Please consider which section is most appropriate — https://www.mql5.com/en/forum/172166/page6#comment_49114893

Your topic has been moved to the section: Expert Advisors and Automated Trading

Please consider which section is most appropriate — https://www.mql5.com/en/forum/172166/page6#comment_49114893

It has been reported back in 2021, but seems still not solved by MQ.

Forum on trading, automated trading systems, and trading strategy testing

Maximum and Relative Drawdown. MT5 Tester

Andrey Khatimlianskii , 2021.03.10 20:24

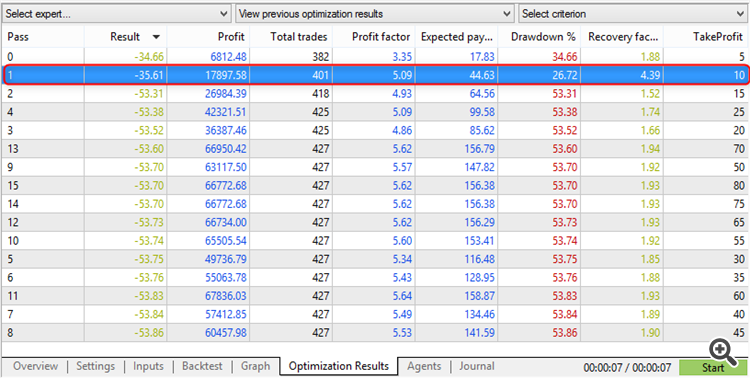

I was surprised to discover that the "DrawDown %" column in the optimization results displays a percentage corresponding to the maximum drawdown in monetary terms. This is far from always the maximum drawdown in percentage terms.

Was this intended? It would be much more useful to see the maximum drawdown as a percentage (STAT_EQUITY_DDREL_PERCENT).

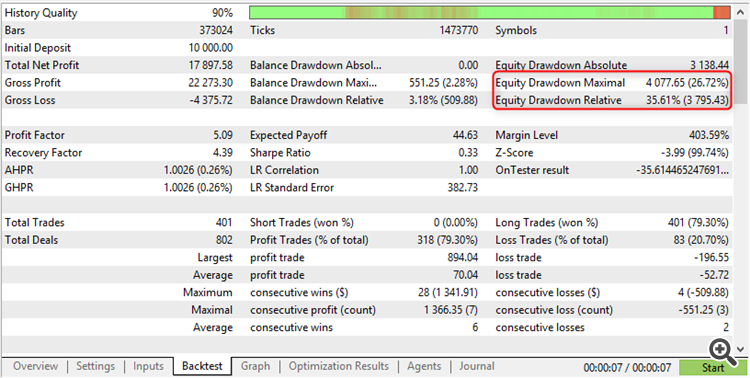

Here is an example of the results, where the maximum drawdown in money (4077.65) as a percentage (26.72%) turned out to be much less than the maximum relative drawdown (3795.43 = 35.61%):

Here's what it looks like on the chart: roughly the same (in monetary terms) drawdowns occurred with different balances:

The optimization table shows the number 26.72:

With a fixed lot these numbers will be the same, but if dynamic money management is used, the relative drawdown should take priority, in my opinion.

I have, of course, added a custom criterion (already calculated and displayed on the screenshot above), but this does not solve the problem of using the wrong drawdown when calculating other criteria.

Thinking about replacing or adding a new column with Relative DD?

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hello, I would like to bring to your attention what, in my opinion, is a relevant issue that occurs during optimization tests.

The optimizer always reports, in the Drawdown % column the value of the Equity ABSOLUTE DD (in %). I hope we can all agree that, when evaluating the risk of a setup among many options, it is riskier to have a $5,000 Equity drawdown on a $10,000 balance than a $15,000 drawdown on a $45,000 balance. So far, the Optimizer, in the case cited, reports a 33% DD while the Relative DD of 50% is ignored.

It would be a great improvement to replace the ABSOLUTE DD% with the RELATIVE DD% or, even better, to report both values.