Thank you for your quick response!

Correct me if I'm wrong.

A Broker gives a constant leverage for all it's symbols.

That's why we use AccountInfoInteger(ACCOUNT_LEVERAGE) an account function and not a symbol function.

But the contract size and volume step differs from symbol to symbol, so we use symbol functions SymbolInfoXXX(symbol, YYY) to get access to their values.

As for AccountFreeMarginCheck() its 3rd argument is the lots.

Basically it tells me the remaining money if I had opened a position with the given lots.

On my problem, lots is the requested number and not the given.

When I calculate the lots I use a fraction of the available money, so I should never reach that point of not enough money.

For example, I have $1000, I want to risk 15% of the money, that makes it $150. So I need to find the correct amount of lots that are equivalent to $150.

Thanks!

Alain Verleyen:

You have to use AccountFreeMarginCheck() and not calculate your self from leverage. For example on GOLD, leverage is usually not the same as for Forex.

You have to use AccountFreeMarginCheck() and not calculate your self from leverage. For example on GOLD, leverage is usually not the same as for Forex.

Correct me if I'm wrong.

A Broker gives a constant leverage for all it's symbols.

That's why we use AccountInfoInteger(ACCOUNT_LEVERAGE) an account function and not a symbol function.

But the contract size and volume step differs from symbol to symbol, so we use symbol functions SymbolInfoXXX(symbol, YYY) to get access to their values.

As for AccountFreeMarginCheck() its 3rd argument is the lots.

Basically it tells me the remaining money if I had opened a position with the given lots.

On my problem, lots is the requested number and not the given.

When I calculate the lots I use a fraction of the available money, so I should never reach that point of not enough money.

For example, I have $1000, I want to risk 15% of the money, that makes it $150. So I need to find the correct amount of lots that are equivalent to $150.

Thanks!

aknetmma:

Thank you for your quick response!

Correct me if I'm wrong.

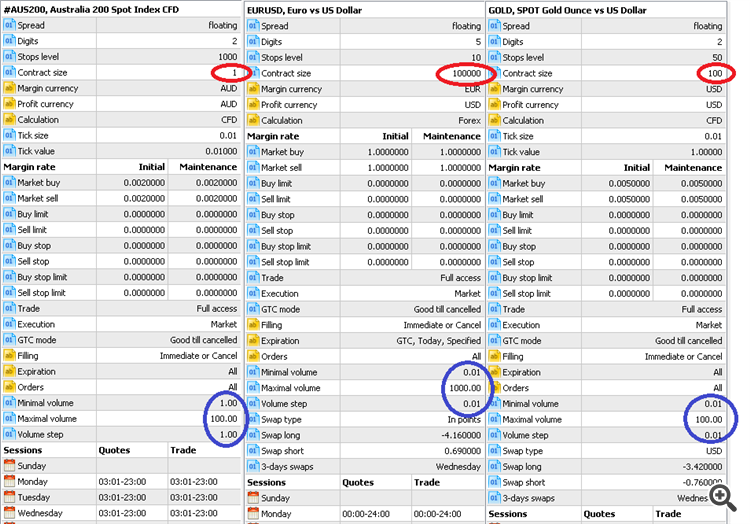

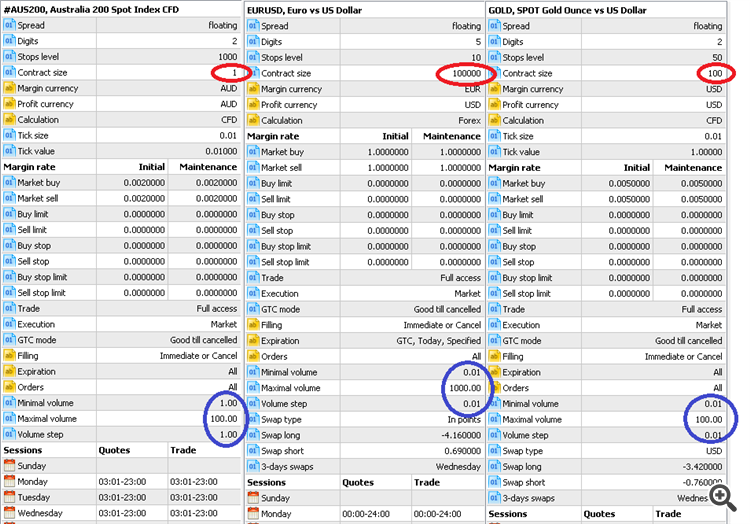

No, you are wrong, it's what I said previously. Don't ask me why, but it's a fact that the leverage symbols is not constant for all symbols. Of course, that could depends of the broker, I didn't check all, but I saw several where it's not the case.Thank you for your quick response!

Correct me if I'm wrong.

A Broker gives a constant leverage for all it's symbols.

...

As for AccountFreeMarginCheck() its 3rd argument is the lots.

Basically it tells me the remaining money if I had opened a position with the given lots.

On my problem, lots is the requested number and not the given.

When I calculate the lots I use a fraction of the available money, so I should never reach that point of not enough money.

For example, I have $1000, I want to risk 15% of the money, that makes it $150. So I need to find the correct amount of lots that are equivalent to $150.

Thanks!

AccountFreeMarginCheck() gives your the margin use for X lots. It's exactly what you need. You know your current margin, you know the margin after you would have open X lots on a given symbol. That gives you the margin for X lots, then it's just a cross-multiplication to have your lot size.

As for AccountFreeMarginCheck() its 3rd argument is the lots.

Basically it tells me the remaining money if I had opened a position with the given lots.

On my problem, lots is the requested number and not the given.

When I calculate the lots I use a fraction of the available money, so I should never reach that point of not enough money.

For example, I have $1000, I want to risk 15% of the money, that makes it $150. So I need to find the correct amount of lots that are equivalent to $150.

Thanks!

Cross-multiplication - Wikipedia, the free encyclopedia

- en.wikipedia.org

Given an equation like: (where and are not zero), one can cross-multiply to get: In practice, the method of cross-multiplying means that we multiply the numerator of each (or one) side by the denominator of the other side, effectively crossing the terms over. The mathematical justification for the method is from the following longer...

//FUNCTION TO CALCULATE LOT SIZE double CalculateLotSize(int SL_Ticks,string symbol,double riskp) { double final_lot=0; //calculation with SL if(SL_Ticks>0) { double tick_value=MarketInfo(symbol,MODE_TICKVALUE); double sl_value=tick_value*SL_Ticks; double amount_to_risk=(AccountBalance()/100)*riskp; final_lot=amount_to_risk/sl_value; } //calculation without SL if(SL_Ticks==0) { double one_lot_margin=SymbolInfoDouble(symbol,SYMBOL_MARGIN_INITIAL); double amount_to_risk=(AccountBalance()/100)*riskp; final_lot=amount_to_risk/one_lot_margin; } //find lot digits for the asset double minlot=MarketInfo(symbol,MODE_MINLOT); int digitos=0; double transfer=minlot; while(transfer<1) { digitos++; transfer=transfer*10; } final_lot=NormalizeDouble(final_lot,digitos); //find lot digits for the asset ends here return(final_lot); } //FUNCTION TO CALCULATE LOT SIZE ENDS HERE

SL_Ticks -> Stop Loss In points , if you want to calculate without the stop loss in mind send SL_Ticks as 0

symbol -> the symbol

riskp -> the risk percentage

You are right .

Thanks Alain

Thanks Alain

Thanks Alain!

What about the Margin Rates?

Should I take account the Margin Initial on lot calculation?

Should I take account the Margin Initial on lot calculation?

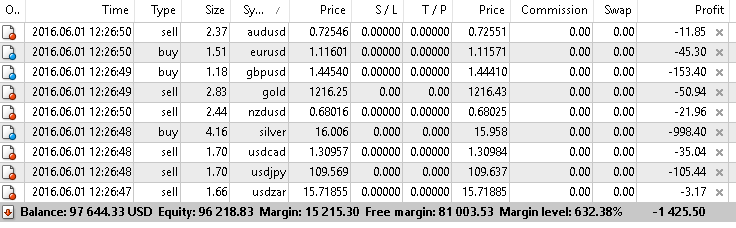

There is an issue on lots.

The method for calculating the lots that is used is according to the previous comments:

Lots = FreeMargin(100) * Risk(0.2) * LotStep(0.01) / FreeMargin(100) - CheckMargin(80)

The difference of FreeMargin and CheckMargin gives the value in dollars of 0.01 lot(input lot for CheckMargin function was 0.01).

Note: The picture is taken just a second after the positions opened.

The question is why some symbols such as silver behave differently from others.

For the same amount of risk percentage(2%) the proportion of lots and profit is vast.

The method for calculating the lots that is used is according to the previous comments:

Lots = FreeMargin(100) * Risk(0.2) * LotStep(0.01) / FreeMargin(100) - CheckMargin(80)

The difference of FreeMargin and CheckMargin gives the value in dollars of 0.01 lot(input lot for CheckMargin function was 0.01).

Note: The picture is taken just a second after the positions opened.

The question is why some symbols such as silver behave differently from others.

For the same amount of risk percentage(2%) the proportion of lots and profit is vast.

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

I'm writing an EA which will trade according to user's risk percentage.

Let's say it opens an Long position during daylight and Short position during night, a simple/stupid EA.

EA's input value is the risk percentage, let's say 15 for 15% of available money.

Whenever opens a position it has to calculate the amount of lots according to the 15% for the money.

The following is the algorithm that I'm using for calculating the lots:

account's currency=USD total money=ACCOUNT_EQUITY //1000 risk=percentage * total money // 0.15*1000 if (account's currency==symbol's margin currency) { //example USDJPY lots= (risk*leverage) / contract size //(150*100)/100000=0.66 } else if (account's currency==symbol's profit currency) { //example EURUSD lots= ( (risk*leverage) / contract size ) / price //((150*100)/100000)/1.13=0.58 //price is the ask/bid of EURUSD } else //not related to account's currency { //example EURGBP lots= (risk*price*leverage) / contract size //(150*0.75*100)/100000=0.11 //price is the ask/bid value of EURUSD //EURUSD = EUR-margin currency of EURGBP // USD-account currency } if (lots>MAX_LOTS) lots=MAX_LOTS else if (lots>MIN_LOTS) lots=MIN_LOTSI suppose this approach should work on all symbols, forex, indeces futures etc...But on metals, indeces and some futures it reaches the maximum amount of lots and it cannot open position because of insufficient amount of money.

What are your opinions?