Mohammadmahdi Sanei / Profile

- Information

|

3 years

experience

|

4

products

|

1069

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

Programmer

at

ICT Capital Co.

Coding and programming have been my primary professional activities for the previous five years. Since I became acquainted with MQL5 and trading robots, a new vista has opened up for me.

Over the last two years, I've tested various trading methods and spent a lot of time and effort building them into a lucrative Trading Bot.

My major area of expertise is in AI and machine learning algorithms for predicting time series, particularly financial markets.

Over the last two years, I've tested various trading methods and spent a lot of time and effort building them into a lucrative Trading Bot.

My major area of expertise is in AI and machine learning algorithms for predicting time series, particularly financial markets.

Friends

247

Requests

Outgoing

Mohammadmahdi Sanei

🔴 Important News on Tuesday in the Forex Market:

Economic Calendar - January 9, 2024

⭐️⭐️ Tokyo Core Consumer Price Index (YoY) (Dec) 🇯🇵

In this data, the change in prices of goods and services purchased by consumers in Tokyo, excluding fresh food, is measured. It is expected that this figure will be lower than previous numbers, potentially weakening the Japanese yen.

⭐️⭐️ Eurozone Unemployment Rate (Nov) 🇪🇺

The unemployment rate is expected to remain similar to previous figures, with little impact on the euro.

📌 Additionally, other data will be released that may have short-term effects on the market, including the trade balance and imports and exports of the United States and Canada.

Economic Calendar - January 9, 2024

⭐️⭐️ Tokyo Core Consumer Price Index (YoY) (Dec) 🇯🇵

In this data, the change in prices of goods and services purchased by consumers in Tokyo, excluding fresh food, is measured. It is expected that this figure will be lower than previous numbers, potentially weakening the Japanese yen.

⭐️⭐️ Eurozone Unemployment Rate (Nov) 🇪🇺

The unemployment rate is expected to remain similar to previous figures, with little impact on the euro.

📌 Additionally, other data will be released that may have short-term effects on the market, including the trade balance and imports and exports of the United States and Canada.

Mohammadmahdi Sanei

🔘 **Key Technical Points for Gold - January 9, 2024!**

🔸 **2054**

🔸 **2044**

▪️ **2033**

🔹 **2030**

🔹 **2013**

🔹 **2000**

✍🏻 Gold found good support from the 2020 range. Currently, the most important figure today is **2030**. Staying above this range will guide gold back towards support levels. Liquidity is currently awaiting confirmation from calendar data for entry into gold.

(🔸Resistance 🔹Support ▪️Current Price)

#GOLD

🔸 **2054**

🔸 **2044**

▪️ **2033**

🔹 **2030**

🔹 **2013**

🔹 **2000**

✍🏻 Gold found good support from the 2020 range. Currently, the most important figure today is **2030**. Staying above this range will guide gold back towards support levels. Liquidity is currently awaiting confirmation from calendar data for entry into gold.

(🔸Resistance 🔹Support ▪️Current Price)

#GOLD

Mohammadmahdi Sanei

❇️ **Is the Gold Trend Upward?**

🔹 Gold faced fluctuations last week, but amid improved US dollar and slightly higher bond yields, gold returned to its lowest level on Friday.

🔸 However, the long-term outlook is bullish as central banks plan to lower interest rates in 2024 due to global inflation, supporting the value of gold.

🔹 Contradictory signals from job data and the ISM services PMI report released on Friday have created some ambiguity in the markets.

🔸 This week's calendar is somewhat weak until the release of US CPI data on Thursday.

🔹 Nevertheless, with the Federal Reserve lowering interest rates this year, and other central banks likely to follow suit, inflationary pressures globally are likely to ease, initiating a cycle of interest rate reduction.

🔸 With a deeper progression in 2024, global inflationary pressures are expected to decrease, initiating a cycle of interest rate reduction.

🔹 The European Central Bank, the Bank of England, and the Federal Reserve are all expected to begin this process in the late first quarter.

#GOLD #CPI

🔹 Gold faced fluctuations last week, but amid improved US dollar and slightly higher bond yields, gold returned to its lowest level on Friday.

🔸 However, the long-term outlook is bullish as central banks plan to lower interest rates in 2024 due to global inflation, supporting the value of gold.

🔹 Contradictory signals from job data and the ISM services PMI report released on Friday have created some ambiguity in the markets.

