EURUSD Technical Analysis 2015, May: Bearish with Weekly Rally and Monthly Ranging with 1.0461 Key Support Level - page 4

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.05.20 01:56

Credit Agricole: Stay Short EUR/USD For 1.08 (based on efxnews article)

"The USD kicked off the week on a strong note, rising against all major currencies. The EUR failed to hold gains near the cycle high of 1.15, adding to our conviction that the single currency could move lower from here."

"We think technical factors have played an important role in the squeeze in European yields, highlighting that rate spreads should shift back in the USD’s favour. While the US economy has lost some momentum at the start of 2015, we still look for the economy to grow above trend for some time. This should help absorb excess slack, pushing the labour market closer to NAIRU by yearend. By the same token, it would only take monthly employment gains of 150k to get the unemployment rate to 5.0% by yearend."

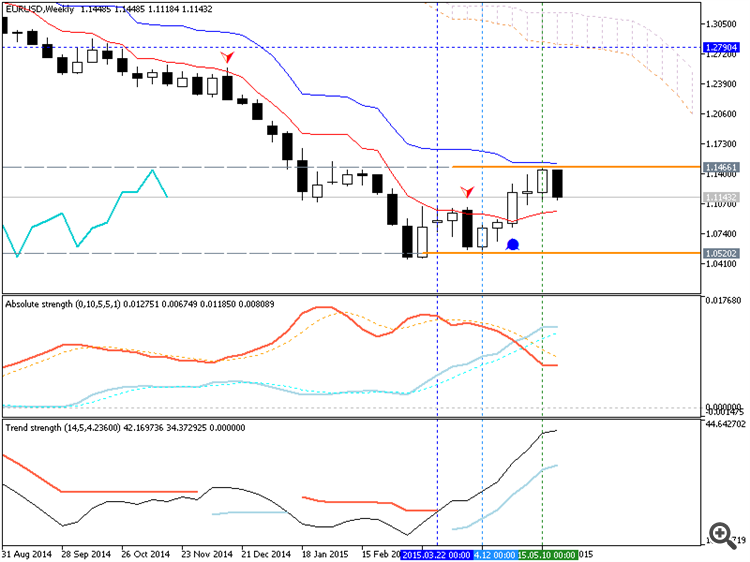

This week's candle was opened in 1.1200 and W1 price is breaking next resistance levels for now: 1.1391

So, if someone used my suggestion and opened buy stop order at 1.1240 (see first post of this thread) - it should be +180 pips in profit for now (based on 'equity open trades').

This week's candle was opened in 1.1448 after the price broke 1.1391 resistance in the last week. Next resistance level is 1.1466

W1 price is going to be ranging between 1.1448 resistance and 1.0520 support levels.

-------------

If we look at Brainwashing system setup so it is not confirmed uptrend was started on ranging:

------------

If wee use PriceChannel Parabolic system so we can get same information: market rally may be started in ranging way:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.05.20 08:53

I am not exactly sure but I think that this price movement (as 64 pips for now) is based on few news events:

"In April 2015 the index of producer prices for industrial products fell by 1.5% compared with the corresponding month of the preceding year. In March 2015 the annual rate of change all over had been –1.7%".

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.05.22 09:26

2015-05-22 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - German GDP]if actual > forecast (or previous data) = good for currency (for EUR in our case)

[EUR - German GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

"The German economy continued to grow at a slightly slower pace. As the Federal Statistical Office (Destatis) already reported in its first release of 13 May 2015, the gross domestic product (GDP) increased 0.3% - upon price, seasonal and calendar adjustment - in the first quarter of 2015 compared with the fourth quarter of 2014. A marked increase of +0.7% was recorded in the last quarter of 2014, as reported earlier. For the entire year of 2014, GDP values did not change as compared with the figures published so far (+1.6%)."MetaTrader Trading Platform Screenshots

EURUSD, M5, 2015.05.22

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 24 pips price movement by EUR - German GDP news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.05.22 10:37

Fading Global Growth View Doesn’t Faze Equities, Yen Crosses or EURUSD (based on dailyfx article)

"Investors should be wary and opportunistic speculators on alert. We revisit the risk-reward evaluation of the global capital markets and sentiment in today's Strategy Video."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.05.22 15:04

2015-05-22 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Consumer Price Index]if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate.

==========

"The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1 percent in April on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index declined 0.2 percent before seasonal adjustment.

The index for all items less food and energy rose 0.3 percent in April and led to the slight increase in the seasonally adjusted all items index. The index for shelter rose, as did the indexes for medical care, household furnishings and operations, used cars and trucks, and new vehicles. In contrast, the indexes for apparel and airline fares declined in April."

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2015.05.22

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 140 pips price movement by USD - Consumer Price Index news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.05.23 10:55

Holiday Conditions and Record Equities Remind of Bigger Liquidity Risks (based on dailyfx article)

If capital markets correct under risk aversion - inevitable over a long enough period - will the retreat be orderly or chaotic? There is usually at least a little panic in a bearish phase after a long build up, but conditions behind the current six-year bull trend suggest there may be more acute trouble when speculative appetites cool. Liquidity risks may have been fostered by the aggressive risk-taking and incredible policy intervention through these past years. We've seen how important liquidity is in the post-Lehman collapse and SNB's withdrawal of its exchange rate floor. But, what happens when the traditional outlets for safety are distorted? We consider the risks - and perhaps some opportunities - of liquidity issues in the unavoidable, next market bear wave in this weekend Strategy Video.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.05.23 12:35

Forex Weekly Outlook May 25-29 (based on forexcrunch article)

The US dollar made a comeback and the greenback was a big loser in a week that saw trends change. And now, US Durable Goods Orders, Consumer Confidence as well as UK, Canadian and US GDP data stand out. These are the highlight events in Forex calendar. Here is an outlook on the main market-movers for this week.

The Federal Reserve released minutes from its April 28-29 policy meeting, revealing the planned rate hike will not take place in June. Despite growing confidence in the US economic recovery, the recent data suggest a temporary slowdown. Weaker consumer spending, slow growth and employment data led policy makers to postpone their decision on raising rates. Fed officials were also disappointed that falling oil prices did not spur growth as anticipated and that the recent dollar softness muted inflation. The Fed has reiterated it will not raise rates until it is “reasonably confident” that prices are moving toward its 2% target. Will the US economy rebound from its recent soft patch? In the euro-zone, talk about front-loading QE hit the euro in particular. The common currency reversed its previous gains. In the UK, inflation dipped below 0% and in Japan GDP came out better than expected.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.05.23 12:56

EUR/USD forecast for the week of May 25, 2015, Technical Analysis (based on fxempire article)

The EUR/USD pair broke down during the course of the week, testing the 1.10 level for support. That’s basically where we close for the week, and this is an area that we should see support at. However, we are closing at the very bottom of the range, and that of course is a very bearish sign. This is a simple set up for us: we believe that if we get a daily close below the 1.10 handle, that the market should continue down to roughly 1.05 or so. On the other hand, if we get a supportive daily candle near the 1.10 level, we believe that the market will then bounce towards the 1.15 handle. With that being said, daily charts will probably be where you need to look for setups.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.05.24 05:39

A Fundamental Push for Key EURUSD, GBPUSD and USDJPY Levels? (based on dailyfx article)