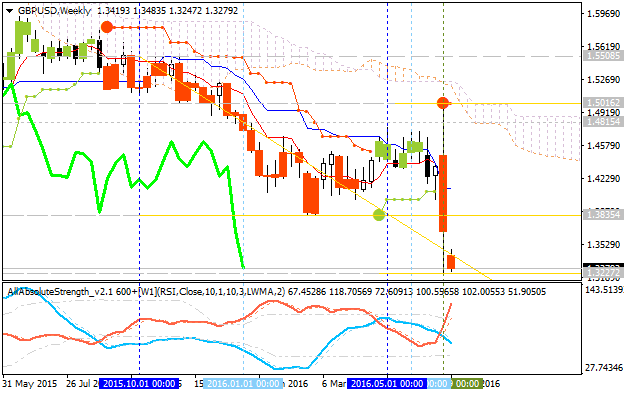

GBPUSD Technical Analysis 2016, 26.06 - 03.07: bearish breakdown with 1.3214 support level to be broken for the daily bearish to be continuing

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.06.25 08:17

Weekly Outlook: 2016, June 26 - July 03 (based on the article)

The Brexit decision had huge market implications with a crash for the pound, falls for other risk currencies and gains for the dollar and the yen. Apart from the Brexit aftershocks, we have US and Canadian GDP data, US Consumer Confidence and other events. These are the major events on forex calendar.

- US GDP( final Q1): Tuesday, 12:30. U.S. economic growth was upgraded to 0.8% in the second release for Q1. Q2 looks much better but the future is uncertain with Brexit.

- US CB Consumer Confidence: Tuesday, 14:00. Consumer confidence is expected to improve to 93.2 this time.

- US Crude Oil Inventories: Wednesday, 14:30.

- Canadian GDP data: Thursday, 12:30. Canadian GDP for April is forecasted to rise 0.1%.

- US Unemployment Claims: Thursday, 12:30. The number of new claims is expected to reach 269,000 this week.

- Chinese PMIs: Friday, 1:00 for the official one and 1:45 for the independent Caixin one. The Caixin manufacturing PMI already looks worse: a minor rise from 47.8 to 47.9 is on the cards.

- US ISM Manufacturing PMI: Friday, 14:00. Manufacturing PMI is expected to climb to 51.6 in June.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.06.26 17:39

Week Ahead: Brexit: This Is Not A Drill - FX Markets Drivers & Views (based on the article)

- "Next week’s data releases may have less of an impact on the markets."

- "All this could push GBP another 7% lower from current levels in the near term and lower still over the longer-term."

- "We expect EUR to underperform USD and JPY."

- "The prospect for FX intervention could limit the JPY and CHF especially against USD."

GBP/USD H4: ranging within narrow levels after bearish breakdown. The price broke 100 SMA/200 SMA level to be reversed to the bearish area of the chart, and it was started to be ranging within the following narrow s/r levels:

- 38.2% Fibo level at 1.3911 located on the border between the primary bearish and the secondary rally on the chart, and

- Fibo level at 1.3229 located far below 100 SMA/200 SMA reversal on the primary bearish area.

If D1 price will break 1.3229

support level on close bar so the bearish trend will be continuing.

If D1 price will break 1.3911

resistance level on close bar from below to above so the local uptrend

as the bear market rally within the bearish market condition will be

started.

If D1 price will break 1.4335

resistance level on close bar so the bullish reversal of the daily

price movement will be started with the secondary ranging condition.

If not so the price will be on ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.06.27 11:51

Britain’s finance minister George Osborne says UK ready to face future from position of strength (based on the article)

- "Britain is ready to confront what the future holds for us from a position of strength."

- "Our economy is about as strong as it could be to confront the challenge our country now faces."

- "Only the UK can trigger Article 50, and in my judgement we should only do that when there is a clear view about what new arrangement we are seeking with our European neighbours."

By the way, Goldman Sachs and Bank of America cut sterling forecasts, and FTSE 250 poised for worst 2-day drop since 2008 crisis.

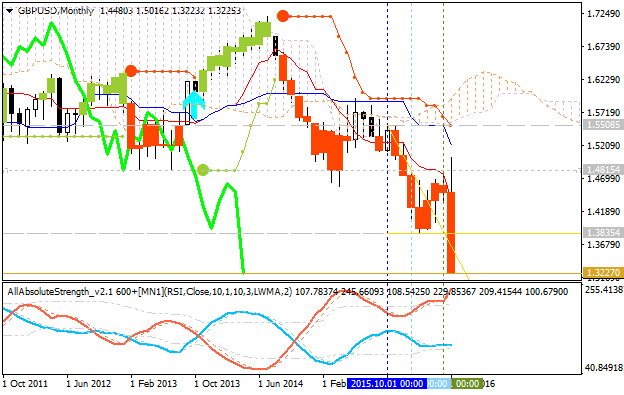

The weekly price was already located below Ichimoku cloud in the bearish area of the chart, so the recent bearish breakdown is the good situation for the traders who opened the sell positiona for example: price will continuing with the bearish trend in case the support level at 1.3227 is going to be broken to below on close weekly bar.

Long term situation for GBP/USD month price: bearish. The support level at 1.3227 is the key level for the long-term bearish trend to be continuing.

The situation: watch 1.3227 support level to be broken to below for weekly/monthly price on close bar to have the idea about the future of GBP/USD: the long-term bearish to be continuing or the price will be on ranging bearish for 2016 and 2017 for example.

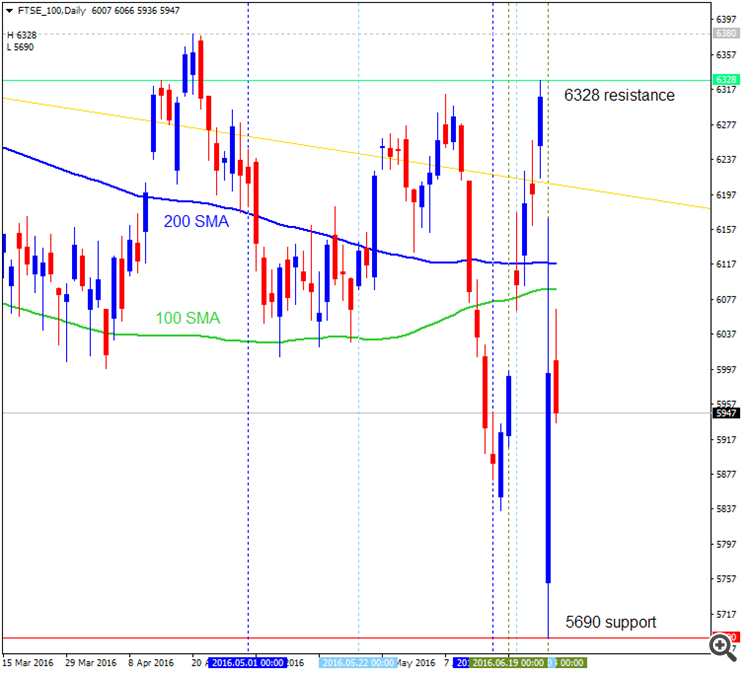

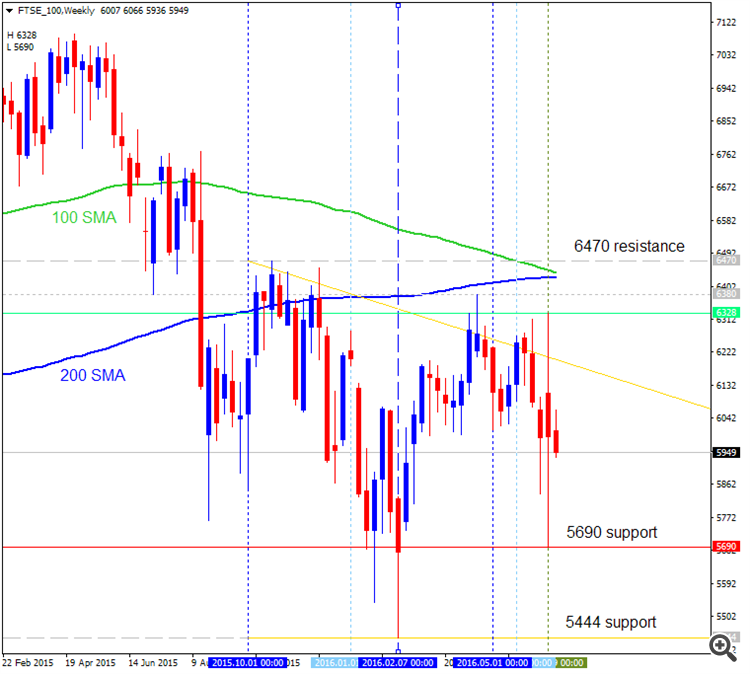

And just about FTSE 100 after Brexit

Daily price.

