Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.20 17:40

Forex Weekly Outlook March 23-27Inflation data in the UK and the US, housing data from the US, German Ifo Business Climate, US Core Durable Goods Orders, Us Unemployment Claims and Stephen Poloz’ speech. These are the highlights of this week. Follow along as we explore the Forex market movers.

Last week, The Federal Reserve removed the word “patient” from its policy statement, increasing the odds for a rate hike in the coming months. However, the Fed also downgraded its economic growth and inflation projections. The Policy makers’ rate hike decision depends on mixed economic data, on one-hand strong job gains and robust consumer demand, while on the other hand, falling oil prices and a strong dollar, reducing exports and lowering inflation. Will the Fed raise rates on its June meeting?

- Mario Draghi speaks: Monday, 14:30. ECB President Mario Draghi will testify before European Parliament’s Economic and Monetary Affairs Committee, in Brussels. He may talk about the new QE program aimed to boost growth in the euro countries and about his growth prospects for the bloc. Market volatility is expected.

- UK inflation data: Tuesday, 9:30. UK inflation declined to the lowest level on record, reaching 0.3% in January, compared to 0.5% in December 2014, amid a sharp depreciation in global oil prices as well as falling food costs. Most economists were not concerned about this drop since core CPI excluding the more volatile prices such as food and energy actually rose to 1.4% in January. Inflation is expected to decline further to 0.1%.

- US inflation data: Tuesday, 12:30. US consumer price index declined 0.7% in January after dropping 0.3% in November and December. Energy prices shed 9.7% while the gasoline index plunged 18.7%. However, excluding the volatile food and energy sectors, core inflation increased 0.4% in January and over 2% on a yearly base. However, economists believe the subdued inflation is temporary held down by the sharp fall in oil prices. Analysts expect consumer prices to gain 0.2%, while core prices to increase by 0.1%.

- US New Home Sales: Tuesday, 14:00. New U.S. single-family home sales declined only mildly in January, reaching 481,000 from 482,000 in December, despite bad weather conditions in winter. Economists expected a decline to 471,000 in January. Analysts believe the housing market will continue to recover in the coming months due to stronger employment data. US new home sales are expected to reach 475,000 in February.

- Eurozone German Ifo Business Climate: Wednesday, 9:00. German business sentiment improved in February to 106.8 from 106.7 in January. The reading was below market expectations, but the continuous growth suggests rising confidence in light of economic growth and optimism over European Central Bank stimulus. German growth was boosted by lower oil prices as well as a weaker euro. However, the Greek ordeal still clouds business sentiment. Business climate is expected to rise further to107.4.

- US Core Durable Goods Orders: Wednesday, 12:30. Orders for durable goods edged up in January for the first time in three months, rising 2.8% suggesting the manufacturing sector is stabilizing. The reading was higher than the 1.7% increase forecasted by analysts and was preceded by a 3.3% fall in December 2014. Meanwhile Core durable goods orders excluding transportation items increased 0.3%. Durable goods orders are expected to gain 0.6%, while core orders are predicted to rise 0.5%.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing new claims for unemployment benefits increased by 1000 last week, reaching 291,000, indicating the job market remains strong. The four-week moving average, rose 2,250 to 304,750 last week. Despite some volatility, the number of claims still indicate a growth trend in the US labor market. The number of jobless claims is expected to reach 295,000 this week.

- Stephen Poloz speaks: Thursday 13:30. BOC Governor Stephen Poloz is scheduled to speak at a press conference in London. Poloz may refer to the recent BOC surprising rate cut decision, following the global oil price crush and its possible effect on the Canadian economy.

- US Final GDP: Friday, 12:30. Following an incredible growth rate of 5% in the third quarter of 2014, the last three months of 2014 are expected to be much weaker. According to the preliminary GDP reading for the fourth quarter, growth reached 2.2%. Analysts expect the final reading to be 2.4%.

- Janet Yellen speaks: Friday, 19:45. Federal Reserve Chair Janet Yellen will speak in San Francisco and talk about the Fed’s monetary policy. On the last policy meeting the Fed omitted the word “Patience” from the statement, preparing markets for a near rate hike despite lowering its forecast on growth and inflation. Market volatility is expected.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.23 11:31

2015-03-23 10:00 GMT (or 12:00 MQ MT5 time) | [EUR - Greece Current Account]- past data is -0.870B

- forecast data is n/a

- actual data is -0.847B according to the latest press release

if actual > forecast (or previous data) = good for currency (for EUR in our case)

[EUR - Greece Current Account] = The current account, released by the Bank of Greece is a net flow of current transactions, including goods, services and interest payments into and out of Greece. A current account surplus indicates that the flow of capital into Greece exceeds the capital reduction. A high reading is seen as positive (or bullish) for the Euro, whereas a low reading is seen as negative (or bearish).

