What is the fundamental difference between these concepts?

If there is overshoot on multiple passes regardless of the forward application, it is a fit.

What is the fundamental difference between these concepts?

Yes, colleagues are right! Any optimisation is a fitting to the story!

And here comes another problem: What is the method to determine the QUALITY of the resulting parameters in the optimization?

My opinion: forward test is not enough to determine optimization quality...

Yes, colleagues are right! Any optimisation is a fitting to the story!

And here comes another problem: How to determine the QUALITY of obtained parameters during optimization?

My opinion: a forward test is not enough to determine the quality of optimization...

I have been dealing with this issue for a year now.

This very characteristic, in my opinion, should be called "sustainability" rather than "quality".

That is, not the "beauty" or "quantity" of the result, but its ability not to change with small changes in the market.

However, I personally try to measure this parameter by the results of the forward test. The results are, alas, very modest.

Optimisation is the search for an optimum, usually a global one. That is, it is a search for stable system parameters. It can turn into a fitting if a local optimum is found and\or the dimensionality of the parameters to be optimised is too large.

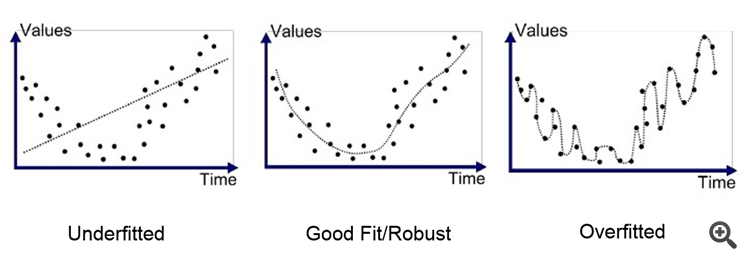

There is good optimization, under-optimization and over-optimization. Over-optimization can be equated with a history matching.

Optimization must be performed in one pass, in the same Expert Advisor body at the first start before the start of trading, and then during the trading process only optimized parameters should be corrected. The optimization is performed by a special internal separate block of the Expert Advisor that calculates parameters instead of going through them. In this case, the parameters can be made private and visible only to the Expert Advisor, as they are self-adjusting (self-optimizing).

If there is an overshoot on multiple passes regardless of the forward application, it is a fit.

In general, it is the wrong way round.

there is good optimisation, under-optimisation and over-optimisation.

Recall the Good Fit criterion, in a nutshell?

the most acceptable acuraci with the least number of parameters, in 2 words

this is without regard to forwards and other things, because the question was what the difference between the two concepts is

if it's a forward, it's a balance of errors, etc. Forward automatically removes overoptimization of the first section, almost probably

And then there are the statistics, which have nothing to do with the optimisation process... general populations, representative samples, etc.the most acceptable acuraci with the least number of parameters, in 2 words

this is without regard to forwards and other things, because the question was what the difference between the two concepts is

if it's a forward, it's a balance of errors, etc. Forward automatically removes overoptimization of the first section, almost probably

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use