Josip Vukelja / Profile

- Information

|

9+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

Friends

50

Requests

Outgoing

Josip Vukelja

Added topic Hotkey for MT4 Fibonacci Retracement

Hello, Is it possible to set a hotkey to Fibo Retracement tool in MT4 platform

Josip Vukelja

Added topic Daily Loss/Profit limit (MT4)

Is it possible to set a Daily Loss Limit based on Daily Equity in the MT4 platform? I would like to have an option that the software Closes all Open and Pending orders once the set Daily Loss or Profit are reached. Thanks for help

Josip Vukelja

Added topic How to add TP option to my Script?

Hello, would anybody be so kind to help me add TP option to my simple MT4 Script? TP should be calculated based on % of the trades range. e.g. 100% = RR 1:1 Thank you

Josip Vukelja

Added topic MQL4 Script to NinjaTrader 8 Script

hello, is there a way to convert mql4 Script to Ninjatrader 8 Script

Josip Vukelja

Added topic Range bar chart

hello, Do you know for reliable indicator/way to use Range Bar Chart type on MT4

Josip Vukelja

Added topic STOP LIMIT Order in MT4

Hi, Any chance to use STOP LIMIT order in MT4 platform? (I don't mean buy/sell stop or buy/sell limit order, some platforms have STOP LIMIT orders which basically guarantee exact price or no fill)

Josip Vukelja

Added topic 10 min chart on MT5 android app?

Hi, How can I see 10 min chart on my mobile phone? I know how to customize toolbar on MT5 platform but can't find solution for my mobile phone

Josip Vukelja

Left feedback to developer for job Pips difference between high/low of last closed bar and high/low or current bar

Very fast and professional service

Josip Vukelja

Market Overview - January 2017

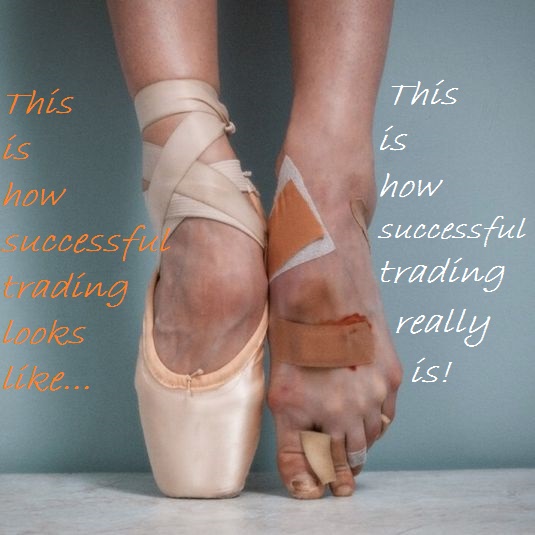

The month is coming to an end and my emotions are still mixed. The market seriously puts us to the test, personally I don't remember such intense pressure thru a month period. (Thumbs up for fellow traders who managed to have a smooth sail meanwhile).

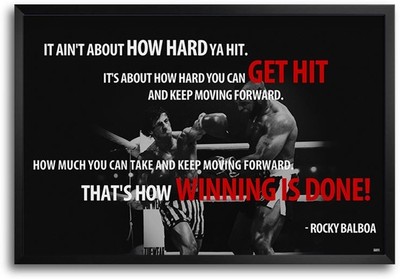

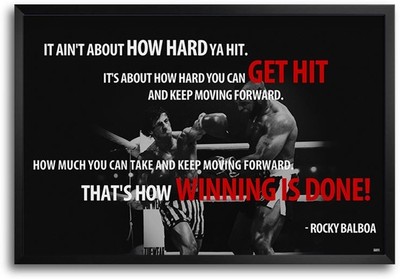

The best way I could describe the conditions in which we have traded in January is a boxing movie. I am a huge boxing fan. Love it so much because it teaches you how to be respectful, modest, disciplined, motivated, happy with small things, healthy both physically and psychically etc.

Since I have some knowledge about boxing as a sport, I find it difficult to watch boxing movies. Why? Because they all have the same story: good and bad guy enters a ring. The bad guy is beating a s*it out of the good guy for 11 rounds and then suddenly a good guy recovers from hundreds of hard shots and manage to knock out a bad guy in the last round. Everybody's happy. :smiley:

We all can agree, the life usually doesn't provide a happy ending once the things start to go wrong from a start. (I say usually, but actually I think never).

https://www.mql5.com/data/temp/1655929/oeqdly0b7a_images_h1j.jpeg

Well, this trading month proved me wrong. I will go so far and say I will find watching boxing movies much more enjoyable. :smiley:

After several taken trades in January I saw this will be a very difficult month to come even close to my previous returns. The huge return isn't my main goal, I always focus to following of my strategy to the perfection and not making any mistakes in that sense. I am glad to state, I don't have a problem with following my trading plan and this actually saved me this month. The results seemed devastating thru the whole month, till the last trade precisely.

I have already shown how much time I invest in strategy testing and improving of my trading skills. I simply couldn't find a logical explanation why GBPJPY won't move from a narrow daily range, day in day out, thru the whole month with some minor exceptions. It was very frustrating but I knew there must be an end eventually. An end to the beating I was taking from the first round. With no doubt, there was no way I will be saved by the bell. This match seemed invincible.

Something close to a miracle happened today, I was trading emotionlessly regardless of the final outcome and I have been rewarded with a positive result at the end of a month. I won, now you understand why this reminded me about boxing movies.

I am glad the January is behind is, it provided enough challenges for a whole year, however, we have many obstacles to overcome yet. This is why our "A" game on every trade is of crucial importance.

To conclude, I am thrilled with this outcome, wasn't very optimistic we will end up being positive. I wouldn't change my approach toward trading even if we didn't succeed. Yearly results are what is the most important. I wish everybody understood this.

If investing in somebody, give him/her time to overcome difficult times. Market is not trending 100% of a time, reasonable drawdowns are normal. Be sure you invest money you can afford to lose, this way it will be much easier to stay calm when troubles arrive. I would recommend you to invest for three consecutive months before deciding to continue or stop investing in some product or trader.

Wish you all great success in the markets!

The month is coming to an end and my emotions are still mixed. The market seriously puts us to the test, personally I don't remember such intense pressure thru a month period. (Thumbs up for fellow traders who managed to have a smooth sail meanwhile).

The best way I could describe the conditions in which we have traded in January is a boxing movie. I am a huge boxing fan. Love it so much because it teaches you how to be respectful, modest, disciplined, motivated, happy with small things, healthy both physically and psychically etc.

Since I have some knowledge about boxing as a sport, I find it difficult to watch boxing movies. Why? Because they all have the same story: good and bad guy enters a ring. The bad guy is beating a s*it out of the good guy for 11 rounds and then suddenly a good guy recovers from hundreds of hard shots and manage to knock out a bad guy in the last round. Everybody's happy. :smiley:

We all can agree, the life usually doesn't provide a happy ending once the things start to go wrong from a start. (I say usually, but actually I think never).

https://www.mql5.com/data/temp/1655929/oeqdly0b7a_images_h1j.jpeg

Well, this trading month proved me wrong. I will go so far and say I will find watching boxing movies much more enjoyable. :smiley:

After several taken trades in January I saw this will be a very difficult month to come even close to my previous returns. The huge return isn't my main goal, I always focus to following of my strategy to the perfection and not making any mistakes in that sense. I am glad to state, I don't have a problem with following my trading plan and this actually saved me this month. The results seemed devastating thru the whole month, till the last trade precisely.

I have already shown how much time I invest in strategy testing and improving of my trading skills. I simply couldn't find a logical explanation why GBPJPY won't move from a narrow daily range, day in day out, thru the whole month with some minor exceptions. It was very frustrating but I knew there must be an end eventually. An end to the beating I was taking from the first round. With no doubt, there was no way I will be saved by the bell. This match seemed invincible.