==========

Greek current account deficit widens in January

Greece's current account deficit widened in January compared to the same month a year earlier while tourism receipts rose slightly, according to central bank data published on Monday.

The deficit stood at 0.85 billion euros ($917 million) versus a deficit of 0.34 billion euros in January 2014, mainly due to a drop in the export of goods.

Tourism revenues rose slightly to 170 million euros in January from 156 million euros in the same month in 2014.

KEY FIGURES (bln euros) 2015 2014

January -0.847 -0.336

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 61 pips price movement by EUR - Greece Current Account news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.23 18:39

2015-03-23 16:20 GMT (or 18:20 MQ MT5 time) | [USD - FOMC Member Fischer Speech]- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[USD - FOMC Member Fischer Speech] = Due to deliver a speech titled "Monetary Policy Lessons and the Way Ahead" at the Economic Club of New York. Federal Reserve FOMC members vote on where to set the nation's key interest rates and their public engagements are often used to drop subtle clues regarding future monetary policy.

==========

"As the FOMC responds to incoming information, it will continue to be absolutely transparent in explaining its decisions and how and why they contribute to meeting the legally mandated dual goals of monetary policy. That transparency serves three purposes: First, it is required if we are to be accountable to the public; second, it is the best way of ensuring that monetary policy decisionmakers continue to follow sensible and rational policies; and third, it is the best way of informing the private sector of the basis on which monetary policy decisions are made and will continue to be made.

With respect to forward guidance: its role has been and continues to be important in the long period in which eventual liftoff has been the key interest rate decision confronting the FOMC and the focus of market expectations. However, as monetary policy is normalized, interest rates will sometimes have to be increased, and sometimes decreased. Market participants will be able to form their expectations of future interest rates on the basis of three elements: first, the policy record of the FOMC, which might be approximated as a reaction function; second, their analysis of the current economic and financial situation and outlook; and, third, whatever guidance the FOMC will provide as to how it sees monetary policy decisions likely to unfold given the economic situation and outlook. It is likely that explicit long-term forward guidance will play less of a role in monetary policy after liftoff than it has during the past few years.

Policymakers' behavior is sometimes summarized as a reaction function, which can be an algebraic description of how the interest rate is set--for instance, a Taylor-type rule in which the federal funds rate reacts simultaneously to the rate of inflation and expectations of inflation as well as to the rate of unemployment and expected changes in the level of unemployment.21 However, a simple rule of that sort will, by necessity, leave out many factors that appropriately influence monetary policy, such as financial developments, temporary divergences in relationships between different measures of economic activity or inflation, and the like. A simple rule can provide the starting point for the decisions made by the FOMC, but in reaching their interest rate decision, members of the Committee will always have to use their judgment to identify the special circumstances confronting the economy, and how to react to them.

To ensure that monetary policy operates in as stabilizing a way as possible, the FOMC will continue to set out, as clearly as it can, the basis of every decision that it makes, and to provide guidance on its expectations of future decisions. And on the basis of the information provided by the FOMC, of their understanding of the historical record of Fed policy decisions, and of their analysis and expectations of the state of the economy and, particularly, the financial markets, market participants will make the best decisions they can"

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 47 pips price movement by FOMC Member Fischer Speaks news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.20 19:22

The euro is going bananas (based on businessinsider article)

The euro is climbing against the dollar again on Friday, rising more than 1.7% to as high as $1.085 as of around 12:40 pm ET.

The euro spiked against the dollar when the Fed's latest decisions came out, as the US central bank looked less likely to hike rates in June (which would typically strengthen the dollar).

As it stands so far, the euro's depreciation bottomed out five days

ago, below $1.05. A lot of people are still expecting parity by the end

of 2015.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.24 10:50

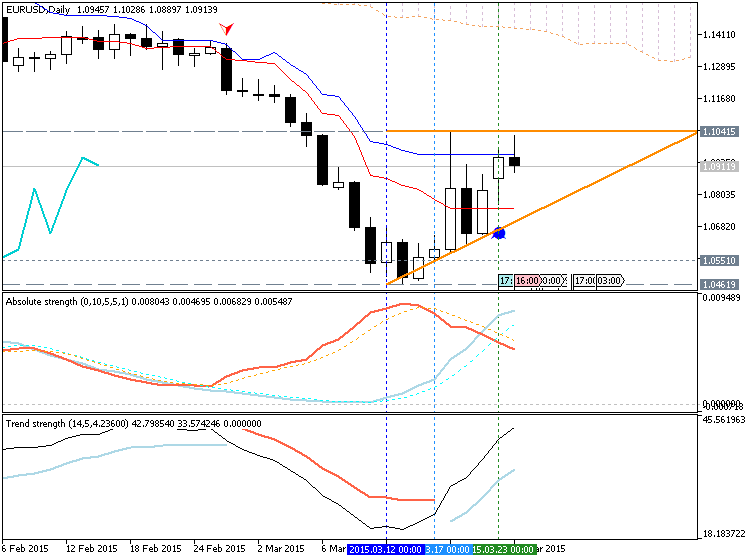

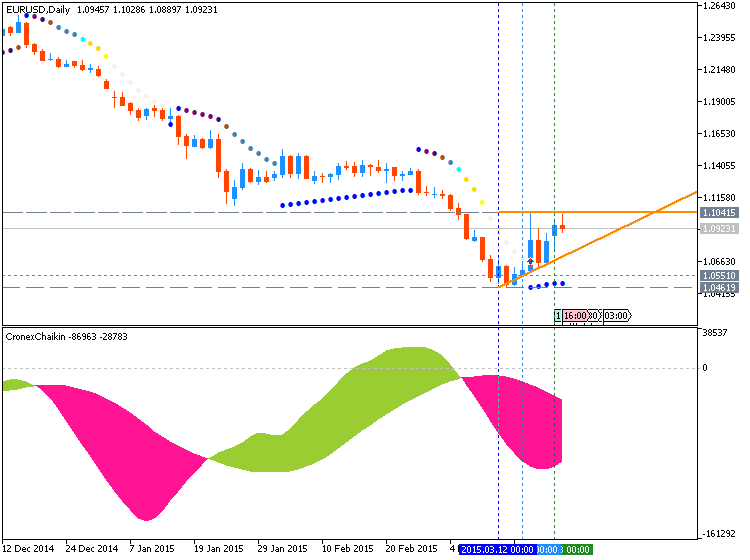

EUR/USD continues higher (based on finances.com article)

- EURUSD continued to race higher and hit resistance at 1.0970 (R1). The rate is still trading above the prior short-term downtrend line taken from the peak of the 26th of February and above the uptrend line drawn from the low of the 13th of March, therefore I would consider the short-term bias to remain positive. Although we may experience a minor retreat, I would expect the next leg up to challenge the resistance hurdle of 1.1045 (R2). As for the broader trend, the price structure still suggests a longer-term downtrend. EURUSD is printing lower peaks and lower troughs below both the 50- and the 200-day moving averages. Therefore, I would treat the near-term uptrend or any possible extensions of it as corrective move of the larger down path.

- Support: 1.0885 (S1), 1.0765 (S2), 1.0700 (S3).

- Resistance: 1.0970 (R1), 1.1045 (R2), 1.1160 (R3)

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.24 13:40

2015-03-24 12:30 GMT (or 14:30 MQ MT5 time) | [USD - CPI]- past data is -0.7%

- forecast data is 0.2%

- actual data is 0.2% according to the latest press release

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate.

==========

Consumer Price Index Summary

"The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in February on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index was unchanged before seasonal adjustment.

The seasonally adjusted increase in the all items index was broad-based, with increases in shelter, energy, and food indexes all contributing. The energy index rose after a long series of declines, increasing 1.0 percent as the gasoline index turned up after falling in recent months. The food index, unchanged last month, also rose in February, though major grocery store food group indexes were mixed.

The index for all items less food and energy rose 0.2 percent in February, the same increase as in January. In addition to shelter, the indexes for used cars and trucks, apparel, new vehicles, tobacco, and airline fares were among those that increased. The medical care index was unchanged, while the personal care index declined.

The all items index was unchanged over the past 12 months, after showing a 0.1-percent decline for the 12 months ending January. Over the last 12 months the food index rose 3.0 percent and the index for all items less food and energy increased 1.7 percent. These increases were offset by an 18.8-percent decline in the energy index."

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 55 pips price movement by USD - CPI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.24 15:51

Euro gains against dollar on robust PMI surveys (based on reuters article)

Robust French, German PMIs help euro

Fed's Williams repeats mid-year rate rise may be appropriate

Dollar still feeling impact of last week's dovish Fed statement

- Aussie slips briefly after weak China flash HSBC PMI

The euro rose for the third day

running against the dollar on Tuesday, bolstered by

better-than-expected euro zone business surveys that pointed to

a broader recovery taking place in the currency bloc.

The dollar was under pressure, with investors awaiting consumer price inflation data later in the day. A softer number, as was registered earlier on Tuesday in Britain, could boost expectations that the Federal Reserve will be in no hurry to raise interest rates.

San Francisco Fed chief John Williams weighed in on the

debate over the dollar's gains, saying the U.S. economy could

handle a stronger currency and pointing to the chance of an

interest rate rise in June.

Other Federal Reserve officials, and new forecasts from the U.S. central bank, have cast doubt on how much more appreciation of the dollar the Fed will easily tolerate and raised speculation it will push back any tightening of monetary policy.

"The bigger question of whether the economic recovery has

any legs remains unanswered," Societe Generale analysts said in

a note.

"In the meantime, after breaking above key resistance at $1.0940 yesterday, the euro's next technical target is $1.1070 and we'd be more interested in re-selling there than in looking for much follow-though from this morning's initial weakness."

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.25 04:05

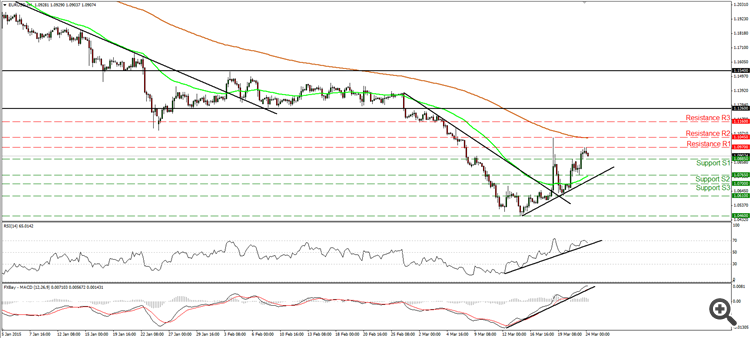

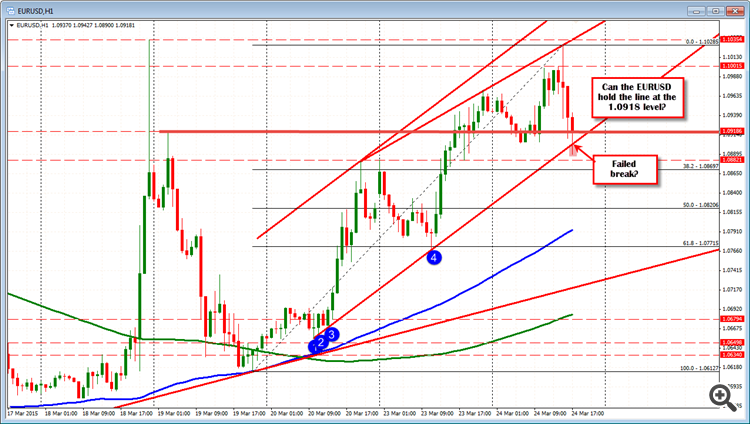

I don't trust the market, but EURUSD at a key test (based on forexlive article)

"There was talk of a large 1.0900 strike option expiry. That expired and opened the door for further freedom.The

price moved below the lower trend line on the hourly chart and made new

lows. The price correction higher has taken the pair back toward the

high corrective price from the day after the FOMC spike at the 1.0918

(see red horizontal line). If the rally can stall here, the seller may

have more control. If it does not, the bias should reverse."

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video March 2015

newdigital, 2015.03.25 10:53

Video: Euro Traders Should Watch Greece’s Financial Health Closely

- Frequent recessions, excessively high unemployment and a large debt load are Greek burdens

- However, the real risk to the country and the Euro is a financial crisis

- A liquidity crisis can occur in Greece without the Troika's influence

The Euro has tumbled on the sharp move towards accommodation from the ECB. While a dovish policy trend from the central bank will keep the pressure on the currency, another round of panicked selling behind the currency is unlikely to occur on a monetary policy basis. Rather, it is likely to come through financial trouble. And, Greece is staring at imminent trouble. The country's leaders are scrambling to come up with reforms that would open up funds from its creditors to offer a medium-term chance to pay down its debts while also supporting growth. However, the risk may be more severe and imminent than many expect. A financial crisis may explode before officials come up with a solution. We discuss the risk Greece poses to the Euro and what to watch in today's Strategy Video.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.25 14:09

2015-03-25 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Durable Goods Orders]- past data is 2.0%

- forecast data is 0.4%

- actual data is -1.4% according to the latest press release

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods. It's a leading indicator of production - rising purchase orders signal that manufacturers will increase activity as they work to fill the orders.

==========

U.S. Durable Goods Orders Show Unexpected Decrease In February

With orders for transportation equipment showing a notable pullback, the Commerce Department released a report on Wednesday showing that new orders for U.S. manufactured durable goods unexpectedly decreased in the month of February.

The report said durable goods orders fell by 1.4 percent in February following a downwardly revised 2.0 percent increase in January.

The drop in orders came as a surprise to economists, who had expected orders to climb by 0.7 percent compared to the 2.8 percent jump that had been reported for the previous month.

Excluding a 3.5 percent drop in transportation orders, durable goods orders still fell by 0.4 percent in February after sliding by 0.7 percent in January. Ex-transportation orders had been expected to rise by 0.3 percent.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 40 pips price range movement by USD - Durable Goods Orders news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

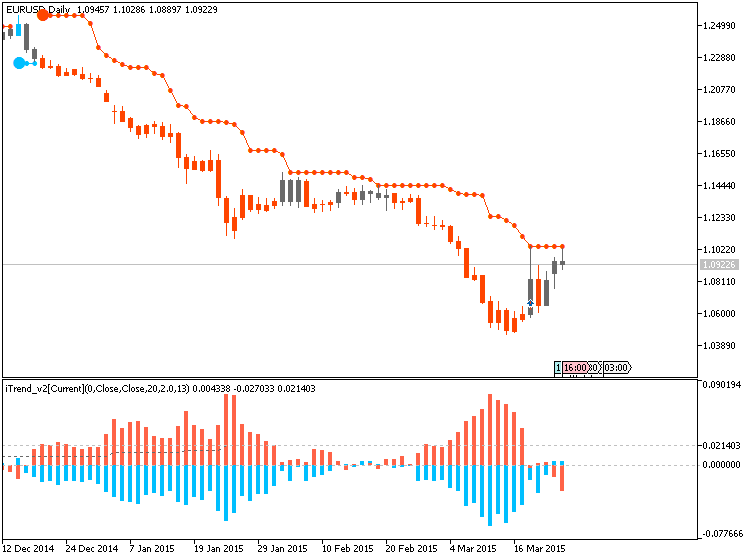

W1 price is on bearish ranging with 1.0461 support level

MN price is on bearish for breaking 1.1097 support level on open MN1 bar

If D1 price will break 1.0461 support level on close D1 bar so the primary bearish will be continuing (good to open sell trade)

If D1 price will break 1.1041 resistance level so we will have the secondary market rally within the primary bearish market condition

If not so it will be bearish ranging between 1.0461 and 1.1041 levels

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2015-03-23 14:00 GMT (or 16:00 MQ MT5 time) | [EUR - ECB President Draghi Speech]

2015-03-23 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Existing Home Sales]

2015-03-23 16:20 GMT (or 18:20 MQ MT5 time) | [USD - FOMC Member Fischer Speech]

2015-03-24 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2015-03-24 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - French Manufacturing PMI]

2015-03-24 08:30 GMT (or 10:30 MQ MT5 time) | [EUR - German Manufacturing PMI]

2015-03-24 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Manufacturing PMI]

2015-03-24 12:30 GMT (or 14:30 MQ MT5 time) | [USD - CPI]

2015-03-24 14:00 GMT (or 16:00 MQ MT5 time) | [USD - New Home Sales]

2015-03-25 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - German Ifo Business Climate]

2015-03-25 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Durable Goods Orders]

2015-03-26 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

2015-03-26 13:00 GMT (or 15:00 MQ MT5 time) | [USD - FOMC Member Lockhart Speech]

2015-03-27 10:30 GMT (or 12:30 MQ MT5 time) | [USD - FOMC Member Fischer Speech]

2015-03-27 12:30 GMT (or 14:30 MQ MT5 time) | [USD - GDP]

2015-03-27 19:45 GMT (or 21:45 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movement

SUMMARY : bearish

TREND : ranging