You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Вот я и думаю, что постановка задачи в самом начале является узкой, в самом узком смысле этого слова. Сдается мне, что это никакого отношения к общему случаю не имеет. :о( Но возможно - ошибаюсь.

Well, dearie me! I'm struggling to bind it all together, while you're trying to widen the frame for me :-)

Go ahead, choose the widest stance and show us how it's done. We'll learn. In the meantime, we'll do what we can.

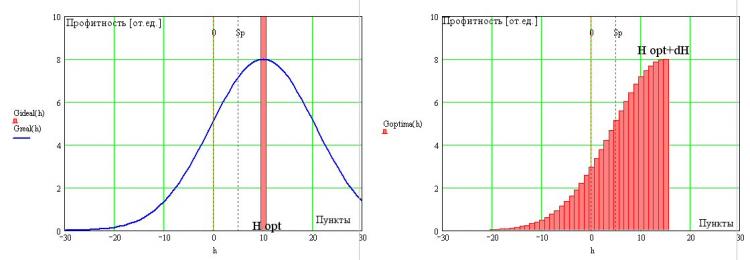

Let's continue considering the transition from an ideal TS with delta-shaped TP distribution and sitting in the optimum on the double spread (fig. on the left, in red) to the optimum one:

Of course, we must admit that in reality, without an opportunity to look into the future (being on the right side of BP), we have to put up with errors of the optimal TP functioning which are inevitable due to the absence of miracles in Nature (it was already mentioned specially). Consequently, the FS of the optimal TS will have a dilution of delta-functional distribution of its ideal prototype, as shown in the same figure with the blue line.

Due to the fact that all open positions automatically start with a negative value in -Sp, even for the optimal TS we will definitely have transactions with a negative outcome. Moreover, trades themselves may be closed with any large minus (we will omit work with protective orders for the time being). This is an unavoidable condition of reality. But we can change the form for the right edge and we have a certain degree of freedom. This is obviously due to the fact that we can choose when to close a profitable trade. Keeping in mind that there is an optimum for the value of profit H, we can assume a sharp edge on the right side of the TP of optimum TS. This requirement is due, as I have already noted, to the presence of two competing processes affecting the profitability of TC - the frequency of transactions and their amplitude. So, the boundary on the right will certainly exist, but will it coincide with Н opt, like for the ideal TS. Obviously not. And this is due to the presence of the inevitable tightened tail on the left. In the most general case, the right boundary of FR will lie in the area behind Н opt (see fig. on the right) and its exact location is not important for us at this stage of our reasoning.

Thus, the general view of the model distribution of takings of the optimal TS is obtained. It will necessarily have a steep right edge, the exact location of which is determined by the spread Sp and a monotonically decreasing right wing with an obligatory entering the negative area. The exact form of this wing will be reconstructed later. But we can already say now that the flatness (or steepness) of the left slope is determined by the absence or presence (their strength) of regularities in the initial price series and the integral of this mountain should (according to T. Oak) give the exact zero on the martingale, which will later allow us to find its (TS) some characteristics.

ystr wrote(a) >> If we take into account that "for an ideal TS all directions are guessable" then I should note that such a system is difficult to implement in practice. And if we set the condition that "the range of price changes" is within the spread, then it's impossible.

Sure. I have already mentioned it above.

все верно. Но плановый TP зависит от временного горизонта во многом.

Definitely. Just disagree about SL. Despite stat advantage, spikes against us are not excluded at all, including strong ones. We must either reduce capital share in the game, or protect ourselves from margin call by stop. So there is a subject for optimization.

...

мы вправе предположить наличие резкой границы справа у ФР взяток оптимальной ТС. Это требование связано, как я уже отмечал, с наличием двух конкурирующих процессов влияющих на профитность ТС - частоты совершения транзакций и их амплитуды.

I find it hard to agree here, at least on the fly. In fact you are talking here about some form of forced time-based position closure. Such a closure would not give an abrupt cutoff, but rather a gradual suppression of tails.

OK, abrupt trimming can be considered an approximation of this suppression. But time will crush both tails, because large losses are also associated with time as well as large profits.

Definitely. Just disagree about SL. Despite stat advantage, spikes against us are not excluded at all, including strong ones. We must either reduce capital share in the game, or protect ourselves from margin call by stop. That is the subject for optimization.

It depends on which of the 3 variants. When the length of the series is known in advance, then it is efficient to select the stake size - depending on the length of the series and without using SL. If the length of the series is not known, the SL has sense, and the lot size will be selected according to its value. Or vice versa - bid size - SL selection. I.e. only in conjunction bid size-SL.

But these are abstract examples, in practice SL is needed, because real price distribution is non-stationary and instead of statistical advantage after entering it's possible to get statistical loss in some time/after some event. That is what SL is trying to cut off.