Something close to a miracle happened today, I was trading emotionlessly regardless of the final outcome and I have been rewarded with a positive result at the end of a month. I won, now you understand why this reminded me about boxing movies.

I am glad the January is behind is, it provided enough challenges for a whole year, however, we have many obstacles to overcome yet. This is why our "A" game on every trade is of crucial importance.

To conclude, I am thrilled with this outcome, wasn't very optimistic we will end up being positive. I wouldn't change my approach toward trading even if we didn't succeed. Yearly results are what is the most important. I wish everybody understood this.

If investing in somebody, give him/her time to overcome difficult times. Market is not trending 100% of a time, reasonable drawdowns are normal. Be sure you invest money you can afford to lose, this way it will be much easier to stay calm when troubles arrive. I would recommend you to invest for three consecutive months before deciding to continue or stop investing in some product or trader.

Wish you all great success in the markets!

Josip Vukelja

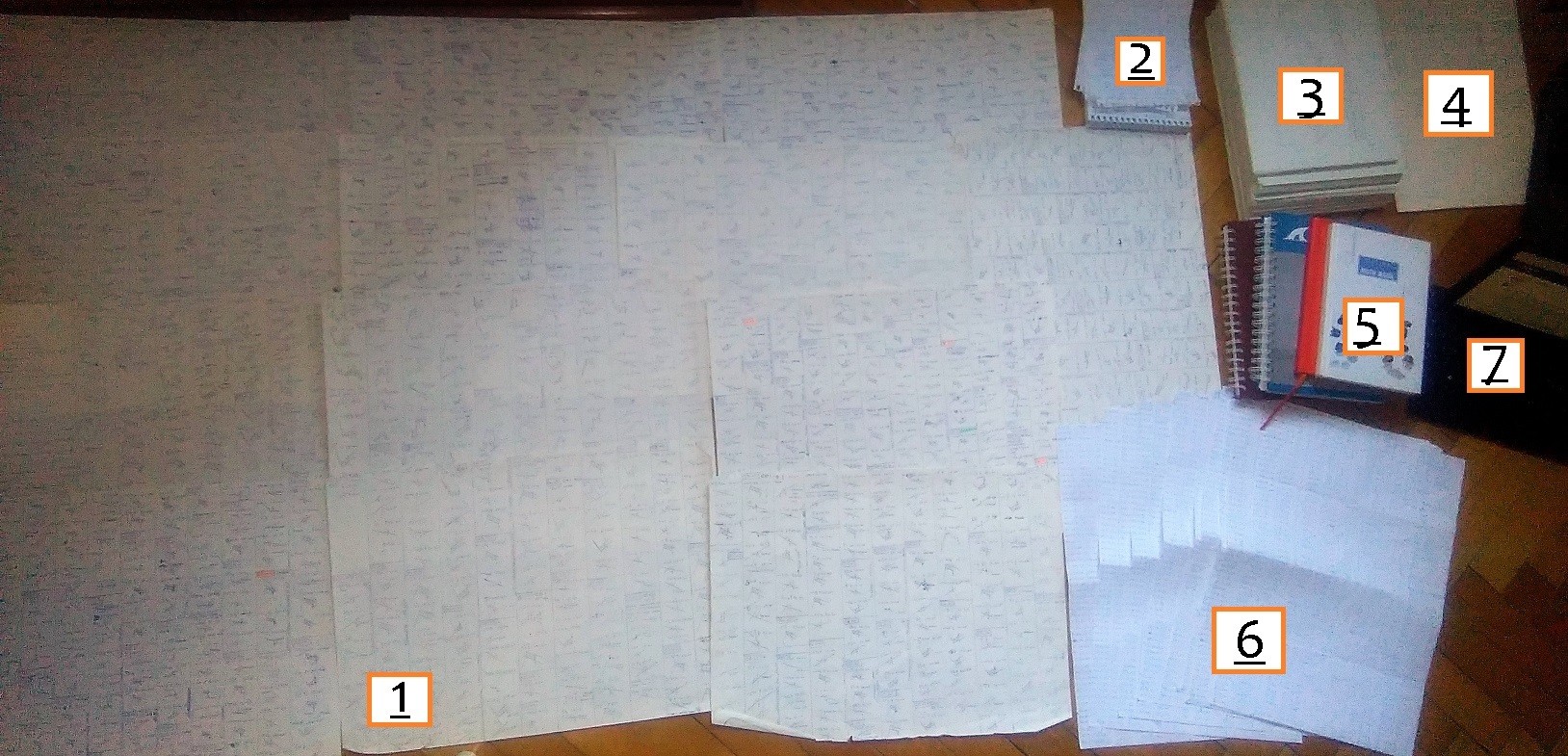

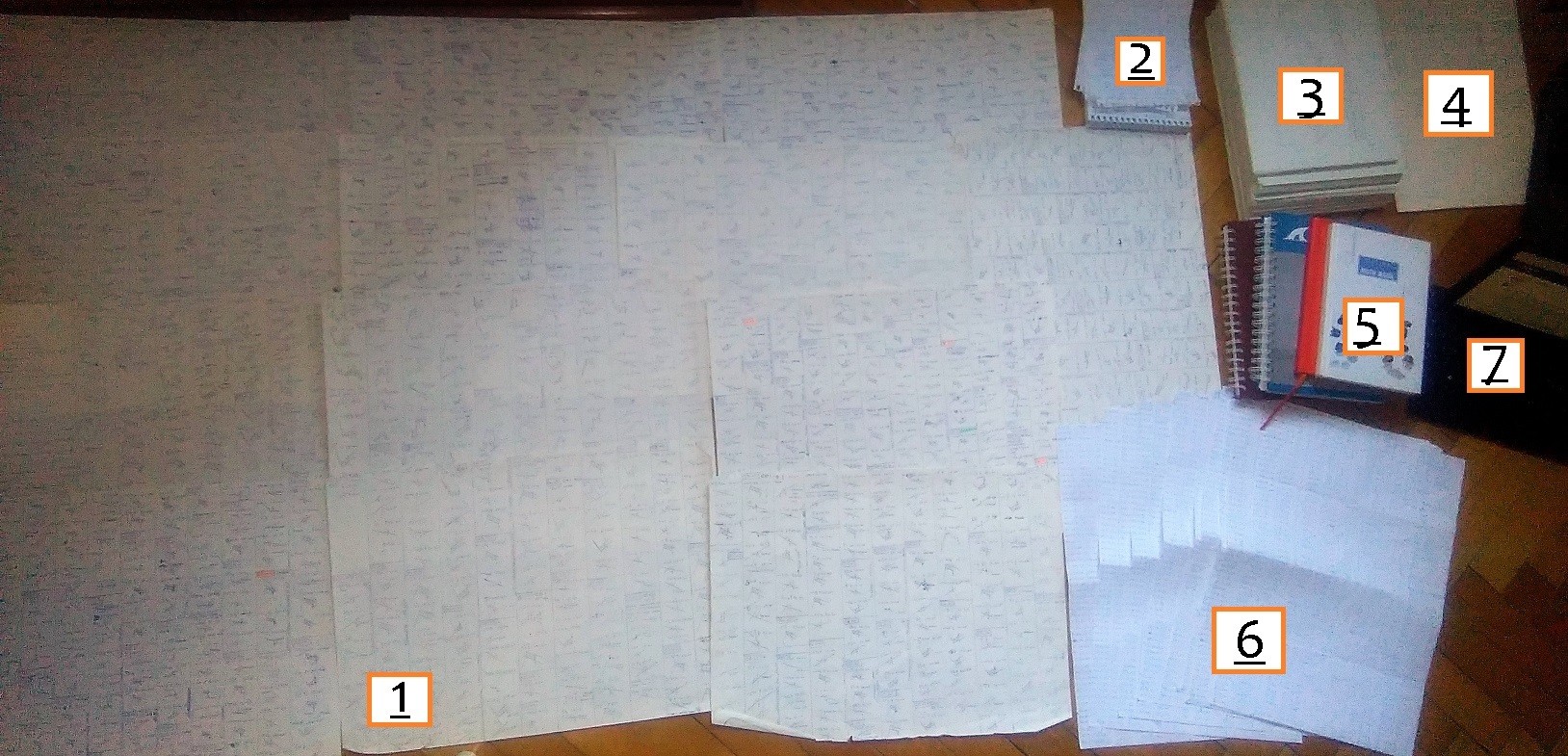

Who would thought that reorganization of my trading room will be a trigger for writing a "few words" about myself and more importantly, about my Signal Trading Stoic.

My Signal is quite young, I have created it approximately 3 months ago. The beginning of my trading looked like a million bucks, great returns, minimal drawdown. I wish I could say the same about January, it has been everything but a smooth sail.

Personally, I am not worried because I am taking my trading very seriously. This losing period had to come sooner or later, hopefully my investors will be at peace if they have a look at a (lower quality) photo which I posted below. I took it today after getting the idea that some people might find it interesting.

It represents as follows:

1 - Drawings + data of my backtested trades (13 pages - B1 format)

2 - Back tested data of my strategy (11 pages - A3 format)

3 - Notepad - Back tested data of my strategy - fully written

4 - PDF books about trading and trading psychology - over 2000 pages (finished from October)

5 - 4 Notepads - Back tested data of my strategy - almost fully written

6 - Ongoing trading journal

7 - Everything written above transferred in my Excel sheets, analyzed in dozens of ways

BTW, I changed my apartment last October and this is the stuff I found on my desk, shelves, and there are plenty of similar materials in different apartments and houses which I left behind.

I am not telling you this to brag, but to help you understand how I approach trading. I counted over 6000 trades on this papers, which helped me define my trading strategy which I use today. This is the way I am telling you I am not scared/angry/mad/suicidal about the current situation in the market. It might be unfortunate for both of us, me as a trader and you as investor that I trade only GBPJPY and that we have a losing streak thanks to Brexit situation and largely thanks to EU Membership Court Ruling which will occur next Tuesday. Yes, it sucks! This is the longest losing streak I have experienced in the last two years, but also, I have chosen GBPJPY for a reason, and a reason is a back test of over 6000 trades, tested manually, tick by a tick on a smaller time frames such as 5 and 15 min. (I am technical trader and all my back tests were made manually). Hope you can imagine how much time and effort takes to back test over 6000 trades manually.

What doesn't kill us, make us stronger they say. If we can learn from our loses - even better.

I am trading forex and futures markets almost full time (95% of a year) and I also invest to and rent my properties. My main goal is to trade for a living, if somebody feels I provide some kind of a value for them it would honor me and I would try even harder to stick to my risk management rules. This losing streak might help you evaluate how I trade under a pressure, everybody can perform cool when the markets are generous. Facing loses, but still sticking to your trade plan and strategy becomes exponentiallyy harder.

P.S. In case you have a question or need any kind of clarification regarding my strategy, let's use this thread as a place to do so, or you can contact me at tradingstoic@outlook.com

I wish you all a great success and awesome trading results in the future!

My Signal is quite young, I have created it approximately 3 months ago. The beginning of my trading looked like a million bucks, great returns, minimal drawdown. I wish I could say the same about January, it has been everything but a smooth sail.

Personally, I am not worried because I am taking my trading very seriously. This losing period had to come sooner or later, hopefully my investors will be at peace if they have a look at a (lower quality) photo which I posted below. I took it today after getting the idea that some people might find it interesting.

It represents as follows:

1 - Drawings + data of my backtested trades (13 pages - B1 format)

2 - Back tested data of my strategy (11 pages - A3 format)

3 - Notepad - Back tested data of my strategy - fully written

4 - PDF books about trading and trading psychology - over 2000 pages (finished from October)

5 - 4 Notepads - Back tested data of my strategy - almost fully written

6 - Ongoing trading journal

7 - Everything written above transferred in my Excel sheets, analyzed in dozens of ways

BTW, I changed my apartment last October and this is the stuff I found on my desk, shelves, and there are plenty of similar materials in different apartments and houses which I left behind.

I am not telling you this to brag, but to help you understand how I approach trading. I counted over 6000 trades on this papers, which helped me define my trading strategy which I use today. This is the way I am telling you I am not scared/angry/mad/suicidal about the current situation in the market. It might be unfortunate for both of us, me as a trader and you as investor that I trade only GBPJPY and that we have a losing streak thanks to Brexit situation and largely thanks to EU Membership Court Ruling which will occur next Tuesday. Yes, it sucks! This is the longest losing streak I have experienced in the last two years, but also, I have chosen GBPJPY for a reason, and a reason is a back test of over 6000 trades, tested manually, tick by a tick on a smaller time frames such as 5 and 15 min. (I am technical trader and all my back tests were made manually). Hope you can imagine how much time and effort takes to back test over 6000 trades manually.

What doesn't kill us, make us stronger they say. If we can learn from our loses - even better.

I am trading forex and futures markets almost full time (95% of a year) and I also invest to and rent my properties. My main goal is to trade for a living, if somebody feels I provide some kind of a value for them it would honor me and I would try even harder to stick to my risk management rules. This losing streak might help you evaluate how I trade under a pressure, everybody can perform cool when the markets are generous. Facing loses, but still sticking to your trade plan and strategy becomes exponentiallyy harder.

P.S. In case you have a question or need any kind of clarification regarding my strategy, let's use this thread as a place to do so, or you can contact me at tradingstoic@outlook.com

I wish you all a great success and awesome trading results in the future!

Josip Vukelja

Trade overview Jan 13th 2017.

Market is really putting pressure on me but I will continue to plan my trades and trade my plan on every single trade in the future (as I did in the past). I guess we are in a period of consolidation, there is no "right" answer (short or long) because market is not moving at all (or it gets me SL and proceeds to my TP levels eventually.

I am still positive, and my emotions are in balance. Yes, I have a losing streak, but I lose $150-$250 per trade, winners will replace the losers soon. Furthermore, my winners are much bigger than my losers.

Wish you all joyful weekend, let's see what market brings next week,

Trade overview Jan 11th 2017.

Quite harsh trading day. Luckily not seen very often. Price action developed perfect setup not once, but three times in a row. Unfortunately, we missed follow up, nothing we can change/do about it. Interestingly enough, this type of setup provided the majority of profit in November and December so we gave a small portion back today. I am positive the rest of month will be more generous and give us some profits in the upcoming trades.

Market is really putting pressure on me but I will continue to plan my trades and trade my plan on every single trade in the future (as I did in the past). I guess we are in a period of consolidation, there is no "right" answer (short or long) because market is not moving at all (or it gets me SL and proceeds to my TP levels eventually.

I am still positive, and my emotions are in balance. Yes, I have a losing streak, but I lose $150-$250 per trade, winners will replace the losers soon. Furthermore, my winners are much bigger than my losers.

Wish you all joyful weekend, let's see what market brings next week,

Trade overview Jan 11th 2017.

Quite harsh trading day. Luckily not seen very often. Price action developed perfect setup not once, but three times in a row. Unfortunately, we missed follow up, nothing we can change/do about it. Interestingly enough, this type of setup provided the majority of profit in November and December so we gave a small portion back today. I am positive the rest of month will be more generous and give us some profits in the upcoming trades.

