NZDUSD Technical Analysis 2015, 18.01 - 25.01: Total Ranging within Primary Bullish and Primary Bearish with .7608 Key Support

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.16 17:06

Forex Weekly Outlook January 19-23 (based on forexcrunch article)

German ZEW Economic Sentiment, Inflation data in New Zealand, Rate

decision in Japan, the Eurozone and Canada, Employment data from the UK

and the US and housing data from the US. These are the main market

movers on Forex calendar. Join us as we explore the highlights of this

week.

Last week, US data failed to raise optimism with a surprise 0.9% drop

in retail sales registering their largest decline in 11 months and a

1.0% decline in core sales. In the manufacturing sector the Philly Fed

index fell to 6.3 points, while expected to reach 20.3 points. Jobless

claims increased unexpectedly to 316,000 from 297,000 crossing to

300,000 line. However, the Empire State index surged to 10 points from

5.3 in the prior month. Will we see better figures this week?

- Eurozone German ZEW Economic Sentiment: Tuesday, 10:00. German investor sentiment edged up in December to 34.9 from 11.5 in November. This was the second consecutive rise, indicating increased optimism for a pickup in Europe’s largest economy. Economists expected a lower figure of 19.8. German economy expanded by a mere 0.1% in the third quarter, bit a boost in consumer spending is expected to improve growth in the final quarter of 2014. German analysts’ sentiment is expected to improve to 40.1.

- NZ inflation data: Tuesday, 21:45. New Zealand consumer prices increased 0.3% from the second quarter, falling short of the 0.5% rise expected by analysts. On a yearly base, consumer price index rose 1% in the third quarter after a 1.6% rise in the previous quarter indicating slower inflation. The absence of inflationary pressures enabled Governor Graeme Wheeler to keep borrowing costs unchanged for longer. Consumer prices are expected to remain unchanged this time.

- Japan rate decision: Wednesday. The Bank of Japan voted to keep its monetary policy unchanged at its December policy meeting, increasing its monetary base at an annual pace of JPY 80 trillion. The decision was in line with market forecast. The BOJ noted the improvement in exports and a recovery in industrial output as well as, rising inflation expectations. Rates are expected to remain unchanged this time.

- UK employment data: Wednesday, 9:30. UK Jobless Claims dropped in November by 26,900 beating expectations for a 19,800 decline. Furthermore, on a quarterly basis, average earnings excluding bonuses edged up 1.6%. UK unemployment in the third quarter fell by 63,000 to 1.96 million indicating an improvement in British labor market. UK unemployment claims are expected to drop 24,200 in December.

- US Building Permits: Wednesday, 13:30. The number of building permits issued in November fell 5.2% to a seasonally adjusted annual rate of 1.04 million, indicating weakness in construction of single-family homes. However, Analysts forecast the housing sector will maintain its momentum in 2015 as job growth continues and mortgage rates remain accommodative. The number of building permits is expected to increase to1.06 million.

- Canadian rate decision: Wednesday, 15:00. The Bank of Canada kept its rate at 1% in December, amid stronger economic recovery in exports and business investment. BoC’s statement was more optimistic than before amid widening expansion on top of strong consumer spending, which may lead to self-sustaining growth. Poloz said the said the output gap is smaller and that the economy has sufficient room to grow before it reached full capacity. Rates are expected to remain at 1%.

- Eurozone rate decision: Thursday, 12:45. The European Central Bank kept interest rates unchanged in December leaving deposit facility at negative 0.20%. Draghi said the central bank requires more time to assess the impact of dropping oil prices on inflation, growth and wages, before deciding the course of action. Falling energy costs will worsen deflation below the ECB’s target of just under 2%, but at the same time, may help the region’s economy by saving companies and consumers billions of euros. The ECB continued to examine a range of options for quantitative easing in case the measures it has already taken fail to boost prices. The ECB is expected to maintain rates this month.

- US Unemployment Claims: Thursday, 13:30. The number of initial claims for unemployment benefits jumped last week by 19,000 to 316,000, from a revised 297,000 in the week before. Economists expected claims to rise moderately to 299,000. The sudden increase is typical for the first full week of the year when holiday workers are fired. The volatility makes it difficult for the government to determine whether the number of applications has truly picked up. The four-week moving average increased to 298,000 last week from 291,250. The number of jobless claims is expected to reach 301,000 this week.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.19 19:30

NZD/USD almost unchanged in cautious trade

The New Zealand dollar was almost unchanged against its U.S. counterpart in cautious trade on Monday, as markets were still jittery after the Swiss National Bank's surprise policy move last week.

NZD/USD hit 0.7806 during early European trade, the session high; the pair subsequently consolidated at 0.7796.

The pair was likely to find support at 0.7744, the low of January 16 and resistance at 0.789, the high of January 16.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.20 08:42

2015-01-19 21:00 GMT (or 23:00 MQ MT5 time) | [NZD - NZIER Business Confidence]- past data is 19

- forecast data is n/a

- actual data is 23 according to the latest press release

if actual > forecast (or actual data) = good for currency (for NZD in our case)

[NZD - NZIER Business Confidence] = Level of a diffusion index based on surveyed manufacturers, builders, wholesalers, retailers, and service providers. It's a leading indicator of economic health - businesses react quickly to market conditions, and changes in their sentiment can be an early signal of future economic activity such as spending, hiring, and investment.

==========

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.20 15:20

NZD/USD drops despite strong N.Z. business confidence data (based on nasdaq article)

The New Zealand dollar dropped against its U.S. counterpart on Tuesday, despite the release of strong business confidence from New Zealand, as downbeat Chinese economic growth data weighed.

NZD/USD hit 0.7709 during late Asian trade, the pair's lowest since January 15; the pair subsequently consolidated at 0.7723, declining 0.76%.

The pair was likely to find support at 0.7688, the low of January 14 and resistance at 0.7810, Monday's high.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.20 20:47

NZD/USD 0.7600 Support at Risk on Dismal 4Q New Zealand CPI (based on dailyfx article)

- NZD Fails to Benefit From Global Dairy Auction; 4Q CPI to Slow for Second Straight Quarter

- USD/CAD Pushes Fresh Monthly Highs Ahead of Bank of Canada (BoC) Meeting

- NZD/USD shows a limited reaction to the 3.8% rise in Whole Milk Power following the Global Dairy Trade auction; may face additional headwinds over the next 24-hours of trade as the 4Q Consumer Price Index (CPI) is expected to slow further.

- As the Relative Strength Index (RSI) retains the bearish momentum, downside targets remained favored with the monthly opening low (0.7617) in focus.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.21 07:34

2015-01-20 21:45 GMT (or 23:45 MQ MT5 time) | [NZD - CPI]- past data is 0.3%

- forecast data is 0.0%

- actual data is -0.2% according to the latest press release

if actual > forecast (or actual data) = good for currency (for NZD in our case)

[NZD - CPI] = Change in the price of goods and services purchased by consumers. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate.

==========

New Zealand Consumer Prices Dip 0.2% In Q4

Consumer prices in New Zealand eased 0.2 percent on quarter in the fourth quarter of 2014, Statistics New Zealand said on Wednesday.

That missed expectations for a flat reading following three straight quarters of 0.3 percent gain.

"Lower prices for petrol and vegetables were partly countered by higher prices for international travel and housing-related costs," prices manager Chris Pike said.

Petrol prices (down 5.7 percent) made the largest downward contribution. Excluding petrol, inflation added 0.1 percent in the quarter.

The average price of a liter of 91 octane petrol in Q4 was NZ$2.00, compared with NZ$2.12 in the previous quarter. By the end of the December quarter, petrol pump prices were 7 percent below the average price for the quarter, and as at 16 January were 17 percent below the average for the quarter.

Seasonally lower prices for tomatoes, lettuce, and cucumber influenced the fall in vegetable prices (down 14 percent) - which was a smaller-than-usual December quarter fall following a mild winter. Vegetable prices are now slightly higher than a year ago.

Prices for newly built houses excluding land climbed 1.7 percent overall, with Auckland up 2.8 percent and Canterbury up 1.7 percent. Housing rentals added 0.3 percent overall, with Canterbury up 0.9 percent.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

NZDUSD M5: 48 pips price movement by NZD - CPI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.21 14:02

NZD/USD rises off 2-week lows despite weak N.Z. inflation data (based on nasdaq article)

The New Zealand dollar rose against its U.S. counterpart on Wednesday, pulling away from two-week lows despite the release of disappointing New Zealand inflation data.

NZD/USD hit 0.7783 during late Asian trade, the session high; the pair subsequently consolidated at 0.7667, gaining 0.35%.

The pair was likely to find support at 0.7620, Tuesday's low and a two-week low and resistance at 0.7781, the high of January 14.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.21 22:24

Daily Forex Market Update: NZD/USD Signaling Long (based on forexmagnates article)

Early trading saw the Euro, Pound, Kiwi and Dollar indexes all sell off. The Aussie and Swiss remain relatively flat. From a macro perspective I still like the Kiwi for a cyclical move higher. The Aussie, Euro, Pound and Dollar are also signaling cyclical moves higher but their price action is much more neutral which impacts the risk profile. I’d prefer to see them at a more substantial support level than they are right now.

PRE-TRADE ANALYSIS

The Pre-Trade Matrix has 14 regression signals, seven of those have

cyclical support, only the NZD/USD isn’t displaying counter momentum as

we head into the US Session. That pair is currently signaling long.

TRADE RECAP

The GBP/JPY and the NZD/CAD were closed in the Asian session for a loss

of just over half a percent. The NZD never really went anywhere but the

Pound did retrace and eventually came to an adjusted support zone,

which, by that time, was into negative territory. This morning I’ve

entered the long NZD/USD and will let this grind a while and evaluate

again this evening.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.22 08:01

2015-01-21 21:30 GMT (or 23:30 MQ MT5 time) | [NZD - Performance of Manufacturing Index]- past data is 55.6

- forecast data is n/a

- actual data is 57.7 according to the latest press release

if actual > forecast (or actual data) = good for currency (for GBP in our case)

[NZD - Performance of Manufacturing Index] = Level of a diffusion index based on surveyed manufacturers. Survey of manufacturers which asks respondents to rate the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories.

==========

"The seasonally adjusted PMI for December was 57.7(a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was 2.1 points higher than November, and a positive end to the year for the sector."

BNZ senior economist Doug Steel said, "The PMI results for manufacturing are consistent with broader indicators showing that the economy is in good heart. There is a lot to like with activity expanding at a solid clip with no inflation."

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

NZDUSD M5: 11 pips price movement by NZD - Performance of Manufacturing Index news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.22 08:40

Kiwi To Fall In Line? (based on dailyfx article)

The NZD/USD daily chart is beginning to look interesting again. Over the past few months while other developed market currencies have been in a virtual free fall against the Greenback, NZD/USD has held its own and traded in a fairly well defined range. With the exchange rate testing the bottom end of the range today we can’t help but wonder if the Bird is about to fall in line with the rest of the currency world? We say this mostly because of the sentiment picture. This outperformance by the Kiwi over the past few months has seen sentiment towards NZD rise well above 50% bulls on the DSI when most other currencies are sporting bullish sentiment levels closer to 10%. In our view this neutral sentiment profile makes the Kiwi much more vulnerable to a decent move lower if the range lows break as there will be plenty of “fuel” for the decline. The .7607 December low looks key with weakness below needed to trigger this negative scenario.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

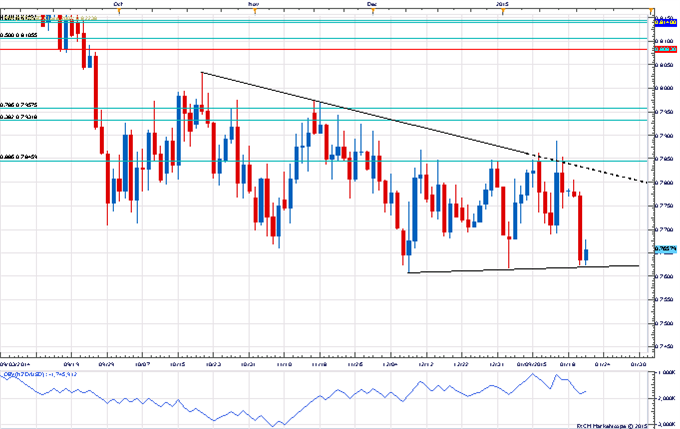

D1 price is on primary bullish with the secondary ranging market condition:

W1 price is on primary bearish with secondary flat since the December last year.

MN price is on bearish market condition with secondary ranging: price is located inside Ichimoku cloud/kumo since the October last year after good breakdown

If D1 price will break 0.7678 support level so we may see the bearish market condition

If D1 price will break 0.7889 resistance level so the bullish trend will be continuing

If not so we can see the total ranging within the primary bullish and the primary bearish

UPCOMING EVENTS (high/medium impacted news events which may be affected on NZDUSD price movement for this coming week)

2015-01-19 21:00 GMT (or 23:00 MQ MT5 time) | [NZD - NZIER Business Confidence]

2015-01-20 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - GDP]

2015-01-20 15:00 GMT (or 17:00 MQ MT5 time) | [USD - FOMC Member Powell Speech]

2015-01-20 21:45 GMT (or 23:45 MQ MT5 time) | [NZD - CPI]

2015-01-21 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Building Permits]

2015-01-21 21:30 GMT (or 23:30 MQ MT5 time) | [NZD - Performance of Manufacturing Index]

2015-01-22 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Unemployment Claims]

2015-01-23 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on NZDUSD price movement

SUMMARY : bullish/bearish

TREND : ranging