Conor Mcnamara / Profile

- Information

|

2 years

experience

|

8

products

|

4

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

I started learning C programming in 2010. From there I picked up many languages.

I have worked with MQL for just a year now. I pick up programming languages very quickly because I'm no stranger to programming.

I'm working on several indicator projects and EA concepts.

I'm currently studying epistemological degeneracy in financial markets.

I have worked with MQL for just a year now. I pick up programming languages very quickly because I'm no stranger to programming.

I'm working on several indicator projects and EA concepts.

I'm currently studying epistemological degeneracy in financial markets.

Conor Mcnamara

I would describe automated trading trading as something that does work. But when you understand what trading is about... it's not more ideal than manual trading.

It is like a car driving by itself. Do you trust that a car will automate driving perfectly? Are you happy to sit in a car that drives without your control? This is exactly how I would describe automated trading.

It is like a car driving by itself. Do you trust that a car will automate driving perfectly? Are you happy to sit in a car that drives without your control? This is exactly how I would describe automated trading.

Rajesh Kumar Nait

2025.07.09

Tesla drives automatically but i saw some instances of crash, It cant drive like human but there are ongonig advancement and continuous software updates (optimization ) which is making it more effective. Trading manually envolves emotion and no human is emotionless, Emotion causes errors.

Conor Mcnamara

2025.07.10

Emotional trading is trading without discipline, however even with discipline there is a huge amount of stress when someone is still in the stage of proving the strategy without trust in it.

Conor Mcnamara

There are many indicators on the codebase that are just proof of science or for data organization, but they're not suitable for trading signals. For "quant" trading, it's a layered combination of tools which makes something suitable for signals. Combine ADX, ATR, and an oscillator..and this gives a much more reliable trend

Conor Mcnamara

this wonder zigzag got a full optimization, but the code is not available

It can be provided for payment, and payment must be in the form of a briefcase of cash

The file will be provided to you on a floppy disk

It can be provided for payment, and payment must be in the form of a briefcase of cash

The file will be provided to you on a floppy disk

Show all comments (4)

Conor Mcnamara

2025.07.05

there were some problems in the beta, they are fixed now It now has pivot modes "strict to pivots" and "strict to candle high/low" The pivot mode only concerns the trend change and instantly switches leg. The candle mode strictly connects legs to candle highest/lowest near the trend change

Conor Mcnamara

2025.07.05

both modes are identifying the new wave much faster than the old traditional zigzag

Conor Mcnamara

It would be helpful to have a table of algos which are profitable in automation, and which are not.

Some indicators are profitable sometimes, but can't survive all market conditions, which means the algorithm essentially isn't good enough for automation. It seems that with most of them, there's a problem. Parabolic sar for example will fail in ranging markets. Fractals is often after the fact, and not always giving true signals. Donchian channel and zigzag by itself is constantly repainting. RSI gives false signals if the market starts to trend in one direction.

Multitimeframe systems and systems that combine indicators are promising, but there are downsides to this as well (it will calculate fewer opportunities and miss out on many).

There's only a few algos left to be reliable for automation.

Some indicators are profitable sometimes, but can't survive all market conditions, which means the algorithm essentially isn't good enough for automation. It seems that with most of them, there's a problem. Parabolic sar for example will fail in ranging markets. Fractals is often after the fact, and not always giving true signals. Donchian channel and zigzag by itself is constantly repainting. RSI gives false signals if the market starts to trend in one direction.

Multitimeframe systems and systems that combine indicators are promising, but there are downsides to this as well (it will calculate fewer opportunities and miss out on many).

There's only a few algos left to be reliable for automation.

Conor Mcnamara

2025.07.02

It is true that every strategy can work with organized risk management, although what I'm hunting for is thr most reliable scalping system which provides frequent and safe entry opportunities. I found a few very good contenders which are far better than other trend following indicators

Conor Mcnamara

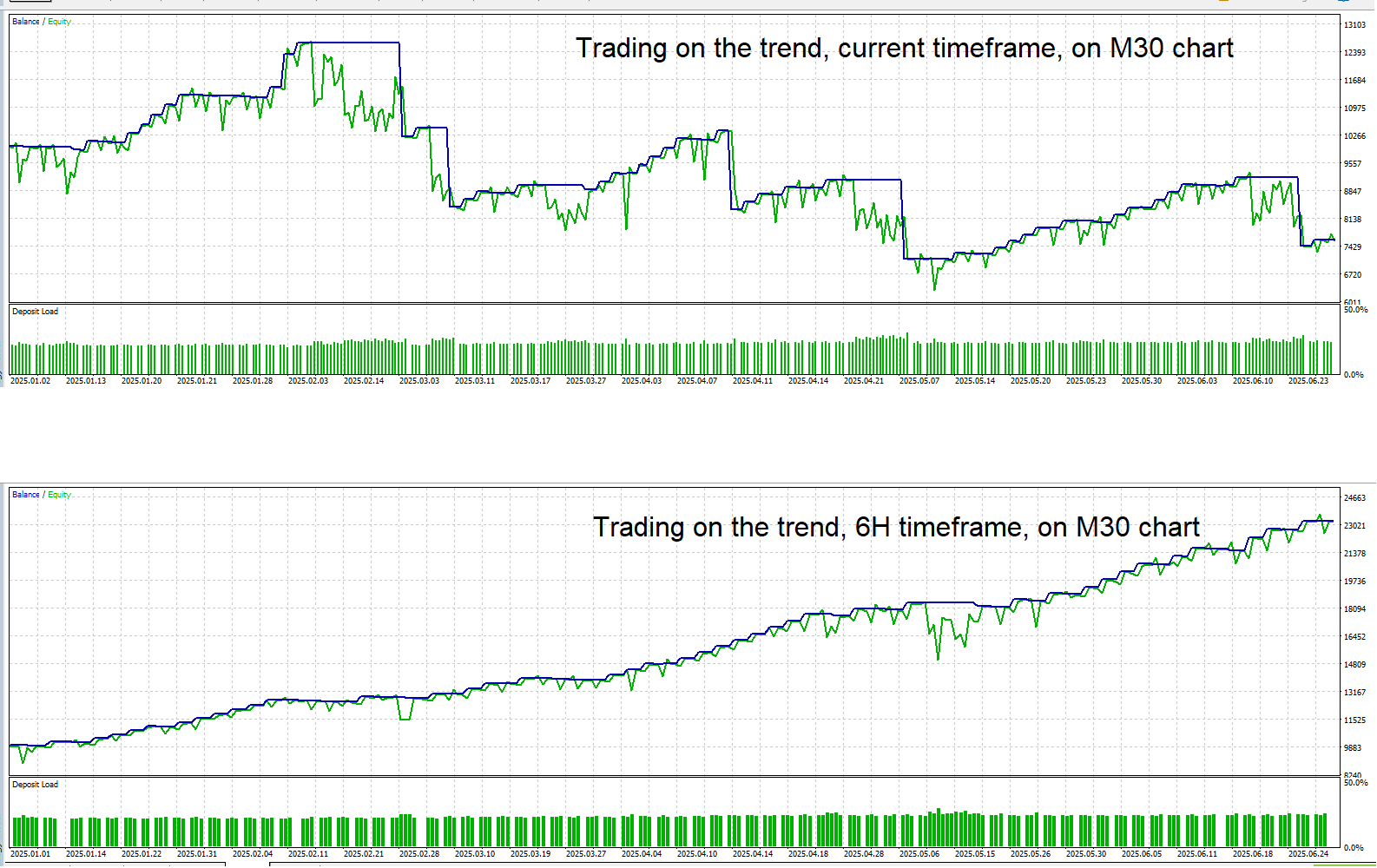

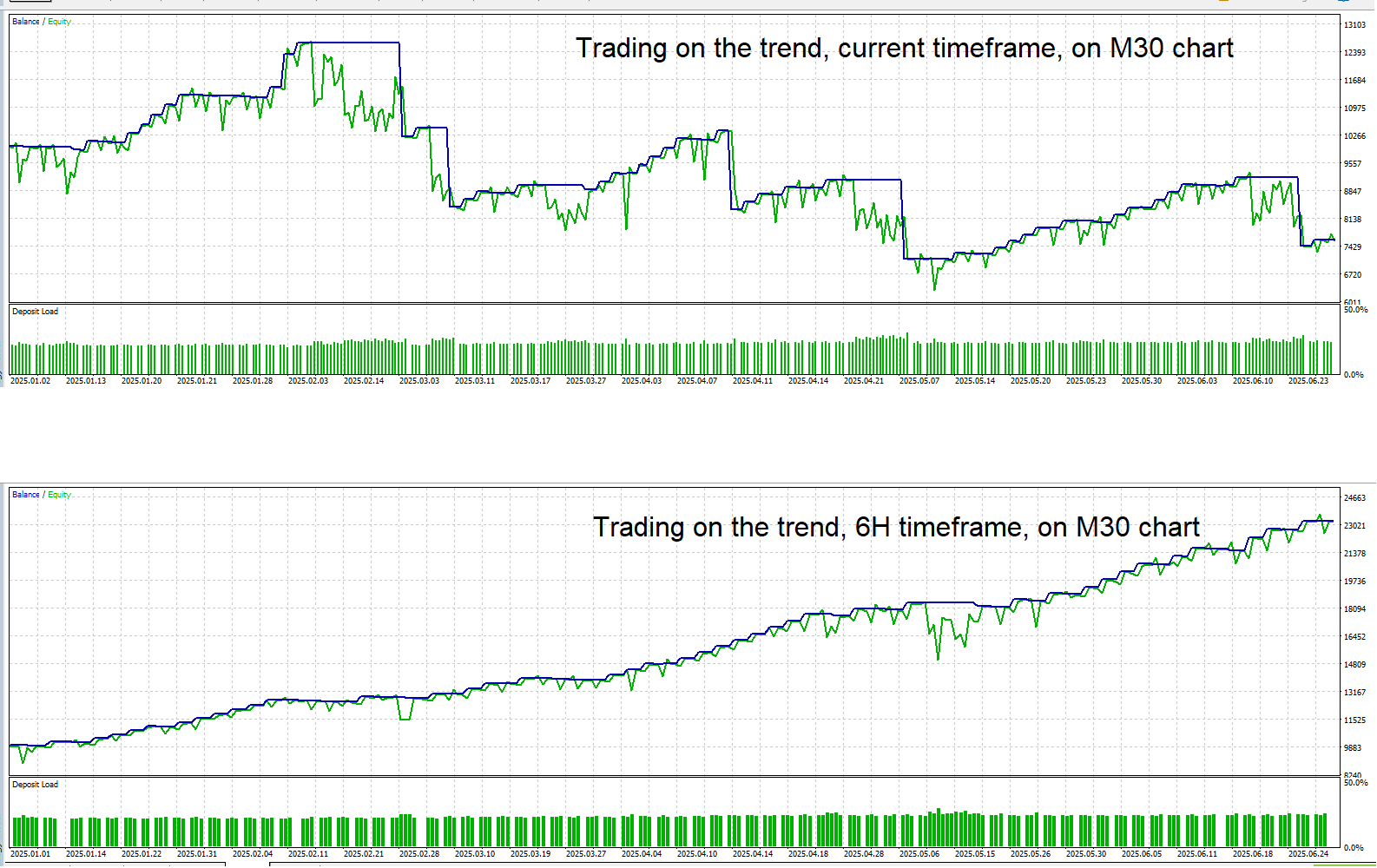

statistically, multi-timeframe trend shows much more positive results for quantitative trend indicators proving that it's not a fad

Mahdi Ebrahimzadeh

2025.07.05

hard word to understand for non-english people. thanks for explanation.

Conor Mcnamara

extreme risk is not a bad thing if the deposit meant nothing to you, and the fact of trading is that higher risk will always give a more fruitful profit over time. But I see so many EAs with no fail-safe features.

For example, let's say the user wants to take really high risk, and the account gained 30%. At least then you could implement a fail-safe where the deposit is protected and the EA can't fall below the original deposit after a certain account gain is reached. I coded these deposit protection features, because it's not logical to allow the expert to blow the account at a late point. It's very easy to code these things, there's no excuse not to have money management

For example, let's say the user wants to take really high risk, and the account gained 30%. At least then you could implement a fail-safe where the deposit is protected and the EA can't fall below the original deposit after a certain account gain is reached. I coded these deposit protection features, because it's not logical to allow the expert to blow the account at a late point. It's very easy to code these things, there's no excuse not to have money management

Rajesh Kumar Nait

2025.06.30

Extreme risk for me is like betting 2 for 1 profit or 3 for 1 profit but it should be done with small accounts only. Once you grow use position sizing to mitigate risk

Conor Mcnamara

In your EAs, do you create a time window for trading? or do you let the EA trade all hours and all sessions? and if you do create an hourly trading window, which hours do you let the EA trade?

Conor Mcnamara

2025.06.28

I saw in one EA this guy made a function to make the expert trade only a specific set of hours. It was this which made it profitable. I know for sure that trading less is a good risk management protocol. But if his way is the best way in forex...it's still questionable. I'll have to do more experiments on that

Conor Mcnamara

2025.06.28

he made the EA trade last hour of Tokyo session into the first two hours of London session. Apparently the last hour of a session is where institutions warm up for the opening of the next session, and liquidity increases

Conor Mcnamara

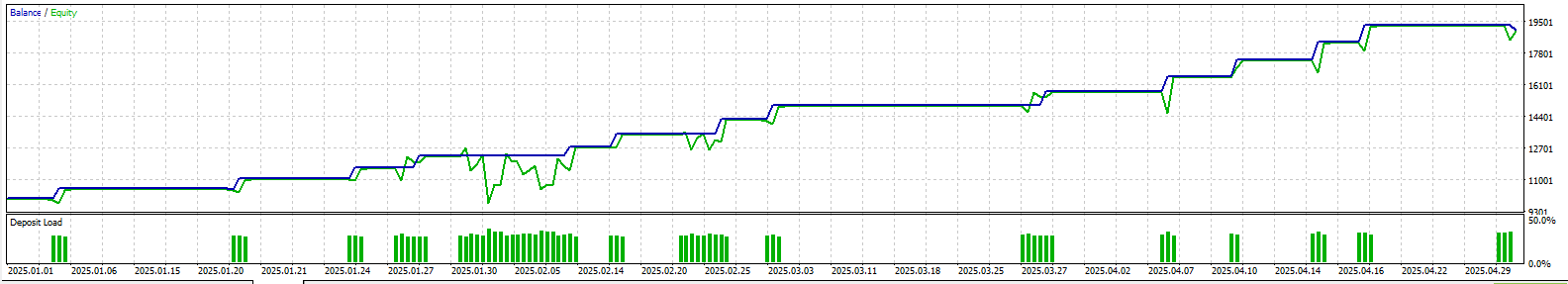

small backtest on the time where real ticks were available, this is trading on H1 chart with the trend following indicator on H12. Possible overfitting, and will not always be smooth. this is why we need either to supervise at times or else automate risk management such as a drawdown controller

Conor Mcnamara

some small discovery in mtf trend following indicators if anyone is interested

M5 chart timeframe likes the indicator to look at M15 or M20 for short term scalping

M20 chart timeframe likes the indicator to look at H8 for swing trades

H1 chart timeframe likes the indicator to look at H12 for swing trades

M5 chart timeframe likes the indicator to look at M15 or M20 for short term scalping

M20 chart timeframe likes the indicator to look at H8 for swing trades

H1 chart timeframe likes the indicator to look at H12 for swing trades

Conor Mcnamara

using the two-stage entry concept on M5 chart with the trend following indicator looking at M15 (MTF). Drawdown is 1%

Conor Mcnamara

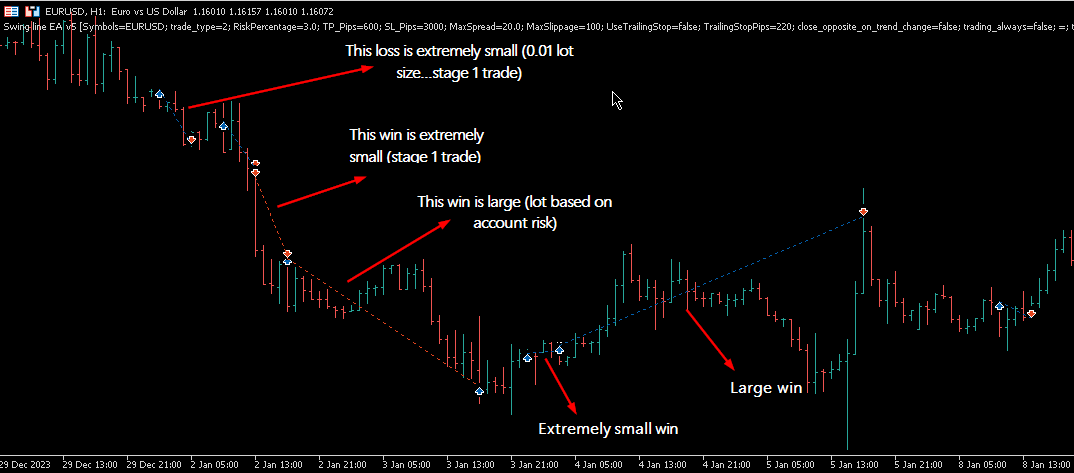

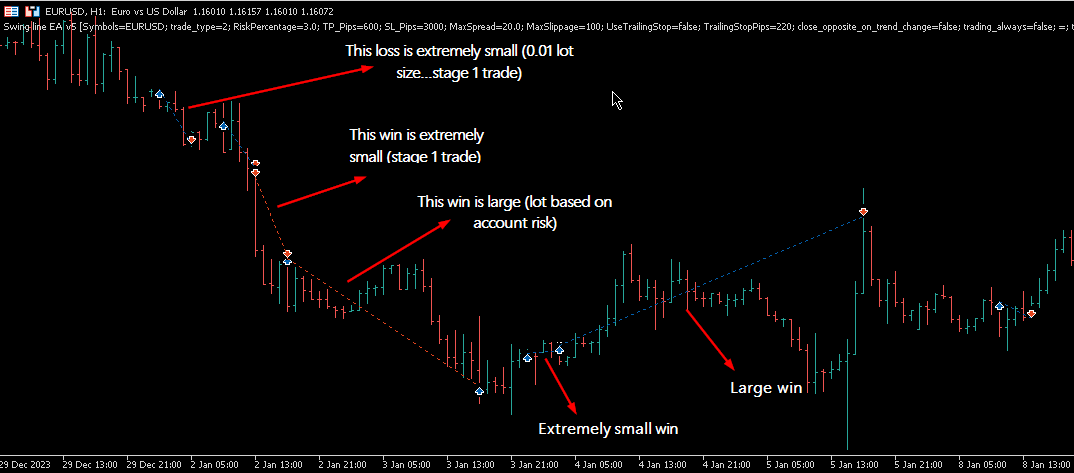

because of the fact that indicator signals can sometimes be false, I developed a concept where the quality of the signal is first tested by the EA with 0.01 micro lot size before it executes a normal sized position (based on a risk % of the account). The PnL of the 0.01 lot size trade is examined... if the position was profitable, it makes another trade with bigger volume, if the position was unprofitable, it could mean that the indicator signal was false. This proved to be good in backtest. Instead of performing surgery on a weak trade, this basically pinpoints bad entries and cancels them

Conor Mcnamara

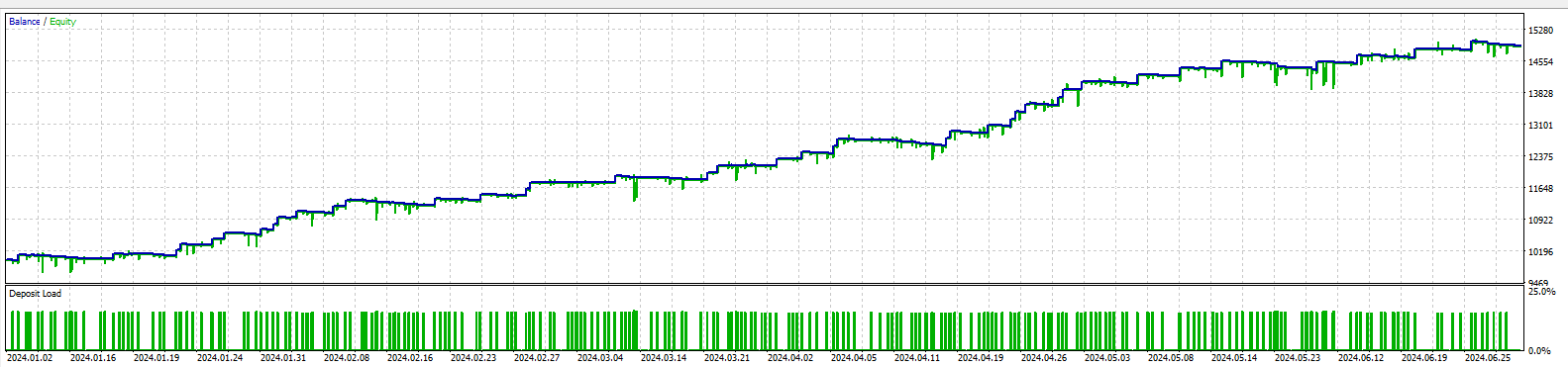

I automated Ron Blacks "Swing line" to do scalping on the H1 timeframe, and on backtest for 2024 it gave very impressive statistics when combined with ADX trend strength. But in 2025, the results are poor surprisingly. I wonder why that is

Rajesh Kumar Nait

2025.06.24

It should be like the hedge fund trading it in 2024 may have retired. The new player use new strategy

Conor Mcnamara

2025.06.24

maybe brokers are also using new tools which counter peoples trades, the landscape keeps changing

Conor Mcnamara

How do people think they published a safe and profitable EA when it doesn't use stop losses and allows equity drawdown to to continue over 50%? There isn't always a correction in markets so the money will be lost, and there will be a margin call. Shame on people purchasing pricey EAs from idiots

Conor Mcnamara

https://www.mql5.com/en/code/87 this is a clever and elegant indicator which measures volume pressure, it's a unique idea, it compares the live tick volume on each current bar to the average volume of the entire series and compares percentages of volume

Conor Mcnamara

I don't need to use AI for coding, but could you argue that if AI isn't helping you, then it is not a fault with AI but rather the fact that your prompt isn't reasonable enough? Maybe I'm way off I don't know

Rajesh Kumar Nait

2025.05.29

Yes prompt engineering is must to have also it's make errors even today but a programmer can understand and solve quickly but novice can't. So learning programming is also required to use AI in a better way

Rajesh Kumar Nait

2025.05.29

Thanks, Your code is good too. As a good programmer our goal should be to minimize coding, avoid redeclaring variables unless required and look for optimized way of coding. As a new programmer my first code which i wrote was 3500+ lines, after experience i rewrote that code in just 95 lines.

Conor Mcnamara

Published code Trendline zigzag in qualitative channel

A dynamic trendline-based evolution of the Donchian Channel

Share on social networks · 2

6539

750

Conor Mcnamara

shared product

Download it now and give it a try. Let me know if it is something that works for you. In the upcoming release, there can be an option to load your own moving average, or even another indicator. The beta is about highlighting the zigzag process itself and not the SMA which it takes information from. It should provide increased clarity with market structure compared to a bare moving average plot, as moving averages normally repaint up and down on the current unclosed bar. Using a backstep of 1 is more suitable for entry signals or automation, and using a higher backstep is more suited for wave analysis

MagZag ( Beta) — A Trend- Based Reinvention of the ZigZag MagZag is a complete remodel of the traditional ZigZag indicator, built on trend- based logic instead of reactive price confirmation. Unlike a traditional ZigZag that works off of price action and relies on future bars to confirm a swing, MagZag calculates new legs immediately — with no forward correction , no lag , and no repainting . Once a leg is drawn, it's final. MagZag includes parameters for deviation and backstep, but it

: