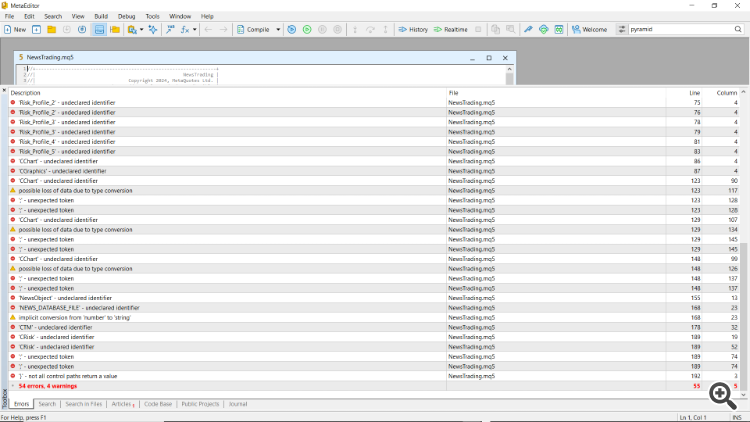

Was trying to test it but i don't know where to put al the files, so the newstrading is not compiling

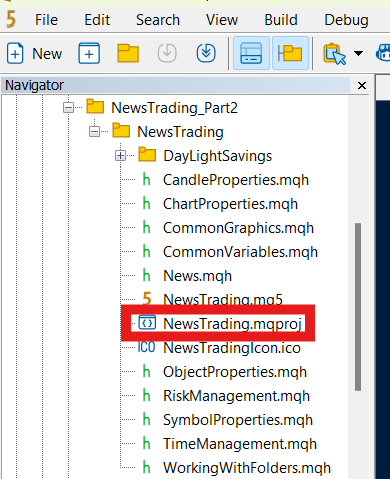

Step 1: Move the NewsTrading folder into the Experts Folder

Step 2:Open The NewsTrading Project File.

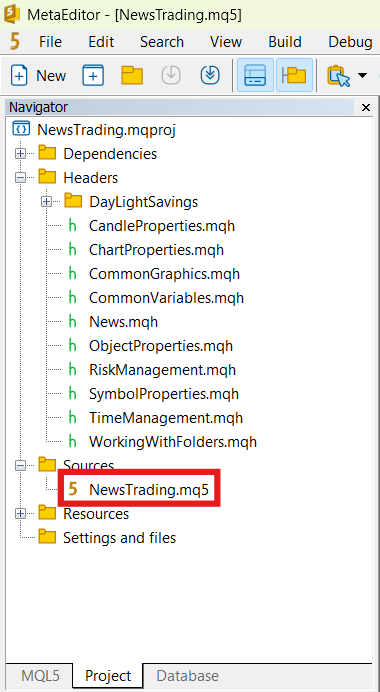

Step 3: Click on the NewsTrading mq5 file and open it.

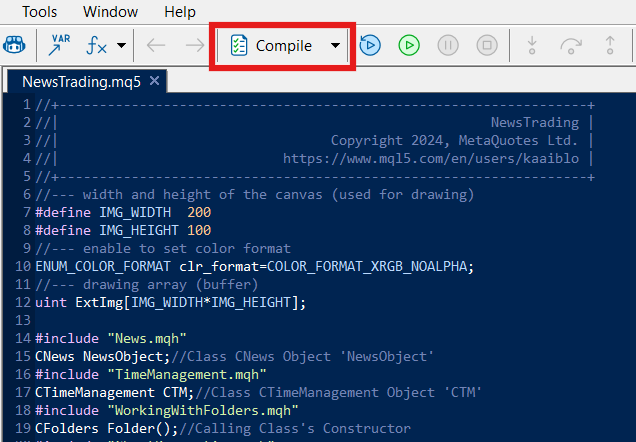

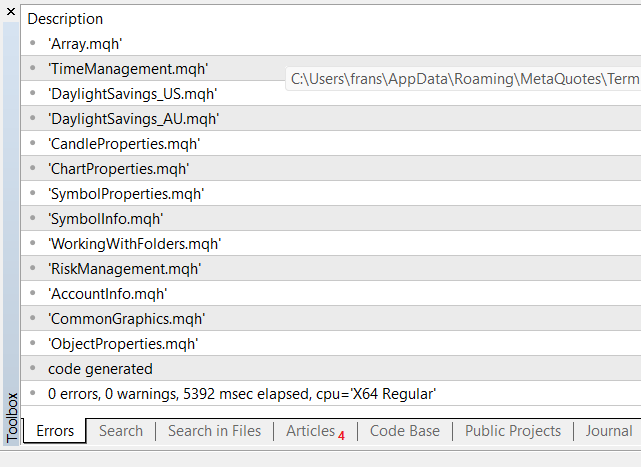

Step 4: Compile the Application.

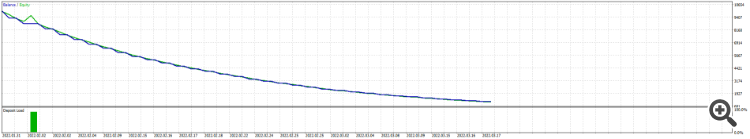

When switching Stop Loss to 0, this is what happens:

Great programming, though needs a bit of a tidy up. Really interesting article and I can see how much effort was put into it.

When switching Stop Loss to 0, this is what happens:

Great programming, though needs a bit of a tidy up. Really interesting article and I can see how much effort was put into it.

Hi Christian, thanks for the kind words. This issue has been noticed and resolved in my later articles which are still in the process of being published. In terms of the commission, are you suggesting that the expert adjust for commissions when calculating risk?

I believe factoring in commissions is an important aspect to profitability and when calculating risk, otherwise traders using automated systems may be closing out trades thinking they're in profit and realistically profit minus expenses = net profit, which reflects the real world.

If a trade is in loss or open for an extended time, the price simply returning back to your entry point is likely not going to cover costs.

Sure, in a demo account, all good for testing purposes, though most brokers charge some kind of commission, so breakeven is never going to be returning to the entry point, it will always be a few points above/below your original entry point depending on whether the broker charges both for entry and exit or whether they charge a percentage. Swaps should also be factored into any breakeven point also.

I believe that accounting for fees is an important aspect of profitability and risk calculation, otherwise traders using automated systems may close trades thinking they are in profit, when in fact profit minus expenses = net profit, which reflects the real world.

If a trade is in the red or has been open for a long time, the price simply returning to the entry point will most likely not cover the costs.

Of course, a demo account is fine for testing purposes, but most brokers charge some commission, so breakeven will never be back to your entry point, it will always be a few pips above/below your original entry point depending on whether the broker charges entry and exit fees or charges a percentage. Swaps must also be factored into any breakeven point.

Thanks for the feedback, it is appreciated!

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Check out the new article: News Trading Made Easy (Part 2): Risk Management.

In this article, inheritance will be introduced into our previous and new code. A new database design will be implemented to provide efficiency. Additionally, a risk management class will be created to tackle volume calculations.

A quick refresher for the previous article in the News Trading Made Easy series. In part 1, we went through the concept of DST(Daylight Savings Time) and the various versions for different countries that essentially change their time zones by an hour ahead and behind during a financial year. This will change trading schedules for the related brokers using DST. The reasons for creating a database and the benefits were addressed. A database was created to store the news events from the MQL5 Economic Calendar with subsequent changes to the event time data to reflect the broker's DST schedule for accurate back-testing in the future. In the project files, an SQL script results in an Excel format was provided for all the unique events accessible through the MQL5 Calendar for all the different countries.

However, in this article, we will make a few changes to our previous code in part 1. Firstly by implementing inheritance to the existing code and upcoming new code, the previous news/calendar database will get a revamp into something more useable and practical. Additionally, we will tackle risk management and create different risk profiles to choose from for users with different risk appetites or preferences.

Author: Kabelo Frans Mampa