You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

depends on the type of activity, I know for sure that trade in building materials in a shop of about 200 sq.m. gives such a turnover in the seasonal months, but if there is no own retail space, then rent will eat a decent portion of income, and the costs there are also not small, at least 5 people need to keep, well, and therefore taxes on all pay

If the kind of activity associated with construction services, there decently eats equipment rental, few of the small IE can afford to keep spets.Technics (crane and crane operator, etc.), the maximum universal driver, who "and the seamstress, and reaper, and to the withers - Many companies have machines at hand, but often without a driver with a valid license.

The idea is that with simplified taxation nobody knows how much is spent and how much is received - the amount received in the account, from which 6 percent is deducted. For instance, you buy something for 90 р., sell it for 100 р., the tax is calculated from the sum of 100р. There are more complicated forms of taxation, you can calculate profit and only tax is deducted from it, in this example, the tax is deducted from 10 rubles.

If services, then the simplified tax is very beneficial. But if trade, not so much.

If services, the simplified system is very profitable. But if it's trade, not so much.

I don't want to ask my spouse, she does it, but I remember that it is not that simple - you want a sole proprietorship, you don't want a LLC, you want a simplified tax system, you don't want, you get an imputed tax - it depends on the turnover that you are ready to show, in my opinion it was about 10 million turnover per year - it seems that the maximum for a sole proprietorship, then you have to open a LLC, or as they say "sole proprietorship plus LLC" - who knows about it nowadays - ))))

The point is that under simplified taxation, no one is concerned about how much is spent and how much is received - what amount is credited to the account, and 6 percent is calculated on it.

There are two types of simplified taxation, you can choose. If on income, the rate is 6 per cent. You can choose 'income minus expenditure' - a rate of 15 per cent.

I was not given one, in spite of my income. In an informal conversation, they said that entrepreneurs and lawyers are not allowed, as there is no certainty of a steady income

the project is gaining momentum, so far only in the regions

the project is gaining momentum, so far only in the regions

The accounting terminology is horrible. Lots of articles on the internet, everyone's different.

It turns out that there is no such thing as turnover, it's a household term.)

By income some people mean one thing, others mean another, somewhere even profit is called income (but then reason just suggests that this is income and is). Somewhere, instead of just income, there is the term "USN income".

In short, no one knows what income is, so its calculation is regulated by the tax code. As always with laws, you can think what you like, but the reality is beyond reason. So, Tax Code Article 248:

For the purposes of this chapter , proceeds from the sale of goods (works, services) both of own production and previously acquired, proceeds from the sale of property rights shall be recognised as income from sale.

Well... They said to consider this as income, let's consider this as income.

After all, correctly said the professor of philology at the Higher School of Economics about the modern Russian language)).

Anyway:

Decided to ask the accountants about the nuances. It's complicated because of the conversion of receipts from customers. Service Desk is still silent.

Here is the answer from my accountant support in the service My Business.

Hello!

All cash receipts from IE you are required to reflect in rubles at the Central Bank exchange rate on the date of receipt of proceeds from buyers without deduction of payment system fee. By analogy, the income of an individual must also be taken into account and taxed at the rate of 13%.

Therefore, in the situation referred to in the question, you must recognise income on the date the foreign payment service receives the funds, in the amount from buyers/customers (without deducting the commission), at the exchange rate of the Central Bank.

Subsequent transfer of funds from the payment system to your personal account is merely a transfer of money, which does not trigger either the moment of receipt or the moment of expenditure for taxation purposes.

In this case additional income for taxation is a positive exchange rate difference from the sale of foreign currency (when the Central Bank exchange rate on the date of receipt in the payment system was lower than the Central Bank exchange rate on the date of sale of foreign currency, i.e. on the date of transfer of funds from the payment system to the current account of the individual in roubles or to the card of the individual in roubles).

For correct accounting you should reflect incoming funds from clients using the followinginstruction, reflecting a foreign service as a payment system in the Service.

1. transaction of receipt into the payment system

On the basis of this transaction in the IE accounting will be formed income in the amount of funds paid by the clients from which the tax will be calculated.

As mentioned above, if the payment is made in foreign currency, then the income should be entered into Service in rubles, recalculated at the Central Bank exchange rate on the date of entering the money.

2. withdrawal transaction from the payment system

This is how the funds transfer operation should look like from the payment system to the P/S of IE or to the card which details should be reflected in "Current accounts".

Please also reflect such transaction in rubles. 3.

Payment system commission fee 3.

This operation is used to record the fee paid for your payments. When applying the simplified taxation system "Income minus expenses", you are entitled to include it in expenses for tax purposes.

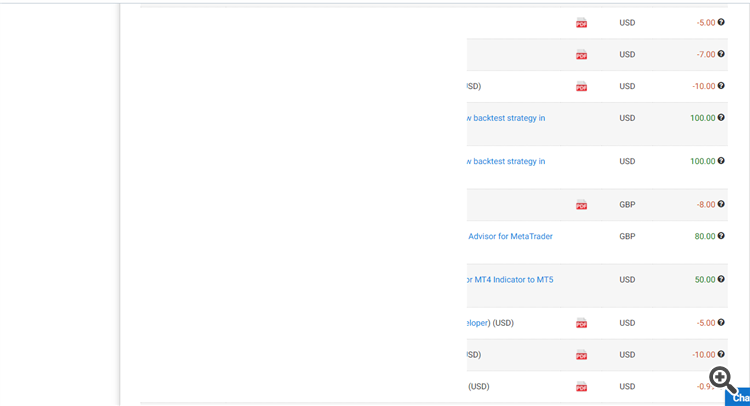

Alas, all of the income on the payments page is already shown minus the fee. So it is left to declare either figures other than those provided on the payments page, or already minus the commission.

Question for Metakvot, why not show the commission on the payments page, as is done on other sites?

Alas, all of the income on the payments page is already shown minus the fee. So you either have to declare figures other than those provided on the payments page, or already minus the commission.

Question for Metakvot, why not show the commission on the payments page as they do on other sites?

Wrong fee.