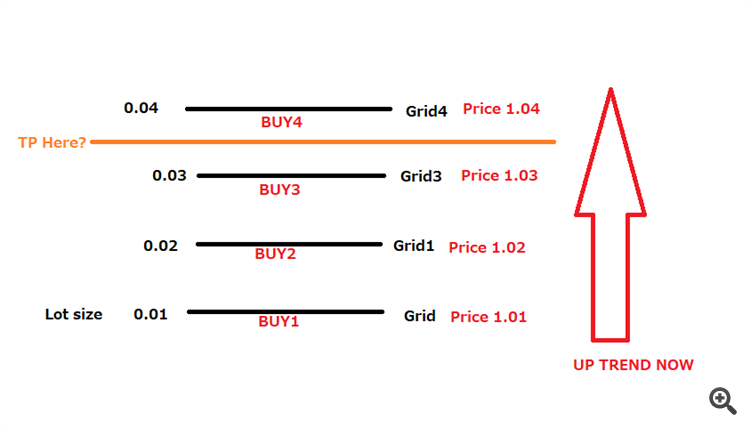

I want to make a total TP for same direction Grid order.

For example, current trend is BUY and I want to place BUY Grid1, 2, 3, 4, ......

They should be closed altogether when BUY Trend change to SELL Trend.

I expect BUY order close price is below orange line.

What will be calculation formula in this case ?

I

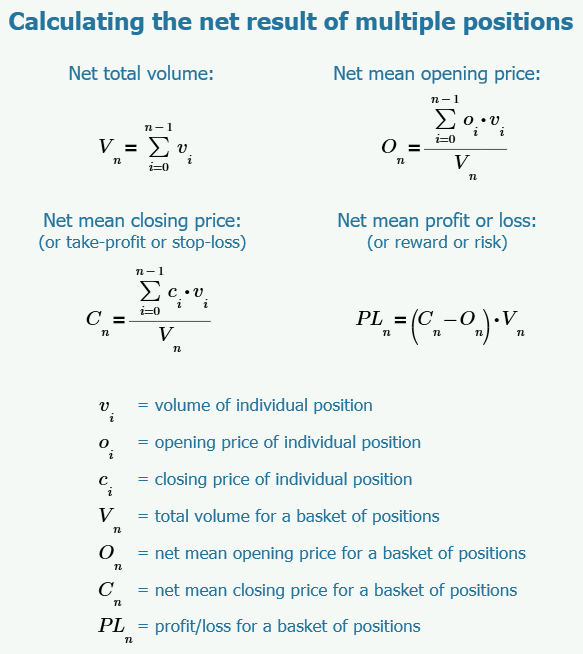

A = buy 0.01 @ 1.01

B = buy 0.02 @ 1.02

C = buy 0.03 @ 1.03

D = buy 0.04 @ 1.04

When we say A.price we mean the open price of order A

close point TP has a certain distance from all orders so

TP_A=TP.price-A.price

TP_B=TP.price-B.price

TP_C=TP.price-C.price

TP_D=TP.price-D.price

then A.tvl = the tick value for the lot (so $ per point of order A and so on)

so

TP.$=A.tvl*TP_A+B.tvl*TP_B+C.tvl*TP_C+D.tvl*TP_D;

TP.$=A.tvl*(TP.price-A.price)+B.tvl*(TP.price-B.price)+C.tvl*(TP.price-C.price)+D.tvl*(TP.price-D.price);

TP.$=A.tvl*TP.price-A.tvl*A.price+B.tvl*TP.price-B.tv*B.price+C.tvl*TP.price-C.tvl*C.price+D.tvl*TP.price-D.tvl*D.price;

A.tvl*TP.price+B.tvl*TP.price+C.tvl*TP.price+D.tvl*TP.price=TP.$+A.tvl*A.price+B.tvl*B.price+C.tvl*C.price+D.tvl*D.price;

but all these lots are for the same asset so we can say if we had a value per point per one lot

TVOL

then A.tvl= A.lot*TVOL and so on

so

TVOL*TP.price*(A.lot+B.lot+C.lot+D.lot)=TP.$+TVOL*(A.lot*A.price+B.lot*B.price+C.lot*C.price+D.lot*D.price);

TP.price=(TP.$+TVOL*(A.lot*A.price+B.lot*B.price+C.lot*C.price+D.lot*D.price))/(TVOL*(A.lot+B.lot+C.lot+D.lot));

so in theory your desired profit TP.$ price is found by the above equation

For TP.$=$0 and TVOL 1$ (break even)

TP.price=(0+(0.01*1.01+0.02*1.02+0.03*1.03+0.04*1.04))/(0.01+0.02+0.03+0.04);

TP.price=(0.0101+0.0204+0.0309+0.0416)/(0.1);

TP.price=(1.03)

I want to make a total TP for same direction Grid order.

For example, current trend is BUY and I want to place BUY Grid1, 2, 3, 4, ......

They should be closed altogether when BUY Trend change to SELL Trend.

I expect BUY order close price is below orange line.

What will be calculation formula in this case ?

I

A = buy 0.01 @ 1.01

B = buy 0.02 @ 1.02

C = buy 0.03 @ 1.03

D = buy 0.04 @ 1.04

When we say A.price we mean the open price of order A

close point TP has a certain distance from all orders so

TP_A=TP.price-A.price

TP_B=TP.price-B.price

TP_C=TP.price-C.price

TP_D=TP.price-D.price

then A.tvl = the tick value for the lot (so $ per point of order A and so on)

so

TP.$=A.tvl*TP_A+B.tvl*TP_B+C.tvl*TP_C+D.tvl*TP_D;

TP.$=A.tvl*(TP.price-A.price)+B.tvl*(TP.price-B.price)+C.tvl*(TP.price-C.price)+D.tvl*(TP.price-D.price);

TP.$=A.tvl*TP.price-A.tvl*A.price+B.tvl*TP.price-B.tv*B.price+C.tvl*TP.price-C.tvl*C.price+D.tvl*TP.price-D.tvl*D.price;

A.tvl*TP.price+B.tvl*TP.price+C.tvl*TP.price+D.tvl*TP.price=TP.$+A.tvl*A.price+B.tvl*B.price+C.tvl*C.price+D.tvl*D.price;

but all these lots are for the same asset so we can say if we had a value per point per one lot

TVOL

then A.tvl= A.lot*TVOL and so on

so

TVOL*TP.price*(A.lot+B.lot+C.lot+D.lot)=TP.$+TVOL*(A.lot*A.price+B.lot*B.price+C.lot*C.price+D.lot*D.price);

TP.price=(TP.$+TVOL*(A.lot*A.price+B.lot*B.price+C.lot*C.price+D.lot*D.price))/(TVOL*(A.lot+B.lot+C.lot+D.lot));

so in theory your desired profit TP.$ price is found by the above equation

For TP.$=$0 and TVOL 1$ (break even)

TP.price=(0+(0.01*1.01+0.02*1.02+0.03*1.03+0.04*1.04))/(0.01+0.02+0.03+0.04);

TP.price=(0.0101+0.0204+0.0309+0.0416)/(0.1);

TP.price=(1.03)

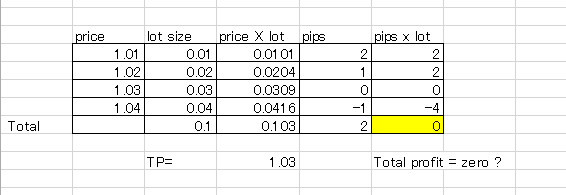

Hello, thank you for your info.

But based on this formula, I see total profit is zero, can you see below figure ?

Yes, according to the maths I provided, the Net Opening Price for your batch is 1.03, which is the Break-Even level of zero profit/loss.

To make a profit, your Take-profit level will then have to be set above the 1.03 price level.

Hello, thank you for your info.

But based on this formula, I see total profit is zero, can you see below figure ?

Yes , i got the same result when i asked the formula which price will give me 0$ (1.03)

You have an issue in trailing the scale in ? There might be things to consider given price increases linearly but your p+l behavior changes with every new order

As Darren said with this scaling your BE will move closer to the edge (if i'm not mistaken)

(and also mq , it would be helpful if i could scroll on the list that pops up when i type @ , and . doesn't work on the tags , and also inform the user someone tagged him)

Yes, you can also do that in Microsoft Word (with the equation editor), but what I provided was actually from PTC Mathcad (software for engineering calculations).

Yes, according to the maths I provided, the Net Opening Price for your batch is 1.03, which is the Break-Even level of zero profit/loss.

To make a profit, your Take-profit level will then have to be set above the 1.03 price level.

I see.,,,,,

So to get profit, just add xxx TP (pips) value in there?

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

I want to make a total TP for same direction Grid order.

For example, current trend is BUY and I want to place BUY Grid1, 2, 3, 4, ......

They should be closed altogether when BUY Trend change to SELL Trend.

I expect BUY order close price is below orange line.

What will be calculation formula in this case ?

I