🔸 This week's calendar is somewhat weak until the release of US CPI data on Thursday.

🔹 Nevertheless, with the Federal Reserve lowering interest rates this year, and other central banks likely to follow suit, inflationary pressures globally are likely to ease, initiating a cycle of interest rate reduction.

🔸 With a deeper progression in 2024, global inflationary pressures are expected to decrease, initiating a cycle of interest rate reduction.

🔹 The European Central Bank, the Bank of England, and the Federal Reserve are all expected to begin this process in the late first quarter.

#GOLD #CPI

Mohammadmahdi Sanei

🔘 **Key Technical Points for Gold on January 8, 2024!**

🔸 2065

🔸 2060

🔸 2044

▪️ 2029

🔹 2020

🔹 2003

🔹 1985

✍🏻 The status of gold in the current day and week is influenced by the US CPI, which will be announced later in the week. The most important support levels for gold today are mentioned in the message. Last week's mixed data has not led to significant changes compared to market expectations. Therefore, intraday support levels can be a place for buying gold.

(🔸Resistance 🔹Support ▪️Current Price)

#GOLD

🔸 2065

🔸 2060

🔸 2044

▪️ 2029

🔹 2020

🔹 2003

🔹 1985

✍🏻 The status of gold in the current day and week is influenced by the US CPI, which will be announced later in the week. The most important support levels for gold today are mentioned in the message. Last week's mixed data has not led to significant changes compared to market expectations. Therefore, intraday support levels can be a place for buying gold.

(🔸Resistance 🔹Support ▪️Current Price)

#GOLD

Mohammadmahdi Sanei

🔴 Here are the important news of Friday in the Forex market:

Economic Calendar

5th January 2024

🔹 Today we have important data on the US dollar, Canadian dollar, and Euro, which we will discuss below.

⭐️⭐️⭐️ Eurozone Consumer Price Index (CPI) (YoY) (Dec) 🇪🇺

This data measures the change in prices of goods and services from the consumer's perspective. Given the trend in the past year, there is a possibility that it will be less than the previous number published and may have a negative impact on the Euro¹.

⭐️⭐️⭐️ Average Hourly Earnings (MoM) (Dec) 🇺🇸

Average hourly earnings measure the change in the price paid by employers for labor, excluding the agricultural sector, and it is predicted to be less or the same as the previous number published².

⭐️⭐️⭐️ Nonfarm Payrolls (Dec) 🇺🇸

Nonfarm payrolls measure the change in the number of employed people in the previous month, except for the agricultural industry, and it is predicted that the data will be less than the previous number published. If this is the case, it may have a negative impact on the dollar³.

⭐️⭐️⭐️ Unemployment Rate (Dec) 🇺🇸

The unemployment rate measures the percentage of the total workforce that was unemployed and actively seeking employment in the previous month. It is predicted that it will be higher than the previous number published, and if it is published according to the prediction, it may have a negative impact on the dollar⁴.

⭐️⭐️ Employment Change 🇨🇦

This data measures the change in the number of employed people, and the probability that the data will be higher than the previous number published is high, which can strengthen the Canadian dollar⁵.

⭐️⭐️ Unemployment Rate (Dec) 🇨🇦

In addition to the US dollar, we also have unemployment rate data for the Canadian dollar, and there is a possibility that it will be higher or the same as the previous number published.

Economic Calendar

5th January 2024

🔹 Today we have important data on the US dollar, Canadian dollar, and Euro, which we will discuss below.

⭐️⭐️⭐️ Eurozone Consumer Price Index (CPI) (YoY) (Dec) 🇪🇺

This data measures the change in prices of goods and services from the consumer's perspective. Given the trend in the past year, there is a possibility that it will be less than the previous number published and may have a negative impact on the Euro¹.

⭐️⭐️⭐️ Average Hourly Earnings (MoM) (Dec) 🇺🇸

Average hourly earnings measure the change in the price paid by employers for labor, excluding the agricultural sector, and it is predicted to be less or the same as the previous number published².

⭐️⭐️⭐️ Nonfarm Payrolls (Dec) 🇺🇸

Nonfarm payrolls measure the change in the number of employed people in the previous month, except for the agricultural industry, and it is predicted that the data will be less than the previous number published. If this is the case, it may have a negative impact on the dollar³.

⭐️⭐️⭐️ Unemployment Rate (Dec) 🇺🇸

The unemployment rate measures the percentage of the total workforce that was unemployed and actively seeking employment in the previous month. It is predicted that it will be higher than the previous number published, and if it is published according to the prediction, it may have a negative impact on the dollar⁴.

⭐️⭐️ Employment Change 🇨🇦

This data measures the change in the number of employed people, and the probability that the data will be higher than the previous number published is high, which can strengthen the Canadian dollar⁵.

⭐️⭐️ Unemployment Rate (Dec) 🇨🇦

In addition to the US dollar, we also have unemployment rate data for the Canadian dollar, and there is a possibility that it will be higher or the same as the previous number published.

Mohammadmahdi Sanei

🔴 **Important News for Thursday in the Forex Market**

**Economic Calendar - January 4, 2024**

🔹 On Thursday, there are important data releases for the US Dollar (USD) and Euro (EUR) that we'll focus on:

⭐️⭐️⭐️ **German Consumer Price Index (CPI) (Month-over-Month) (Dec) 🇩🇪**

This data measures changes in the prices of goods and services from the perspective of German consumers. Given the trend observed in 2023, it is expected that the data will be lower than the previous figure, potentially having a negative impact on the Euro (EUR).

⭐️⭐️⭐️ **ADP Nonfarm Employment Change (Dec) 🇺🇸**

This data assesses the estimated change in the number of employed people in the past month, excluding the agricultural and government sectors. It is anticipated that the data for the new year will be higher than the previous figure, which could have a positive impact on the US Dollar (USD).

⭐️⭐️⭐️ **Initial Jobless Claims 🇺🇸**

This data measures the number of individuals who filed for unemployment insurance for the first time in the past week. A lower-than-expected figure is anticipated, which could have a positive impact on the US Dollar (USD).

**Economic Calendar - January 4, 2024**

🔹 On Thursday, there are important data releases for the US Dollar (USD) and Euro (EUR) that we'll focus on:

⭐️⭐️⭐️ **German Consumer Price Index (CPI) (Month-over-Month) (Dec) 🇩🇪**

This data measures changes in the prices of goods and services from the perspective of German consumers. Given the trend observed in 2023, it is expected that the data will be lower than the previous figure, potentially having a negative impact on the Euro (EUR).

⭐️⭐️⭐️ **ADP Nonfarm Employment Change (Dec) 🇺🇸**

This data assesses the estimated change in the number of employed people in the past month, excluding the agricultural and government sectors. It is anticipated that the data for the new year will be higher than the previous figure, which could have a positive impact on the US Dollar (USD).

⭐️⭐️⭐️ **Initial Jobless Claims 🇺🇸**

This data measures the number of individuals who filed for unemployment insurance for the first time in the past week. A lower-than-expected figure is anticipated, which could have a positive impact on the US Dollar (USD).

Mohammadmahdi Sanei

🔘 **Key Technical Points for Gold on Thursday, January 4, 2024!**

🔸 2069

🔸 2061

🔸 2047

▪️ 2048

🔹 2026

🔹 2010

✍🏻 Gold is still in a corrective cycle. The most important resistance levels for Gold today, January 4, are 2047 and 2067. Confirmation above 2047 will depend on the market sentiment towards Gold improving today. Otherwise, the mentioned support levels could serve as intraday targets for Gold's movement.

(🔸Resistance 🔹Support ▪️ Current Price)

#GOLD

🔸 2069

🔸 2061

🔸 2047

▪️ 2048

🔹 2026

🔹 2010

✍🏻 Gold is still in a corrective cycle. The most important resistance levels for Gold today, January 4, are 2047 and 2067. Confirmation above 2047 will depend on the market sentiment towards Gold improving today. Otherwise, the mentioned support levels could serve as intraday targets for Gold's movement.

(🔸Resistance 🔹Support ▪️ Current Price)

#GOLD

Mohammadmahdi Sanei

📅 Brief Economic Calendar Overview Today! 3, Jan 2024

🔹 Today's economic calendar presents three significant events influencing the dollar and the market. We have the release of supply management data, simultaneous release of November job openings, and finally, details from the latest Federal Reserve meeting.

🔹 The latest supply management data indicated a relatively stable trend (despite cooling in ISM Global Supply Management data). Now, the market is eager to see how the stable US trade data will unfold.

🔹 In ADP employment data and overall US employment figures, we've observed a mild and moderate downward trend, somewhat alleviating concerns for the Federal Reserve. The focus is now on how employment figures will shape up this week.

🔹 In the final key event, market participants are seeking more details from the latest Federal Reserve meeting, particularly interested in whether the details align with Mr. Powell's explicit remarks about tapering.

👌 The outcomes of these events will be crucial for the dollar's trajectory.

🔹 Today's economic calendar presents three significant events influencing the dollar and the market. We have the release of supply management data, simultaneous release of November job openings, and finally, details from the latest Federal Reserve meeting.

🔹 The latest supply management data indicated a relatively stable trend (despite cooling in ISM Global Supply Management data). Now, the market is eager to see how the stable US trade data will unfold.

🔹 In ADP employment data and overall US employment figures, we've observed a mild and moderate downward trend, somewhat alleviating concerns for the Federal Reserve. The focus is now on how employment figures will shape up this week.

🔹 In the final key event, market participants are seeking more details from the latest Federal Reserve meeting, particularly interested in whether the details align with Mr. Powell's explicit remarks about tapering.

👌 The outcomes of these events will be crucial for the dollar's trajectory.

Mohammadmahdi Sanei

Passed 50K FTMO Propfirm Challenge in Just 3 Days with My Trading Strategy

3 January 2024, 12:45

🎉 ** Conquering the 50K FTMO Challenge!** Hey Traders! 🚀 I am thrilled to share some exciting news with you. Recently, I successfully passed the 50K FTMO challenge, and I am beyond grateful for this achievement...

Share on social networks · 2

735

2

Mohammadmahdi Sanei

🔘 The most important technical points for GOLD, December 27!

🔸2073

▪️2065

🔹2061

🔹2058

🔹2054

✍🏻 As expected, the market is experiencing very low depth, which is why gold can display movements purely in response to technical points. The most important points that can act as temporary supports and operate on an intraday basis are mentioned. While the economic calendar is also free of news, announcements, increased tensions, and other factors can easily serve as catalysts.

(🔸Resistance 🔹Support ▪️Current Price)

#GOLD 🌟

🔸2073

▪️2065

🔹2061

🔹2058

🔹2054

✍🏻 As expected, the market is experiencing very low depth, which is why gold can display movements purely in response to technical points. The most important points that can act as temporary supports and operate on an intraday basis are mentioned. While the economic calendar is also free of news, announcements, increased tensions, and other factors can easily serve as catalysts.

(🔸Resistance 🔹Support ▪️Current Price)

#GOLD 🌟

Mohammadmahdi Sanei

🔘 The most important technical points for gold on Thursday, December 21!

🔸2052

🔸2042

▪️2035

🔹2030

🔹2022

🔹2012

✍🏻 Today, December 21, the most important range for gold is 2030. As long as we are above this number, the upward tendencies persist. (The analysis from yesterday and the target of $2100 per ounce are still valid, but it seems that gold needs more rest and consolidation to reach its targets. The release of U.S. data could lead to movements in gold for today, so be attentive.

(🔸Resistance 🔹Support ▪️Current Price)

#GOLD 🌟

🔸2052

🔸2042

▪️2035

🔹2030

🔹2022

🔹2012

✍🏻 Today, December 21, the most important range for gold is 2030. As long as we are above this number, the upward tendencies persist. (The analysis from yesterday and the target of $2100 per ounce are still valid, but it seems that gold needs more rest and consolidation to reach its targets. The release of U.S. data could lead to movements in gold for today, so be attentive.

(🔸Resistance 🔹Support ▪️Current Price)

#GOLD 🌟

Mohammadmahdi Sanei

For further analysis and GOLD updates follow my channel:

MQL5 channel:

https://www.mql5.com/en/channels/fusion_forex_insights

MQL5 channel:

https://www.mql5.com/en/channels/fusion_forex_insights

Mohammadmahdi Sanei

🔘 Key Technical Levels for Gold on Wednesday, December 20th!

🔸2075

🔸2060

🔸2050

▪️2040

🔹2036

🔹2025

🔹2012

✍🏻 For December 20th, the crucial range for gold is 2035. As long as we stay above this level, the targets of 2050 and 2065 are within reach. Maintaining the range at 2035, the current target for gold in the current period is $2100, which faces numerous resistances along the way (let's try to trade in the right direction as the best friend for us is the trend).

(🔸Resistance 🔹Support▪️ Current Price)

#GOLD 🌐

🔸2075

🔸2060

🔸2050

▪️2040

🔹2036

🔹2025

🔹2012

✍🏻 For December 20th, the crucial range for gold is 2035. As long as we stay above this level, the targets of 2050 and 2065 are within reach. Maintaining the range at 2035, the current target for gold in the current period is $2100, which faces numerous resistances along the way (let's try to trade in the right direction as the best friend for us is the trend).

(🔸Resistance 🔹Support▪️ Current Price)

#GOLD 🌐

Mohammadmahdi Sanei

📈 Technical Analysis for Gold - December 19

🔸 Resistance:

- 2045

- 2035

▪️ Current Level:

- 2024

🔹 Support:

- 2017

- 2007

✍🏻 The key range for Tuesday, December 19, is within 2025 dollars. Currently, the price is interacting with this range. The confirmation above this range opens the door to the levels of 2035 and 2045. The support range of 2017 is also well-regarded for today.

(🔸Resistance 🔹Support ▪️Current Price)

#GOLD 🌟

🔸 Resistance:

- 2045

- 2035

▪️ Current Level:

- 2024

🔹 Support:

- 2017

- 2007

✍🏻 The key range for Tuesday, December 19, is within 2025 dollars. Currently, the price is interacting with this range. The confirmation above this range opens the door to the levels of 2035 and 2045. The support range of 2017 is also well-regarded for today.

(🔸Resistance 🔹Support ▪️Current Price)

#GOLD 🌟

Mohammadmahdi Sanei

⚠️FTMO feedback on the trading challenge that I have passed⚠️

FTMO - Support

3:50 AM (1 hour ago)

to me

We are sending you Account Analysis of your account: 1052104296.

Congratulations! Trading Objectives have been passed. Your trading system meets the requirements to pass our Evaluation Process. These are great results, which are only achieved by a small number of traders.

If you think it’s the right time, consider applying for the full FTMO Challenge. Disciplined traders are always welcome with us. I would also like to remind you that a fee for the FTMO Challenge will be refunded to you with your first profit withdrawal once you become an FTMO Trader. If you are still undecided whether you can meet the Trading Objectives of the FTMO Challenge, you can always set up a new Free Trial in your Client Area.

We'd love to hear your feedback as it will help us improve our services. How was your trading? Was the Free Trial beneficial to you? Are you ready for the FTMO Challenge? Every feedback we obtain gives us valuable insight into the quality of our services.

We are looking forward to successful cooperation.

The Account Analysis can be found in your Client Area or on this link https://trader.ftmo.com/account-analysis/1052104296

Best regards,

Jaroslav Spilar

Support Team

⚠️⚠️⚠️ Don`t hesitate and join my channel: ⚠️⚠️⚠️

https://www.mql5.com/en/channels/fusion_forex_insights

FTMO - Support

3:50 AM (1 hour ago)

to me

We are sending you Account Analysis of your account: 1052104296.

Congratulations! Trading Objectives have been passed. Your trading system meets the requirements to pass our Evaluation Process. These are great results, which are only achieved by a small number of traders.

If you think it’s the right time, consider applying for the full FTMO Challenge. Disciplined traders are always welcome with us. I would also like to remind you that a fee for the FTMO Challenge will be refunded to you with your first profit withdrawal once you become an FTMO Trader. If you are still undecided whether you can meet the Trading Objectives of the FTMO Challenge, you can always set up a new Free Trial in your Client Area.

We'd love to hear your feedback as it will help us improve our services. How was your trading? Was the Free Trial beneficial to you? Are you ready for the FTMO Challenge? Every feedback we obtain gives us valuable insight into the quality of our services.

We are looking forward to successful cooperation.

The Account Analysis can be found in your Client Area or on this link https://trader.ftmo.com/account-analysis/1052104296

Best regards,

Jaroslav Spilar

Support Team

⚠️⚠️⚠️ Don`t hesitate and join my channel: ⚠️⚠️⚠️

https://www.mql5.com/en/channels/fusion_forex_insights

Mohammadmahdi Sanei

⚠️Posted a detailed description about the FTMO challenged I passed last week⚠️

Read this post in MQL5 website with the following link.

https://www.mql5.com/en/blogs/post/755382

Read this post in MQL5 website with the following link.

https://www.mql5.com/en/blogs/post/755382

Mohammadmahdi Sanei

Passed FTMO Propfirm Challenge in Just 2 Days with My Trading Strategy

16 December 2023, 20:07

🚀 **Conquering the FTMO Challenge with a Winning Trading Strategy! 📈** Hello fellow traders! I'm excited to share my recent achievement in the world of trading—a remarkable journey that saw me successfully navigate the $10,000 FTMO account challenge with a $500 profit target in just two weeks...

Share on social networks · 3

695

1

Mohammadmahdi Sanei

Hello Dear Traders and Members of FFI Channel;

Last week I got many messages from you, and many ask about the statistics of my new trading strategy. I think the best tool for measuring the potential of this strategy is the FTMO challenge that I past last week. I will explain briefly some main statistics about the results for your kind reference.

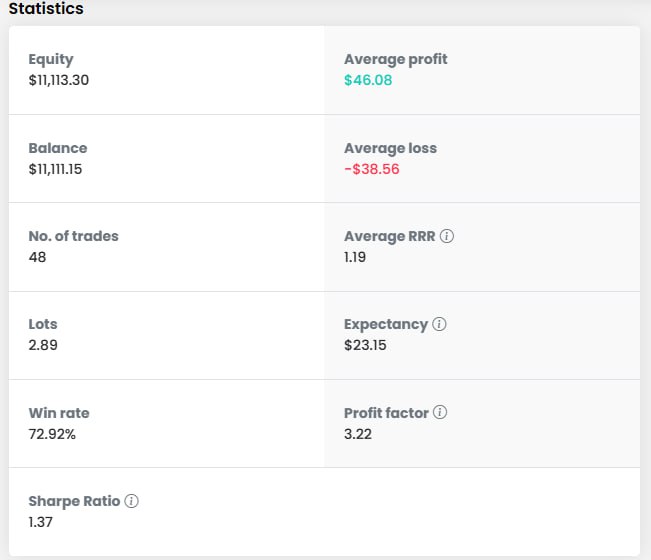

In this screenshot you can see the trades statistics. Average RRR = 1:19, Win rate = 72.92 %, Profit factor = 3.22, and Sharp ratio = 1.37.

These data are FTMO analysis of the trades I took during the challenge.

Subscribe to my channel to be notified about my new products:

https://www.mql5.com/en/channels/fusion_forex_insights

Last week I got many messages from you, and many ask about the statistics of my new trading strategy. I think the best tool for measuring the potential of this strategy is the FTMO challenge that I past last week. I will explain briefly some main statistics about the results for your kind reference.

In this screenshot you can see the trades statistics. Average RRR = 1:19, Win rate = 72.92 %, Profit factor = 3.22, and Sharp ratio = 1.37.

These data are FTMO analysis of the trades I took during the challenge.

Subscribe to my channel to be notified about my new products:

https://www.mql5.com/en/channels/fusion_forex_insights

Mohammadmahdi Sanei

Hello Dear Traders

Since 4 Dec 2023 I started the FTMO challenge to test my trading strategy based on FTMO trading rules and assess my strategy performance.

The results were amazing and I passed the 500$ target in just two days and continued the challenge till now with near 70% consistency which shows the trades are successful after 7 days of trading. Check the following link to see more details about the trading outputs. If you are interested I can share the trading journal too to see which trading toll I traded with specific details.

Happy trading.

https://trader.ftmo.com/metrix?share=ffc63961c0fd&lang=en

subscribe to my channel:

https://www.mql5.com/en/channels/fusion_forex_insights

Since 4 Dec 2023 I started the FTMO challenge to test my trading strategy based on FTMO trading rules and assess my strategy performance.

The results were amazing and I passed the 500$ target in just two days and continued the challenge till now with near 70% consistency which shows the trades are successful after 7 days of trading. Check the following link to see more details about the trading outputs. If you are interested I can share the trading journal too to see which trading toll I traded with specific details.

Happy trading.

https://trader.ftmo.com/metrix?share=ffc63961c0fd&lang=en

subscribe to my channel:

https://www.mql5.com/en/channels/fusion_forex_insights

Mohammadmahdi Sanei

Hello Dear subscribers:

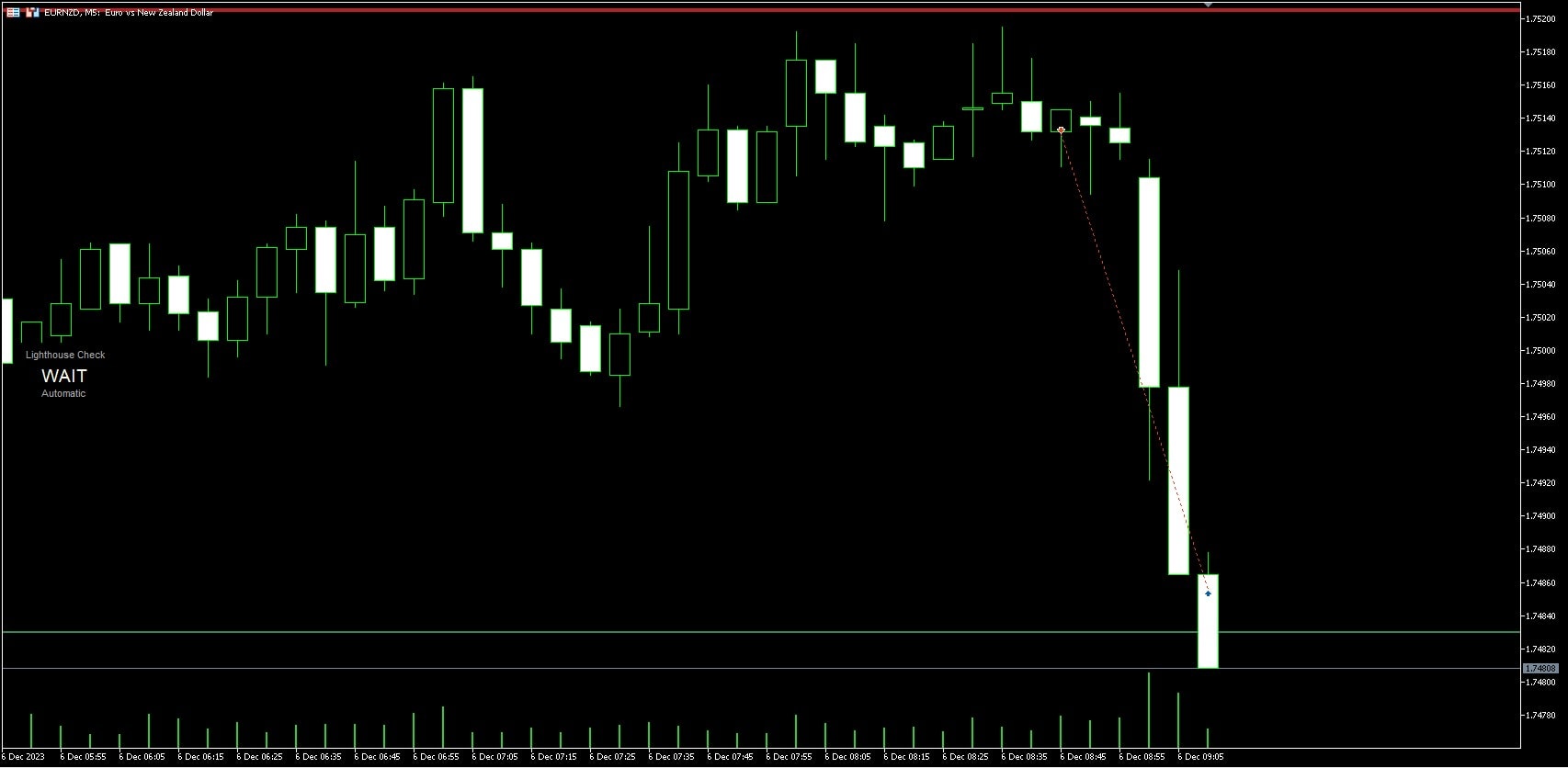

I want to discuss another trade based on the new strategy resulted from forward testing.

This is another successful sell trade on EURNZD based on the golden 7 steps I discussed before. When technical analysis combines with fundamental indicators the results are supper awesome.

For your information please note that price moves between supply and demand zones. this strategy takes the entry and exit prices based on these zones, the TP and SL are calculated according to these zones. The red and green lines are indicating supply and demand locations on the chart.

I want to discuss another trade based on the new strategy resulted from forward testing.

This is another successful sell trade on EURNZD based on the golden 7 steps I discussed before. When technical analysis combines with fundamental indicators the results are supper awesome.

For your information please note that price moves between supply and demand zones. this strategy takes the entry and exit prices based on these zones, the TP and SL are calculated according to these zones. The red and green lines are indicating supply and demand locations on the chart.

: