Mohammadmahdi Sanei / Profile

- Information

|

3 years

experience

|

4

products

|

1069

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

Programmer

at

ICT Capital Co.

Coding and programming have been my primary professional activities for the previous five years. Since I became acquainted with MQL5 and trading robots, a new vista has opened up for me.

Over the last two years, I've tested various trading methods and spent a lot of time and effort building them into a lucrative Trading Bot.

My major area of expertise is in AI and machine learning algorithms for predicting time series, particularly financial markets.

Over the last two years, I've tested various trading methods and spent a lot of time and effort building them into a lucrative Trading Bot.

My major area of expertise is in AI and machine learning algorithms for predicting time series, particularly financial markets.

Friends

246

Requests

Outgoing

Mohammadmahdi Sanei

⭐️ Once in life time discount for the Zenith Zone EA only 35$ ⭐️

Only a few number of purchases are available

⚠️ Zenith Zone MT5 EA published in the market ⚠️

https://www.mql5.com/en/market/product/112044

⚠️ Zenith Zone MT4 EA published in the market ⚠️

https://www.mql5.com/en/market/product/112046

Only a few number of purchases are available

⚠️ Zenith Zone MT5 EA published in the market ⚠️

https://www.mql5.com/en/market/product/112044

⚠️ Zenith Zone MT4 EA published in the market ⚠️

https://www.mql5.com/en/market/product/112046

Mohammadmahdi Sanei

As you requested for the next 24 hours I will extend the 50 % discount. So you can buy it for 79$, after 24 hours discount will end.

Best regards

⚠️ Zenith Zone MT5 EA published in the market ⚠️

https://www.mql5.com/en/market/product/112044

⚠️ Zenith Zone MT4 EA published in the market ⚠️

https://www.mql5.com/en/market/product/112046

Best regards

⚠️ Zenith Zone MT5 EA published in the market ⚠️

https://www.mql5.com/en/market/product/112044

⚠️ Zenith Zone MT4 EA published in the market ⚠️

https://www.mql5.com/en/market/product/112046

Mohammadmahdi Sanei

Dear MQL5 Community, Zenith Zone EA Inputs and Backtest Tutorial: https://www.mql5.com/en/blogs/post/755971/ I am thrilled to present my latest creation, the Zenith Zone Bot - a recently developed multi-currency expert advisor that embodies a revolutionary trading strategy...

Share on social networks · 1

354

Mohammadmahdi Sanei

⭐️⭐️⭐️ Input description and back-tests tutorial ⭐️⭐️⭐️ **Live Trading Signal** Contact me directly or Click Here Backtest setting: If you want to backtest use the following setting, TimeFrame = H1, Symbol = GBPAUD Inputs of the EA: Symbols 1...

Share on social networks · 1

433

Mohammadmahdi Sanei

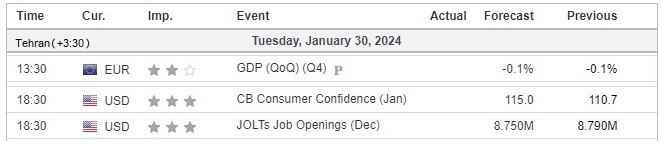

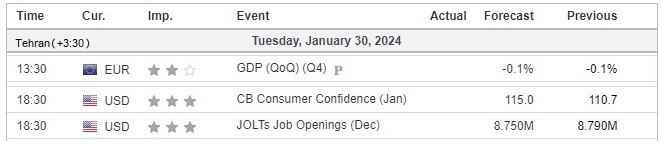

Economic Calendar, January 30, 2024

⭐️⭐️ Eurozone Gross Domestic Product (GDP) 🇪🇺

The most important data we have for the Euro is Gross Domestic Product, and based on the available data, there is a possibility that it will be released similar to the previous figure of 0.1.

⭐️⭐️⭐️ US Consumer Confidence 🇺🇸

This data measures the level of consumer confidence in economic activities, and considering the data from the past three months, which have been higher than the previous figure, it is expected that this time it will also be higher than the previous figure, having a positive impact on the US Dollar.

⭐️⭐️⭐️ US Job Openings 🇺🇸

Another important data for the US Dollar is job opportunities, and this data reports the number of job openings throughout the month, excluding the agricultural industry. There is a possibility that the data will be lower than the previous figure, having a negative impact on the US Dollar.

#News #Forex

⭐️⭐️ Eurozone Gross Domestic Product (GDP) 🇪🇺

The most important data we have for the Euro is Gross Domestic Product, and based on the available data, there is a possibility that it will be released similar to the previous figure of 0.1.

⭐️⭐️⭐️ US Consumer Confidence 🇺🇸

This data measures the level of consumer confidence in economic activities, and considering the data from the past three months, which have been higher than the previous figure, it is expected that this time it will also be higher than the previous figure, having a positive impact on the US Dollar.

⭐️⭐️⭐️ US Job Openings 🇺🇸

Another important data for the US Dollar is job opportunities, and this data reports the number of job openings throughout the month, excluding the agricultural industry. There is a possibility that the data will be lower than the previous figure, having a negative impact on the US Dollar.

#News #Forex

Mohammadmahdi Sanei

⚠️Zenith Zone Bot will be ready for the MQL market soon⚠️

Monday, 29 Jan 2024

Follow my MQL5 channel in case of buying new trading robots at he LOWEST Price and with 50% discount:

https://www.mql5.com/en/channels/fusion_forex_insights

Monday, 29 Jan 2024

Follow my MQL5 channel in case of buying new trading robots at he LOWEST Price and with 50% discount:

https://www.mql5.com/en/channels/fusion_forex_insights

Mohammadmahdi Sanei

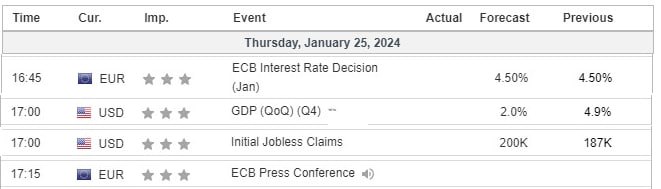

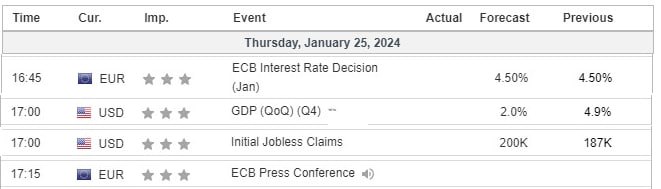

📅 **Economic Calendar - January 25, 2024**

⭐️⭐️⭐️ **Eurozone Interest Rate Decision**

- ECB Interest Rate Decision (Jan) 🇪🇺

The most important data for the Euro tomorrow is the interest rate decision. Given the existing data, there is a possibility that it will be released at the same rate as the previous figure, which is 4.50.

⭐️⭐️⭐️ **U.S. Gross Domestic Product (GDP)**

- GDP (QoQ) (Q4) 🇺🇸

For the U.S. dollar, we also have the Gross Domestic Product, which is the most important measure of economic activity and the primary indicator of overall economic health. There is a possibility that it will be lower than the previous figure, which could weaken the dollar.

⭐️⭐️⭐️ **U.S. Initial Jobless Claims**

- Initial Jobless Claims 🇺🇸

Another important data for the U.S. is the initial jobless claims. Given the statistics published in recent weeks, it is expected to be lower than the previous figure, which could be in favor of the dollar.

📌 Tomorrow, we also have a press conference by the European Central Bank (ECB), where clues about future monetary policies and the overall economic outlook, including inflation, will be discussed.

#News #Forex

⭐️⭐️⭐️ **Eurozone Interest Rate Decision**

- ECB Interest Rate Decision (Jan) 🇪🇺

The most important data for the Euro tomorrow is the interest rate decision. Given the existing data, there is a possibility that it will be released at the same rate as the previous figure, which is 4.50.

⭐️⭐️⭐️ **U.S. Gross Domestic Product (GDP)**

- GDP (QoQ) (Q4) 🇺🇸

For the U.S. dollar, we also have the Gross Domestic Product, which is the most important measure of economic activity and the primary indicator of overall economic health. There is a possibility that it will be lower than the previous figure, which could weaken the dollar.

⭐️⭐️⭐️ **U.S. Initial Jobless Claims**

- Initial Jobless Claims 🇺🇸

Another important data for the U.S. is the initial jobless claims. Given the statistics published in recent weeks, it is expected to be lower than the previous figure, which could be in favor of the dollar.

📌 Tomorrow, we also have a press conference by the European Central Bank (ECB), where clues about future monetary policies and the overall economic outlook, including inflation, will be discussed.

#News #Forex

Mohammadmahdi Sanei

🔘 **Key Technical Points for Gold Ounce - January 24, 2024!**

🔸 2039

🔸 2030

▪️ 2024

🔹 2020

🔹 2010

🔹 2003

✍🏻 Still, the most crucial daily resistance for the gold ounce is the range of $2030. If it consolidates below the $2020 range, it may act as a scenario for analytical consideration.

(🔸 Resistance 🔹 Support ▪️ Current Price)

#GOLD

🔸 2039

🔸 2030

▪️ 2024

🔹 2020

🔹 2010

🔹 2003

✍🏻 Still, the most crucial daily resistance for the gold ounce is the range of $2030. If it consolidates below the $2020 range, it may act as a scenario for analytical consideration.

(🔸 Resistance 🔹 Support ▪️ Current Price)

#GOLD

Mohammadmahdi Sanei

🔘 **Key Technical Points for Gold Ounce - January 23, 2024!**

🔸 2039

🔸 2030

▪️ 2027

🔹 2020

🔹 2015

🔹 2007

✍🏻 The most important daily resistance for gold ounce is in the range of $2030. However, as long as it stays around $2020, it can still test resistances. Gold ounce is currently in a range, and it seems that market participants do not see justification for entering it for higher growth at the current price.

(🔸 Resistance 🔹 Support ▪️ Current Price)

#GOLD

🔸 2039

🔸 2030

▪️ 2027

🔹 2020

🔹 2015

🔹 2007

✍🏻 The most important daily resistance for gold ounce is in the range of $2030. However, as long as it stays around $2020, it can still test resistances. Gold ounce is currently in a range, and it seems that market participants do not see justification for entering it for higher growth at the current price.

(🔸 Resistance 🔹 Support ▪️ Current Price)

#GOLD

Mohammadmahdi Sanei

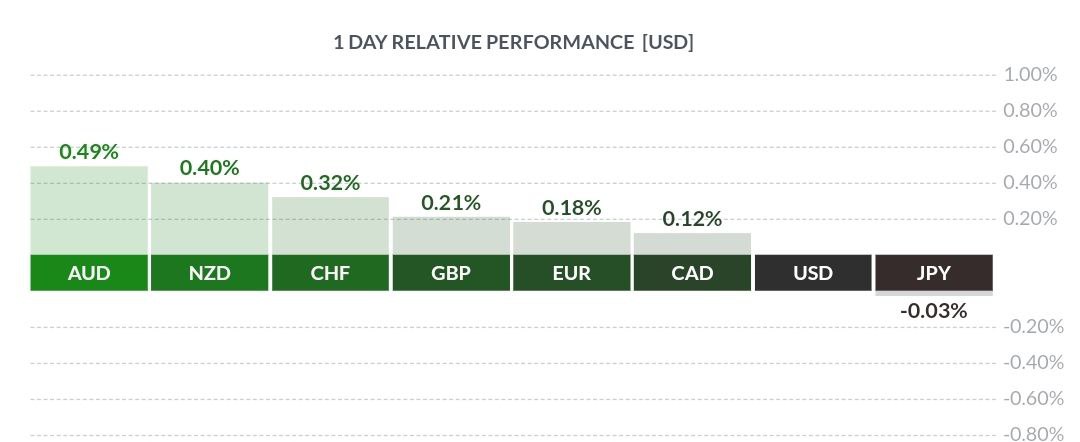

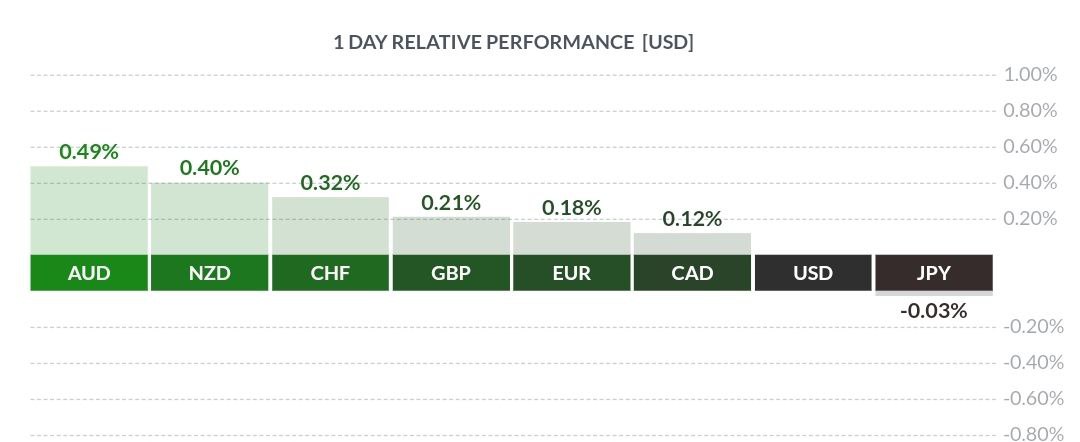

❇️ **Currency Status as of Now in the Market!**

🔹 The price of gold increased on Tuesday, accompanied by a slight decrease in the US dollar, as traders acted cautiously ahead of the potential decline in key economic indicators in the United States this week.

🔸 Strongest currency: Australian Dollar

🔸 Weakest currency: Japanese Yen

#Market

🔹 The price of gold increased on Tuesday, accompanied by a slight decrease in the US dollar, as traders acted cautiously ahead of the potential decline in key economic indicators in the United States this week.

🔸 Strongest currency: Australian Dollar

🔸 Weakest currency: Japanese Yen

#Market

Mohammadmahdi Sanei

🔘 **Key Technical Points for Gold on January 22, 2024!**

🔸2038

🔸2029

▪️2021

🔹2010

🔹2000

✍🏻 Tuesday is relatively quiet on the calendar, and gold may exhibit range-bound movements within resistance and support levels. Intraday resistances and supports for gold are specified. The most important resistance today is in the range of 2030, and the first support is in the range of 2020.

(🔸Resistance 🔹Support ▪️Current Price)

#GOLD

🔸2038

🔸2029

▪️2021

🔹2010

🔹2000

✍🏻 Tuesday is relatively quiet on the calendar, and gold may exhibit range-bound movements within resistance and support levels. Intraday resistances and supports for gold are specified. The most important resistance today is in the range of 2030, and the first support is in the range of 2020.

(🔸Resistance 🔹Support ▪️Current Price)

#GOLD

Mohammadmahdi Sanei

Trading Strategy that Can Pass PropFirm Challenges Successfuly

20 January 2024, 07:39

Hello, traders! In this post, I want to share with you a trading strategy that I have developed recently and have great potential for traders who want to pass PropForms challenges and trade funded account of trading PropFirms like FTMO and FundedNext...

Share on social networks · 2

433

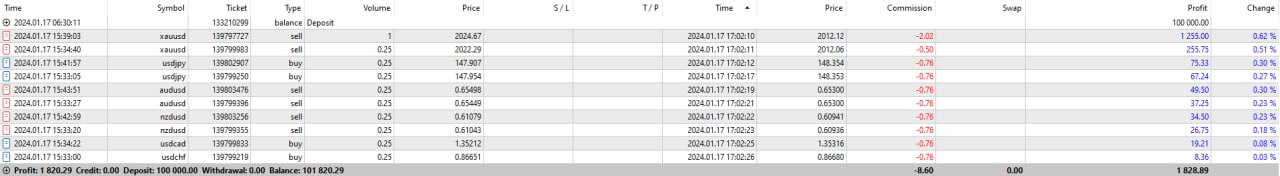

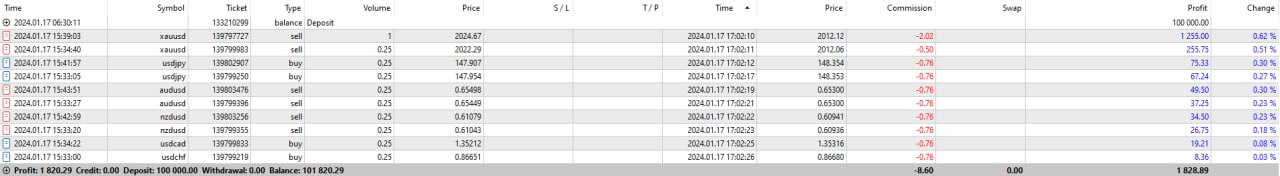

Mohammadmahdi Sanei

Hello Dear traders, the overall analysis for today resulted in a fascinating trade on USD pairs and GOLD. Combination of fundamental and technical analysis makes such results as above.

Follow my MQL5 channel for daily market analysis, signals and trading robots:

https://www.mql5.com/en/channels/fusion_forex_insights

Follow my MQL5 channel for daily market analysis, signals and trading robots:

https://www.mql5.com/en/channels/fusion_forex_insights

Mohammadmahdi Sanei

Hello Dear Traders;

Market Forecast for London Session 17 Jan 2024, Signals are based on High Probability and Wining Rate.

1. GOLD, Strong Sell Potential

2. AUD/USD, Strong Sell Potential

3. NZD/USD, Strong Sell Potential

4. GBP/AUD, Strong Buy Potential (due to GBP CPI news of today)

5. GBP/JPY, Strong Buy Potential (due to GBP CPI news of today)

Trading involves a possibility of losing money therefore all decisions in market speculation are undertaken at your own financial risk.

Follow my MQL5 channel for daily market analysis, signals and trading robots:

https://www.mql5.com/en/channels/fusion_forex_insights

Market Forecast for London Session 17 Jan 2024, Signals are based on High Probability and Wining Rate.

1. GOLD, Strong Sell Potential

2. AUD/USD, Strong Sell Potential

3. NZD/USD, Strong Sell Potential

4. GBP/AUD, Strong Buy Potential (due to GBP CPI news of today)

5. GBP/JPY, Strong Buy Potential (due to GBP CPI news of today)

Trading involves a possibility of losing money therefore all decisions in market speculation are undertaken at your own financial risk.

Follow my MQL5 channel for daily market analysis, signals and trading robots:

https://www.mql5.com/en/channels/fusion_forex_insights

Mohammadmahdi Sanei

Market Forecast for London Session 16 Jan 2024, Signals are based on High Probability and Wining Rate.

1. XAU/AUD: Strong Buy Potential

2. AUD/USD: Strong Sell Potential

3. NZDUSD: Strong Sell Potential

Trading involves a possibility of losing money therefore all decisions in market speculation are undertaken at your own financial risk.

Follow my MQL5 channel for daily market analysis, signals and trading robots:

https://www.mql5.com/en/channels/fusion_forex_insights

1. XAU/AUD: Strong Buy Potential

2. AUD/USD: Strong Sell Potential

3. NZDUSD: Strong Sell Potential

Trading involves a possibility of losing money therefore all decisions in market speculation are undertaken at your own financial risk.

Follow my MQL5 channel for daily market analysis, signals and trading robots:

https://www.mql5.com/en/channels/fusion_forex_insights

Mohammadmahdi Sanei

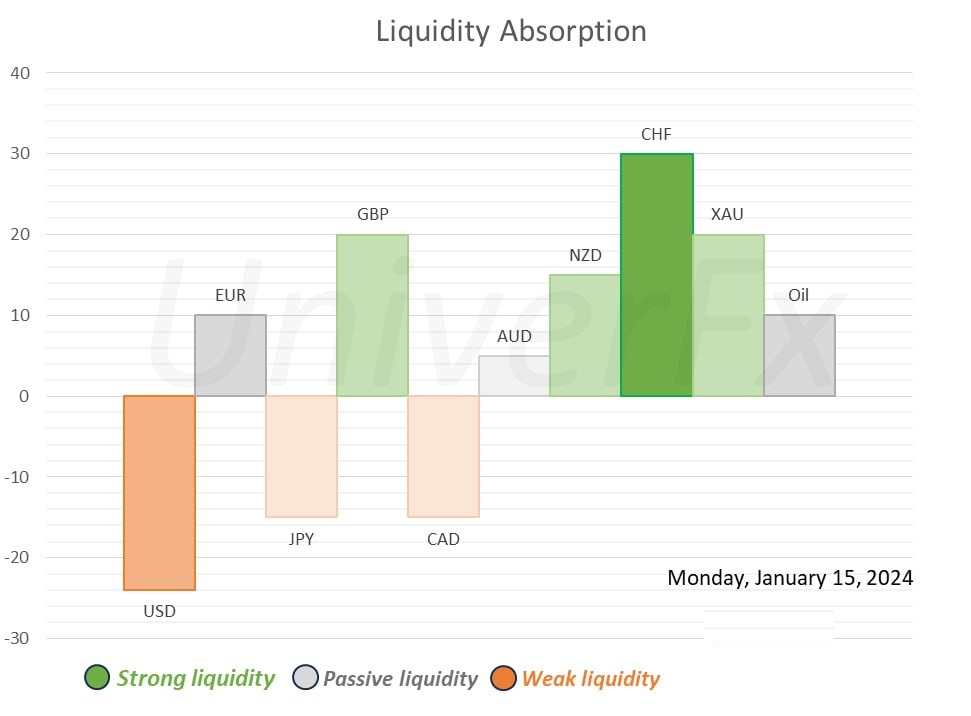

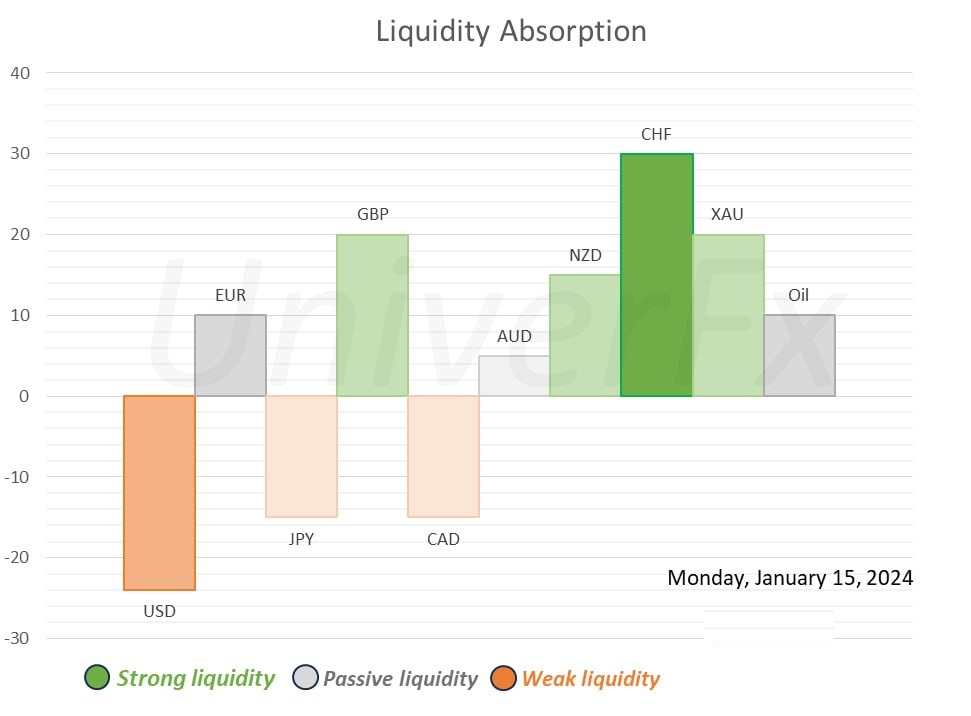

📊 **Liquidity Absorption Chart**

🔹 **Liquidity Absorption Potential (Major Currencies, Gold, and Oil) - January 15, 2024**

🔹 The larger the number on the chart, the more indicative it is of the potential for the respective currency (considering all fundamental and prevailing sentiment factors) to attract liquidity and grow for the day (and vice versa).

🔹 Given that price changes in the market often move towards price equilibrium based on unfolding events, it's crucial to compare the daily changes on the chart with the preceding days.

🔸 A number on the chart exceeding 25 indicates the potential for upward liquidity absorption and growth.

🔸 A number within the range (25-10) suggests weak upward liquidity absorption and growth, and similarly for negative ranges.

✍🏻 Pay closer attention to changes in the liquidity absorption chart compared to previous days. These changes are what drive movements in the market. The market, at every moment, aims to achieve a new equilibrium based on the unfolding events.

#Liquidity #MarketAnalysis

🔹 **Liquidity Absorption Potential (Major Currencies, Gold, and Oil) - January 15, 2024**

🔹 The larger the number on the chart, the more indicative it is of the potential for the respective currency (considering all fundamental and prevailing sentiment factors) to attract liquidity and grow for the day (and vice versa).

🔹 Given that price changes in the market often move towards price equilibrium based on unfolding events, it's crucial to compare the daily changes on the chart with the preceding days.

🔸 A number on the chart exceeding 25 indicates the potential for upward liquidity absorption and growth.

🔸 A number within the range (25-10) suggests weak upward liquidity absorption and growth, and similarly for negative ranges.

✍🏻 Pay closer attention to changes in the liquidity absorption chart compared to previous days. These changes are what drive movements in the market. The market, at every moment, aims to achieve a new equilibrium based on the unfolding events.

#Liquidity #MarketAnalysis

Mohammadmahdi Sanei

📈 Key Technical Points for Gold - January 15, 2024

🔸 **Resistance:**

- $2085

- $2072

- $2065

▪️ **Support:**

- $2056

🔹 **Intraday Perspective:**

- $2046

- $2040

- $2030

✍🏻 Today, Monday, marks the first trading day of the week, and with several U.S. states observing a holiday, there is less liquidity in the market. Considering geopolitical issues, gold is maintaining its upward guard, and within suitable support ranges, one might consider a buy position for gold. It's essential to note that gold is currently situated in high-risk trading ranges, both from a buying and selling perspective.

(🔸Resistance 🔹Support ▪️Current Price)

#GOLD

🔸 **Resistance:**

- $2085

- $2072

- $2065

▪️ **Support:**

- $2056

🔹 **Intraday Perspective:**

- $2046

- $2040

- $2030

✍🏻 Today, Monday, marks the first trading day of the week, and with several U.S. states observing a holiday, there is less liquidity in the market. Considering geopolitical issues, gold is maintaining its upward guard, and within suitable support ranges, one might consider a buy position for gold. It's essential to note that gold is currently situated in high-risk trading ranges, both from a buying and selling perspective.

(🔸Resistance 🔹Support ▪️Current Price)

#GOLD

Mohammadmahdi Sanei

🔘 **Cash Absorption Chart**

🔹 **Potential Cash Absorption (Major Currencies, Gold, and Oil) - January 10, 2024**

🔹 The larger the number on the chart, the greater the capacity of the respective currency (considering all fundamental and sentiment factors) to absorb cash and grow for the day (and vice versa).

🔹 Given that price changes in the market often move towards price equilibrium based on events that occur, one crucial aspect of this chart is comparing its daily changes with its previous days.

🔸 A chart number above 25 indicates potential absorption and upward growth.

🔸 A chart number in the range of (25-10) indicates weak potential absorption and upward growth, and conversely for negative ranges.

🔹 **Potential Cash Absorption (Major Currencies, Gold, and Oil) - January 10, 2024**

🔹 The larger the number on the chart, the greater the capacity of the respective currency (considering all fundamental and sentiment factors) to absorb cash and grow for the day (and vice versa).

🔹 Given that price changes in the market often move towards price equilibrium based on events that occur, one crucial aspect of this chart is comparing its daily changes with its previous days.

🔸 A chart number above 25 indicates potential absorption and upward growth.

🔸 A chart number in the range of (25-10) indicates weak potential absorption and upward growth, and conversely for negative ranges.

Mohammadmahdi Sanei

🔘 **Cash Absorption Chart**

🔹 **Potential Cash Absorption (Major Currencies, Gold, and Oil) - January 9, 2024**

🔹 The larger the number on the chart, the greater the capacity of the respective currency (considering all fundamental and sentiment factors) to absorb cash and grow for the day (and vice versa).

🔹 Given that price changes in the market often move towards price equilibrium based on events that occur, one crucial aspect of this chart is comparing its daily changes with its previous days.

🔸 A chart number above 25 indicates potential absorption and upward growth.

🔸 A chart number in the range of (25-10) indicates weak potential absorption and upward growth, and conversely for negative ranges.

✍🏻 The market is in a dilemma with the economic data of the United States. In this situation, the situation of gold can be followed very cautiously. The yield rate of bonds is crucial and strongly influences the movements of gold and the dollar. As mentioned before, the current market valuation is not favorable for the ascent of gold due to changes in interest rates.

🔹 **Potential Cash Absorption (Major Currencies, Gold, and Oil) - January 9, 2024**

🔹 The larger the number on the chart, the greater the capacity of the respective currency (considering all fundamental and sentiment factors) to absorb cash and grow for the day (and vice versa).

🔹 Given that price changes in the market often move towards price equilibrium based on events that occur, one crucial aspect of this chart is comparing its daily changes with its previous days.

🔸 A chart number above 25 indicates potential absorption and upward growth.

🔸 A chart number in the range of (25-10) indicates weak potential absorption and upward growth, and conversely for negative ranges.

✍🏻 The market is in a dilemma with the economic data of the United States. In this situation, the situation of gold can be followed very cautiously. The yield rate of bonds is crucial and strongly influences the movements of gold and the dollar. As mentioned before, the current market valuation is not favorable for the ascent of gold due to changes in interest rates.

: