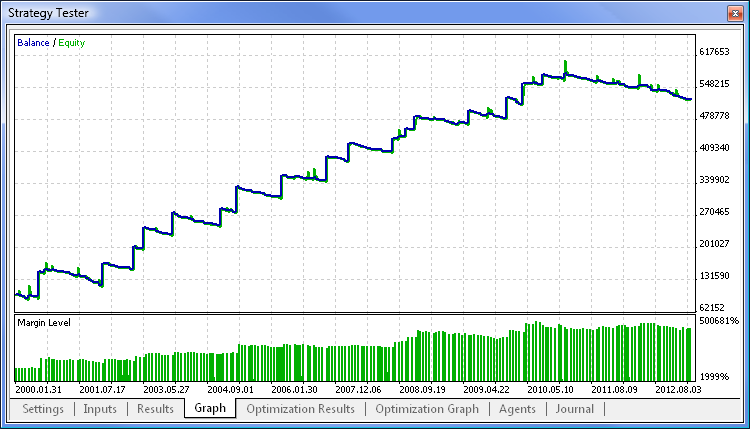

Comentario sobre el tema Indicators: Laguerre

Laguerre Scalping Trading System Please find template for this system. Do not forget to download Laguerre indicator (other indicators already exist in Metatrader 5). Place Laguerre in indicators

Sergey Golubev

Forbes - Week Ahead: Twitter IPO And 60 Trillion Reasons Central Banks Goose Markets

Twitter’s IPO will take the headlines this coming week, but there are 60 trillion reasons why stock market investors are more interested in the words and actions of the world’s central bankers as we move in to the last two months of 2013.

==========

Good morning

Twitter’s IPO will take the headlines this coming week, but there are 60 trillion reasons why stock market investors are more interested in the words and actions of the world’s central bankers as we move in to the last two months of 2013.

==========

Good morning

Sergey Golubev

Forbes :

ollar Index: The dollar index had a very strong weekly close after breaking support at line a, the previous week. The 20-week EMA is at $81.27. The OBV has turned up from the longer-term uptrend, line c. The OBV needs to overcome its WMA and the downtrend, line b, to turn positive.

Crude Oil

Crude oil was hit hard last week as it closed down well over $3 per barrel. Prices are now in a solid area of support but there are no signs yet of a bottom.

Precious Metals

The Spyder Gold Trust (GLD) lost almost $4 per share last week as it tried to close above its flat EMA before turning lower. The technical outlook has turned more negative as the weekly chart suggests that a continuation pattern, lines d and e, is forming.

A break of the support at line e will signal a move to new lows. The OBV also shows a negative formation as it has formed lower highs, line f. The OBV may break support at line g before prices violate support.

The Week Ahead

Though it has been a great year for stocks, I do think further gains are likely before the end of 2013. The sharp rise in the major averages is keeping many on the sidelines but there are quite a few stocks that appear to be bottoming after testing good support.

Therefore, it is clearly a stock picker’s market, and I would look for stocks to buy, not averages. Some of the sector ETFs do look attractive, and I will continue to make recommendations where the risk can be well controlled.

I am still looking to get back into the homebuilders, but it will take some more weakness to get them down to attractive levels. This is also true of the department store stocks, which I covered last week. The emerging markets should be a good play as I have several of the country ETFs on my radar.

For those new to stocks, I hope you implemented the dollar-cost-averaging strategy that I discussed in early August’s column It's Never Too Late to Build a Portfolio.

I would continue implementing the dollar-cost-averaging strategy in the Vanguard FTSE Emerging Markets ETF (VWO), and I focused on the emerging markets last week.

Be sure to have your plan in place, which will help you avoid reacting emotionally to the market actio

ollar Index: The dollar index had a very strong weekly close after breaking support at line a, the previous week. The 20-week EMA is at $81.27. The OBV has turned up from the longer-term uptrend, line c. The OBV needs to overcome its WMA and the downtrend, line b, to turn positive.

Crude Oil

Crude oil was hit hard last week as it closed down well over $3 per barrel. Prices are now in a solid area of support but there are no signs yet of a bottom.

Precious Metals

The Spyder Gold Trust (GLD) lost almost $4 per share last week as it tried to close above its flat EMA before turning lower. The technical outlook has turned more negative as the weekly chart suggests that a continuation pattern, lines d and e, is forming.