The short-term situation after Breexit was really very bad for this index: the price was on breakdown with the bearish reversal. The bearish trend will be continuing in case the price breaks 5690 support level to below, otherwise - ranging bearish.

But as we see from the chart below - the price is going to be on slowly recovering way with the secondary rally to be started near the bullish reversal area for example.

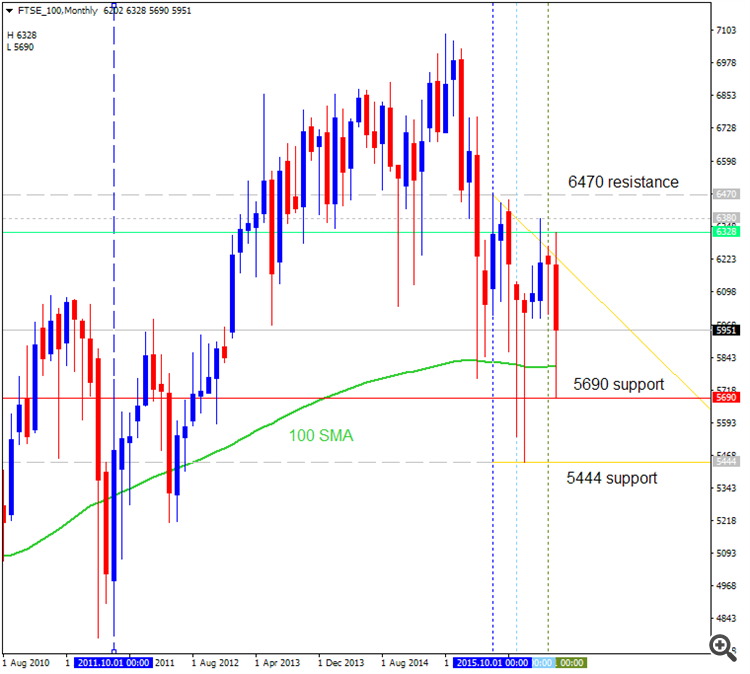

Weekly price.

The medium-term situation after Bexit: the price is on ranging market condition within the primary bearish trend. If the price breaks 5690 support to below on close weekly bar so the bearish trend will be continuing, otherwise - the ranging bearish.

But as we see from the chart below - the more worse situation was in the beginning of the February this year for FTSE 100 because the price was testing 5444 support level located very far from 200 SMA bullish reversal area.

Monthly price.

The long-term situation. The price is continuing with the secondary correction in the ranging way. The same key support level at 5690 is going to be testing to below for the correction to be continuing.

But we had more worse situation in the beginning of October 2011 with the price to be tested with 4750 support level.

General Conclusion.

This may be really worse for FTSE 100 related to Brexit but in a short-term situation only. And there are no any significant changes to be expected for FTSE 100 in the medium-term and long-term perspective for example. To make it shorter: nothing serious to be happened with FTSE 100 in medium/long-term situation.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.06.28 10:59

Intra-Day Fundamentals: EU Parliament to Vote on Resolution on U.K. Referendum

2016-06-28 08:00 GMT | [EUR - EU Parliament to Vote on Resolution on U.K. Referendum]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[EUR - EU Parliament to Vote on Resolution on U.K. Referendum] = MEPs will meet on in Brussels for an extraordinary plenary session at 10:00. Parliament's political group leaders will discuss the consequences of the UK vote with Commission President Jean-Claude Juncker and a representative of the Dutch Presidency of the Council. They will vote on a non-binding resolution to feed into Wednesday's meeting of 27 EU heads of state and government on the same topic. Parliament will have to approve any withdrawal agreement with the UK as well as any agreement on a new relationship between the EU and the UK.

==========

European Parliament to press UK for quick exit ahead of summit (from Independent article):"European Union lawmakers are meeting in emergency session to discuss the U.K.'s unprecedented vote to leave the EU, set to call for Britain to trigger the exit process immediately. A non-binding draft resolution drawn up for Tuesday's session says the process should be launched once Prime Minister David Cameron notifies the outcome of the British referendum to EU leaders. Cameron is to share his views about the referendum and perhaps Britain's future at a summit in Brussels on Tuesday afternoon. He has signaled that Britain might not trigger the exit clause known as Article 50 until October. EU nations acknowledge the political chaos in the U.K. but they want Article 50 triggered as soon as possible to calm markets and reassure European citizens."

==========

EUR/USD M5: 19 pips price movement by EU Parliament to Vote on Resolution on U.K. Referendum news event

GBP/USD M5: 68 pips price movement by EU Parliament to Vote on Resolution on U.K. Referendum news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.06.28 14:44

Intra-Day Fundamentals: U.S. Gross Domestic Product

2016-06-28 12:30 GMT | [USD - GDP]

- past data is 0.8%

- forecast data is 1.0%

- actual data is 1.1% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - GDP] = Annualized change in the inflation-adjusted value of all goods and services produced by the economy.

==========

- "Real gross domestic product -- the value of the goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes -- increased at an annual rate of 1.1 percent in the first quarter of 2016, according to the "third" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2015, real GDP increased 1.4 percent."

- "The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, th increase in real GDP was 0.8 percent. With the third estimate for the first quarter, the general picture of economic growth remains the same; exports increased more than previously estimated."

- "Real gross domestic income (GDI), which measures the value of the production of goods and services in the United States as the costs incurred and the incomes earned in production, increased 2.9 percent in the first quarter, compared with an increase of 1.9 percent in the fourth. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 2.0 percent in the first quarter, compared with an increase of 1.7 percent in the fourth."

==========

EUR/USD M5: 9 pips range price movement by U.S. Gross Domestic Product news event

GBP/USD M5: 27 pips range price movement by U.S. Gross Domestic Product news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.06.30 17:48

GBP/USD Intra-Day Fundamentals: BoE Gov Carney Speaks and 185 pips range price movement

2016-06-30 15:00 GMT | [GBP - BoE Gov Carney Speaks]

- past data is 1.2%

- forecast data is 1.4%

- actual data is 1.5% according to the latest press release

[GBP - BoE Gov Carney Speaks] = The speech at the Bank of England, in London.

==========

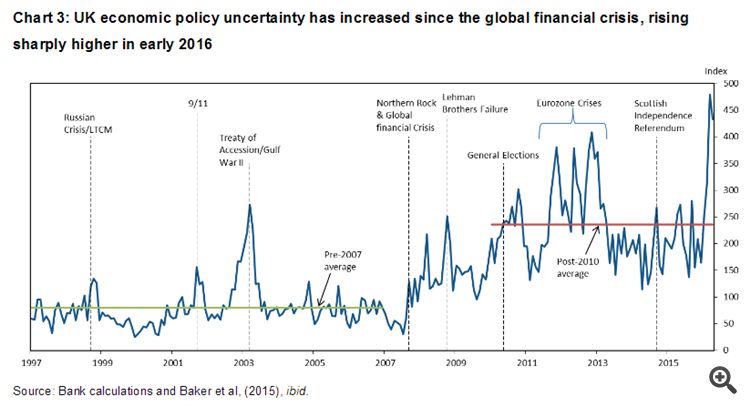

Uncertainty, the economy and policy - speech by Mark Carney :

- "In recent years, policy uncertainty has increased globally. In some jurisdictions, fiscal frameworks have been questioned; in others, exchange rate regimes. And with very low interest rates and expanding unconventional policies, the efficacy of monetary policy itself has been questioned. The charge that central banks are out of monetary ammunition is wrong, but the widespread absence of global price pressures demands that our firepower be well aimed."

- "When uncertainty is high, policymakers should have three objectives. First, conduct a sober, objective assessment of the outlook and the risks to it. Second, develop and communicate a plan to reduce those risks and to seize new opportunities. And third, do no harm, by minimising any possible confusion about the commitment to core macroeconomic policy frameworks themselves."

==========

GBP/USD M5: 185 pips range price movement by BoE Gov Carney Speaks news event :

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is on bearish breakdown related to Brexit result by the breaking key support levels to below:

If the price will break 1.3835 support level on close daily bar so the bearish trend will be continuing.

If D1 price will break 1.3214 support level on close bar from above to below so the bearish breakdown will be resumed.

If D1 price will break 1.4946 resistance level on close bar so the price will be fully reversed to the bullish market condition located to be above 100 SMA/200 SMA reversal area in the bullish area of the chart.

If not so the price will be on ranging bearish within the levels.

SUMMARY : bearish breakdown

TREND : bearish