Tamas Molnar / Profile

- Information

|

11+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

Broker

at

laszlo.tamas.molnar@gmail.com

Tamas Molnar

The last trade of the week is already running :) We’ve achieved a great result this week. Enjoy your weekend, and next week we’ll be back at it again!

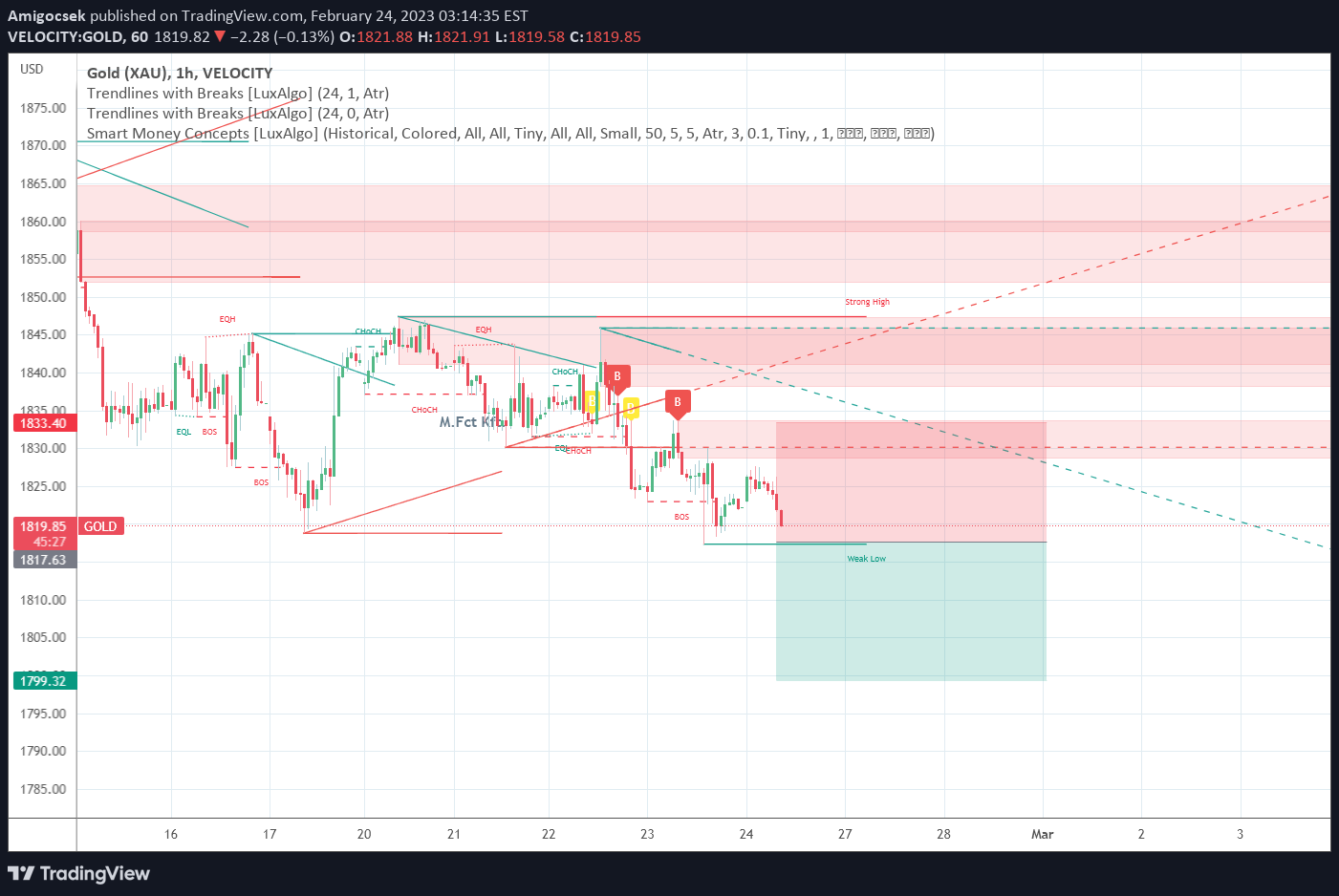

Amigo Pip Killer!

