Yashar Seyyedin / Profile

- Information

|

3 years

experience

|

0

products

|

0

demo versions

|

|

369

jobs

|

0

signals

|

0

subscribers

|

MQL job link: https://www.mql5.com/en/job/new?prefered=yashar.seyyedin

You can also connect for full stack web application development at fiverr or upwork:

https://www.upwork.com/freelancers/~0169759d56a4a0dc91?mp_source=share

https://www.fiverr.com/s/ZmK18aj

You can claim 5% discount on all programs if it is your first time with The5ers.

Just follow this link: http://www.the5ers.com/?afmc=10mq

Connect directly via Telegram @YasharSeyyedin

You can also connect for full stack web application development at fiverr or upwork:

https://www.upwork.com/freelancers/~0169759d56a4a0dc91?mp_source=share

https://www.fiverr.com/s/ZmK18aj

You can claim 5% discount on all programs if it is your first time with The5ers.

Just follow this link: http://www.the5ers.com/?afmc=10mq

Connect directly via Telegram @YasharSeyyedin

Friends

440

Requests

Outgoing

Yashar Seyyedin

Left feedback to customer for job Updates on Existing Job

Thanks for the fair order.

| Specification quality | 5.0 | |

| Result check quality | 5.0 | |

| Availability and communication skills | 5.0 |

Yashar Seyyedin

Left feedback to customer for job MT5 EA Development Project

Thanks for the fair order.

| Specification quality | 5.0 | |

| Result check quality | 5.0 | |

| Availability and communication skills | 5.0 |

Yashar Seyyedin

Social networks, including LinkedIn, either give people a sense of over-importance or under-importance.

