Desbot

- Asesores Expertos

- Luke Joel Desmaris

- Versión: 1.0

- Activaciones: 5

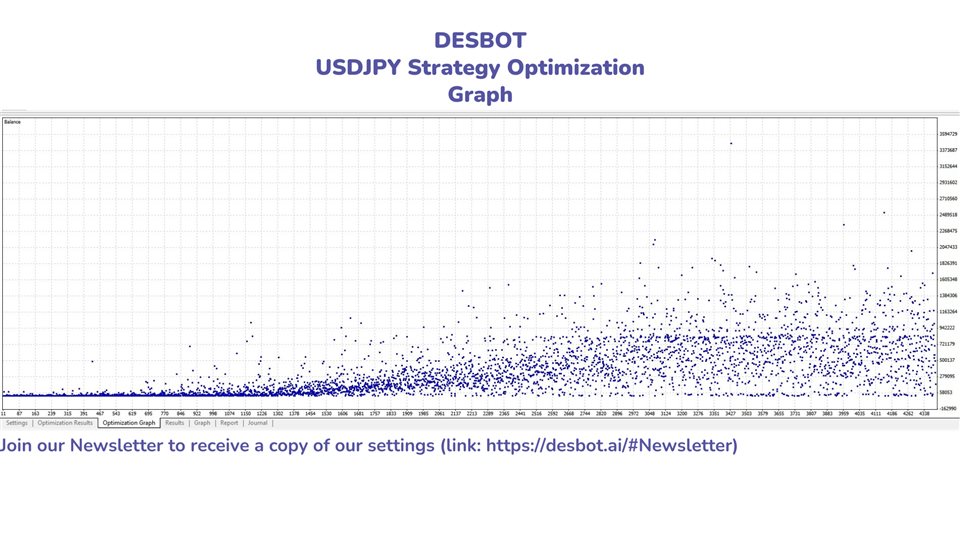

Join our Newsletter to also get a copy of our Optimization Settings: https://desbot.ai/#Newsletter

Input Parameters

- RiskPercentage: Enter the number that represents the percent of your account balance you want Desbot to risk per trade. For example, entering 1.5 would risk 1.5% of your Account Balance.

- SLTicks: Enter the number of ticks you want for your stop loss. For Example, entering 500 would set 500 tick aka a 50 Pip stop loss.

- TPTIcks: Enter the number of ticks you want for your take profit. For Example, entering 500 would set 500 tick aka a 50 Pip take profit.

- startHour: Enter the hour of the day you want Desbot to start trading. This field is based on the 24 hour clock, so if you want Desbot to start working at 4 pm enter 16.

- endHour: Enter the hour of the day you want Desbot to stop trading. This field is based on the 24 hour clock, so if you want Desbot to stop working at 5 pm enter 17.

- MALow: Enter the number of candles close prices you want Desbot to use when calculating this moving average. For example enter 21 for Desbot to use the average of the last 21 candle close prices to educate itself with a moving average line.

- MAMedium: Enter the number of candles close prices you want Desbot to use when calculating this moving average. For example enter 50 for Desbot to use the average of the last 50 candle close prices to educate itself with a moving average line.

- MAHigh: Enter the number of candles close prices you want Desbot to use when calculating this moving average. For example enter 200 for Desbot to use the average of the last 200 candle close prices to educate itself with a moving average line.

The Strategy

Without giving too many of our secrets away… Desbot first Checks the clock making sure it's between its Start time (startHour) and End time (endHour), followed by making sure there are no active orders in play. Desbot will then check for specific patterns on your chosen timeframe and currency pair, which occur in line with an order of moving average lines, depending on the type of trade. For a Buy trade, Desbot will look for a pattern, the low line (MALow) above the medium line (MAMedium) and MAMedium above the high line (MAHigh). Desbot will look for the opposite order for a Sell trade.

Once Desbot is ready to make a trade it will use your preferred Risk Percentage (RiskPercentage) set the percentage of your account balance to risk and lock in your fixed Stop Loss and Take Profits. Desbot also takes advantage of RSI lines to help reduce the risk of a trade hitting the Stop Loss. Once you are in the lucky position of being able to risk more than your broker would allow per trade Desbot will use your broker's maximum Lot size to judge how many trades it needs to make at the same time to roughly risk the same risk percentage of your account balance. For example, if your broker's maximum lot size is 50 and your account balance is around £1.7 million on the currency pair USD/JPY Desbot will divide the lot size needed to meet your risk percentage by your Broker's maximum lot size per trade, round to the nearest whole number and use that as an indicator for the number of trades it need to make in one go.

Minimum requirements and recommendations

- Broker: Any broker with a low spread. We recommend Avatrade.

- Minimum initial deposit: $500 in accounts with 1:30 leverage.

- Recommended initial deposit: $1000 in accounts with 1:100 leverage.

- Leverage: at least 1:30

- Use a VPS for the EA to work 24/7.

FAQs

Compatible with my Meta Trader?

Absolutely! DESBOT is specifically designed to trade on MetaTrader4. We are also working on a MetaTrader5 version.

Why is it important to Backtest before using DESBOT?

Backtesting is a critical step in algorithmic trading because it allows traders to assess the viability and effectiveness of their strategies in historical market conditions. Importantly, it also helps in understanding the impact of different brokers and their spreads on strategy performance. Variations in spreads and execution speeds can significantly affect trading outcomes, leading to variations in profit and loss. By backtesting with data from multiple brokers, traders gain valuable insights into how their strategies adapt to real-world conditions, helping them optimize their algorithms for specific broker environments and enhance the robustness of their trading systems. This process is crucial for making informed decisions, managing risk, and ultimately increasing the chances of success in the dynamic and competitive world of algorithmic trading.

Suitable for beginner traders?

You bet! Using Desbot you can avoid the typical beginner mistakes of emotionally trading. which tends happens when people break their ow rules to win back lost funds.

Why didn't DESBOT open Any Trades for me today?

Desbot is only designed to make Buy or Sell trades depending on candle patterns it spots in the daily time frame. If Desbot doesn't spot any patterns it will aim to protect your account by not making any trades. Additionally Desbot also looks for additional patterns on the timeframe it is enabled to trade on if those patterns don't appear Desbot will not make a trade. It is also important to make sure you are trading below the Daily timeframe on the following Forex currency pairs Desbot has been successfully tested on:

-

EUR/USD

-

GBP/USD

-

USD/JPY

-

USD/CHF

-

USD/CAD

-

AUD/USD

-

NZD/USD

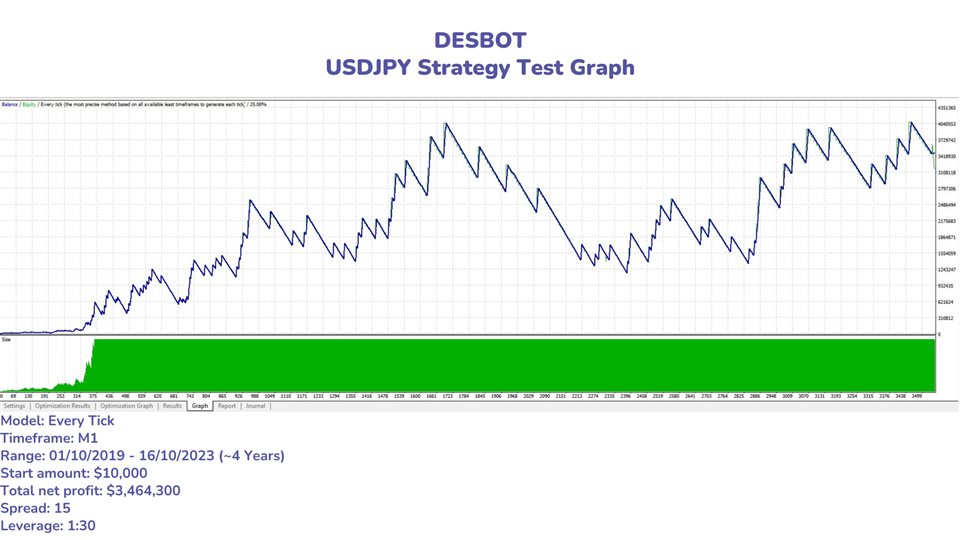

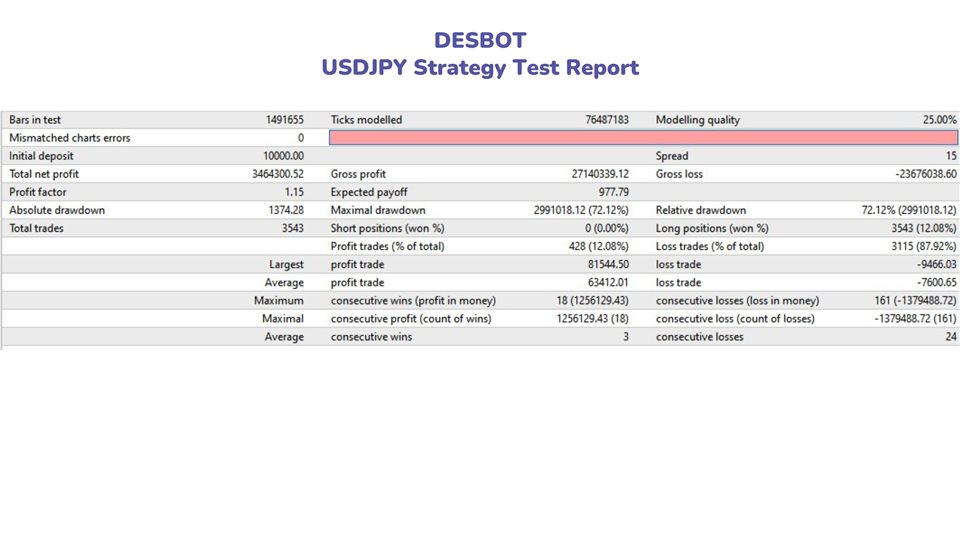

Strategy Tester

- Use 'Open prices'.

Disclaimer

Please be aware that trading in the financial markets carries a significant risk of losing your investment. The Desbot Meta Trader 4 Expert Advisor, provided by Des&Co, is a trading tool that can automate strategies, but it does not guarantee profits, and past performance is not indicative of future results. Users are entirely responsible for their trading decisions and risk management. Des&Co will not be liable for any financial losses incurred while using the Expert Advisor. It is essential to trade responsibly and only with funds you can afford to lose.