A break of the support at line e will signal a move to new lows. The OBV also shows a negative formation as it has formed lower highs, line f. The OBV may break support at line g before prices violate support.

The Week Ahead

Though it has been a great year for stocks, I do think further gains are likely before the end of 2013. The sharp rise in the major averages is keeping many on the sidelines but there are quite a few stocks that appear to be bottoming after testing good support.

Therefore, it is clearly a stock picker’s market, and I would look for stocks to buy, not averages. Some of the sector ETFs do look attractive, and I will continue to make recommendations where the risk can be well controlled.

I am still looking to get back into the homebuilders, but it will take some more weakness to get them down to attractive levels. This is also true of the department store stocks, which I covered last week. The emerging markets should be a good play as I have several of the country ETFs on my radar.

For those new to stocks, I hope you implemented the dollar-cost-averaging strategy that I discussed in early August’s column It's Never Too Late to Build a Portfolio.

I would continue implementing the dollar-cost-averaging strategy in the Vanguard FTSE Emerging Markets ETF (VWO), and I focused on the emerging markets last week.

Be sure to have your plan in place, which will help you avoid reacting emotionally to the market actio

Sergey Golubev

Bitcoin Singapore Conference: Charlie Shrem to be the Principal Speaker

Charles ‘Charlie’ Shrem IV, the 23 year old American businessman and entrepreneur who co-founded the Bitcoin startup company BitInstant and currently working as Vice Chairman of the Bitcoin Foundation, will be the lead speaker in the Bitcoin Singapore Conference which is going to be held on November 15th at Fullerton Hotel.

Charles ‘Charlie’ Shrem IV, the 23 year old American businessman and entrepreneur who co-founded the Bitcoin startup company BitInstant and currently working as Vice Chairman of the Bitcoin Foundation, will be the lead speaker in the Bitcoin Singapore Conference which is going to be held on November 15th at Fullerton Hotel.

Sergey Golubev

Comentario sobre el tema Press review

Bitcoin Singapore Conference: Charlie Shrem to be the Principal Speaker Charles ‘Charlie’ Shrem IV, the 23 year old American businessman and entrepreneur who co-founded the Bitcoin startup company

Sergey Golubev

Trading the News: U.S. ISM Manufacturing

Sergey Golubev

Comentario sobre el tema Press review

Trading the News: U.S. ISM Manufacturing "A slowdown in the ISM Manufacturing survey may undermine the rebound in the U.S. dollar as it highlights a slowing recovery in the world’s largest economy."

Sergey Golubev

Sergey Golubev

Comentario sobre el tema 如何开始学习MQL5

MQL5 Cookbook: 基于三重滤网策略开发交易系统框架 在寻找或者开发交易系统的过程中,很多交易者肯定听说过由Alexander Elder博士提出的三重滤网策略。在互联网上很多人认为这个策略不佳,然而,也有很多人认为它可以帮人获利,您不一定要相信任何一种观点,每件事都应该 做亲手验证,如果您学习编程,您就可以使用回溯测试来亲手检验这个交易策略的效果了。

Sergey Golubev

消息:中国国企改革文件将会在中共十八届三中全会后公布

Sergey Golubev

Comentario sobre el tema 报刊评论

消息:中国国企改革文件将会在中共十八届三中全会后公布 有消息称国企改革文件将会在中共十八届三中全会后公布,作为未来中国国企改革的纲领性文件,《深化国有企业改革的指导意见》与《关于完善公有制实现形式的指导意见》有望在中共十八届三中全会之后出台。 预计中国国企分类监管、股权激励、利用资本市场发展壮大国资、扩大对民资开放等将成为重点改革内容。

Sergey Golubev

Canada, the country which has been a country that welcomed Bitcoin wholeheartedly, has become part of history now with its first BTC ATM.

Sergey Golubev

Comentario sobre el tema Press review

Bitcoin Landscape Changes in Canada for the Better Victor Hugo had said, “None can stop the idea whose time has come.” It looks like the idea of Bitcoin has come finally as the first ever BTC ATM has

Sergey Golubev

Forbes : Stocks Levitate As Strong Earnings Roll In

LinkedIn (LNKD) had a solid report but not enough for new highs. It’s had a monster move from $90 to upwards to $250ish. See if it can hold $235 for a trade, if not, perhaps it could see $220.

Baidu (BIDU) got sold off with the volatility in the Chinese names but had a very solid earnings report after the close and is trading above pivot resistance. See if it can hold above $167.50, otherwise it might try to fill the upside gap.

Facebook (FB) earnings come out after the close today. It’s had a monster move since last quarter, but over the past two weeks the stock has pulled in 10% off the highs of $54.68. I could look to take some type of call spread here into the report, but don’t have much conviction that it will see new highs on the report.

Google (GOOG) caught a bid yesterday after a healthy inside day on Monday. The stock gained 2.09% to close near all-time high of 1040. Look for potential upside follow-through above yesterday’s high of 1037. Lots of nice tradable set-ups since earnings.

LinkedIn (LNKD) had a solid report but not enough for new highs. It’s had a monster move from $90 to upwards to $250ish. See if it can hold $235 for a trade, if not, perhaps it could see $220.

Baidu (BIDU) got sold off with the volatility in the Chinese names but had a very solid earnings report after the close and is trading above pivot resistance. See if it can hold above $167.50, otherwise it might try to fill the upside gap.

Facebook (FB) earnings come out after the close today. It’s had a monster move since last quarter, but over the past two weeks the stock has pulled in 10% off the highs of $54.68. I could look to take some type of call spread here into the report, but don’t have much conviction that it will see new highs on the report.

Google (GOOG) caught a bid yesterday after a healthy inside day on Monday. The stock gained 2.09% to close near all-time high of 1040. Look for potential upside follow-through above yesterday’s high of 1037. Lots of nice tradable set-ups since earnings.

Sergey Golubev

compartir el código del autor Nikolay Kositsin

Commentator (Comentarista)

El indicador Commentator (Comentarista) analiza un grupo de indicadores técnicos y muestra información sobre el estado actual del mercado y recomendaciones de negociación.

Sergey Golubev

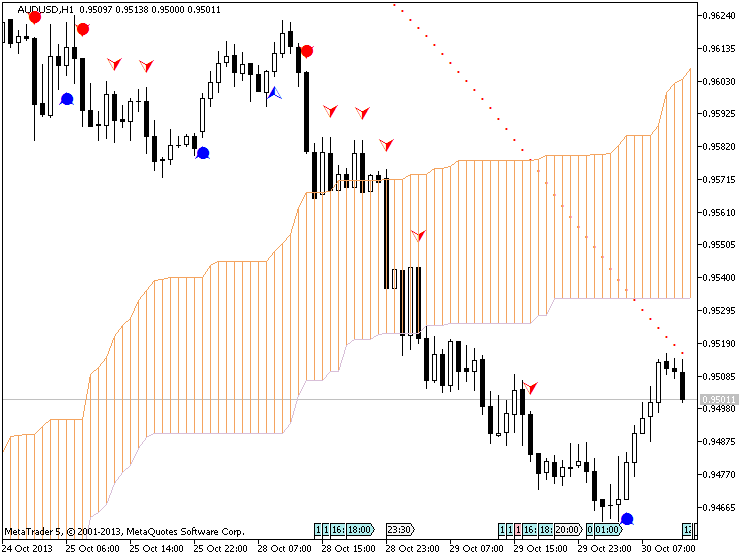

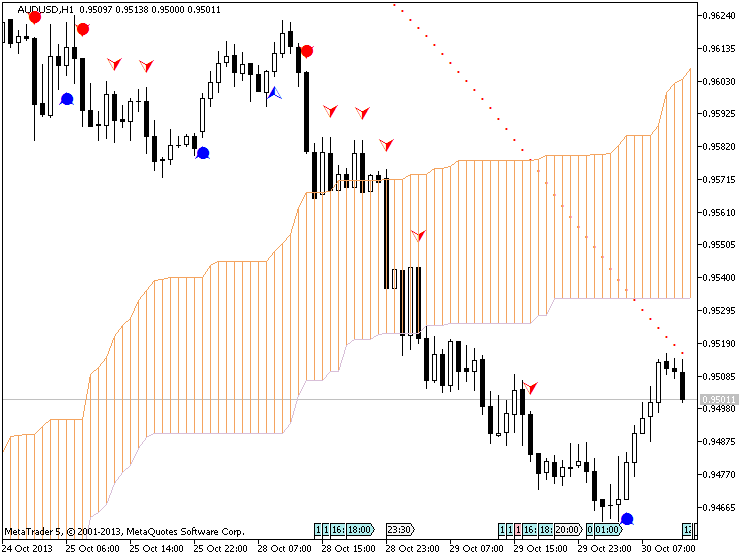

Indicators and templates for PriceChannel ColorPar Ichi system are uploaded on this post https://www.mql5.com/en/forum/9773#comment_396616

Just for information

Just for information

Sergey Golubev

Comentario sobre el tema Market Condition Evaluation based on standard indicators in Metatrader 5

Indicators and templates for PriceChannel ColorPar Ichi system are uploaded on this post . Just for information

Sergey Golubev

You may be wondering, how many losses are needed to become a better winner?

A common misconception is that a strategy’s success hinges on a high win ratio. That is simply not true. Some of the best strategies win only 40-50% of the time.

A common misconception is that a strategy’s success hinges on a high win ratio. That is simply not true. Some of the best strategies win only 40-50% of the time.

Sergey Golubev

Comentario sobre el tema Press review

Trading is Methodical - Markets are Emotional Talking Points Reasonable market expectations are a key to consistency, A trader’s method is often projected as the market being methodical, Learn to lose

Sergey Golubev

compartir el artículo del autor Anatoli Kazharski

Guía práctica de MQL5: Supervisar múltiples períodos de tiempo en una sola ventana

MetaTrader 5 ofrece 21 períodos de tiempo para el análisis. Puede aprovechar los objetos gráficos especiales que puede colocar en el gráfico existente y establecer el símbolo, el período de tiempo y otras propiedades. En este artículo se va a proporcionar una información detallada acerca de estos objetos gráficos: crearemos un indicador con controles (botones) que nos permitirán establecer múltiples objetos gráficos en una subventana al mismo tiempo. Además, se encajarán los objetos gráficos con precisión en la subventana y se ajustarán automáticamente al modificar el tamaño del gráfico principal o el de la ventana del terminal.

Sergey Golubev

Automated-Trading

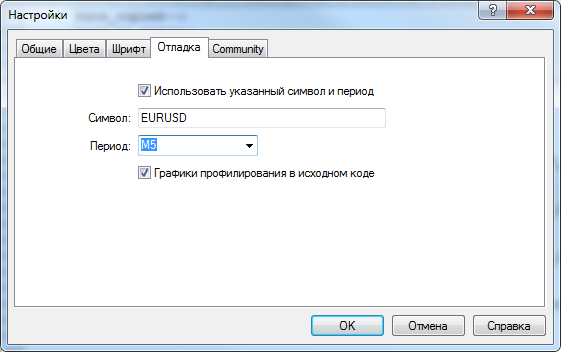

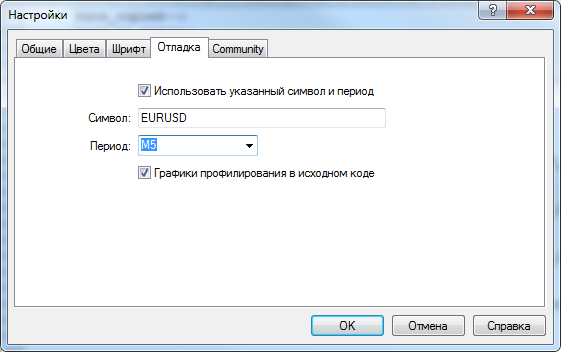

Comentario sobre el tema Ошибки, баги, вопросы

IRash : Привет всем! Сделал индикатор, запускаю в MetaEditor в дебаге. НО он всегда запускается на таймфрейме H1. Вопрос: как изменить таймфрейм перед запуском индикатора в дебаге

Sergey Golubev

中国新华社:中共中央政治局29日召开会议,讨论十八届二中全会以来中央政治局工作,研究全面深化改革重大问题,审议并同意印发《党政机关厉行节约反对浪费条例》。会议决定,十八届三中全会将于11月9日至12日在北京召开。中共中央总书记习近平主持会议

Sergey Golubev

Comentario sobre el tema 报刊评论

中国新华社:十八届三中全会将于11月9日至12日在北京召开 中国新华社:中共中央政治局29日召开会议,讨论十八届二中全会以来中央政治局工作,研究全面深化改革重大问题,审议并同意印发《党政机关厉行节约反对浪费条例》。会议决定,十八届三中全会将于11月9日至12日在北京召开。中共中央总书记习近平主持会议。

Sergey Golubev

路透社消息:中国央行官员称外汇占款出现明显回升,国内面临较大的资本流入及结汇压力; 央行官员称近期资金面紧张主因财政收支管理节奏与市场预期略有偏差,乃短期因素;央行官员称年内流动性及公开市场操作都将继续保持平稳;央行仍建议金融机 构要适度收缩杠杆不要太激进,以免在资金面紧张时受到冲击。

Sergey Golubev

Comentario sobre el tema 报刊评论

路透社消息:中国央行官员称外汇占款出现明显回升,国内面临较大的资本流入及结汇压力 星期二, 十月 29 2013, 08:05 GMT 路透社消息:中国央行官员称外汇占款出现明显回升,国内面临较大的资本流入及结汇压力; 央行官员称近期资金面紧张主因财政收支管理节奏与市场预期略有偏差,乃短期因素;央行官员称年内流动性及公开市场操作都将继续保持平稳;央行仍建议金融机

Sergey Golubev

It was Daylight Saving Time Shift this night so MQ MT5 is on GMT +1 for now. Just for information.

How do we know about it, or about any MT5 broker concerning GMT + ... ? Use this indicator : https://www.mql5.com/en/code/1364

How do we know about it, or about any MT5 broker concerning GMT + ... ? Use this indicator : https://www.mql5.com/en/code/1364

Sergey Golubev

Comentario sobre el tema How to Start with Metatrader 5

It was Daylight Saving Time Shift this night so MQ MT5 is on GMT +1 for now. Just for information. How do we know about it, or about any MT5 broker concerning GMT + ... ? Use this indicator : Clock

Sergey Golubev

Sergey Golubev

Comentario sobre el tema Press review

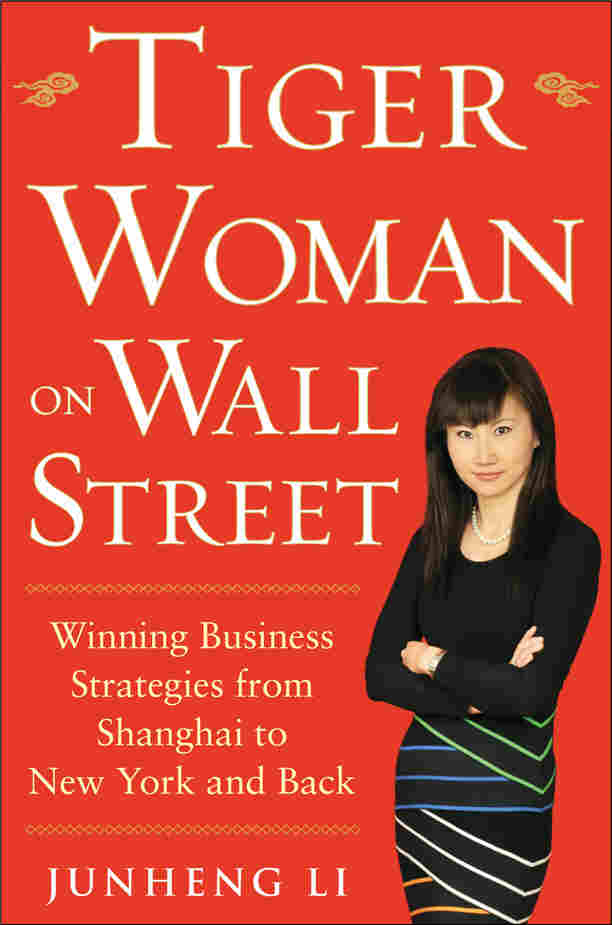

Tiger Woman on Wall Street: Winning Business Strategies from Shanghai to New York and Back by Junheng Li The author’s new book “Tiger Woman On Wall Street” will be released on Nov 8, 2013 by McGraw

: