GOLD Technical Analysis 2015, 22.02 - 01.03: Bullish Breakout or Bullish Ranging with 1306.82 Key Resistance

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.20 18:05

Forex Weekly Outlook February 23-27

German Business sentiment, Mario Draghi and Janet Yellen’s speeches,

US Consumer Confidence, US New Home Sales, Inflation data and GDP data

from the US and the UK. These are the major events on our Forex

calendar. Here is an outlook in the highlights of this week.

Last week, the Greek drama remained at the center of attention without

reaching resolution as Germany opposed the bailout extension proposed by

Greece. From the US: Jobless claims release came out better than

expected with a 21,000 fall to 283,000 claims and the 4-week moving

average declined to 283,250, indicating the US labor market is gathering

momentum. Other US events were more disappointing such as the Philly

Fed index falling to 5.2 from 6.3 while expected to reach 8.8. The FOMC

minutes release remained on the same note, reiterating patients

regarding the rate hike option. Will the EU reach agreement with Greece

this week?

Eurozone German Ifo Business Climate: Monday, 9:00. German

business moral edged up for the third straight month in January,

reaching 106.7 from 105.5 in December, in line with market forecast. The

weak euro boosted exports and is expected to continue its decent amid

the fresh bond buying program initiated by the ECB to spur growth.

Stronger German growth will help the Euro-area out of its sluggish

state. German business is expected to rise further to107.4.

Mario Draghi speaks: Tuesday, 14:00, Wednesday 14:00. ECB

President Mario Draghi is scheduled to speak in Frankfurt and in

Brussles before the European Parliament. Draghi refrained from

addressing the Grexit scenario, saying it made no sense to speculate on

Greece abandoning the euro zone. Draghi may refer to the Greek

negotiations and his statement from Feb 7.

US CB Consumer Confidence: Tuesday, 15:00. U.S. consumer

confidence rose to a seven-year high in January, reaching 102.9 from an

upwardly revised 93.1 in December. Optimism increased about the labor

market and economic conditions. Analysts expected a small rise to 95.1.

Responders were also positive on short-term outlook and wage growth. Low

inflation due to gasoline prices also boosted consumers’ spirits.

Consumer confidence is expected to reach 99.6 this time.

Janet Yellen testifies: Tuesday, 15:00. Federal Reserve Chair

Janet Yellen will testify before the House Financial Services Committee,

in Washington DC. Yellen may address the rate hike issue, the weak

inflation trend and the strengthening labor market. Market volatility is

expected.

US New Home Sales: Wednesday, 15:00. New home sales increased

sharply in December to a seasonally adjusted annual rate of 481,000,

following 452,000 in the previous month. The 11.6% climb indicates an

improvement from 2014. Stronger labor market and better economic

conditions have facilitated the positive trend of home acquisitions.

Furthermore, sales of existing homes rose 2.4% in December to a

seasonally adjusted annual rate of 5.04 million. New home sales are

predicted to shrink to 447,000 in January.

UK GDP data: Thursday, 9:30. The second GDP estimate of the third

quarter confirmed a minor slowdown in Britain’s economic activity. GDP

increased 0.7% but growth was heavily dependent on domestic demand. The

GDP data indicates that the UK Government does not succeed to balance

growth between all sectors. Falling Business investment and low

Industrial growth weighed heavily on output. Exports declined 0.4%,

while imports increased by 1.4%. However, household spending edged up

0.8% over the third quarter, showing growth in 13 consecutive quarters.

The second GDP estimate of the fourth quarter is expected to be 0.5%.

US Inflation data: Thursday, 13:30. U.S. consumer prices

registered their biggest fall in December, dropping 0.4%, the largest

decline since December 2008, following a 0.3% decline in the prior

month. On a yearly base, CPI gained a mere 0.8%, the weakest reading

since October 2009. The continuous decline diminishes the possibility of

a rate hike. Meanwhile, Core prices without food and energy costs

remained unchanged in December. In the 12 months through December, core

CPI increased 1.6%, the smallest gain since February. U.S. consumer

price index is expected to decline 0.6% while core CPI is forecasted to

rise 0.1%.

US Core Durable Goods Orders: Thursday, 13:30. Capital goods

orders plunged 3.4% in December amid slowing global growth and low crude

oil prices. Core orders excluding aircraft, dropped 0.8% in December

while expected to gain 0.5%. The strong dollar also held back new

investments. Durable goods orders took a step back in the fourth quarter

of 2014 after strong gains in the previous two quarters. Durable Goods

Orders are expected to gain 1.7% while core orders are expected to add

0.6%.

US Unemployment Claims: Thursday, 13:30. The number of Americans

filing initial claims for unemployment benefits fell 21,000 last week to

283,000, indicating a positive momentum in the US labor market.

Analysts expected claims to reach 293,000. The four-week moving average

of claims, a more stable measure of labor market trends fell 6,500 to

283,250 last week. The number of jobless claims is expected to reach

285,000 this week.

US GDP data: Friday, 13:30. The U.S. economy expanded more than

initially estimated in the third quarter, rising 3.9% from 3.5%

forecasted a month back. The strong release was preceded by a 4.6%

growth in the second quarter, marking the two strongest quarters since

the second half of 2003. Analysts expected a growth rate of 3.3% However

economists expect a weaker expansion below 3% in the fourth quarter.

The expansion rate in the fourth quarter is estimated to reach 2.1%.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.21 10:51

GOLD Fundamentals (based on dailyfx article)

Fundamental Forecast for Gold: Neutral

- Gold Stalling at 1200 Figure, SPX 500 Stalling at Record High

- Gold Price Rebounds from Fibonacci Level; 1170s Still Possible

Gold prices are lower for a fourth consecutive week with the precious metal off more than 2.4% to trade at $1199 ahead of the New York close on Friday. Despite the losses, gold is poised to close the week well-off the lows after rebounding off key support mid-week with the greenback on the defensive as the USDOLLAR index posts its third consecutive weekly decline.

Minutes from the latest FOMC policy meeting cited a more cautious tone from the committee with “many officials” inclined to maintain the central bank’s zero interest rate policy amid concerns over the strengthening dollar and “foreign weakness” from the likes of China, the Middle East, Ukraine and Greece. The release prompted a rebound in gold prices which were trading into a critical support region as expectations for a June rate hike diminished. While the technical damage done to gold this month cannot be overlooked, near-term the shift in Fed rhetoric could continue to offer gold a reprieve from the recent selling pressure.

Looking ahead to next week, traders will closely eying key US metrics with January CPI, durable goods orders, and the second read on 4Q GDP. The most significant event risk will likely be on Tuesday when Federal Reserve Chair Janet Yellen testifies before the Senate Bank Panel in Washington. Look for any weakness / downward revisions in the data or more dovish comments from Yellen to prop up gold as investors push out expectations for Fed normalization. We’ll also be watching the developing story in Greece with the current bailout set to expire at the end of the week. With news on Friday affirming that an initial four-month extension has been granted, the focus will remain on US data and the central bank interest rate outlook heading into next week.

From a technical standpoint, gold rebounded off key support this week at the $1196/98. This level is defined by the confluence of the 61.8% retracement of the November advance & the 1.618% extension of the decline off the January high and is backed closely by a basic trendline support off the November low. We’ reserve this region as our near-term bullish invalidation level and although the broader bias remains weighted to the down-side, near-term this structure may offer stronger support. Note that daily RSI is holding just above the 40-threshold and we’ll use pending resistance trigger as validation of either a near-term recovery higher into the close of the month, or a material break sub 1196. Such a scenario targets subsequent support targets at $1171 & $1155. Interim resistance (near-term bearish invalidation) stands at $1218/24 with a breach above targeting $1239/40. Bottom line: looking for a low early next week with a general topside bias in play near-term while above $1196/98.

Forum on trading, automated trading systems and testing trading strategies

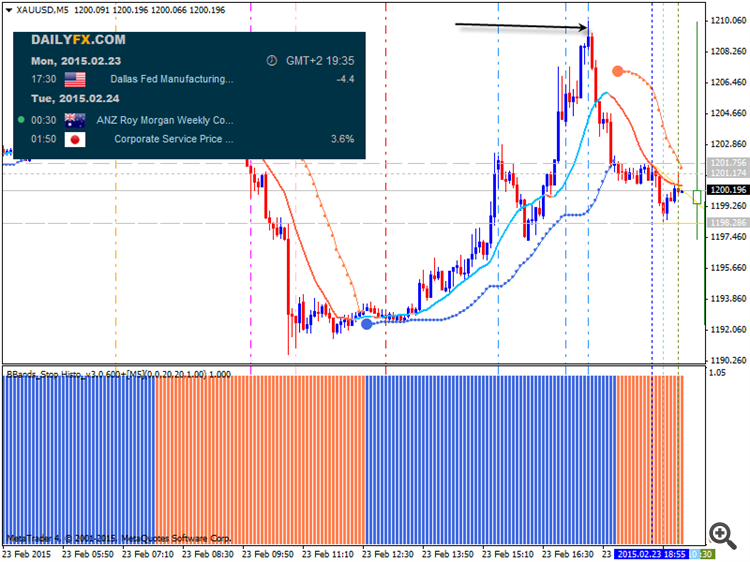

newdigital, 2015.02.23 18:56

2015-02-23 15:30 GMT (or 17:30 MQ MT5 time) | [USD - Dallas Fed Manufacturing Activity]- past data is -4.4

- forecast data is -4.0

- actual data is -11.2 according to the latest press release

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Dallas Fed Manufacturing Activity] =The Dallas Fed conducts the Texas Manufacturing Outlook Survey monthly

to obtain a timely assessment of the state's factory activity. Firms are

asked by Federal Reserve Bank of Dallas

whether output, employment, orders, prices and other indicators

increased, decreased or remained unchanged over the previous month.

Survey responses are used to calculate an index for each indicator. Each

index is calculated by subtracting the percentage of respondents

reporting a decrease from the percentage reporting an increase.

United States Dallas Fed Manufacturing Business Index fell from previous -4.4 to -11.2 in February

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.24 05:18

AUDIO - Chris Vermeulen – Gold Still in a Bear Market, but Don’t Lose Hope

Gold is still in a bear market, like it has been for the past three years. There’s an opportunity to pick up a quick profit when it rebounds from its current plunge, but don’t be fooled. It’s all setting up very nicely for the ultimate bull market that’s getting closer. Same with the much maligned Toronto Venture Exchange (TSX:V), which is at record lows due to its composition of miners and resource companies.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.24 09:53

What charts say about the outlook for gold

Weaker-than-expected U.S. housing data lifted gold prices from a seven-week low on Monday, but charts suggest that investors shouldn't get too excited.

Gold got some reprieve on Monday, rebounding from a seven-week low intraday after data showed U.S. home resales for January declined to a nine-month low. The data are unlikely to dent the overall trend, however; gold posted its fourth consecutive weekly decline last week amid a stronger U.S. dollar and expectations that the Federal Reserve will raise interest rates later this year.

Meanwhile, the outlook on charts is bearish.

The weekly gold chart has developed a complex technical pattern with three features: a downtrend line; strong historical support; certain pattern behavior in the Guppy Multiple Moving Average (GMMA) indicator.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.24 13:12

Gold, Crude Oil Stall at Chart Barriers as SPX 500 Digests Gains (based on dailyfx article)

Prices challenging pivotal support at 1197.86, the 61.8% Fibonacci retracement. A break below this barrier exposes channel floor support at 1176.34, followed by the 76.4% level at 1171.96. Alternatively, a reversal above 50% Fib at 1218.80 targets the 38.2% retracement at 1239.73.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.24 16:23

2015-02-24 15:00 GMT (or 17:00 MQ MT5 time) | [USD - Consumer Confidence]- past data is 103.8

- forecast data is 99.6

- actual data is 96.4 according to the latest press release

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Consumer Confidence] = Level of a composite index based on surveyed households. Financial confidence is a leading indicator of consumer spending, which accounts for a majority of overall economic activity.

==========U.S. Consumer Confidence Index Pulls Back More Than Expected In February

After reporting a sharp increase in U.S. consumer confidence in the previous month, the Conference Board released a report on Tuesday showing that its consumer confidence index pulled back by more than expected in the month of February.

The Conference Board said its consumer confidence index tumbled to 96.4 in February from an upwardly revised 103.8 in January.

Economists had expected the index to drop to a reading of 99.1 from the 102.9 originally reported for the previous month.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.25 05:51

The Justice Department Goes Hunting For A Gold Price Fix (based on forbes article)

Quaint or corrupt, that’s the question the U.S. Justice Department and the Commodity Futures Trading Commission have set themselves in their attempt to prize back the lid on the centuries-old world of trading metals in London.

Gold is the primary focus of the double-barreled inquiry with silver, platinum and palladium also on the agenda.

What the U.S. investigators hope to find is a smoking gun linking some of the world’s biggest banks to allegations of market rigging, a job which European investigators have already dropped.

The starting point for the metals probe, which was launched before Christmas but has only just been revealed, is the process by which benchmark metal prices have historically been set in the private world of London banking.

Deep-Seated Flaws In Benchmark Setting

Similar inquiries into interest-rate setting and foreign exchange dealing has already revealed deep-seated flaws, some of which can be traced to old methods of price-setting not tolerated in a modern world of high-speed financial transactions.

In a way what’s happening in the metals market is a case of the old world of lax London methods, where a man’s word was considered his bond, bumping into the new world of tight U.S. regulations where business is done by the book.

European regulators, it seems, were prepared to accept that London’s way of trading metals was understandable when looked at from an historic perspective which took into account the fact that systems simply evolved, no-one designed them.

Fixing The Fix

The solution was the unfortunately-named London Gold Fix, a benchmark price first struck in September 1919 after representatives of five London-based banks swapped market information by telephone, a system which later became a twice-daily meeting to set a morning and afternoon gold price.

There have been frequent changes to the way the gold price is fixed with most gold exchanged these day by electronic means on markets open 24-hours a day.

Other metals have also been traded in what now look to be archaic systems, including the way members of the London Metal Exchange (LME) trade certain metals in five-minute bursts of open outcry bidding while sitting in a ring at the exchange located in London’s business heart, The City.

Mining companies, and metal buyers, had no way of knowing whether the prices quoted were correct but one Australian mining company became suspicious when it consistently failed to get the price quoted for the cobalt it produced as a by-product at its nickel mines.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.25 13:27

Gold Tries to Launch Recovery, SPX 500 Resumes Upward Push (based on dailyfx article)

GOLD TECHNICAL ANALYSIS

Prices are attempting to launch a

recovery from support at 1197.86, the 61.8% Fibonacci retracement. The

reversal requires a push above a major resistance cluster in the

1209.67-18.80 area, marked by a falling channel top, the underside of a

recently broken trend line and the 50% Fibonacci retracement. If a break

does materialize, the next upside barrier comes in at 1239.73, the

38.2% level. Alternatively, a turn below 1197.86 aims for the

intersection of channel floor support and the 76.4% Fib at 1171.96.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

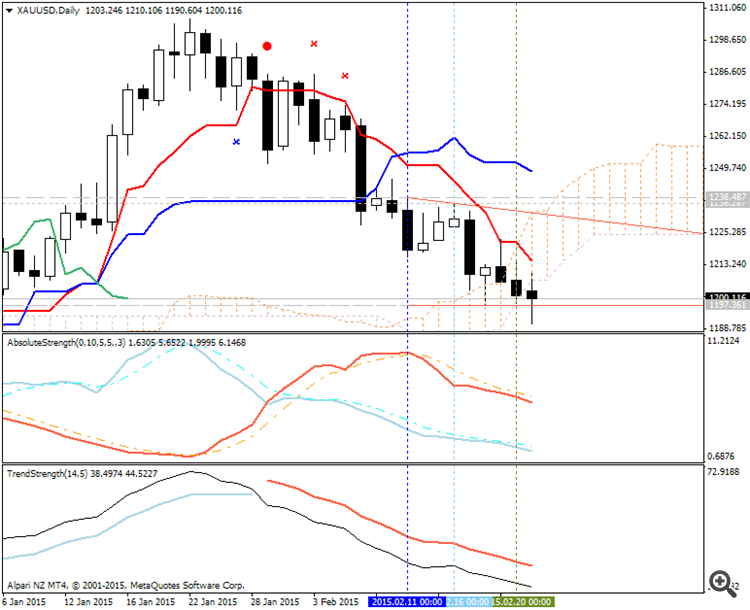

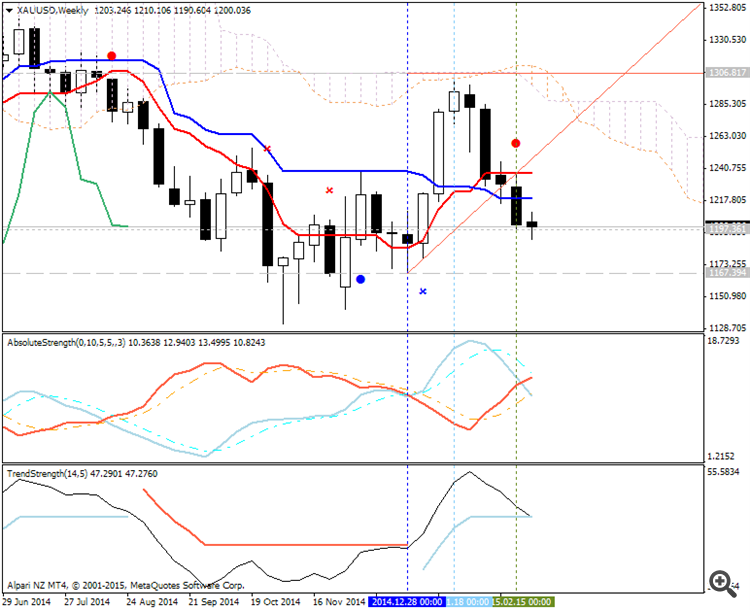

H4 price is inside Ichimoku cloud/kumo with the following condition:

D1 price is on primary bullish with the correction which was started in the end of January this year:

W1 price is on bearish with secondary rally started in the beginning of January this year; Chinkou Span line is located to be close to the price for good possible breakout to reversal of the price movement from bearush to the bullish market condition

MN price is on bearish market condition with market rally started on open monthly bar

If D1 price will break 1251.80 support level on close bar - we may see good secondary correction inside the primary bullish

If D1 price will break 1306.82 resistance level so the bulliosh trend will be continuing

If not so it will be bullish ranging between 1251.80 and 1306.82 levels

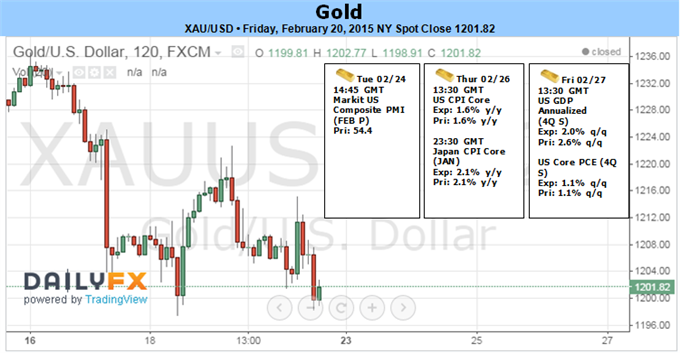

UPCOMING EVENTS (high/medium impacted news events which may be affected on XAUUSD price movement for this coming week)

2015-02-24 14:45 GMT (or 16:45 MQ MT5 time) | [USD - Services PMI]

2015-02-24 15:00 GMT (or 17:00 MQ MT5 time) | [USD - Consumer Confidence]

2015-02-24 15:00 GMT (or 17:00 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2015-02-25 15:00 GMT (or 17:00 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2015-02-26 13:30 GMT (or 15:30 MQ MT5 time) | [USD - CPI]

2015-02-26 23:30 GMT (or 01:30 MQ MT5 time) | [JPY - CPI]

2015-02-27 13:30 GMT (or 15:50 MQ MT5 time) | [USD - GDP]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on XAUUSD price movementSUMMARY : bullish

TREND : ranging