You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Cotton CTK0-N0

CFD was invented by the British. At the end of the last century. Until now they are traded in London..., did not know about Australia..., so in Australia too. But these contracts are traded on the exchange, and, just like futures contracts, are the property of the exchange, or of brokers accredited at the exchange..., who in their turn are accountable to the regulators... It is clear, since such trading is strictly controlled by market regulators, then liberty with quotes and timing for CFDs is not allowed...

It is another matter when in your own country some garage declares itself as the owner of CFD contracts, and no one controls it by definition ..., so you get a thimblerig game ..., twist and turn ..., guess where it is hidden ...?

CFD придумали англичане. В конце прошлого века. До сих пор они торгуются в Лондоне..., про Австралию не знал..., значит и в Австралии тоже.

And in England, too, CFDs are an OTC product, i.e. they fall under the definition of "the shark is declaring itself the owner of the contracts". It's like that everywhere, all over the world. Even those which are traded on the stock exchange in Australia can be said so, the stock exchange itself issues them, but the stock exchange is a common commercial entity, i.e. a shell company. It is just a big one with a history.

The liberties with quotes depend on the model used by the CFD provider.

- DMA (direct market access), the CFD tracks the stock exactly, no liberties with the quotes at all, because for each CFD provider buys a real stock - expensive, slow, partial filling, no spread, there is a commission, completely transparent and fair;

- marketmaker - the provider himself creates the market, he creates the quotes, his right to manipulate quotes is written in all documents - the spread is price manipulation. The degree of manipulation is determined by the honesty of the provider, a decent company does not abuse it. Cheap, fast, convenient, but sometimes it can be scary.

That's what I'm saying, it's scary... It's just that a lot of people here are deluded, and when asked "What do you trade?" they proudly answer "Grain futures"... And they don't even suspect that CFD is a derivative of a derivative futures..., which is also freely interpreted by an out-of-state brokerage company... No one controls...

Of course everyone should decide what to trade and with whom to trade, but nevertheless we should be aware that trading with OTC derivatives gives rise to additional risks...

Hi all. I once wrote about XDRUSD, this is the chart I got using this formula:

MacdBuffer[i]=(iClose("XDRUSD",15,i) - 0.75*iClose("EURUSD",15,i)+0.25*iClose("GBPUSD",15,i)+0.0025*iClose("USDJPY",15,i) )*100;

though I think there should be no spread here, maybe I was wrong?

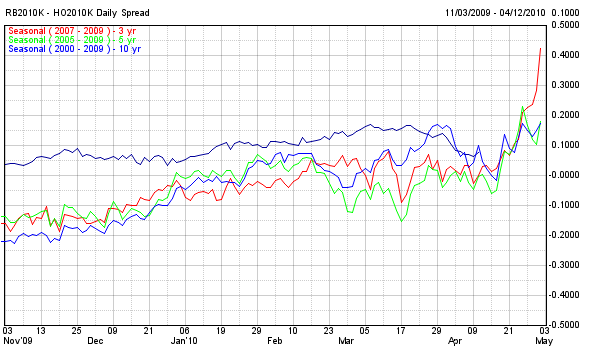

hello all .on a seasonal trend 4 days ago went in on petrol and fuel oil and today on petrol- at the moment the spread has run up nicely

and today on petrol- at the moment the spread has run up nicely

Tomorrow I start to collect tick statistics (synchronously) for FTSE - FDAX - CAC till Friday, may I add some more? I made an experiment today, the tick chart is not the same as in MT4, it is drawn by Clause. Please advise how to set the condition in the EA to start working from that time to that.

всем привет .по сезонной тенденции 4 дня назад зашел по бензину-мазуту......

Change to N contracts urgently.