Neutron писал(а) >>

So go ahead, pick your widest staging and show us how it's done. We'll learn. In the meantime, we'll do what we can.

The subject of SL is very interesting to me, and it's still open, so I've been pestering you with questions. The gravitation of the gravitational force is determined by the amount of mercury in the first two weeks, but it doesn't increase the value of the gravitation. And of course I hope it will become more common in the narrow sense of the word. :о)

It depends on which of the 3 options. When the length of the series is known in advance, the method of selecting the stake size is effective - again, depending on the length of the series and without using SL. If the length of the series is not known, the SL has a meaning and the lot will be selected depending on its size. Or vice versa - bid size - SL selection. I.e. only in conjunction bid size-SL.

But these are abstract examples, in practice SL is necessary, because real price distribution is non-stationary and instead of statistical advantage after entering it's possible to get statistical loss in some time/after some event. That's what SL is trying to cut off.

And in my opinion, when the length of the series is known, it is convenient to choose SL for it on the basis of statistics, based on the risk measure accepted for oneself. Going outside of this measure is perceived as a sudden large spike against the position and is closed by SL.

And in my opinion, when the length of the series is known, it is convenient to choose SL for it on the basis of statistics, based on the risk measure accepted for yourself. Going beyond this measure is perceived as an unexpectedly large spike against the position and closed by SL.

So it is in real tasks. What I described was for a coin with constant probabilities

Но существует и вторая ось координатной плоскости, где разыгрываются наши события, - ценовая, и связь между ними однозначная. Согласно выше приведённой формуде, амплитуда цены V(t) и время t в течении которого эта амплитуда наигрывается связаны следующим выражением:

The assumption of a one-to-one relationship looks unreasonably strong; in reality, the relationship is statistical. But even in the unambiguous relation approximation this formula will apply to both "for us" and "against us" motions.

Therefore, imho, the asymmetry can be correctly introduced only by introducing additional conditions. For example in this case it would be "cut profit, let the loss grow". In general for a separate consideration of SL one can go in from this side as well, but it needs to be stipulated. Imho, of course.

Предположение об однозначности связи выглядит неоправданно сильным, реально эта связь статистическая. Но даже в приближении однозначной связи эта формула будет относиться как к движениям "за нас", так и к движениям "против нас".

Поэтому, имхо, корректно ввести асимметрию можно только введя дополнительные условия. Например для данного случая это будет "режь прибыль, давай убытку расти". В общем для отдельного рассмотрения вопроса о SL можно зайти и с этой стороны, но это нужно оговорить. Имхо, разумеется.

I don't know... I can't think of anything at the moment.

Let's return to the analysis of optimum FC (OTS, because we are fed up with writing out the same thing :-).

From fig. you see that we have two degrees of freedom in determining the position of the FS - it can be moved left - right and change the slope steepness (fig. on the left):

Moreover, for change of steepness dependencies in price series are responsible. Since there are only two options (steeper-posher), we can assume that these two options correspond to some two basic non-marting properties of the Market... Right! - One hundred percent, it's either a trend or a flat (the third steady state - martingale). On a martingale the integral of the FR should give zero at infinity. It is clear. On a real price series, we obtain MO>0 or MO<0, and we can trade, though in the latter case we will have to "reverse" the TS for MO to become larger than zero again (see fig. right). The position of vertically cut off border is determined, as I mentioned before, by the spread and the degree of predictability of the market. The more predictable the market, the closer this boundary is to its H opt=2Sp limit. The more the market resembles a martingale, the further this boundary moves into the area of larger values of h and the less effective trading becomes.

Note that so far in the construction of OTC equations we never specified types of regularities that it can outplay on the markets, thereby bringing us profit. Dependencies in BP, as we know, are linear and all other dependencies (non-linear). The identification of linear dependencies in price series is not an easy task, but it's possible, while non-linear dependencies are more difficult - their variety is infinite and there is no universal catcher for them (if it's not our ОТС, of course). Each one must be clearly identified, a specific mechanism must be adjusted for it, and we pray that it (non-linear dependence) doesn't inadvertently change some coefficient in the power series, which describes it.) So, the presence of nonlinearities in BP will cause non-monotonics (I'm speaking about TP without protective orders) in the form of smooth swells and thinning. That is, if the linear dependence will change the slope of the FR, then non-linear dependence will lead to deformation, there will be, for example, thick tails, etc. An example of a linear dependence between neighbouring samples in the PDF is shown below left :

The system on the right is very non-linear:-)

Thus, we have only one adjustable parameter in TS - H opt and only one parameter that characterizes the market condition - the slope steepness of the FR. The latter parameter, apparently, hardly depends on the non-linear pricing features and the OTS thus pretends to be integral (in the sense of a complete manipulation of any market combinations).

P.S. Shit, the previous post got lost...