Amigo Pip Killer!

Tamas Molnar

💥 REAL TRADERS. REAL RESULTS. 💥

📈 Join a community of real traders — no robots, no algorithms, just human analysis and experience at work.

We completely reject automated trading because we believe only human logic, intuition, and market understanding can truly read the charts and make smart decisions.

🔥 Copy our signals and see how real market professionals operate.

💰 Minimum deposit: $500

🎯 No hype. No “AI magic.” Just real people making real profits with discipline and strategy.

👉 Trust experience. Follow our trades and trade like a pro.

#ForexSignals #RealTraders #HumanTrading #NoRobots #CopyOurTrades

📈 Join a community of real traders — no robots, no algorithms, just human analysis and experience at work.

We completely reject automated trading because we believe only human logic, intuition, and market understanding can truly read the charts and make smart decisions.

🔥 Copy our signals and see how real market professionals operate.

💰 Minimum deposit: $500

🎯 No hype. No “AI magic.” Just real people making real profits with discipline and strategy.

👉 Trust experience. Follow our trades and trade like a pro.

#ForexSignals #RealTraders #HumanTrading #NoRobots #CopyOurTrades

Tamas Molnar

VIGILANT! no one should go to NAGA forex site! they don't pay the money, they constantly invent everything so that they don't have to pay!

I have been fighting for 10,000 dollars for almost 2 months! to finally get paid! we are now at the point where I filed the report with the stock exchange supervision.

I have been fighting for 10,000 dollars for almost 2 months! to finally get paid! we are now at the point where I filed the report with the stock exchange supervision.

Tamas Molnar

TODAY ALERT!!!!! NO MORE OPEN!!!!!! Non-Farm Employment Change!!!!! WERRY DANGER!!! TODAY DATE!!!

Tamas Molnar

Inflation in Germany rose at a stronger pace than expected in October.

EUR/USD trades in negative territory at around 0.9950 after hot German CPI data.

Annual inflation in Germany, as measured by the Consumer Price Index (CPI), climbed to 10.4% in October from 10% in September, Germany's Destatis reported on Friday. This reading came in higher than the market expectation of 10.1%.

Meanwhile, the Harmonised Index of Consumer Prices (HICP), the European Central Bank's (ECB) preferred gauge of inflation, jumped to 11.6% from 10.9%, compared to analysts' estimate of 10.9%.

On a monthly basis, the CPI and the HICP arrived at 0.9% and 1.1%, respectively, surpassing market forecasts.

Market reaction

The EUR/USD pair showed no immediate reaction to these figures and was last seen losing 0.08% on the day at 0.9955.

EUR/USD trades in negative territory at around 0.9950 after hot German CPI data.

Annual inflation in Germany, as measured by the Consumer Price Index (CPI), climbed to 10.4% in October from 10% in September, Germany's Destatis reported on Friday. This reading came in higher than the market expectation of 10.1%.

Meanwhile, the Harmonised Index of Consumer Prices (HICP), the European Central Bank's (ECB) preferred gauge of inflation, jumped to 11.6% from 10.9%, compared to analysts' estimate of 10.9%.

On a monthly basis, the CPI and the HICP arrived at 0.9% and 1.1%, respectively, surpassing market forecasts.

Market reaction

The EUR/USD pair showed no immediate reaction to these figures and was last seen losing 0.08% on the day at 0.9955.

Tamas Molnar

Viktor Orbán Their salary has been raised, Because there is a war next door, Meanwhile, the Hungarian people are suffering and living in increasingly bad conditions.

1 euro = 400 FT

1 Kg of bread: 1,000 HUF 1 Euro: 400 HUF

Average Hungarian salary: 220.00 HUF

Nobody does anything. meanwhile Orbán destroys and exploits an entire Country and an entire nation. Meanwhile, the EU does not deal with it only sometimes scolds :) Congratulations EU!

1 euro = 400 FT

1 Kg of bread: 1,000 HUF 1 Euro: 400 HUF

Average Hungarian salary: 220.00 HUF

Nobody does anything. meanwhile Orbán destroys and exploits an entire Country and an entire nation. Meanwhile, the EU does not deal with it only sometimes scolds :) Congratulations EU!

: