KT ATR Bands MT5

- Indicadores

- KEENBASE SOFTWARE SOLUTIONS

- Versión: 1.0

- Activaciones: 5

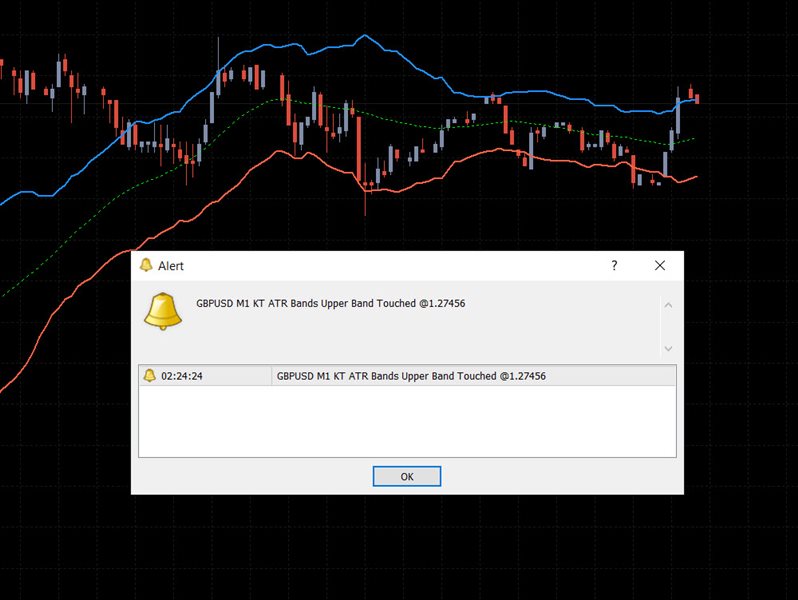

KT ATR Bands draws the volatility envelops and bands using a combination of Average True Range and Moving average. They are typically used to identify the potential reversal points and the periods of high and low volatility.

Features

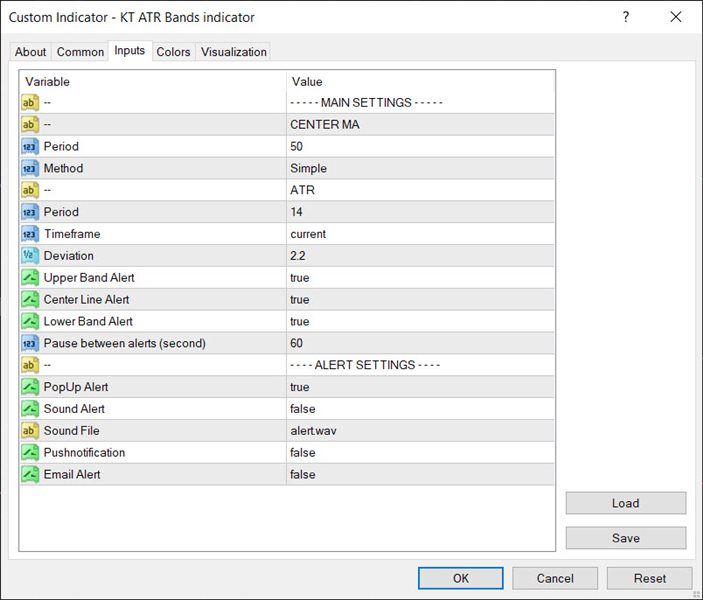

- Multi-Timeframe Ability: For example, you can have the atr bands from the daily timeframe on the H1 timeframe.

- Smart Alerts: You can turn on/off alerts for each band separately. Also, you can choose a minimum time interval between each alert to stop unnecessary, annoying alerts.

- Fully Customizable: The indicator offers complete customization, such as ATR periods, MA methods, and colors.

- Coded from Scratch: The indicator has been coded from scratch to avoid potential bugs or glitches.

Understanding the ATR Bands

The world of trading is abundant with Forex indicators and tools designed to give traders an edge. One such effective tool is the ATR Bands. A popular tool amongst traders, it brings a sophisticated approach to understanding market volatility.

We will discuss how to set up the ATR bands on your MT4/MT5, formulate an effective entry strategy, and set up crucial stop-loss and take-profit levels.

Background of ATR Bands

ATR Bands, for Average True Range Bands, are volatility-based envelopes set above and below an asset's price on a chart.

Their calculation is based on the ATR, which measure volatility by decomposing the entire range of an asset price for a certain period.

Typically, the calculation of the ATR value is based on 14 periods.

Volatility refers to the rate at which the price of an asset increases or decreases for a set of returns.

It's a crucial aspect of market trading as it can indicate the trend's strength and potential reversals and signal optimal entry and exit points.

Manipulating the ATR Value and ATR Multiplier allows you to optimize the responsiveness of the ATR Bands to market volatility and price fluctuations.

This provides a steady measure akin to other volatility channels like the Keltner Channel.