Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.11.09 08:45

USD, EUR, GBP, CAD, AUD: Outlooks For The Week - Morgan Stanley (based on efxnews article)

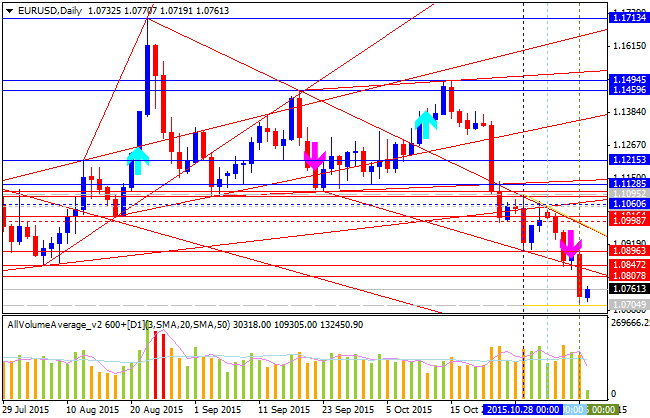

EUR: Bearish

"We have revised our EUR forecasts lower and now look for 1.06 at year

end. Our economists now expect another 10 bp cut in the deposit rate,

an addition to QE, and an extension of the asset purchase programme. All

of this should be EUR negative. We believe the deposit rate cut is

likely to be the most currency negative, as it should incentivize

foreign investors to fund in EUR and domestic investors to seek returns

overseas."

USD: Bullish

"We believe USD could start to see inflows related to investment,

rather than repatriation of assets. While the latter does not require

tighter Fed policy, the former will benefit from a higher probability of

Fed hikes. Indeed, this is likely to support US assets and boost USD."

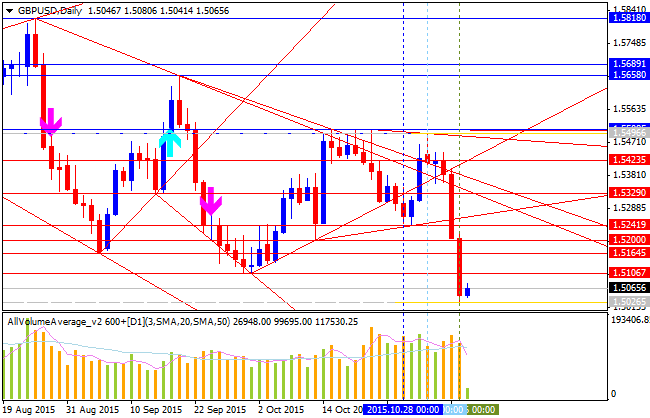

GBP: Bearish

"Markets have taken the BoE dovishly as they revised CPI forecasts and

started to get concerned about the impact of EM growth on the UK

economy. On top of this, there is a downside risk to near-term inflation

as the strong trade-weighted GBP (ERI) puts downward pressure on import

prices. The focus is now on EM data again and its impact on commodity

prices and general market volatility as GBP remains sensitive to all of

these factors."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.11.13 17:33

Forex Weekly Outlook November 16-20 (based on the article)

The US dollar had a mixed week after the NFP. Japan GDP data, Inflation data from the UK, the US and Canada and a rate decision in Japan stand out. These are the main events on forex calendar. Here is an outlook on the market-movers for this week.

A long list of Fed speakers basically left expectations for a Fed hike unchanged, thus leaning towards a move in December. Yellen remained silent. In the euro-zone. Data was mixed, with a disappointment in retail sales but upbeat consumer confidence also a positive JOLTs report, Draghi reiterated his desire to act in December: provide more easing. In Australia, the jobs report was excellent and falling oil prices weighed on the Canadian dollar.

- Japan GDP data: Sunday 23:50. Japan’s economy contracted 0.4% in the second quarter, when Gross domestic product declined by an annualized 1.6% between April to June. The contraction was less than expected, but consumer spending and investments weakened. Many economists believe inflation will not reach the 2% target by summer 2016 expecting further monetary easing in the coming months. GDP is expected to remain negative at -0.1%.

- Mario Draghi speaks: Monday. 10:15 and Friday, 8:00. ECB President Mario Draghi will give speeches in Madrid and in Frankfurt. During his talk before the European Parliament last week, Draghi dropped another hint that the ECB is preparing further monetary easing measures to boost the Eurozone’s recovery. The ECB president admitted that the 2% inflation target will take longer to achieve and that the central bank will re-examine a QE program in early December. Market volatility is expected.

- UK inflation data: Tuesday, 9:30. UK Consumer Prices fell to -0.1% in September hovering close to zero for most of this year. Food prices declined by 2.5% in the year amid ongoing supermarket price wars. According to the low CPI release, the Bank is in no hurry to raise rates anytime soon. Furthermore, core CPI also remained weak at 1.0% suggesting no underlying inflationary pressures despite continuing strength in wage growth. Consumer prices are expected to remain at -0.1%.

- German ZEW Economic Sentiment: Tuesday, 10:00 German analysts and investors sentimentplunged in October to 1.9 points, following 12.1 in September amid the scandal at Volkswagen and the weakness in emerging markets. Analysts expected a reading of 6.8. Current conditions declined to 55.2 points from 67.5 points in September, below expectations for a drop to 64.7. German economic sentiment is expected to reach 6.7% this time.

- US inflation data: Tuesday, 13:30. Consumer prices in the U.S. declined 0.2% in September while Core CPI excluding the volatile food and energy sectors gained 0.2%. Analysts expected CPI to drop 0.2% and Core CPI was predicted to rise by 0.1%. Despite the fall in headline inflation, core prices edged up 1.9% in the past 12-months, from 1.8% the prior month getting closer to a December rate hike call. The energy index plunged 4.7% in September. A continued decline in the gasoline index, this time by 9%, was the main cause in the decline for overall CPI. Both CPI and Core CPI are forecasted to rise 0.2% in October.

- US Building Permits: Wednesday, 13:30. Building permits declined 5% to a 1.1 million pace in September the lowest number since March. Meanwhile, applications for single-family projects declined 0.3% to a 697,000 unit pace; indicating this component will come to a standstill in the coming months. However, housing starts were encouraging consistent with the builders increasing confidence in the outlook for their industry. The number of permits is expected to reach a unit pace of 1.15 million in October

- US FOMC Meeting Minutes: Wednesday, 19:00. In the Fed’s October decision, the tone was relatively hawkish regarding inflation and employment, not expressing real worries. In addition, they provided a hint about action in December. The minutes may reveal how hawkish the members really are and how close a December hike is real. Note that the excellent NFP was released in the meantime, and that the Fed edits the minutes until the last minute before the publication. Markets always move by any wording nuances.

- Japan rate decision: Thursday. The Bank of Japan maintained its monetary policy, refraining from adding further stimulus at its policy meeting in October. However, the members reiterated their promise to increase the monetary base at an annual rate of 80 trillion yen ($660 billion). At the Press conference, following the meeting, BOJ Governor Haruhiko Kuroda said there were no proposals to ease monetary policy during the meeting, and blamed the low energy prices for the failure to achieve the BOJ’s inflation target.

- US Unemployment Claims: Thursday, 13:30. New U.S. applications for unemployment benefits remained unchanged last week, indicating strong labor market conditions. The data was worse than the 270,000 forecasted but still supports the Federal Reserve call to raise interest rates next month. The four-week moving average of claims rose 5,000 to 267,750 last week, still close to a 42-year low. The number of people continuing to receive benefits after an initial week of aid increased 5,000 to 2.17 million last week. Jobless claims for this week are expected to reach 272,000.

- US Philly Fed Manufacturing Index: Thursday, 15:00. The Philadelphia manufacturing index remained in negative territory for the second month in a row reaching -4.5 in October after posting -6 in the prior month. The negative figures show sharp slowing in the manufacturing sector. The strength of the US dollar has been weighing on US industry since last fall, making products less competitive in the global market. Philadelphia manufacturing index is expected to rise to 0.1 in November.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The price is on bearish reversal: the price broke Ichimoku cloud and 'reversal' Sinkou Span line from above to below to be reversed from the primary bullish to the primary bearish area of the chart.

W1 price is on breakdown with the bearish reversal:

- The

price is breaking 1.5106 support level from above to below for the breakdown to be continuing.

- Tenkan-sen

line is below Kijun-sen line of Ichimoku indicator which is indicating

the primary bearish condition to be continuing.

- Chinkou

Span line crossed the price from above to below for the breakdown.

- Nearest support levels are S2 Pivot level at 1.4702 and key support level at 1.4565.

- Nearest resistance levels are 1.5658 and 1.5929.

MN price is on bearish breakdown tobe started with 1.4565 as the real bearish target.If W1 price will break 1.4702 support level so the primary bearish will be continuing.

If W1 price will break 1.5658 resistance level so the reversal to the primary bullish condition will be started with the secondary ranging (the price will be inside Ichimoku cloud/kumo in this case).

If W1 price will break 1.5929 resistance level so the price will be fully reversed to the bullish market condition with good breakout possibility.

If not so the price will be ranging within the levels.

SUMMARY : bearish

TREND : breakdown of support levels