Josip Vukelja

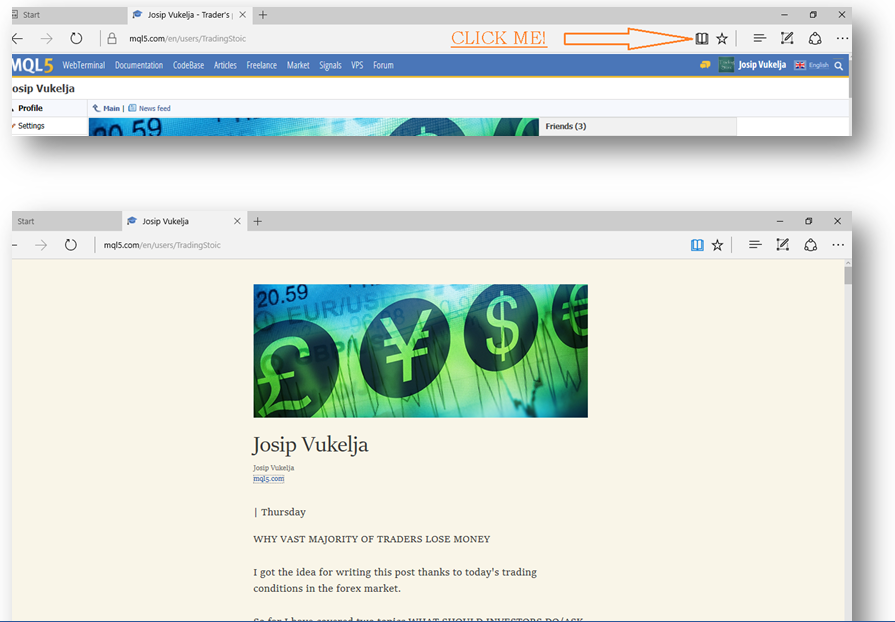

USEFUL TIP FOR MICROSOFT EDGE USERS

The majority of my posts here are quite large and even I find it dificult to keep a track of my thoughts because it is a plain text, with no possibilities to highlight or seperate paragraphs effectively. If you are using Microsoft Edge to navigate thru internet here is one useful tip how to read posts on my page. Take a look of the photos bellow, If you click on "book" icon on the top right corner, the text will be transformed into much more enjoyable read and this might help you to better understand my posts.

The majority of my posts here are quite large and even I find it dificult to keep a track of my thoughts because it is a plain text, with no possibilities to highlight or seperate paragraphs effectively. If you are using Microsoft Edge to navigate thru internet here is one useful tip how to read posts on my page. Take a look of the photos bellow, If you click on "book" icon on the top right corner, the text will be transformed into much more enjoyable read and this might help you to better understand my posts.

Josip Vukelja

WHY VAST MAJORITY OF TRADERS LOSE MONEY

I got the idea for writing this post thanks to today's trading conditions in the forex market.

So far I have covered two topics WHAT SHOULD INVESTORS DO/ASK THEMSELVES BEFORE CHOOSING TRADING SIGNALS and GOOD TRADER - BAD TRADER. Both posts are just my humble opinions based on my life and trading experiences, this post won't be anyhow different.

First post covered some of the things I believe it would be wise to do for some of the investors / less experienced traders looking for diversification of their portfolio by choosing trading signals instead of classical bank saving options.

Second post reflects the wrong / right approach when it comes to the trading career of every individual. It describes two completely opposite perspectives and definitely two different outcomes based on their decisions and input.

This, third post, will be another episode on the path of the every trader, and why even some diligent and serious traders don't succeed in the trading industry. I will assume you have read GOOD TRADER - BAD TRADER post till now and you know that I believe there is an enormous workload in front of you before even considering live trading. Let's assume one did follow all the steps (and more) written in GT-BT, one did manage to trade profitably at a first but then losing streak occurred.

Back testing is great and A MUST homework to have a slightest chance in reaching long term trading success, BUT, there is a huge pressure on our back to perform emotionless even with a million of testing days/ trades which occurred in the past.

Let's take my account for example:

You will see that I have recently opened a new live account and offered it as a Signal here at MQL5 web page. As soon as started trading a losing streak occurred. It wasn't a big deal but the history shows 1 winning trade followed by 2 losing trades. This pattern happened for two times, leaving me with 2 winning and 4 losing trades. Did I liked it? Absolutely not, who would like to lose 2/3 of the overall trades? And like that wasn't enough, I missed 1 winning trade on the first day of my trading on this account. It was a great trade with the profit bigger for 50% than my initial risk. My strategy is battle tested, I know in the long run I will probably be profitable, nevertheless, nothing helps to cool down completely in one's subconscious.

Then today's trade came and I executed it calmly and objectively. It wasn't easy due to recent past events described above. Luckily for me, I learned by now this is the only way to trade successfully.

It was a hard and emotional trade for several reasons:

- Normally my trades are over within 1 -2 hours, this one lasted for 5 hours.

- Trade went to a nice profit, I thought this will be one of the easy, fast, profitable trades. Shortly afterwards, I have had a negative balance again (potentially 3rd losing trade in a row, 5th out of 7). Nice recovery followed, but even faster I was in the red again. (normally when this happens, I usually prepare myself for a losing trade - because I understand market profile quite well due to my back test). Finally, the price changed the direction again, and I ended up with a really nice profit in the bag. Feels great!

The chart can help you understand the price action more easily. Those 5 hours was something like a light bulb moment for me why many good traders don't succeed in the markets, even with a massive hard work invested in their future.

The problem with trading and markets is, they don't give a f*ck how many nights you didn't sleep because of it. All it matters is what you do or sometimes even better to say, what you don't do while trading. This is a mind game, many times (at least in my case) it is mind blowing - both in a negative and positive way.

This type of scenario is not an exemption, it happens more often than not, and every individual decision counts on our PnL. Ironically, this is exactly why you must believe in yourself and your system instead of your money and PnL. Following of your trading plan on EVERY trade inside out is your best chance to succeed. Even occasional deviation from the plan will destroy you sooner or later. Add to your plan's deviation some profitable trade which you miss and your catastrophe is complete.

I will try to explain my statement a bit further just by analyzing today's trade:

Scenario 1: Plan followed to the perfection:

Actually, the outcome turns to be a winning trade, and quite nice one, with my profit 2x big as my initial risk (let's assume I risk $100/trade) . So Risk / Reward is 1:2 and my profit is $200.

Scenario 2: 50% profit taking at RR 1:1 and another 50% to BE

This is still a profitable scenario, I might take $100 quite fast, but my other half of the trade will be BE or +$1. Overall $101.

Scenario 3: SL moved at BE after seeing some profit

This trade would be BE completely or $1 profit.

There are endless scenarios which I could use, but this should be more than enough to do the math and help you understand how big an impact every decision has on every trade. Remember, there is $200 difference on the daily result on this ONE TRADE, calculate a difference on your monthly and yearly results.

Same market conditions, even same trades, completely different results.

Hope this will provoke you to start trading price action instead PnL. It makes a huge difference!

I got the idea for writing this post thanks to today's trading conditions in the forex market.

So far I have covered two topics WHAT SHOULD INVESTORS DO/ASK THEMSELVES BEFORE CHOOSING TRADING SIGNALS and GOOD TRADER - BAD TRADER. Both posts are just my humble opinions based on my life and trading experiences, this post won't be anyhow different.

First post covered some of the things I believe it would be wise to do for some of the investors / less experienced traders looking for diversification of their portfolio by choosing trading signals instead of classical bank saving options.

Second post reflects the wrong / right approach when it comes to the trading career of every individual. It describes two completely opposite perspectives and definitely two different outcomes based on their decisions and input.

