You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Вот-вот.

Ты предлагаешь опять вернуться к стандартному анализу обычного графика кросса ?

Например, GC/SI ?

//-------------------------------

Видимо, пора прекращать этот бесполезный спор! Это всё равно, что спорить, - что вкуснее - щи или кисель.

I've been tired of arguing for a long time now, but my position remains the same:

whether you like it or not, spread trading is nothing more than trading a synthetic instrument like GC/SI

and it is just as common as eur/gbp for example

---

if you don't want to analyse it, that's your right

I've been tired of arguing for a long time now, but my position remains the same:

whether you like it or not, spread trading is nothing more than trading a synthetic instrument like GC/SI

and it is just as common as eur/gbp for example

---

if you don't want to analyse it, that's your right

For some people, but for me the main criterion of success is the following: if the score increases, all is fine, if not, let's keep digging.

And what kind of analysis (or lack of it) results in growing the score - moon phase or coffee grounds - is of no importance.

"It doesn't matter what colour the cat is, as long as it catches mice."

да мне уже давно надоело спорить, но моя позиция остается прежней:

хочешь ты или не хочешь, а торговля спредом - это не что иное, как торговля синтетическим инструментом, например, GC/SI

а это такой же обычный инструмент, как и например, eur/gbp

---

не хочешь его анализировать - твое право

In theory, trading the spread is similar to trading a currency pair, but...

When you trade a spread, and if you pick the right pair, you have good reason to believe (hope) that your traded process is mean-reverting. And that's a whole different story.

Since you pick the instruments yourself, you will take the ones that are cointegrated and not the ones offered to you by the broker.

You can create and trade a spread-process with any ratio of one instrument to another, not just 1:1 like a currency pair.

A spread process can be made up of several instruments, it can be a portfolio of a very large number of assets.

I come here often - http://ibcclub.ru/forumdisplay.php?f=72?pid=122

// https://www.mql5.com/go?link=http://ibcclub.ru/forumdisplay.php?f=71

Thank you very much, useful informationСейчас вот сижу пробую по разному настраивать оба индикатора. Возник вопрос. Как вы настройки МА расчитываете? Или они должны быть стабильными?

Specifically, what is the problem?What do you mean by "trying different settings"?

On my charts in this thread - these are the settings for MA (m5 - n4):

MA_per = 21;

MA_fast = 8;

ma_method=2;

Price=6;

Я по соевым заходил. По муке с маслом.

По сигналу, - что на предыд. страничке выставил. И сезонная тенденция по этому входу совпала.

Тож оч. неплохо вот сейчас закрыл.

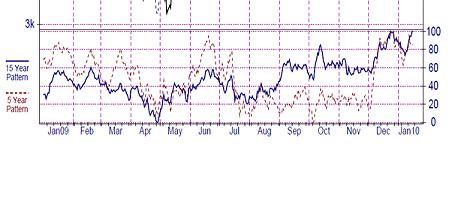

Seasonal spread trends on these soybeans(ZM - ZL) :

Seasonal spread trends on these soybeans(ZM - ZL) :

Where do you get the seasonal trends ?

Where do you get the seasonal trends ?

Here's what I've gathered so far with the help of others.

Here's what I've gathered so far with the help of others.

>>Thank you!!!