Yashar Seyyedin

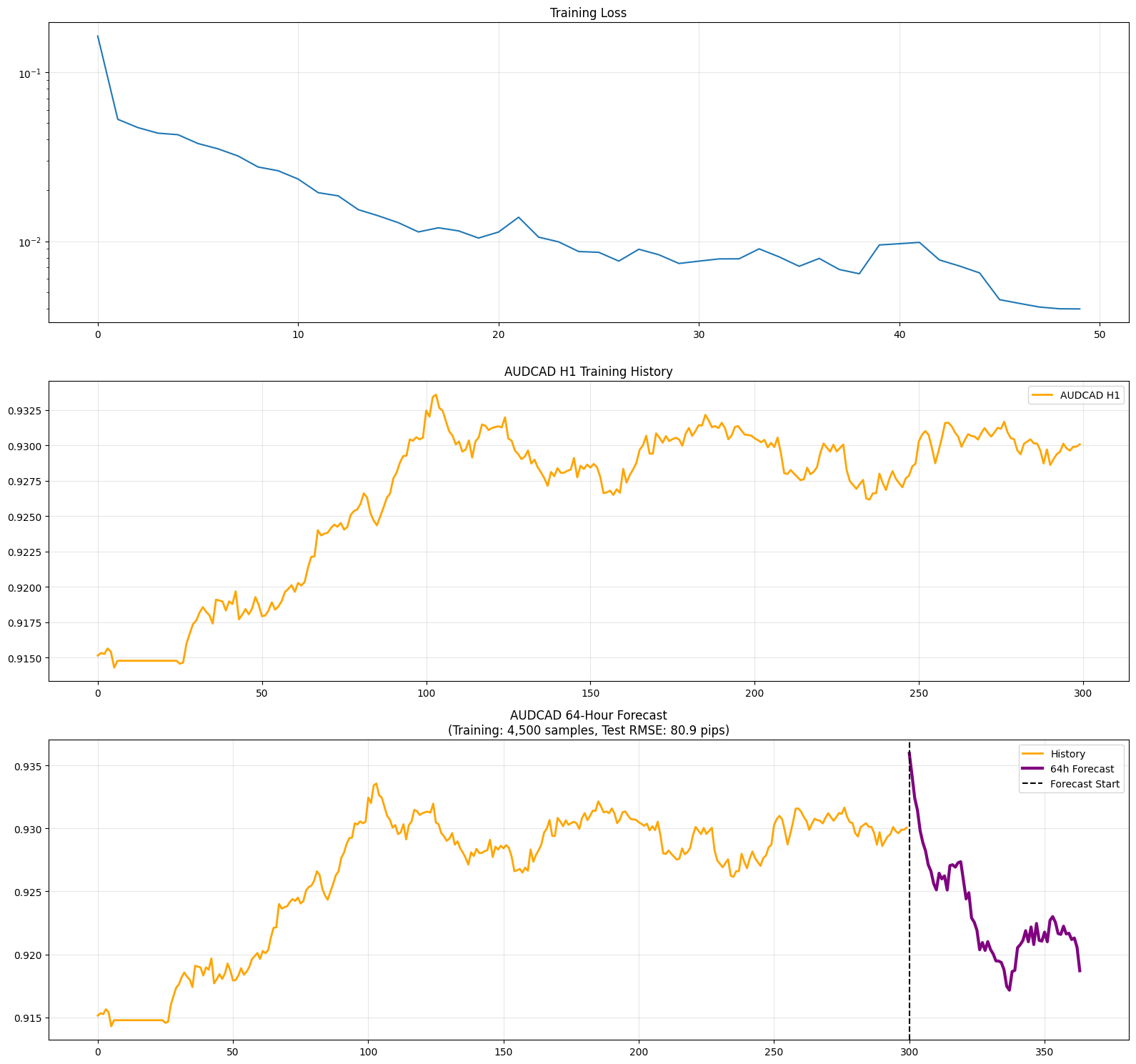

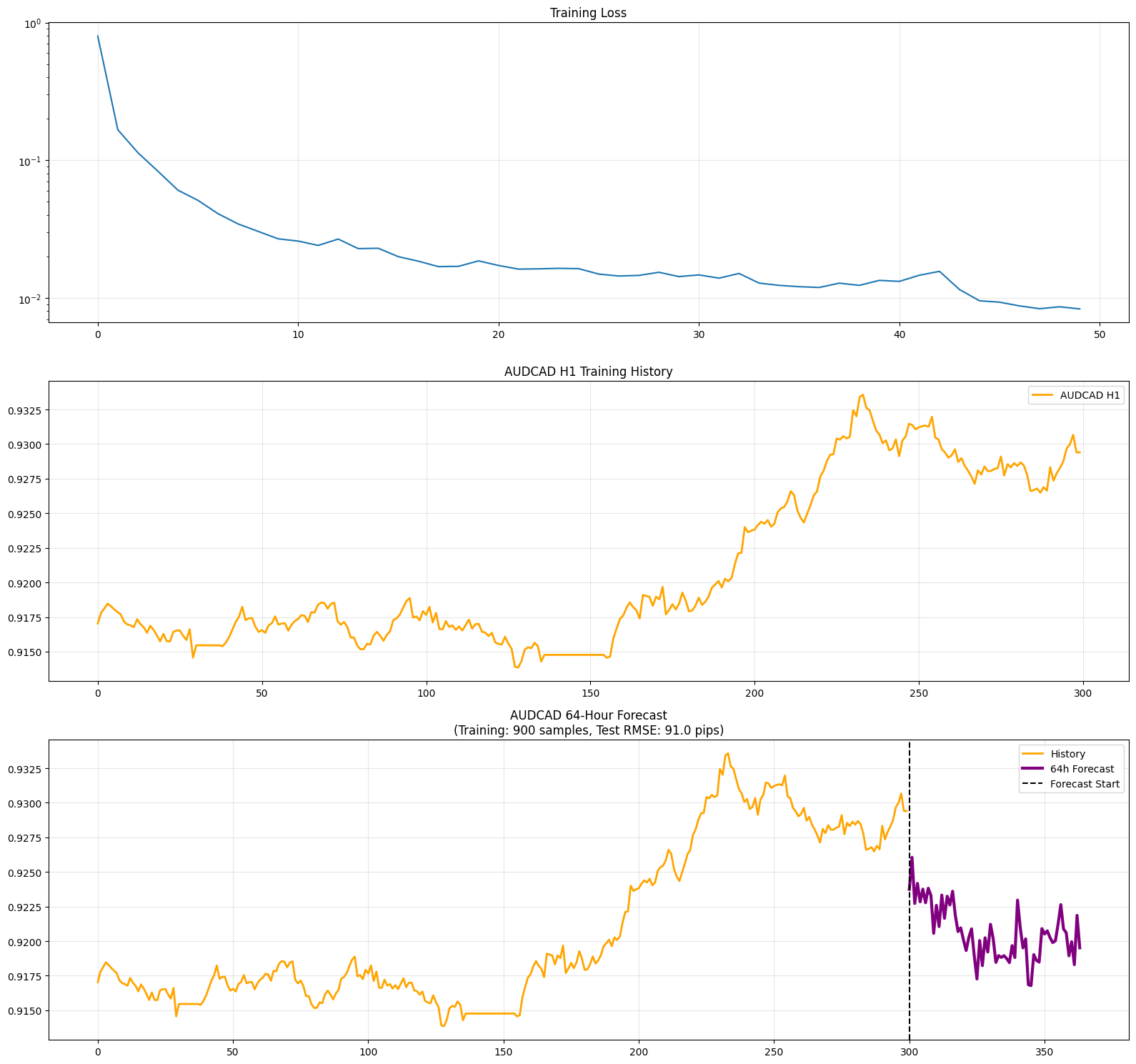

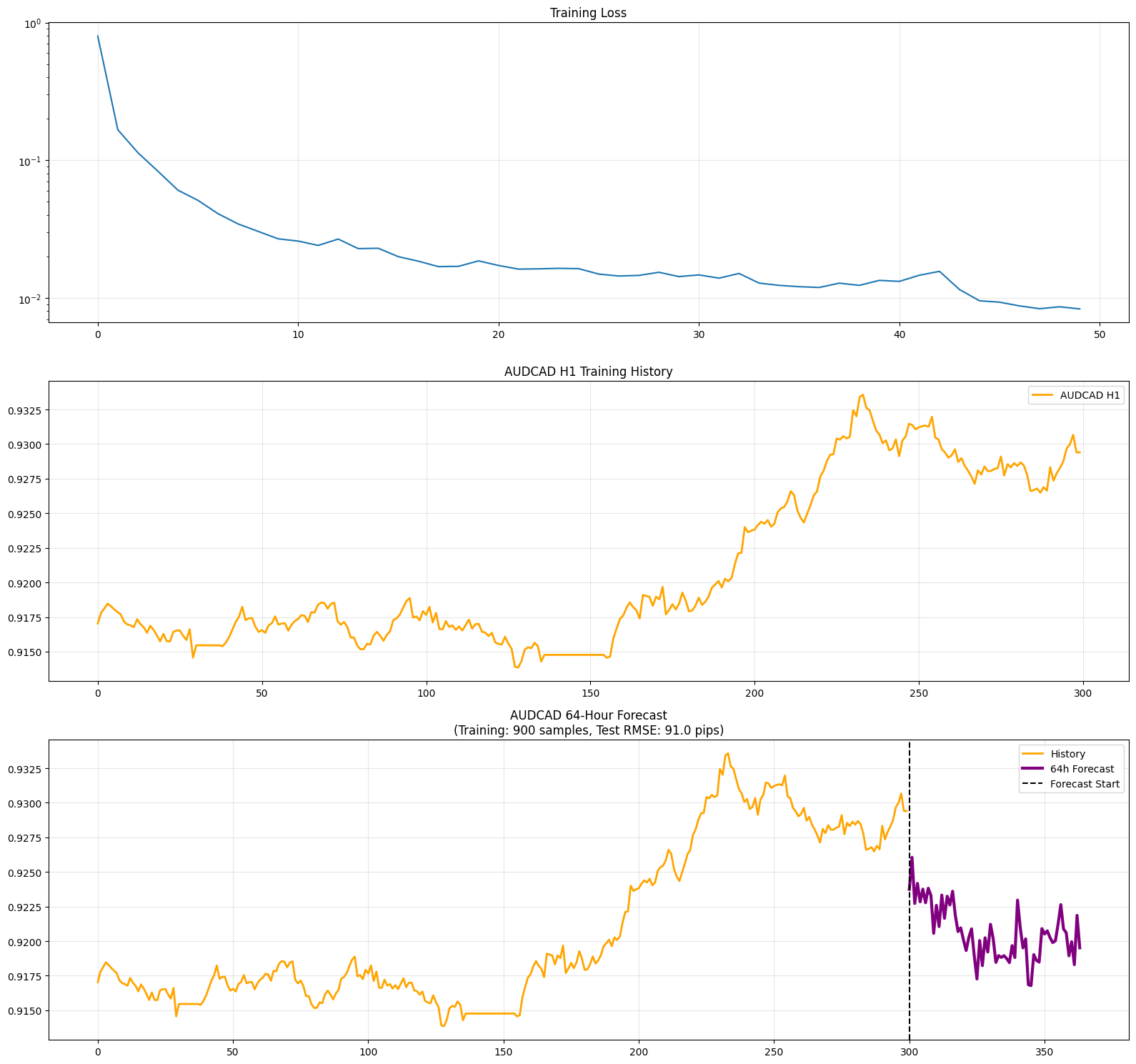

Sometimes AI prediction match well into traders' intuition and prediction. That should make things better.

Yashar Seyyedin

https://github.com/amazon-science/chronos-forecasting

Checkout this... easy to use pretrained forecast model for financial charts. I do not think you can create any better model with your available computational power and your knowledge.

Checkout this... easy to use pretrained forecast model for financial charts. I do not think you can create any better model with your available computational power and your knowledge.

Yashar Seyyedin

When you buy a car, you know that it is going to get you from one point to another. Although you may be a little satisfied or dissatisfied with its performance. When it comes to trading robots, 99% of buyers have a completely opposite perception of reality. Isn't this enough reason to give up selling EAs?

Yashar Seyyedin

Left feedback to customer for job Update Existing EA

Thanks for the fair order.

| Specification quality | 5.0 | |

| Result check quality | 5.0 | |

| Availability and communication skills | 5.0 |

Yashar Seyyedin

Why I Prefer Manual Trading

Having a busy schedule, not having enough time to trade, or psychological problems do not seem to be good excuses for preferring algorithmic trading to manual trading. The most important factor for me to prefer algorithmic trading is knowing that I can achieve better returns compared to the risk and effort I put in. ]n this post I want to explain what the minimum requirements are for using a trading robot in the financial market and in final section I will be discussing some pathologic points.

Warning: For those who have been following me for a while, you must have noticed by now that I only do my research on forex pairs and my statements do not apply to stock indices, gold, and other assets. Also note that we are talking about algorithmic trading here, not a trading algorithm... meaning that a computer decides to make a trade of a certain size, not a human. Even though in both cases there is a specific algorithm, human behavior can analyze more and more complex factors than a conventional trading robot written by an average MQL programmer.

Assessing robot performance:

1. For me to have the courage to put my personal capital at the disposal of a trading robot, I must have seen its behavior in a 1000-trade backtest for a trading system with 3 indicators (and probably the same number of optimization parameters - please don't say I might not optimize because the person who first created the indicators also optimized them) The curve should show a consistent and good behavior. The more parameters and indicators, the more trades in the backtest should be, because there is risk of overfitting with a large number of parameters.

2. Another way is to use a version of k-fold cross validation that ensures that the train and test data are in correct and timed manner. This version is known among algorithmic traders as forward testing, but to get reliable results, we must have at least 200 trades per iteration, and the number of iterations must be at least ten to get a reliable mean and standard deviation of the validation scores.

The pathology of algorithmic traders

Since algorithmic traders are much fewer in number than manual traders, and since they are much less transparent than manual traders (i.e. they don't reveal what they are doing), I have to guess at some points. By studying the algorithms commonly used in algorithmic trading and examining the performance and claims of algorithmic traders, I came to some conclusions that you may find interesting.

First, most people are not capable of getting a passing score on even one of the two tests above. However, financial markets are too complex to consistently produce consistent returns using an algorithm (even if it is optimized over time). This causes people to reduce reliable tests to simpler versions in order to pretend they are in the business. For example, in test number one, they will do 500 trades instead of 1000 trades. They may justify the bot’s failure in test number two by saying that it was due to certain external factors, such as the decisions of a certain politician or central bank, and think to themselves that it is okay. The bot is probably reliable despite its poor performance over a specific period of time. I have seen people doing k-fold validation with k=3 which is pretty optimistic.

The misleading factor of prop companies even encourages algorithmic trading to this approach because these companies benefit from risky and unreliable methods rather than from the consistent and predictable success of traders. Therefore, many of these algorithmic traders enter this business relying on simplified tests and shout about their success on social networks. Of course, there seems to be a hidden (perhaps even an open) contract between the trader and the prop company in these cases.

Having a busy schedule, not having enough time to trade, or psychological problems do not seem to be good excuses for preferring algorithmic trading to manual trading. The most important factor for me to prefer algorithmic trading is knowing that I can achieve better returns compared to the risk and effort I put in. ]n this post I want to explain what the minimum requirements are for using a trading robot in the financial market and in final section I will be discussing some pathologic points.

Warning: For those who have been following me for a while, you must have noticed by now that I only do my research on forex pairs and my statements do not apply to stock indices, gold, and other assets. Also note that we are talking about algorithmic trading here, not a trading algorithm... meaning that a computer decides to make a trade of a certain size, not a human. Even though in both cases there is a specific algorithm, human behavior can analyze more and more complex factors than a conventional trading robot written by an average MQL programmer.

Assessing robot performance:

1. For me to have the courage to put my personal capital at the disposal of a trading robot, I must have seen its behavior in a 1000-trade backtest for a trading system with 3 indicators (and probably the same number of optimization parameters - please don't say I might not optimize because the person who first created the indicators also optimized them) The curve should show a consistent and good behavior. The more parameters and indicators, the more trades in the backtest should be, because there is risk of overfitting with a large number of parameters.

2. Another way is to use a version of k-fold cross validation that ensures that the train and test data are in correct and timed manner. This version is known among algorithmic traders as forward testing, but to get reliable results, we must have at least 200 trades per iteration, and the number of iterations must be at least ten to get a reliable mean and standard deviation of the validation scores.

The pathology of algorithmic traders

Since algorithmic traders are much fewer in number than manual traders, and since they are much less transparent than manual traders (i.e. they don't reveal what they are doing), I have to guess at some points. By studying the algorithms commonly used in algorithmic trading and examining the performance and claims of algorithmic traders, I came to some conclusions that you may find interesting.

First, most people are not capable of getting a passing score on even one of the two tests above. However, financial markets are too complex to consistently produce consistent returns using an algorithm (even if it is optimized over time). This causes people to reduce reliable tests to simpler versions in order to pretend they are in the business. For example, in test number one, they will do 500 trades instead of 1000 trades. They may justify the bot’s failure in test number two by saying that it was due to certain external factors, such as the decisions of a certain politician or central bank, and think to themselves that it is okay. The bot is probably reliable despite its poor performance over a specific period of time. I have seen people doing k-fold validation with k=3 which is pretty optimistic.

The misleading factor of prop companies even encourages algorithmic trading to this approach because these companies benefit from risky and unreliable methods rather than from the consistent and predictable success of traders. Therefore, many of these algorithmic traders enter this business relying on simplified tests and shout about their success on social networks. Of course, there seems to be a hidden (perhaps even an open) contract between the trader and the prop company in these cases.

Yashar Seyyedin

People who are interested in trading, despite all the motivations such as financial freedom, not having a boss, not having commitments, and getting rid of a full-time job, actually have only one motivation: to get rich. I think this is the story of all of us.

In fact, the process of learning to trade can be summarized as realizing that the return on trading is no higher than the return on most funds in bank and stocks, and that the return on trading is not even higher than long-term investments in physical assets such as gold and real estate. Trading is just a way of diversifying in managing financial resources, and that's it.

Are you one of those people who prefer to back down when you realize that getting rich in this field, like getting rich in other money-making fields, takes time and effort?

In fact, the process of learning to trade can be summarized as realizing that the return on trading is no higher than the return on most funds in bank and stocks, and that the return on trading is not even higher than long-term investments in physical assets such as gold and real estate. Trading is just a way of diversifying in managing financial resources, and that's it.

Are you one of those people who prefer to back down when you realize that getting rich in this field, like getting rich in other money-making fields, takes time and effort?

Yashar Seyyedin

I do not really know what market structure is but I know when that low is taken you can find short entries. Clever ones of course.

Yashar Seyyedin

Tron's black hole address receives burned TRX from transaction fees and protocol mechanisms. This used to be banks'.

Yashar Seyyedin

History has shown that the safe sectors of the economy consist of two groups: first, business owners who were owners from the beginning, not true entrepreneurs. Second, salaried workers and government contractors who are generally in their positions through family ties.

If you are a skilled worker and are not in the above two groups, you have very little chance. Don't try too much. Your effort has no effect on the outcome.

If you are a skilled worker and are not in the above two groups, you have very little chance. Don't try too much. Your effort has no effect on the outcome.

Yashar Seyyedin

Today, both the Philly Fed and inflation data were bad enough for USD to fall, but this did not happen. Reading the news alone without knowing how much has been already priced seems difficult. Especially for those of us who are used to charts and spend less time studying macroeconomics and microeconomics. So how do we know?

In my opinion, a simple way is to monitor the price movements for a few months and analyze the reaction to the news. For example, the EUR/USD pair rose from the FOMC meeting in October into November/December. That was expected, while almost everyone knew that the rate was going to be cut, so further growth after the December meeting(last week) should not have been expected, while surprisingly the dollar fell slightly even afterwards. Now perhaps it is possible to understand why today's bad data (inflation and Philly Fed) practically did not lead to further decline in the dollar and the dollar is likely to grow in the coming days.

In my opinion, a simple way is to monitor the price movements for a few months and analyze the reaction to the news. For example, the EUR/USD pair rose from the FOMC meeting in October into November/December. That was expected, while almost everyone knew that the rate was going to be cut, so further growth after the December meeting(last week) should not have been expected, while surprisingly the dollar fell slightly even afterwards. Now perhaps it is possible to understand why today's bad data (inflation and Philly Fed) practically did not lead to further decline in the dollar and the dollar is likely to grow in the coming days.

Show all comments (7)

Yashar Seyyedin

2025.12.19

The fact that institutions control the market does not mean that the market is chaotic, and the fact that the market is not chaotic does not mean that the decision to buy or sell is simple... In my opinion, to deal with institutions is to not try to identify the exact points of price reversal. Even if we do manage to identify it in one case, we should not hope for it.

Conor Mcnamara

2025.12.19

I agree that we can't hope for the reversal or pivot, that's why I don't trust limit orders placed far away from the current tick price anymore. My approach is to "test" the reversal when I think the pivot is strong, and I'm prepared to try and close it in a small loss or breakeven if the price suddenly diverges against my trade

Yashar Seyyedin

Left feedback to customer for job Updates on Existing Job

Thanks for the fair order.

| Specification quality | 5.0 | |

| Result check quality | 5.0 | |

| Availability and communication skills | 5.0 |

Yashar Seyyedin

Hey everyone! Check out this AI generated code I have done for detecting decoupling pairs... https://github.com/yasharseyyedin-a11y/FX_Correlations_Check

The script compares recent 1-day correlations against 10-day rolling correlations (longer-term baseline). When short-term correlations fade or reverse from the 10-day norm it signals mean reversion opportunities, choppy markets ending, or trend shifts. This "fading correlation" edge spots when pairs diverge temporarily, offering entries before they snap back.

The script compares recent 1-day correlations against 10-day rolling correlations (longer-term baseline). When short-term correlations fade or reverse from the 10-day norm it signals mean reversion opportunities, choppy markets ending, or trend shifts. This "fading correlation" edge spots when pairs diverge temporarily, offering entries before they snap back.

Yashar Seyyedin

I was hoping that implementing neural networks in MetaTrader would at least give me more options for evaluation. After all, our problem is maximizing profit, not maximizing an imaginary parameter... In the current situation, Python is definitely a better option for training.

Yashar Seyyedin

One advantage of testing with normal strategies on MetaTrader is when you get a good result you have some idea to capture why it is performing good and reject problematic backtests. This will not work with ML-driven solutions... Everything is a blackbox. All you can do is trust it is splitting data correctly during cross validation and hopefully it is not ovefit. Am I right? Does anyone has an idea?

: