Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.16 10:59

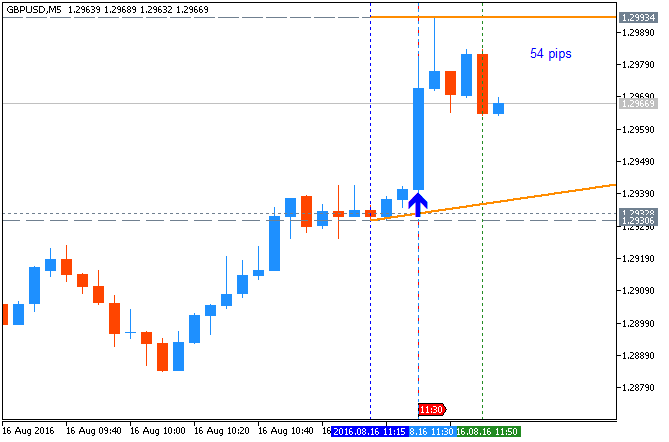

GBP/USD Intra-Day Fundamentals: U.K. Consumer Price Index and 54 pips price movement

2016-08-16 08:30 GMT | [GBP - CPI]

- past data is 0.5%

- forecast data is 0.5%

- actual data is 0.6% according to the latest press release

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - CPI] = Change in the price of goods and services purchased by consumers.

==========

- "The Consumer Prices Index (CPI) rose by 0.6% in the year to July 2016, compared with a 0.5% rise in the year to June."

- "Although the small increase in the rate between June 2016 and July 2016 takes it to the highest seen since November 2014, it is still relatively low in the historic context."

- "The main contributors to the increase in the rate were rising prices for motor fuels, alcoholic beverages and accommodation services, and a smaller fall in food prices than a year ago."

==========

GBP/USD M5: 54 pips price movement by U.K. Consumer Price Index news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.16 15:13

Intra-Day Fundamentals - EUR/USD and GBP/USD: U.S. Consumer Price Index2016-08-16 12:30 GMT | [USD - CPI]

- past data is 0.2%

- forecast data is 0.0%

- actual data is 0.0% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers.

==========

- "The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in July on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 0.8 percent before seasonal adjustment."

- "The energy index declined in July and the food index was unchanged. The index for all items less food and energy rose, but posted its smallest increase since March. As a result, the all items index was unchanged after rising in each of the 4 previous months."

- "The energy index fell 1.6 percent after rising in each of the last four months. The decline was due to a sharp decrease in the gasoline index; other energy indexes were mixed. The food at home index declined 0.2 percent as four of the six major grocery store food group indexes decreased, while the index for food away from home rose 0.2 percent."

- "The index for all items less food and energy increased 0.1 percent in July after rising 0.2 percent in June. The shelter index rose 0.2 percent, its smallest increase since March, and the indexes for medical care, new vehicles, and motor vehicle insurance also rose. In contrast, the indexes for airline fares, used cars and trucks, communication, and recreation were among those that declined in July."

==========

GBP/USD M5: 71 pips range price movement by U.S. Consumer Price Index news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.17 09:57

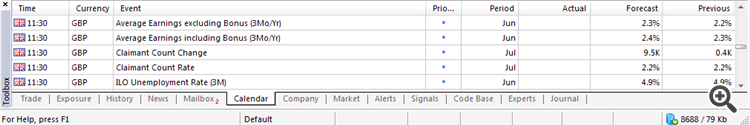

Trading News Events: Trading the News: U.K. Jobless Claims Change (adapted from the article)

- "Even though U.K. Jobless Claims are projected to increase another 9.0K in July, signs of stronger wage growth may keep the British Pound afloat, with GBP/USD at risk of staging a larger recovery should the data tame market expectation for additional monetary support."

- "The Bank of England (BoE) is widely anticipated to further embark on its easing cycle this year as ‘a majority of members expect to support a further cut in Bank Rate to its effective lower bound,’ but the central bank may move to the sidelines after delivering the comprehensive easing packing earlier this month especially as Governor Mark Carney rules out a zero-interest rate policy (ZIRP) for the U.K."

Bullish USD Trade

- "Need green, five-minute candle following the print to consider a long GBP/USD trade."

- "If market reaction favors buying sterling, long GBP/USD with two separate position."

- "Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward."

- "Move stop to entry on remaining position once initial target is hit, set reasonable limit."

- "Need red, five-minute candle to favor a short GBP/USD trade."

- "Implement same setup as the bullish British Pound trade, just in the opposite direction."

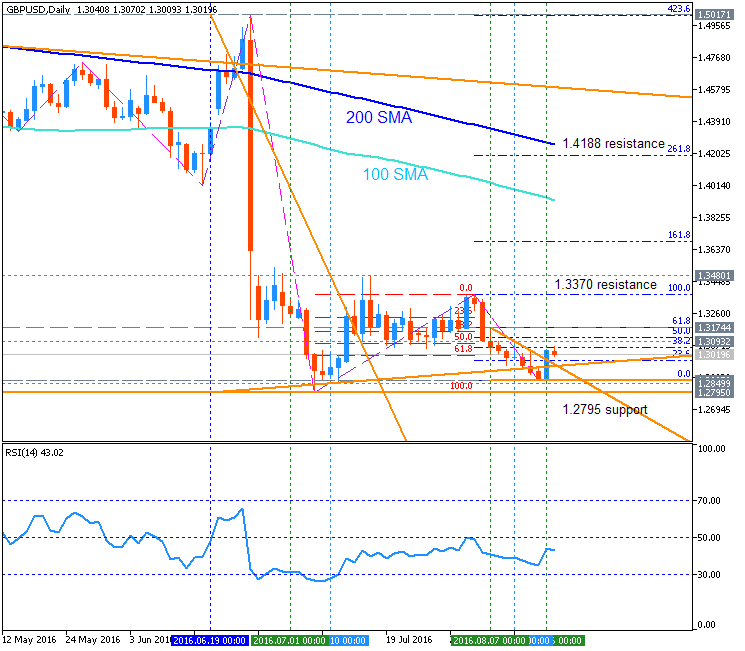

Daily price

is located below 100 SMA/200 SMA in the bearish area of the chart. The price is on ranging within the narrow support/resistance levels waiting for the direction of the bearish trend to be continuing or the seconary bear market rally to be starte.

- If D1 price breaks 1.3370

resistance level to above on

close daily bar so the local uptrend as the seconary rally will be started.

- If price breaks 1.2795

support on close daily bar to below so the primary bearish trend will be resumed.

- If not so the price will be ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.17 11:06

GBP/USD Intra-Day Fundamentals: U.K. Jobless Claims and 58 pips range price movement

2016-08-17 08:30 GMT | [GBP - Jobless Claims]

- past data is 0.4K

- forecast data is 9.0K

- actual data is -8.6K according to the latest press release

if actual < forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Jobless Claims] = Change in the number of people claiming unemployment-related benefits during the previous month.

==========

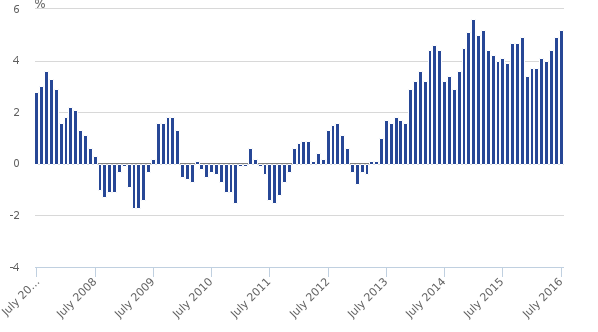

- "Between January to March 2016 and April to June 2016, the number of people in work increased. The number of unemployed people and the number of people not working and not seeking or available to work (economically inactive) fell."

- "There were 31.75 million people in work, 172,000 more than for January to March 2016 and 606,000 more than for a year earlier."

- "There were 23.22 million people working full-time, 374,000 more than for a year earlier. There were 8.53 million people working part-time, 231,000 more than for a year earlier."

- "The employment rate (the proportion of people aged from 16 to 64 who were in work) was 74.5%, the highest since comparable records began in 1971."

- "There were 1.64 million unemployed people (people not in work but seeking and available to work), 52,000 fewer than for January to March 2016, 207,000 fewer than for a year earlier and the lowest since March to May 2008."

- "There were 890,000 unemployed men, 124,000 fewer than for a year earlier. There were 750,000 unemployed women, 84,000 fewer than for a year earlier."

- "The unemployment rate was 4.9%, down from 5.6% for a year earlier. The last time it was lower was for July to September 2005. The unemployment rate is the proportion of the labour force (those in work plus those unemployed) that were unemployed."

- "There were 8.84 million people aged from 16 to 64 who were economically inactive (not working and not seeking or available to work), 58,000 fewer than for January to March 2016 and 179,000 fewer than for a year earlier."

- "The inactivity rate (the proportion of people aged from 16 to 64 who were economically inactive) was 21.6%, the joint lowest since comparable records began in 1971."

==========

GBP/USD M5: 58 pips range price movement by U.K. Jobless Claims news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.17 20:20

Intra-Day Fundamentals - EUR/USD and GBP/USD: FOMC Meeting Minutes

2016-08-17 18:00 GMT | [USD - FOMC Meeting Minutes]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[USD - FOMC Meeting Minutes] = It's a detailed record of the FOMC's most recent meeting, providing in-depth insights into the economic and financial conditions that influenced their vote on where to set interest rates.

==========

Fed minutes: Some FOMC voters thought a rate hike may be needed soon (based on CNBC article)

- "Some voting Federal Reserve policymakers expect that a U.S. interest rate increase will be needed soon, although there is general agreement that more data is needed before such a move, according to the minutes from the Fed's July policy meeting."

- "Some ... members anticipated that economic conditions would soon warrant taking another step in removing policy accommodation," the Fed said in the minutes, which were released on Wednesday."

- "After the release of the minutes, the U.S. dollar hit a session low against the yen at about 100.15 yen. The euro touched a session high against the dollar of about $1.1295."

==========

EUR/USD M5: 53 pips range price movement by FOMC Meeting Minutes news event

==========

GBP/USD M5: 82 pips range price movement by FOMC Meeting Minutes news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.18 11:05

GBP/USD Intra-Day Fundamentals: U.K. Retail Sales and 95 pips price movement

2016-08-18 08:30 GMT | [GBP - Retail Sales]

- past data is -0.9%

- forecast data is 0.1%

- actual data is 1.4% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[GBP - Retail Sales] = Change in the total value of inflation-adjusted sales at the retail level.

==========

- "Compared with June 2016, the quantity bought increased by 1.4%; all sectors showed growth with the main contribution again coming from non-food stores."

- "Average store prices (including petrol stations) fell by 2.0% in July 2016 compared with July 2015. Compared with June 2016, there was a fall of 0.8%."

==========

GBP/USD M5: 95 pips price movement by U.K. Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.18 14:53

Intra-Day Fundamentals - EUR/USD and GBP/USD: Philadelphia Fed Business Outlook Survey

2016-08-18 12:30 GMT | [USD - Philly Fed Manufacturing Index]

- past data is -2.9

- forecast data is 1.4

- actual data is 2.0 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Philly Fed Manufacturing Index] = Level of a diffusion index based on surveyed manufacturers in Philadelphia.

==========

==========

EUR/USD M5: 21 pips range price movement by Philadelphia Fed Business Outlook Survey news event

==========

GBP/USD M5: 25 pips range price movement by Philadelphia Fed Business Outlook Survey news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.19 09:46

Technical Targets for GBP/USD by United Overseas Bank (based on the article)

H4 price is on bullish ranging near and above 100 SMA/200 SMA on the border between the primary bearish and the primary bullish trend on the chart: the price is testing 1.3126 support level to below for the reversal of the price movement to the primary bearish market condition to be started

Daily

price. United Overseas Bank is expecting for GBP/USD to keep the bearish trend with 1.3270 level to be unlikely to be broke to above:

- If daily price breaks 1.3319 resistance level

on close bar to above so the local uptrebd as the bear market rally will be started.

- If daily price breaks 1.2794 support level on close bar so the primary bearish trend will be resumed.

- If not so the price will be ranging within the levels.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is located below Ichimoku cloud for the bearish market condition: the price is breaking 1.2935 support level for the bearish trend to be continuing with 1.2795 nearest bearish daily target to re-enter.

If D1 price breaks 1.2935 support level on close bar so the primary bearish trend will be continuing with 1.2795 nearest target.

If D1 price breaks 1.3371 resistance level on close bar from below to above so the local uptrend as the bear market rally will be started with the good possibility to the bullish reversal.

If not so the price will be on bearish ranging within the levels.

SUMMARY : bearish