EURUSD Technical Analysis 2015, 31.05 - 07.06: real situation for primary global reversal of the price movement to final bearish market condition

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.29 18:19

Forex Weekly Outlook June 1-5 (based on forexcrunch article)

ISM Manufacturing PMI, Rate decisions in Australia, the UK and the Eurozone, GDP data from Australia, Employment data from Canada as well as important labor figures from the US including the all-important NFP release. These are the highlights event on forex calendar. Join us as we explore the market-movers of this week.

U.S. second GDP estimate was released, indicating the economy contracted 0.7% in the first quarter, amid harsh winter storms, strong dollar weighing on exports and labor disputes at West Coast ports. While the first estimate a month ago, showed 0.2% growth. Economists say the first quarter GDP reading is not accurate and expect a pick-up in the next quarter. Also upbeat data in Durable goods orders and Consumer sentiment fuels optimism about US economic growth.

- US ISM Manufacturing PMI: Monday, 14:00. U.S. manufacturing growth remained unchanged in April, posting 51.5. The reading was lower than the 52.1 anticipated by analysts. New orders increased to 53.5 from 51.8 in March but employment fell to contraction. However, April’s figure still reflects growth. The manufacturing sector os expected to expand further to 52.8.

- Australian rate decision: Tuesday, 4:30. The Reserve Bank of Australia cut interest rates by 25 basis points to a record low of 2% in its May meeting. Analysts anticipated the move. RBA governor Glenn Stevens noted in his previous statement that additional cuts might take place in order to sustain growth. However, economists do not expect further cuts in the coming months. Analysts expect rates to remain unchanged in June.

- Australian GDP: Wednesday, 1:30. Australia’s economy continued to expand at a mild pace in the fourth quarter of 2014 growing 0.5% compared to 0.4% in the third quarter. Economists expected a higher figure of 0.7%. Data was more encouraging in the non-mining sectors and consumer spending also improved. However, domestic demand still did not react to lower interest rates, lower petrol prices and the weaker currency, therefore may require additional rate cuts to spur growth. The economy is expected to grow by 0.6% this time.

- Eurozone rate decision: Wednesday, 11:45. The European Central Bank kept interest rates unchanged in April, at a record low 0.05% and maintained overnight deposits at minus 0.20%, to prevent banks from stacking excess reserves with the central bank. Mr. Draghi stated that the Eurozone has finally turned a corner after years of recession with renewed growth. While a weak euro spurs exports due to cheaper products, low oil prices are raising the purchasing power of the region’s consumers and businesses. The ECB is expected to inject over 1 trillion euros through September 2016 into the eurozone economy via bond purchases in hope of raising inflation back to the ECB’s medium-term target of just below 2%. The ECB is not expected to change rates this time.

- US ADP Non-Farm Employment Change: Wednesday, 12:15. US Private sector employment increased by 169,000 jobs in April according to the April ADP National Employment Report. The reading missed predictions for a 199,000 gain and was preceded by a 175,000 increase in March. April job gains fell below 200,000 for the second straight month. However, the collapse of oil prices and the rising dollar weighed on job creation. US Private sector is forecasted to grow by 200,000 in May.

- US Trade Balance: Wednesday, 12:30. US trade deficit rose in March to $51.4 billion due to a surge of 7.7% in imports. Trade deficit reached a 6-1/2 years high, indicating the economy contracted in the first quarter. However, growth accelerated in April, suggesting the first quarter contraction was only temporary. Economists forecast trade deficit to rise mildly to $41.2 billion. In a separate report, the Institute for Supply Management showed the services sector rose to 57.8 in April, the highest since November. Meanwhile, exports increased only by 0.9% in March. US trade deficit is expected to improve to 44.2bl in April.

- US ISM Non-Manufacturing PMI: Wednesday, 14:00. Service sector activity edged up in April to 57.8 up from 56.5 in March. The big increase was higher than the 56.2 forecasted by analysts. The reading raised optimism that the U.S. economy has rebounded from the soft patch in the first quarter. The New Orders Index rose 1.4 points from March to 59.2. The Employment Index inched 0.1 points to 56.7 from the March reading of 56.6. The Prices Index declined 2.3 points from 52.4 reaching 50.1, indicating prices increased in April for the second consecutive month, but mildly. US Service sector activity is expected to reach 57.2 this time.

- UK rate decision: Thursday, 11:00. The Bank of England policy makers chose to continue maintaining rates at a record low of 0.50%, This policy was introduced more than six years ago. Savers received lower returns, but mortgage borrowers benefited having lower payments. The Bank’s QE remained at £375bn. The BOE is expected to raise inflation towards 2%, however, the rate stood at 0% in both February and March. Officials stated that inflation could also turn negative at some point in the coming months because of the fall in oil prices. The Bank expects rates to remain on hold until at least the first quarter of next year. Economists expect the Bank of England will keep its monetary policy unchanged.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing new claims for unemployment benefits increased last week to 282,000, rising more than anticipated but remains positive. Analysts expected claims to decline to 271,000. Despite the volatility of this weekly reading, the number of jobless claims has been generally declining since 2009, indicating a positive trend in the US labor market. The four-week moving average rose by 5,000 to 271,500 last week. The number of jobless claims is expected to reach 277,000 this week.

- Canadian employment data: Friday, 12:30. The Canadian job market shed 19,700 positions in April. This disappointing release can be explained by the unexpected rise of 28,700 jobs in March. However, broader economic data still suggests the Canadian economy is recovering and should rebound in the coming months. The unemployment rate remained unchanged for the third straight month at 6.8%. The Canadian economy added 46,900 full-time positions and shed 66,500 part-time jobs. The Canadian economy is expected to gain 10,200 new jobs, while the unemployment rate is expected to remain at 6.8%.

- US Non-Farm Employment Change and Unemployment rate: Friday, 12:30. US job-creation rebounded in April with a 223,000 job addition, following March’s disappointing revised release of 85,000 positions. The unemployment rate fell to 5.4%, the lowest since May 2008, compared to 5.5% in Match. Wage growth accelerated at a slower than expected pace inching 0.1% in average hourly earnings compared to 0.2% rise in March. All in all, the NFP report suggests the economy is nearing full employment as defined by the Fed indicating growth in the coming months. US labor market is expected to grow by 224,000 and the unemployment rate is expected to remain at 5.4%.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.01 06:36

EUR/USD May Swing to Downside This Week (based on wsj article)

The EUR/USD may swing toward the downside later this week, having failed to break through strong resistance around the 1.10 mark, says IG Securities market analyst Junichi Ishikawa in a morning note. Concerns about the Greek situation and possible upbeat U.S. data out later this week will likely keep a lid on any strong gains in the pair, he says. The focus is on whether the pair, now at 1.0950, can stay above the 1.08 level, its low of May 27. Still, should a surge of short positions kick in, the pair may be able to finally break through the upside resistance, but that kind of upside momentum will likely be capped around 1.1145, the 21-day moving average, he adds.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.01 11:43

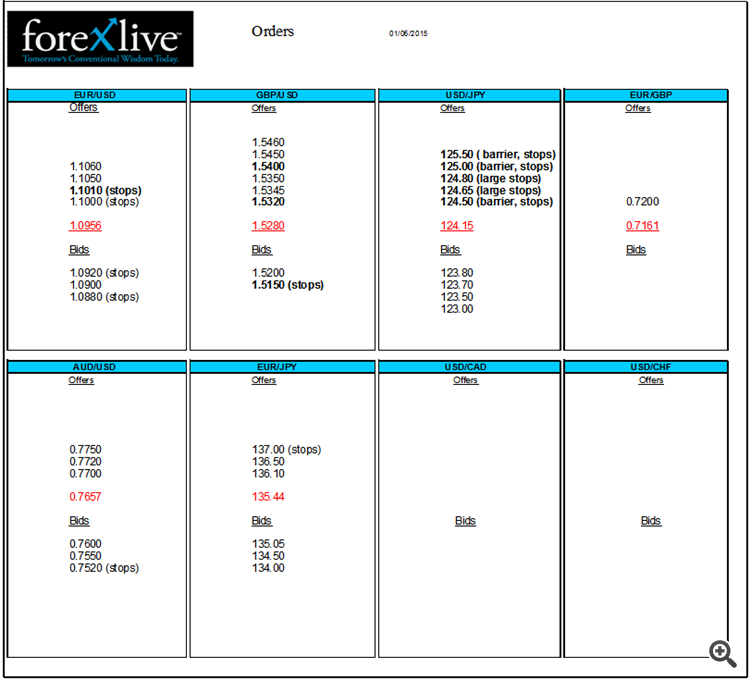

Forex market orders 1 June 2015 Updated: 08.05 gmt USdJPY, AUD USD, EURJPY, EURUSD (based on forexlive article)

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.01 14:58

2015-06-01 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Core PCE Price Index]- past data is 0.1%

- forecast data is 0.2%

- actual data is 0.1% according to the latest press release

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Core PCE Price Index] = Change in the price of goods and services purchased by consumers, excluding food and energy.

==========

"Personal income increased $59.4 billion, or 0.4 percent, and disposable personal income (DPI) increased $48.8 billion, or 0.4 percent, in April, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $2.6 billion, or less than 0.1 percent. In March, personal income increased $4.0 billion, or less than 0.1 percent, DPI increased $0.5 billion, or less than 0.1 percent, and PCE increased $65.6 billion, or 0.5 percent, based on revised estimates.

Real DPI increased 0.3 percent in April, in contrast to a decrease of 0.2 percent in March.

Real PCE decreased less than 0.1 percent, in contrast to an increase of 0.4 percent."

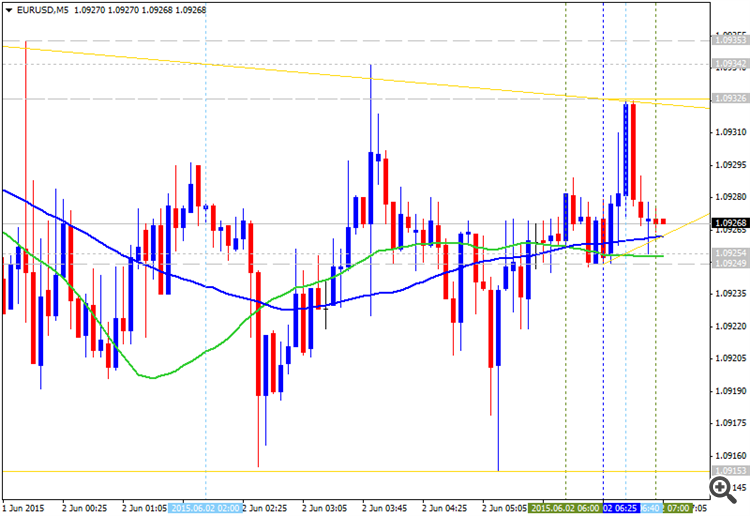

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

EURUSD: 26 pips price movement by USD - Core PCE Price Index news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.01 16:47

ISM Manufacturing PMI jumps to 52.8 – USD rises (based on forexcrunch article)

Better than expected data in the US: manufacturing has moved up to 52.8 points, reflecting stronger growth. Also the unemployment component, which is eyed towards Friday, is back to growth territory with 51.7 points.

The US dollar is slightly stronger across the board.

New orders rose to 52 points and prices paid made a big rebound from the lows: 49.5, almost at the barrier between growth and contraction, after hitting 40.5 in April.

Also construction spending, released at the same time, impressed with a rise of 2.2%. This was more than triple the expectations for +0.7% and on top of an upwards revision of the previous data to a gain of 0.6% instead of a drop of 0.5% originally reported.

Earlier, Markit’s manufacturing PMI was upgraded to 54 points from the initial assessment 53.8 points. However, US data did not excel beforehand: the core PCE Price Index rose only 1.2% year over year.

MetaTrader Trading Platform Screenshots

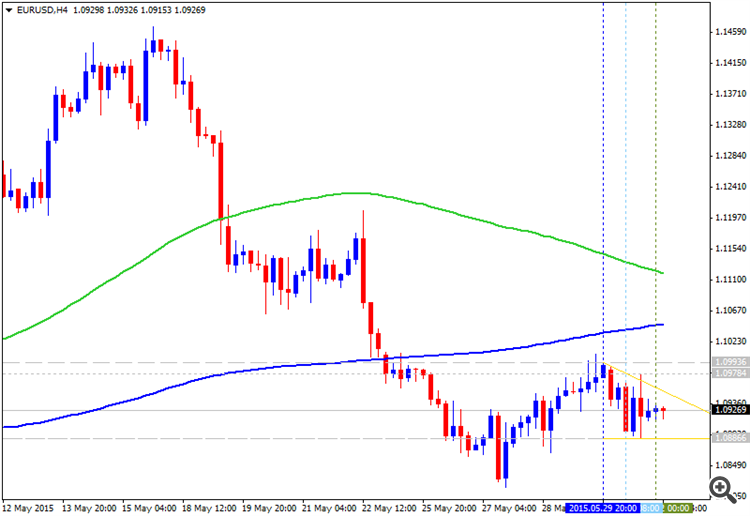

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 71 pips price movement by USD - ISM Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.01 20:24

EURUSD heads towards 200 hour MA (based on forexlive article)

The EURUSD could not keep a lid on the pair at the 1.0956 level. Sellers relented and buyers took more control. The price has now moved above the European highs and looks towards the high for the day and the 200 hour MA as the next targets (at 1.09876-89). The high from last week at 1.1008 and the 38.2% of the move down from the May 22 high comes in at 1.10129 become the next targets.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.02 06:08

EUR/USD Below 1.0950 on Greece Concerns (based on marketpulse article)

Mounting concern about Greece’s future is taking a toll on the euro — and yes, the dollar is benefiting from that — but an aggressive rally in the greenback is unlikely while U.S. data remains weak, analysts said.

The euro skidded 0.8 percent to around $1.0892 on Monday after Greece missed a self-imposed Sunday deadline to reach a deal with its lenders to unlock crucial aid. An agreement is seen as key for Greece avoiding a debt default and dodging a potential exit from the euro zone.

“We have moved from a situation where Greece really wasn’t an issue and people were not pricing it in to now, where it is becoming an issue for the euro,” Geoffrey Yu, a currency strategist at UBS, told CNBC. “I wouldn’t say the euro is going to correct massively yet, because even under a negative scenario where Greece missus a (debt) payment, Greece is largely quarantined and the risks are not systemic.”

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.02 13:59

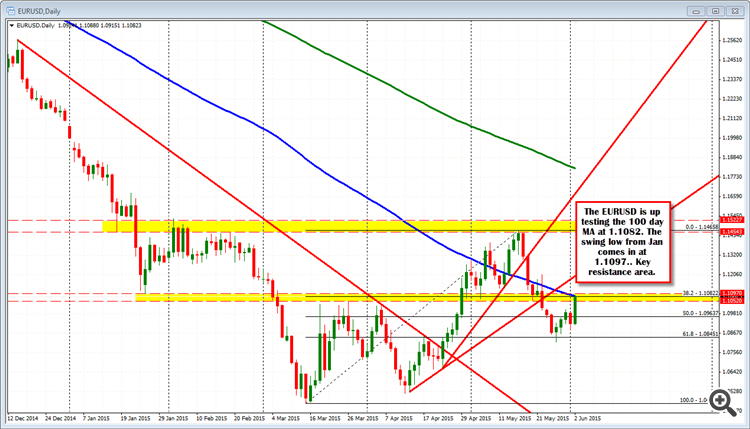

Forex technical analysis EURUSD 2 June 2015 (based on forexlive article)

"The euro is knocking on the door of an old resistance level at 1.1040. It's pretty tight around here and 1.1050 and a break above could well see us having another look at the may highs."

"We've just nudged through 1.1050 to 1.1056 as I type but have quickly dropped back below."

"The Greek news is driving the price and the story from the WSJ is yet another that gives us the impression that something is coming close. As I mentioned in that post though, it is only something coming from one side of the table and the Greek still need to decide on it. The chances are that both sides are now tinkering around the edges of a deal rather than facing any big impasses that they had previously "Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.02 18:46

Forex technical analysis: EURUSD rises on Greek deal. We have been down this road before (adapted from forexlive article)

"EURUSD has rallied today on the headlines and is currently testing the 100 day MA which comes in at the 1.1082 level. The pair has moved through the highs from March at 1.1052. This is now a level to get back below if the bears are to take back control. The swing low from Jan comes in at 1.1097. This area between 1.1082 and 1.1097 should be a tough resistance area."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

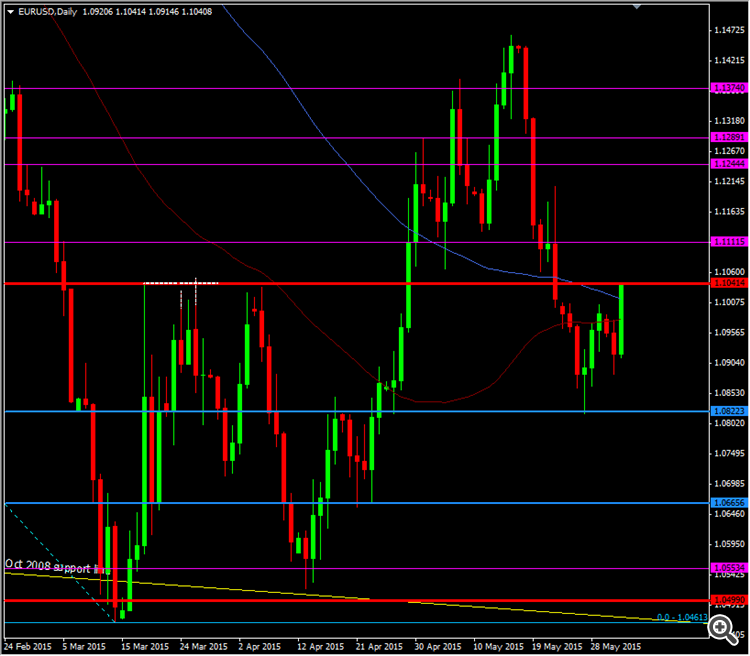

Daily price was on secondary correctional movement within the primary bulish trend for the last week. The price came to inside Ichimoku cloud/kumo, and it was stopped by 1.0818 support level and started to be ranging between 1.1325 resistance level and 1.0818 support level which is near Sinkou Span A line as bearish/bullish border on the chart.

If the price will cross 1.0818 support level together with Chinkou Span line to be crossing with the price so it will be real situation for primary global reversal of the price movement to final bearish market condition on daily timeframed price.

D1 price is on primary bullish with secondary correction:W1 price is on bearish market condition with secondary ranging between 1.0520 (W1) support level and 1.1466 (W1) resistance level

MN price is on ranging bearish with 1.0461 support level

If D1 price will break 1.0818 support level on close D1 bar so we may see the good possibility for the daily price to be reversed to the bearish in the week.

If D1 price will break 1.1325 resistance level so the bullish trend will be continuing

If not so the price will be on bullish ranging between 1.0818 and 1.1325 levels

SUMMARY : possible reversal to the bearish

TREND : breakdown