This, third post, will be another episode on the path of the every trader, and why even some diligent and serious traders don't succeed in the trading industry. I will assume you have read GOOD TRADER - BAD TRADER post till now and you know that I believe there is an enormous workload in front of you before even considering live trading. Let's assume one did follow all the steps (and more) written in GT-BT, one did manage to trade profitably at a first but then losing streak occurred.

Back testing is great and A MUST homework to have a slightest chance in reaching long term trading success, BUT, there is a huge pressure on our back to perform emotionless even with a million of testing days/ trades which occurred in the past.

Let's take my account for example:

You will see that I have recently opened a new live account and offered it as a Signal here at MQL5 web page. As soon as started trading a losing streak occurred. It wasn't a big deal but the history shows 1 winning trade followed by 2 losing trades. This pattern happened for two times, leaving me with 2 winning and 4 losing trades. Did I liked it? Absolutely not, who would like to lose 2/3 of the overall trades? And like that wasn't enough, I missed 1 winning trade on the first day of my trading on this account. It was a great trade with the profit bigger for 50% than my initial risk. My strategy is battle tested, I know in the long run I will probably be profitable, nevertheless, nothing helps to cool down completely in one's subconscious.

Then today's trade came and I executed it calmly and objectively. It wasn't easy due to recent past events described above. Luckily for me, I learned by now this is the only way to trade successfully.

It was a hard and emotional trade for several reasons:

- Normally my trades are over within 1 -2 hours, this one lasted for 5 hours.

- Trade went to a nice profit, I thought this will be one of the easy, fast, profitable trades. Shortly afterwards, I have had a negative balance again (potentially 3rd losing trade in a row, 5th out of 7). Nice recovery followed, but even faster I was in the red again. (normally when this happens, I usually prepare myself for a losing trade - because I understand market profile quite well due to my back test). Finally, the price changed the direction again, and I ended up with a really nice profit in the bag. Feels great!

The chart can help you understand the price action more easily. Those 5 hours was something like a light bulb moment for me why many good traders don't succeed in the markets, even with a massive hard work invested in their future.

The problem with trading and markets is, they don't give a f*ck how many nights you didn't sleep because of it. All it matters is what you do or sometimes even better to say, what you don't do while trading. This is a mind game, many times (at least in my case) it is mind blowing - both in a negative and positive way.

This type of scenario is not an exemption, it happens more often than not, and every individual decision counts on our PnL. Ironically, this is exactly why you must believe in yourself and your system instead of your money and PnL. Following of your trading plan on EVERY trade inside out is your best chance to succeed. Even occasional deviation from the plan will destroy you sooner or later. Add to your plan's deviation some profitable trade which you miss and your catastrophe is complete.

I will try to explain my statement a bit further just by analyzing today's trade:

Scenario 1: Plan followed to the perfection:

Actually, the outcome turns to be a winning trade, and quite nice one, with my profit 2x big as my initial risk (let's assume I risk $100/trade) . So Risk / Reward is 1:2 and my profit is $200.

Scenario 2: 50% profit taking at RR 1:1 and another 50% to BE

This is still a profitable scenario, I might take $100 quite fast, but my other half of the trade will be BE or +$1. Overall $101.

Scenario 3: SL moved at BE after seeing some profit

This trade would be BE completely or $1 profit.

There are endless scenarios which I could use, but this should be more than enough to do the math and help you understand how big an impact every decision has on every trade. Remember, there is $200 difference on the daily result on this ONE TRADE, calculate a difference on your monthly and yearly results.

Same market conditions, even same trades, completely different results.

Hope this will provoke you to start trading price action instead PnL. It makes a huge difference!

Josip Vukelja

Just a quick heads up. I decided to create my personal Signal just to back up my trading philosophy written on my profile page so far.

I know for many of fellow traders my timing (negative return so far) won't be very logical, nevertheless, I believe it is perfect.

I know my strategy works, couple of losing trades won't change anything. Besides, the month is still young, (I am trying to be positive :))

I know for many of fellow traders my timing (negative return so far) won't be very logical, nevertheless, I believe it is perfect.

I know my strategy works, couple of losing trades won't change anything. Besides, the month is still young, (I am trying to be positive :))

Josip Vukelja

GOOD TRADER - BAD TRADER

“Judging is preventing us from understanding a new truth. Free yourself from the rules of old judgments and create the space for new understanding.” ― Steve Maraboli, Life, the Truth, and Being Free

This quote is perfectly applicable to trading, you don't have to go far to analyze this, just visit any trading forum, read reviews of signals offered here or go thru social media materials. The PROBLEM with incosistent traders is they keep doing the same things (read MISTAKES) and expecting different outcomes. Something similar would be placing 2+2 order in your calculator and expecting different results every time (sometimes 2+2=4, next time 5, 3rd 10 etc.) You get an idea, I am pretty sure about that.

This is exactly why I wanted to make the following list, describing the differences between GOOD (long term profitable) and BAD (inconsistent, unprofitable trader):

GOOD TRADER: Chances to succeed in trading are very slim, given the statistics, how many overall traders fail (>95%); I better educate myself before even considering placing my first real trade.

BAD TRADER: How come I didn't find out about trading earlier, my capital of $500 could have already been multiplied coupe of hundred times... F*ck... OK, calm down, you are still young, this time next year I'm gonna be a millionaire!

GOOD TRADER: I know my trading platform inside out because I have practiced placing different order types, made countless drawings on my charts etc. It is time to backtest my strategy which I have been developing by combining many different parts of strategies which successful traders are talking about. I will use some of the parts many of them mentioned so far, and make a strategy which suits my character and lifestyle, otherwise it will be really hard to put my trust in it and execute the orders eventually.

BAD TRADER: GAP? WTF? This is clear robbery! Dude, all of my $500 capital is gone? SLIPPAGE? WTF? This is clear robbery! Dude, all of my $500 capital is gone? 10 pips SPREAD? WTF? This is clear robbery! -$1000 on my account?! HOW?!?!

GOOD TRADER: I have made a list with all the steps / rules my strategy will have, now is time to put some hard work into it (for my own good). I will go back in time for at least a year (this depends about the time frame which you choose to trade on and type of strategy obviously), the more trades I get backtested the better. I wouldn't go bellow 100 trades, 1000 sounds much better.

BAD TRADER: OK, calm down, everybody burns his first account. Now is a perfect time to borrow some money and start over. PAY BACK time, you stupid market, you kind'a ask for it...

GOOD TRADER: Good job! Hundred of hours of hard work, my back pain from sitting and back testing is killling me but it is finally over. I really have something to lean on when I finally start trading. You reap what you sow some says and this really should help me to trade like a pro. Just to finish my final observations how to tune up my perfect strategy and it is time to move to the next step.

BAD TRADER: Fu*k yeah! I knew SL was for pus**es, I don't use it and guess what, I just doubled my $200 account. Show me your ROI, bi*ch??

GOOD TRADER: I have a list with my trading rules which I know it works, now I just have to put it into practice. My next goal is to open a demo account and focus ONLY on following the TRADING PLAN. I will start trading my real money after I manage to FOLLOW MY PLAN/STRATEGY for a two consecutive months without making any mistake such as entry/exit hesitations, trading around the major news, SL movement, etc.)

BAD TRADER: Martingale system. That was a part I have been missing in order to be a perfect trader.

GOOD TRADER: After two months of following my plan perfectly, I am feeling really confident about my trading skills and I will start trading real money. Again, I understand, trading with real money is way harder than demo trading due to psychological aspect. This is why I won't risk more than 1% of my trading capital per trade, if I manage to trade with no errors for two months, I will start increasing the risk per trade.

BAD TRADER: Everything fine so far, I must push the pace up. From now on, I will monitor every currency pair offered by my broker, for at least 16 hours per day!

GOOD TRADER: Wow trading isn't easy. Look, even the best out of the best struggle to make some profit in this year, must have been due to many political and economical changes we have around.

BAD TRADER: OK, no profit yet, but just look at my WIN percentage ratio, almost 90%. Man, I am killing the markets, I just have to continue holding my losses as long as they come to $2 profit and close my positions.

GOOD TRADER: 7 loses in a row sucks, but hey, it happen 3 times before in the last year and my backtest clearly shows that. I knew this shitty time had to come again and it has nothing to do with my trading. I execute my positions almost automatically, and I know this is the game of probabilities. Besides, my 2-3 winners will cover this 7 losses easily, because my winners are always bigger than my losers. Furthermore, I know where my SL has to be, if I have to lose, so be it, but I will always continue to give my trades enough room to breathe if they have to consolidate a bit before moving into some profits, but also, if the trade decide to go against me, I will always choose to lose my predefined loss instead of moving my SL and hoping for the best.

BAD TRADER: Who said I don't educate myself? I just found out about CENT accounts. All I have to do is open one of these, fund it with a $100 and it will look like I have $10000 on it. In addition to that, my Win percentage ratio is awesome, insainly high. That's it - I am going to be a great SIGNAL PROVIDER and all investors will be glad to pay me for my trading skills. (unfortunately - sometimes this actually works so be careful).

GOOD TRADER: Profits are pouring in slowly but steadly. I think I mastered this ONE instrument/currency pair and I also read 100+ trading / psychology books so far. Maybe it's time to move on and repat all the process which is written above. This time I am going to choose another instrument which I could trade in a different hours so I could keep my focus on it.

BAD TRADER: I am stupid, this isn't working! I blow my accounts on several occassions, maybe I should seek some help from a GOOD TRADER? Meh, noooo, that would be really stupid.

GOOD TRADER: I will continue to trade just a PERFECT SETUPS. If that means I will have to wait several days/weeks/even months for it - I am perfectly fine with that. I am trading to EARN some money, not to lose it. Furthermore, I KNOW trading is dangerous game even with this type of the approach.

BAD TRADER: I love trading, all that excitement while you have 10 trades open every day. This is why we traders are trading after all!

GOOD TRADER: I understand that trading is like anything what we have been thought from our birth till we die basically. Actually, to be successful in trading, completely different "laws" have to be obeyed. Emotions are ours worst enemy while we trading, this is why so many people fail. You have been thinking one way for the whole life, now all of the sudden, you have to rotate your mindset for 180 degrees over the night, and like that isn't enough, you have to top that new belifes with your fuc*ing money. This is the naked truth about trading, sooner you accept it, better for you. What we all have to do if trading, first find out what works and what not, then learn how to act like a robot and add your intuition on it (after you have been looking at price action for 1000 of hours, intuition surely helps).

BAD TRADER: I just won $200 with my 0,5 lot position, imagine what I could achieve with 100 lot position. I wouldn't have to work for the rest of my life.

GOOD TRADER: Risk management is all you have to respect in order to stay in the game for a long time. I will try to summarise my trading philosophy in here:

TRADING IS A LONG TERM GAME!

BE SURE YOU CAN SURVIVE CHALENGING TIMES AND PREPARE YOURSELF FOR THEM BEFORE THEY COME!

TRADE THE WAY YOUR LOSES ARE SMALLER THAN YOUR WINNERS! which brings us to:

DETERMINE YOUR RISK (SL) AND PROFIT (TP) BEFORE YOU ENTER THE TRADE! ALWAYS!

FOLLOW YOUR PLAN, DON'T CHANGE YOUR STRATEGY AFTER COUPLE OF LOSES - IF YOU HAVE TESTED IT!

THERE IS NO HOLLY GRAIL! CONSIDER TRADING AS A BUSINESS BECAUSE IT IS!

TRADING IS NOT SUPPOSED TO BE FUN AND EXCITING!

KILL YOUR EGO!

BE OPTIMISTIC! BELIEVE IN YOUR SKILLS IF YOU MASTERED YOUR STRATEGY!

MARKET DOESN'T CARE WHEATHER YOU ARE LONG OR SHORT!

WINNING OR A LOOSING TRADE DOESN'T REFLECT YOU, YOU ARE JUST AN EXECUTOR AND YOU DON'T CONTROL THE OUTCOME!

FOCUS ON A THING WHICH YOU CAN CONTROL (YOURSELF) DON'T WORRY ABOUT ANYTHING ELSE!

DON'T FOCUS ON STUPIDITIES SUCH AS WIN RATIO - HIGHER/LOWER % DOESN'T GUARANTEE YOU ANYTHING.

TRADE ONLY WHEN THERE IS SOMETHING TO TRADE!

SITTING ON HANDS IS ALSO TRADING! having 0 is beter than having debt!

ALWAYS TRY TO IMPROVE YOUR TRADING SKILLS!

Another huge post, I don't know what is happening to me :)

“Judging is preventing us from understanding a new truth. Free yourself from the rules of old judgments and create the space for new understanding.” ― Steve Maraboli, Life, the Truth, and Being Free

This quote is perfectly applicable to trading, you don't have to go far to analyze this, just visit any trading forum, read reviews of signals offered here or go thru social media materials. The PROBLEM with incosistent traders is they keep doing the same things (read MISTAKES) and expecting different outcomes. Something similar would be placing 2+2 order in your calculator and expecting different results every time (sometimes 2+2=4, next time 5, 3rd 10 etc.) You get an idea, I am pretty sure about that.

This is exactly why I wanted to make the following list, describing the differences between GOOD (long term profitable) and BAD (inconsistent, unprofitable trader):

GOOD TRADER: Chances to succeed in trading are very slim, given the statistics, how many overall traders fail (>95%); I better educate myself before even considering placing my first real trade.

BAD TRADER: How come I didn't find out about trading earlier, my capital of $500 could have already been multiplied coupe of hundred times... F*ck... OK, calm down, you are still young, this time next year I'm gonna be a millionaire!

GOOD TRADER: I know my trading platform inside out because I have practiced placing different order types, made countless drawings on my charts etc. It is time to backtest my strategy which I have been developing by combining many different parts of strategies which successful traders are talking about. I will use some of the parts many of them mentioned so far, and make a strategy which suits my character and lifestyle, otherwise it will be really hard to put my trust in it and execute the orders eventually.

BAD TRADER: GAP? WTF? This is clear robbery! Dude, all of my $500 capital is gone? SLIPPAGE? WTF? This is clear robbery! Dude, all of my $500 capital is gone? 10 pips SPREAD? WTF? This is clear robbery! -$1000 on my account?! HOW?!?!

GOOD TRADER: I have made a list with all the steps / rules my strategy will have, now is time to put some hard work into it (for my own good). I will go back in time for at least a year (this depends about the time frame which you choose to trade on and type of strategy obviously), the more trades I get backtested the better. I wouldn't go bellow 100 trades, 1000 sounds much better.

BAD TRADER: OK, calm down, everybody burns his first account. Now is a perfect time to borrow some money and start over. PAY BACK time, you stupid market, you kind'a ask for it...

GOOD TRADER: Good job! Hundred of hours of hard work, my back pain from sitting and back testing is killling me but it is finally over. I really have something to lean on when I finally start trading. You reap what you sow some says and this really should help me to trade like a pro. Just to finish my final observations how to tune up my perfect strategy and it is time to move to the next step.

BAD TRADER: Fu*k yeah! I knew SL was for pus**es, I don't use it and guess what, I just doubled my $200 account. Show me your ROI, bi*ch??

GOOD TRADER: I have a list with my trading rules which I know it works, now I just have to put it into practice. My next goal is to open a demo account and focus ONLY on following the TRADING PLAN. I will start trading my real money after I manage to FOLLOW MY PLAN/STRATEGY for a two consecutive months without making any mistake such as entry/exit hesitations, trading around the major news, SL movement, etc.)

BAD TRADER: Martingale system. That was a part I have been missing in order to be a perfect trader.

GOOD TRADER: After two months of following my plan perfectly, I am feeling really confident about my trading skills and I will start trading real money. Again, I understand, trading with real money is way harder than demo trading due to psychological aspect. This is why I won't risk more than 1% of my trading capital per trade, if I manage to trade with no errors for two months, I will start increasing the risk per trade.

BAD TRADER: Everything fine so far, I must push the pace up. From now on, I will monitor every currency pair offered by my broker, for at least 16 hours per day!

GOOD TRADER: Wow trading isn't easy. Look, even the best out of the best struggle to make some profit in this year, must have been due to many political and economical changes we have around.

BAD TRADER: OK, no profit yet, but just look at my WIN percentage ratio, almost 90%. Man, I am killing the markets, I just have to continue holding my losses as long as they come to $2 profit and close my positions.

GOOD TRADER: 7 loses in a row sucks, but hey, it happen 3 times before in the last year and my backtest clearly shows that. I knew this shitty time had to come again and it has nothing to do with my trading. I execute my positions almost automatically, and I know this is the game of probabilities. Besides, my 2-3 winners will cover this 7 losses easily, because my winners are always bigger than my losers. Furthermore, I know where my SL has to be, if I have to lose, so be it, but I will always continue to give my trades enough room to breathe if they have to consolidate a bit before moving into some profits, but also, if the trade decide to go against me, I will always choose to lose my predefined loss instead of moving my SL and hoping for the best.

BAD TRADER: Who said I don't educate myself? I just found out about CENT accounts. All I have to do is open one of these, fund it with a $100 and it will look like I have $10000 on it. In addition to that, my Win percentage ratio is awesome, insainly high. That's it - I am going to be a great SIGNAL PROVIDER and all investors will be glad to pay me for my trading skills. (unfortunately - sometimes this actually works so be careful).

GOOD TRADER: Profits are pouring in slowly but steadly. I think I mastered this ONE instrument/currency pair and I also read 100+ trading / psychology books so far. Maybe it's time to move on and repat all the process which is written above. This time I am going to choose another instrument which I could trade in a different hours so I could keep my focus on it.

BAD TRADER: I am stupid, this isn't working! I blow my accounts on several occassions, maybe I should seek some help from a GOOD TRADER? Meh, noooo, that would be really stupid.

GOOD TRADER: I will continue to trade just a PERFECT SETUPS. If that means I will have to wait several days/weeks/even months for it - I am perfectly fine with that. I am trading to EARN some money, not to lose it. Furthermore, I KNOW trading is dangerous game even with this type of the approach.

BAD TRADER: I love trading, all that excitement while you have 10 trades open every day. This is why we traders are trading after all!

GOOD TRADER: I understand that trading is like anything what we have been thought from our birth till we die basically. Actually, to be successful in trading, completely different "laws" have to be obeyed. Emotions are ours worst enemy while we trading, this is why so many people fail. You have been thinking one way for the whole life, now all of the sudden, you have to rotate your mindset for 180 degrees over the night, and like that isn't enough, you have to top that new belifes with your fuc*ing money. This is the naked truth about trading, sooner you accept it, better for you. What we all have to do if trading, first find out what works and what not, then learn how to act like a robot and add your intuition on it (after you have been looking at price action for 1000 of hours, intuition surely helps).

BAD TRADER: I just won $200 with my 0,5 lot position, imagine what I could achieve with 100 lot position. I wouldn't have to work for the rest of my life.

GOOD TRADER: Risk management is all you have to respect in order to stay in the game for a long time. I will try to summarise my trading philosophy in here:

TRADING IS A LONG TERM GAME!

BE SURE YOU CAN SURVIVE CHALENGING TIMES AND PREPARE YOURSELF FOR THEM BEFORE THEY COME!

TRADE THE WAY YOUR LOSES ARE SMALLER THAN YOUR WINNERS! which brings us to:

DETERMINE YOUR RISK (SL) AND PROFIT (TP) BEFORE YOU ENTER THE TRADE! ALWAYS!

FOLLOW YOUR PLAN, DON'T CHANGE YOUR STRATEGY AFTER COUPLE OF LOSES - IF YOU HAVE TESTED IT!

THERE IS NO HOLLY GRAIL! CONSIDER TRADING AS A BUSINESS BECAUSE IT IS!

TRADING IS NOT SUPPOSED TO BE FUN AND EXCITING!

KILL YOUR EGO!

BE OPTIMISTIC! BELIEVE IN YOUR SKILLS IF YOU MASTERED YOUR STRATEGY!

MARKET DOESN'T CARE WHEATHER YOU ARE LONG OR SHORT!

WINNING OR A LOOSING TRADE DOESN'T REFLECT YOU, YOU ARE JUST AN EXECUTOR AND YOU DON'T CONTROL THE OUTCOME!

FOCUS ON A THING WHICH YOU CAN CONTROL (YOURSELF) DON'T WORRY ABOUT ANYTHING ELSE!

DON'T FOCUS ON STUPIDITIES SUCH AS WIN RATIO - HIGHER/LOWER % DOESN'T GUARANTEE YOU ANYTHING.

TRADE ONLY WHEN THERE IS SOMETHING TO TRADE!

SITTING ON HANDS IS ALSO TRADING! having 0 is beter than having debt!

ALWAYS TRY TO IMPROVE YOUR TRADING SKILLS!

Another huge post, I don't know what is happening to me :)

Stefan Marjoram

2016.11.20

This was a really good and funny read, I think everyone goes through the stage of being a bad trader at some point :) it takes a lot of self discipline and motivation to become the "good trader" I think this is why most fail the journey is too much for some.

Josip Vukelja

2016.11.21

@Stefan Marjoram, Thanks for your comment, I am glad you liked it and totally agree with you, even the best traders of the world had some "bad trader" excursions during their journey.

Josip Vukelja

WHAT SHOULD INVESTORS DO/ASK THEMSELVES BEFORE CHOOSING TRADING SIGNALS

1. DO your homework best as you can!

Trading and investing are the best fields in the world to participate in, and consequently, to develop your passion into a professional career. Hard work stands behind every long term successful individual, be sure you understand that, and even more importantly, be sure you are not an exemption from this rule.

2. TAKE full responsibility for your actions and decisions!

Whatever you do in this industry from now on, please understand that only you must take all the merits, regardless of the outcome. You are about to invest your money, you take credit both for the profits and losses (which will most definitely occur at some point).

3. SEARCH for potential signals, worth of your attention, time and money!

Here I would ask myself the following questions:

a) Is signal traded on demo, cent or LIVE account?

Obviously, you should focus on live/real accounts only. Why? Ask yourself one simple question: if somebody claims to be a great trader, better than the majority of people, has great results for several years, yet, doesn't trade with a real money. What's his/her problem? There is nobody so crazy out there that is wouldn't take millions out of the market IF they could.

b) Compare Live account sizes (choose 10-15 signals at this point of the research)

Before I forget, be very careful with CENT accounts. Yes, they are funded with a real money, however, they are cent accounts and nothing more. If you see some signal with a MQL5 note: "Сent account! Provider can take high risks while trading" on the left side of the Signal description, you must understand the following: e.g. Signal XYZ has a balance of $15 000. WOW this looks good right? Well, give it a second thought. Cent account with $15 000 must be divided by 100, therefore, 15 000/ 100 = $150. This gigantic account doesn't look so sexy anymore right? Some traders use Cent accounts for three main reasons: Firstly, their accounts look huge - more professional this way. You instantly get an impression that they are serious about their trading and you naturally want to join them and grow your account securely. Secondly, there is almost zero risk for their trading decisions, they can open e.g. 20 cent accounts with $50 for each (you might think they have deposited $5 000 on it), trade for a couple of months on their accounts and after managing to grow several of the to some profit of 1000% and offer them to the investors. You might again think that you found next Tesla or Einstein right of the bat. Thirdly, cent accounts can be easily manipulated drawdown wise. When things go south and they start to lose e.g. 50% of their capital, all they have to do is to deposit another $50 on their account and the drawdown won't look so ugly anymore. In fact, this 50% drawdown will look like 25% drawdown immediately. Nice trick huh?

Logically, you would like to invest and benefit from the traders/signals who trade for a living, professionals ideally, because they put THEIR money where their mouth is. They don't have to be some institutional traders, this is not the place where they trade after all, but at least look for traders who trade some normal accounts with at least $5 000 on them, remember $5 000 on real, live accounts.

c) Narrow the list of reliable Signals to 3-5 out of 10-15.

4. TEST those Signals on your demo account for some time.

I know, this step will be a bit harder to swallow for some of you, nobody wants to spend real money and pay for the Signals just to make some point. I know, we are not coming here to lose money, but to earn it, fast, and to grow our micro accounts exponentially ASAP. Well, guess what, I've been there and I've done it all before. Ugly truth is, that get rich quick scheme doesn't work ANYWHERE in the world, no matter of your beliefs, color, religion, height, weight etc. And it certainly won't work in trading/investing. Don't believe me? Just ask the 98% of the LOSERS who tried it (and many still trying it) the same stupid, stubborn way over and over again. It is time for you to give yourself a chance to succeed in this industry, consider paying approximately $100-$200 as an investment in your future. It is the fastest way to succeed, my humble opinion as everything else written here so far. If you think $200 is too big investment, then I must tell you, your capital is too small to have the slightest chance to be profitable from trading. What you need is objective, realistic expectancy what you might earn from trading, and more importantly, how fast can you do it.

5. INVEST in 1-3 of Signals providers.

At this point I can only assume you have done your homework the right way. Please understand that investing is seasonal like everything in life and nature. There will always be some good and a bit less good times in our lives. Study the Signals, their results and behavior thru the year. It is more important how a trader handles bad times, his risk management (winers bigger than losers etc.) and CONSISTENCY. Understand that this is the game of probabilities, doesn't matter if the Signal has 5-6 losses in a row, every trader on the planet face losses more often than not. Just be sure you must treat investing as a business, you won't fail if you choose the Signal this way. Lastly, give to signal some time to judge it, when you think about trading results, look at yearly return, no monthly or even worse - daily results. Be ready to put your trust in the signal for three consecutive months before getting a clear picture about how good your choice was after all.

WOW, I didn't know this will become such a huge post, anyway, I hope it will help you in making a decision, how to treat yourself and your investment in the future. If I manage to help to save/earn $1 for a single person, my mission will be accomplished.

Stay smart!

1. DO your homework best as you can!

Trading and investing are the best fields in the world to participate in, and consequently, to develop your passion into a professional career. Hard work stands behind every long term successful individual, be sure you understand that, and even more importantly, be sure you are not an exemption from this rule.

2. TAKE full responsibility for your actions and decisions!

Whatever you do in this industry from now on, please understand that only you must take all the merits, regardless of the outcome. You are about to invest your money, you take credit both for the profits and losses (which will most definitely occur at some point).

3. SEARCH for potential signals, worth of your attention, time and money!

Here I would ask myself the following questions:

a) Is signal traded on demo, cent or LIVE account?

Obviously, you should focus on live/real accounts only. Why? Ask yourself one simple question: if somebody claims to be a great trader, better than the majority of people, has great results for several years, yet, doesn't trade with a real money. What's his/her problem? There is nobody so crazy out there that is wouldn't take millions out of the market IF they could.

b) Compare Live account sizes (choose 10-15 signals at this point of the research)

Before I forget, be very careful with CENT accounts. Yes, they are funded with a real money, however, they are cent accounts and nothing more. If you see some signal with a MQL5 note: "Сent account! Provider can take high risks while trading" on the left side of the Signal description, you must understand the following: e.g. Signal XYZ has a balance of $15 000. WOW this looks good right? Well, give it a second thought. Cent account with $15 000 must be divided by 100, therefore, 15 000/ 100 = $150. This gigantic account doesn't look so sexy anymore right? Some traders use Cent accounts for three main reasons: Firstly, their accounts look huge - more professional this way. You instantly get an impression that they are serious about their trading and you naturally want to join them and grow your account securely. Secondly, there is almost zero risk for their trading decisions, they can open e.g. 20 cent accounts with $50 for each (you might think they have deposited $5 000 on it), trade for a couple of months on their accounts and after managing to grow several of the to some profit of 1000% and offer them to the investors. You might again think that you found next Tesla or Einstein right of the bat. Thirdly, cent accounts can be easily manipulated drawdown wise. When things go south and they start to lose e.g. 50% of their capital, all they have to do is to deposit another $50 on their account and the drawdown won't look so ugly anymore. In fact, this 50% drawdown will look like 25% drawdown immediately. Nice trick huh?

Logically, you would like to invest and benefit from the traders/signals who trade for a living, professionals ideally, because they put THEIR money where their mouth is. They don't have to be some institutional traders, this is not the place where they trade after all, but at least look for traders who trade some normal accounts with at least $5 000 on them, remember $5 000 on real, live accounts.

c) Narrow the list of reliable Signals to 3-5 out of 10-15.

4. TEST those Signals on your demo account for some time.

I know, this step will be a bit harder to swallow for some of you, nobody wants to spend real money and pay for the Signals just to make some point. I know, we are not coming here to lose money, but to earn it, fast, and to grow our micro accounts exponentially ASAP. Well, guess what, I've been there and I've done it all before. Ugly truth is, that get rich quick scheme doesn't work ANYWHERE in the world, no matter of your beliefs, color, religion, height, weight etc. And it certainly won't work in trading/investing. Don't believe me? Just ask the 98% of the LOSERS who tried it (and many still trying it) the same stupid, stubborn way over and over again. It is time for you to give yourself a chance to succeed in this industry, consider paying approximately $100-$200 as an investment in your future. It is the fastest way to succeed, my humble opinion as everything else written here so far. If you think $200 is too big investment, then I must tell you, your capital is too small to have the slightest chance to be profitable from trading. What you need is objective, realistic expectancy what you might earn from trading, and more importantly, how fast can you do it.

5. INVEST in 1-3 of Signals providers.

At this point I can only assume you have done your homework the right way. Please understand that investing is seasonal like everything in life and nature. There will always be some good and a bit less good times in our lives. Study the Signals, their results and behavior thru the year. It is more important how a trader handles bad times, his risk management (winers bigger than losers etc.) and CONSISTENCY. Understand that this is the game of probabilities, doesn't matter if the Signal has 5-6 losses in a row, every trader on the planet face losses more often than not. Just be sure you must treat investing as a business, you won't fail if you choose the Signal this way. Lastly, give to signal some time to judge it, when you think about trading results, look at yearly return, no monthly or even worse - daily results. Be ready to put your trust in the signal for three consecutive months before getting a clear picture about how good your choice was after all.

WOW, I didn't know this will become such a huge post, anyway, I hope it will help you in making a decision, how to treat yourself and your investment in the future. If I manage to help to save/earn $1 for a single person, my mission will be accomplished.

Stay smart!

Josip Vukelja

Hello MQL5 community! Just joined it and I like it so far. Did some research in the Signal section and will probably write some of my observations and modest opinions regarding the Signals, traders and what should investors pay attention to, before putting their money into the markets. I might offer mine Signal eventually as well.

: