| 10014 | TRADE_RETCODE_INVALID_VOLUME | Invalid volume in the request |

| 10015 | TRADE_RETCODE_INVALID_PRICE | Invalid price in the request |

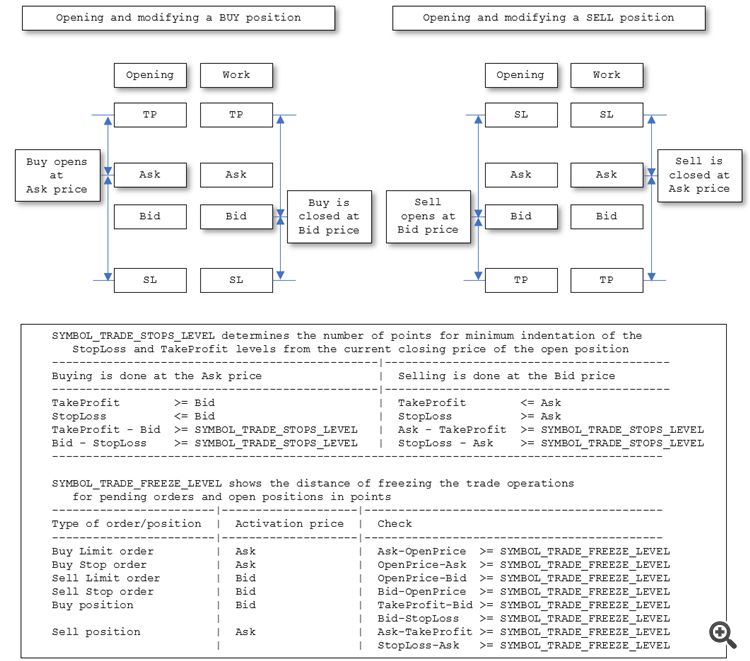

Even if it is not for market product, the following still applies. Please read it and implement it in your code ...

The checks a trading robot must pass before publication in the Market

MetaQuotes, 2016.08.01 09:30

Before any product is published in the Market, it must undergo compulsory preliminary checks in order to ensure a uniform quality standard. This article considers the most frequent errors made by developers in their technical indicators and trading robots. An also shows how to self-test a product before sending it to the Market.

Also see the following ...

Hello!

I think that you set stop loss above open price for long and below open price for short.

Also volume size should be normalized.Your method CalculatePositionSize() returns double values, don't return false value.

You're welcome

i simplified it to this and im still getting 10016 : invalid stops.

//+------------------------------------------------------------------+ //| Calculate Stop Loss | //+------------------------------------------------------------------+ double CalculateStopLoss() { double stopLoss = 0.0; int orderDirection = DetermineOrderDirection(); double highestHigh = iHigh(_Symbol, _Period, iHighest(_Symbol, _Period, MODE_HIGH, slLengthB, 0)); double lowestLow = iLow(_Symbol, _Period, iLowest(_Symbol, _Period, MODE_LOW, slLengthA, 0)); long stopLevel = SymbolInfoInteger(_Symbol,SYMBOL_TRADE_STOPS_LEVEL); long symbolDigits = SymbolInfoInteger(_Symbol,SYMBOL_DIGITS); double priceLevel = stopLevel * SymbolInfoDouble(_Symbol,SYMBOL_POINT); double askPrice = SymbolInfoDouble(_Symbol,SYMBOL_ASK); double bidPrice = SymbolInfoDouble(_Symbol, SYMBOL_BID); long spreadPoints = SymbolInfoInteger(_Symbol, SYMBOL_SPREAD); double spreadPrice = spreadPoints * SymbolInfoDouble(_Symbol, SYMBOL_POINT); double closePrice = iClose(_Symbol, _Period, 0); if (orderDirection == Long) { stopLoss = closePrice - MathAbs(((closePrice - lowestLow) * slMultiplierA) - stopLossTicks + spreadPrice); } else if (orderDirection == Short) { stopLoss = closePrice + MathAbs(((closePrice - highestHigh) * slMultiplierB) + stopLossTicks - spreadPrice); } if (stopLoss == 0.0) { PrintFormat("Failed to calculate stop loss. Check conditions or function implementation. OrderDirection: %d", orderDirection); } return NormalizeDouble(stopLoss,_Digits); } //+------------------------------------------------------------------+ //| Calculate Take Profit | //+------------------------------------------------------------------+ double CalculateTakeProfit() { double takeProfit = 0.0; int orderDirection = DetermineOrderDirection(); double highestHigh = iHigh(_Symbol, _Period, iHighest(_Symbol, _Period, MODE_HIGH, tpLengthA, 0)); double lowestLow = iLow(_Symbol, _Period, iLowest(_Symbol, _Period, MODE_LOW, tpLengthB, 0)); double closePrice = iClose(_Symbol, _Period, 0); long spreadPoints = SymbolInfoInteger(_Symbol, SYMBOL_SPREAD); double spreadPrice = spreadPoints * SymbolInfoDouble(_Symbol, SYMBOL_POINT); if (orderDirection == Long) { // Calculate takeProfit takeProfit = closePrice + MathAbs((closePrice - highestHigh) * tpMultiplierLong) + tpTicks + spreadPrice; } else if (orderDirection == Short) { // Calculate takeProfit takeProfit = closePrice - MathAbs((closePrice - lowestLow) * tpMultiplierShort) - tpTicks - spreadPrice; } else { PrintFormat("Invalid order direction. Check conditions or function implementation."); return 0.0; } return NormalizeDouble(takeProfit,_Digits); } //+------------------------------------------------------------------+ //| Calculate Position Size | //+------------------------------------------------------------------+ double CalculatePositionSize() { double accBalance = AccountInfoDouble(ACCOUNT_BALANCE); double riskAmount = accBalance * riskPercentage / 100; if(riskAmount == 0) { PrintFormat("ERROR: Get data from broker's server failed. (0)"); return 0; } return riskLots(riskAmount); } //+------------------------------------------------------------------+ //| Get distance between stop loss and open price | //+------------------------------------------------------------------+ double GetDistance() { // Function return variable double askPrice = SymbolInfoDouble(_Symbol, SYMBOL_ASK); double lotStep = SymbolInfoDouble(_Symbol, SYMBOL_VOLUME_STEP); double stopLossPrice = CalculateStopLoss(); double normalizedOpenPrice = NormalizeDouble(askPrice, _Digits); double normalizedStopLossPrice = NormalizeDouble(stopLossPrice, _Digits); double distance = MathAbs(normalizedOpenPrice - normalizedStopLossPrice); return distance; } //+------------------------------------------------------------------+ //| Calculate Max Lot Size based on Maximum Risk | //+------------------------------------------------------------------+ double riskLots(double riskAmount) { double riskRatio = riskPercentage / 100; double minLots = SymbolInfoDouble(_Symbol, SYMBOL_VOLUME_MIN); double maxLots = SymbolInfoDouble(_Symbol, SYMBOL_VOLUME_MAX); double lotStep = SymbolInfoDouble(_Symbol, SYMBOL_VOLUME_STEP); double tickSize = SymbolInfoDouble(_Symbol, SYMBOL_TRADE_TICK_SIZE); double tickValue = SymbolInfoDouble(_Symbol, SYMBOL_TRADE_TICK_VALUE); double accountValue = fmin(fmin(AccountInfoDouble(ACCOUNT_EQUITY),AccountInfoDouble(ACCOUNT_BALANCE)),AccountInfoDouble(ACCOUNT_MARGIN_FREE)); double riskValue = accountValue * riskRatio; double orderRisk = riskAmount * tickValue / tickSize; double calculateLot = fmin(maxLots,fmax(minLots,round(riskValue / orderRisk / lotStep) * lotStep)); return NormaliseLots(calculateLot); } //+------------------------------------------------------------------+ //| Lot size normalizer, round (floating point) numbers. | | //+------------------------------------------------------------------+ double NormaliseLots(double lots) { double lotsMinimum = SymbolInfoDouble(_Symbol, SYMBOL_VOLUME_MIN); double lotsMaximum = SymbolInfoDouble(_Symbol, SYMBOL_VOLUME_MAX); double lotStep = SymbolInfoDouble(_Symbol, SYMBOL_VOLUME_STEP); // Prevent too greater volume. Prevent too smaller volume. Align to Step value return fmin(lotsMaximum, fmax(lotsMinimum, round(lots / lotStep) * lotStep)); }

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

I keep getting error 10014 and/or 10016 related to the correct volume and/stop. Pls assist, i have read almost all blogs pertaining this :D