Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.01 09:07

Ahead of NFP: Fundamental Forecasts by Bank of America Merrill Lynch, Nordea Bank AB and Skandinaviska Enskilda Banken (adapted from the article)

2016-04-01 08:55 GMT | [USD - Non-Farm Employment Change]

- past data is 242K

- forecast data is 206K

- actual data is n/a according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

- BofAML:

"The March employment report likely showed another strong month for the

labor market. We anticipate a healthy 190,000 gain in nonfarm payrolls,

with the private sector contributing 185,000."

- Nordea: "We expect a 200k gain in nonfarm payrolls in March after the surprisingly strong 242k rise in February, consistent with a continued healthy labour market improvement."

- SEB: "We take the lowside on this one and forecast a 180k on the headline, 170k on private employment, 0.1% on average hourly earnings and 4.9% on the unemployment rate."

==========

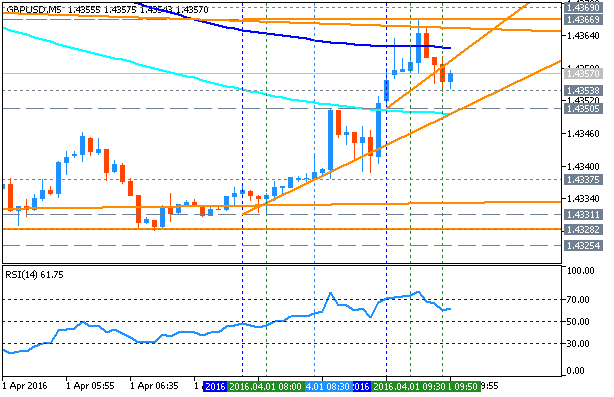

GBP/USD M5: ranging within 100/200 SMA area for direction. Intra-day M5 price is located to be within 100/200

period SMA for the secondary ranging market condition. If the price breaks 1.4366 resistance to above so the bullish reversal will be started with 1.4373 target to re-enter. Alternatively, if the price breaks 1.4337 suport so the primary intra-day bearish trend will be continuing with 1.4328 target.

GBP/USD Intra-Day Technical Analysis - waiting to break the levels

H4 price is located between SMA with period 100 (100 SMA) and SMA with the period 200 (200 SMA) waiting for the direction for the possible breakout or breakdown. The key support/resistance levels for this pair are the following: 1.4370 as the resistance and 1.4170 as support level.

- If the price will break 1.4370 resistance level so the bullish trend will be continuing.

- If price will break 1.4170 support so the reversal of the price movement from the ranging bullish to the primary bearish will be started.

- If not so the price will be ranging within the levels.

| Resistance | Support |

|---|---|

| 1.4370 | 1.4170 |

| 1.4458 | 1.4056 |

- Recommendation to go short: watch the price to break 1.4170 support level for possible sell trade

- Recommendation to go long: watch the price to break 1.4370 resistance level for possible buy trade

- Trading Summary: ranging

SUMMARY : ranging

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.04 11:02

GBP/USD Intra-Day Fundamentals: UK Construction PMI and 34 pips price movement

2016-04-04 09:30 GMT | [GBP - Construction PMI]

- past data is 54.2

- forecast data is 54.1

- actual data is 54.2 according to the latest press release

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Construction PMI] = Level of a diffusion index based on surveyed purchasing managers in the construction industry.

==========

"At 54.2 in March, the seasonally adjusted Markit/CIPS UK Construction Purchasing Managers’ Index® (PMI®) posted above the neutral 50.0 value for the thirty-fifth month running. However, the latest reading was unchanged since February and indicated the joint-slowest rate of output growth since June 2013. Sub-sector data highlighted that faster rises in commercial work and civil engineering activity were offset by another slowdown in residential building. The latest increase in housing activity was only marginal and the weakest recorded since January 2013."

==========

GBPUSD M5: 34 pips price movement by UK Construction PMI news event :

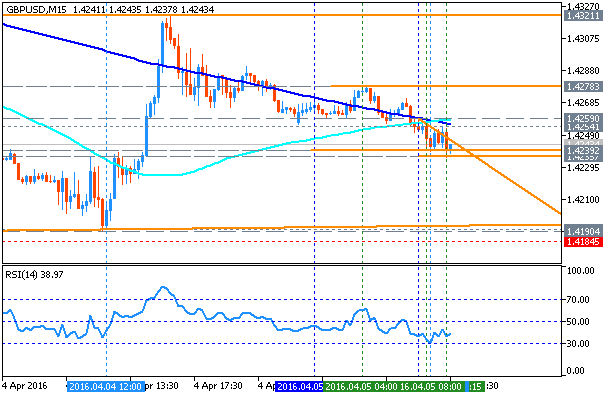

GBP/USD Intra-Day Technical Analysis - ranging near 200 SMA ranging area waiting for direction ahead of Services PMI news event

M15 price

is located near and below SMA with period 100 (100 SMA) and SMA with the period

200 (200 SMA) waiting for the direction for the possible breakout or

breakdown. The key support/resistance levels for this pair are the following:

- 1.4321 resistance located above 100 SMA/200 SMA in the primary bullish area of the chart, and

- 1.4184 support level located far below 100 SMA/200 SMA in the primary bearish area.

RSI indicator is estimating the raging bearish trend to be continuing.

- If the price will break 1.4321 resistance level so the intra-day price will be reversed back to the bullish condition.

- If price will break 1.4184 support so the bearish trend will be continuing without secondary ranging.

- If not so the price will be ranging within the levels.

| Resistance | Support |

|---|---|

| 1.4278 | 1.4233 |

| 1.4321 | 1.4184 |

- Recommendation to go short: watch the price to break 1.4184 support level for possible sell trade

- Recommendation to go long: watch the price to break 1.4321 resistance level for possible buy trade

- Trading Summary: ranging bearish

SUMMARY : ranging

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.05 11:17

GBP/USD Intra-Day Fundamentals: UK Services PMI and 20 pips price movement

2016-04-05 09:30 GMT | [GBP - Services PMI]

- past data is 52.7

- forecast data is 53.9

- actual data is 53.7 according to the latest press release

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Services PMI] = Level of a diffusion index based on surveyed purchasing managers in the services industry.

==========

"The Business Activity Index rose to 53.7 in March, from February’s 35-month low of 52.7. This signalled a faster rate of growth in output, but the second-weakest in six months. Moreover, the Index remained below its long-run average of 55.2, and the average for the first quarter of 2016 (54.0) was the lowest of any quarter since Q1 2013."

==========

GBPUSD M5: 20 pips price movement by UK Services PMI news event :

GBPUSD Intra-Day Technical Analysis - ranging bearish within the narrow s/r levels ahead of UK Factory production news event

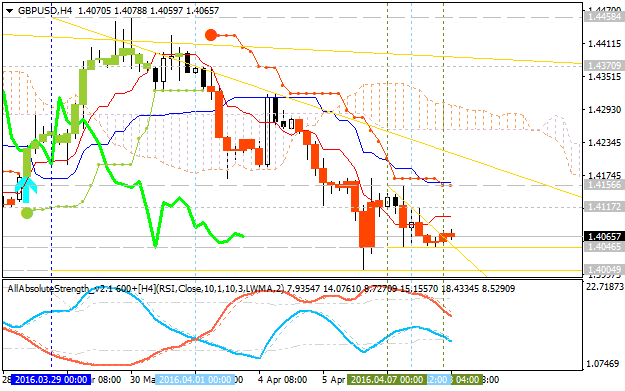

H4 price

is on bearish market condition located far below Ichimoku cloud and Senkou Span line which is the border of the virtual border between the primary ebarish and the primary bullish trend on the chart.

- Chinkou Span line is below the price indicating the ranging bearish market condition.

- Absolute Strength indicator is estimating the ranging condition to be continuing in the near future.

- The nearest support levels for H4 price are 1.4046 and 1.4004.

- The nearest resistance level for H4 price are 1.4117 and 1.4156.

| Resistance | Support |

|---|---|

| 1.4117 | 1.4046 |

| 1.4156 | 1.4004 |

If

H4 price will break 1.4046 support level on close H4 bar so the primary bearish will be continuing.

If H4 price will break 1.4156 resistance level so the local uptrend as the bear market rally will be started.

If not so the price will be ranging within the levels.

- Recommendation for long: watch close H4 price to break 1.4156 for possible buy trade

- Recommendation

to go short: watch H4 price to break 1.4046 support level for possible sell trade

- Trading Summary: ranging

SUMMARY : bearish

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.08 11:16

GBP/USD Intra-Day Fundamentals: U.K. Manufacturing Production and 46 pips price movement

2016-04-08 09:30 GMT | [GBP - Manufacturing Production]

- past data is 0.5%

- forecast data is -0.2%

- actual data is -1.1% according to the latest press release

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Manufacturing Production] = Change in the total inflation-adjusted value of output produced by manufacturers.

==========

- "Total production output is estimated to have decreased by 0.5% in

February 2016 compared with the same month a year ago, the largest fall

since August 2013. The largest contribution to the fall came from

manufacturing, which decreased by 1.8%. This was the largest fall since

July 2013, when it fell by an equal amount."

- "Total production output is estimated to have decreased by 0.3% between January 2016 and February 2016. There were decreases in 2 of the 4 main sectors, with manufacturing (the largest component of production) having the largest contribution to the decrease, falling by 1.1%."

==========

GBPUSD M5: 46 pips price movement by U.K. Manufacturing Production news event :

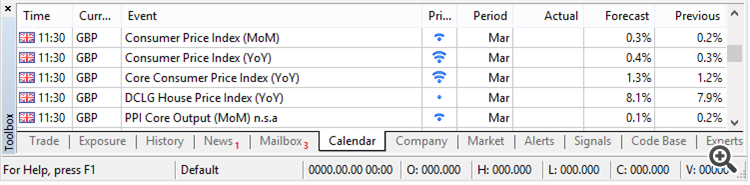

GBP/USD M5: pips price movement by U.K. CPI news event :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.12 07:35

Trading News Events: U.K. Consumer Price Index (CPI) - to be ranging on 200 SMA for direction of the trend (based on the article)What’s Expected:

Why Is This Event Important:

- "Even though the Monetary Policy Committee (MPC) is widely expected to preserve the record-low interest rate ahead of the U.K. Referendum in June, heightening price pressures may prompt Governor Mark Carney to adopt a more hawkish tone over the coming months as the BoE sees a risk of overshooting the 2% inflation-target over the policy horizon."

- "Nevertheless, U.K. firms may increase their efforts to draw domestic demand amid the slowdown in private-sector lending accompanied by the weakening outlook for the global economy, and a soft inflation report may spur a near-term selloff in the sterling as market participants push out bets for a BoE rate-hike."

Bullish GBP Trade: Headline & Core Inflation Upticks in March

- Need green, five-minute candle following the print to consider a long GBP/USD trade.

- If market reaction favors buying sterling, long GBP/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

- Need red, five-minute candle to favor a short GBP/USD trade.

- Implement same setup as the bullish British Pound trade, just in reverse.

- GBP/USD may continue to track sideways as it preserves the March range, but the bullish tilt on the Relative Strength Index (RSI) may foster a larger rebound over the near-term especially as the pair appears to be carving an inverse head-and-shoulders formation.

- Interim Resistance: 1.4910 (61.8% retracement) to 1.4930 (38.2% expansion)

- Interim Support: 1.3870 (78.6% expansion) and 1.4000 pivot

GBP/USD Intra-Day Technical Analysis - primary bearish condition near intra-day ranging area

M5 price is located below SMA with period 100 (100 SMA) and below SMA with the period 200 (200 SMA) for the primary bearish market condition: the price is ranging within narrow key reversal support/resistance levels:

- 1.4157 resistance level located within 100 SMA/200 SMA ranging area on the border between the primary bearish and the primary bullish market condition on the chart, and

- 1.4089 support level located below 100 SMA/200 SMA in the primary bearish area.

RSI indicator is estimating the ranging condition to be continuing in the near future.

- If the price will break 1.4157 resistance level so the bullish reversal of the intra-day price movement will be started.

- If price will break 1.4089 support so the bearish trend will be continuing.

- If not so the price will be ranging within the levels.

| Resistance | Support |

|---|---|

| 1.4138 | 1.4105 |

| 1.4157 | 1.4089 |

- Recommendation to go short: watch the price to break 1.4089 support level for possible sell trade

- Recommendation to go long: watch the price to break 1.4157 resistance level for possible buy trade

- Trading Summary: ranging

SUMMARY : ranging

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.14 13:24

GBP/USD Intra-Day Fundamentals: BoE Interest Rates and 55 pips range price movement

2016-04-14 11:00 GMT | [GBP - BoE Interest Rates]

- past data is 0.50%

- forecast data is 0.50%

- actual data is 0.50% according to the latest press release

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - BoE Interest Rates] = Interest rate at which the BOE lends to financial institutions overnight.

==========

"The Bank of England’s Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target and in a way that helps to sustain growth and employment. At its meeting ending on 13 April 2016 the MPC voted unanimously to maintain Bank rate at 0.5%. The Committee also voted unanimously to maintain the stock of purchased assets financed by the issuance of central bank reserves at £375 billion."

==========

GBP/USD M5: 55 pips range price movement by BoE Interest Rates news event :

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.03.31 12:03

GBP/USD Intra-Day Fundamentals: U.K. Current Account and 24 pips price movement

2016-03-31 09:30 GMT | [GBP - Current Account]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Current Account] > Difference in value between imported and exported goods, services, income flows, and unilateral transfers during the previous quarter.

==========

"The United Kingdom’s (UK) current account deficit was £32.7 billion in Quarter 4 (October to December) 2015, up from a revised deficit of £20.1 billion in Quarter 3 (July to September) 2015. The deficit in Quarter 4 (October to December) 2015 equated to 7.0% of gross domestic product (GDP) at current market prices, the largest proportion since quarterly records began in 1955, up from 4.3% in Quarter 3 (July to September) 2015."

==========

GBPUSD M5: 24 pips price movement by U.K. Current Account news event :