If you want to place a stop, then by no means immediately send an order to a broker in the terminal (as many do)

brokers see all stop losses and their traders who sit in the dealing centres of all brokers

consolidate with each other (even from different but partner brokers) and move the price to the set stop losses

by intentionally knocking them down. This is called client sweeping....... And when approaching takeprofits they also turn around.

You should set "virtual" stop losses only in your terminal by an Expert Advisor or a script (without sending an order to a broker right away).

and by stealth technology (i.e. invisible to brokers). Also, takeprofits should not be revealed to brokers in advance as well.

You should not give them your cards in their hands and the possibility to calculate your mathematical expectation in advance..........

If you want to place a stop, then by no means immediately send an order to a broker in the terminal (as many do)

brokers see all stop losses and their traders who sit in the dealing centres of all brokers

consolidate with each other (even from different but partner brokers) and move the price to the set stop losses

by intentionally knocking them down. This is called client sweeping....... And when approaching takeprofits they also turn around.

You should set "virtual" stop losses only in your terminal by an Expert Advisor or a script (without sending an order to a broker right away).

and by stealth technology (i.e. invisible to brokers). Also, takeprofits should not be revealed to brokers in advance as well.

You should not give them your cards in their hands and the possibility to calculate your mathematical expectation in advance..........

I wonder what kind of a smart guy taught most traders to put stops behind the nearest highs and lows.

When I first tried trading it seemed silly to me. Although at that time collecting stops was not fashionable yet.

Now this concept is so popular that it clearly illustrates typical stop patterns.

Not only big players, but also ordinary traders gather stops of skilled beginners.

In my opinion, it's an absolute imbecility to place stops behind the nearest extremums))).

Stops are better placed either relative to levels, or according to the limit of losses on one position or another.

Moreover, when setting stops by level, we should carefully consider how many points were affected by false-breaks of levels during the last six months, and set the appropriate stops.

One might think that my post is taking bread away from stop traders. But in fact, it is the banks, not the traders, who get the vast majority of the meat from the stops. When this shop closes, experienced traders will earn a lot more and easier.

I agree with you about the stock, but you can't say that they don't have a lot of money. I agree with you about the stops on the highs and lows, they are levels and most of the traders place their stops behind the level. I'd rather trade up to those levels than enter from them because it has a high probability the price will reach those levels.

There's a good level where the false-breakout was, that's where the good levels are!

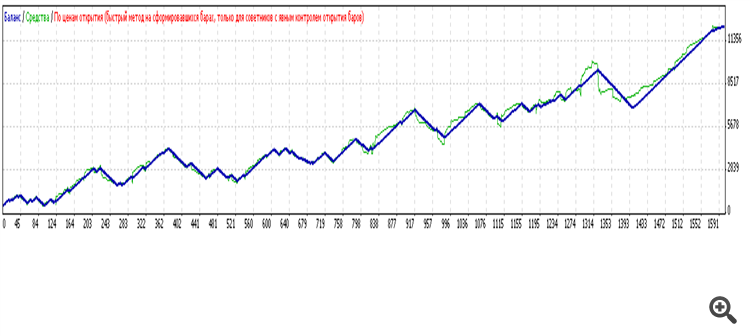

I think if the TS is able to show a positive trading advantage, then it should do so under condition TP=SL, for example TP=SL=300pp... Trading without SL at all, firstly, is risky, and secondly, one may end up making less profit as well. In this matter, I focus on the ratio K= maximum profit/maximum drawdown. In my tester I select such TP=SL, that K was maximal. Believe me, this index does not approve of absence of SL at all. Here is an example from the tester with SL=TP=300pp on EUR/USD for the period from 01/01/2009 to the present time on D1:

There are 2255 bars in the history

Modelled ticks 3855

Modeling quality n/a

Chart mismatch errors 0

Initial deposit 500.00

Spread Current (19)

Net profit 11825.88

Total profit 29607.02

Total loss -17781.14

Profitability 1.67

Expected payoff 7.39

Absolute drawdown 48.64

Maximum drawdown 2695.16 (26.43%)

Relative drawdown 63.32% (779.01)

Total trades 1600

Short positions (% win) 799 (66.33%)

Long positions (% win) 801 (60.67%)

Profitable trades (% of all) 1016 (63.50%)

Loss trades (% of all) 584 (36.50%)

Largest

largest profitable trade 29.99

losing trade -35.13

Average

profitable trade 29.14

losing trade -30.45

Maximum number

consecutive wins (profit) 91 (2686.55)

78 (-2523.70) continuous losses (loss)

Maximum

Continuous Profit (number of wins) 2686.55 (91)

Continuous loss (number of losses) -2523.70 (78)

Average

continuous winnings 16

Continuous loss 9

К=11825.88/2695.16 = 4,39

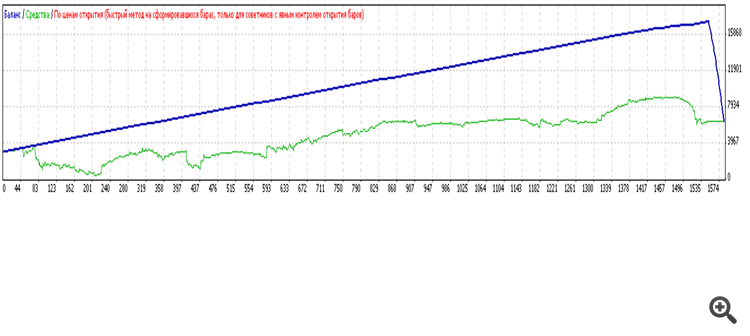

Now let's put SL=0:

Bars in the history 2255

Modelled ticks 3855

Simulation quality n/a

Chart mismatch errors 0

Initial deposit 3000.00

Spread Current (20)

Net profit 3376.32

Total profit 14354.82

Total loss -10978.50

Profitability 1.31

Expected payoff 2.13

Absolute drawdown 2477.79

Maximum drawdown 3258.68 (35.42%)

Relative drawdown 85.01% (2961.79)

Total trades 1583

Short positions (% win) 782 (97.06%)

Long positions (% win) 801 (94.76%)

Profitable trades (% of all) 1518 (95.89%)

Loss trades (% of all) 65 (4.11%)

Largest

profitable trade 9.99

losing trade -433.25

Average

profitable trade 9.46

losing trade -168.90

Maximum number

continuous wins (profit) 895 (8330.19)

Continuous losses (loss) 34 (-10895.31)

Maximum

Continuous Profit (number of wins) 8330.19 (895)

Continuous loss (number of losses) -10895.31 (34)

Average

continuous win 127

Continuous loss 5

K= 3376.32/3258.68 = 1.04 with a deposit of 6 times the previous case. Therefore, I have changed my view on the SL problem from complete rejection to a sober approach considering the market peculiarities and possibilities of TS, and I always try to observe the SL=TP principle.

If you want to place a stop, then by no means immediately send an order to a broker in the terminal (as many do)

brokers see all stop losses and their traders who sit in the dealing centres of all brokers

consolidate with each other (even from different but partner brokers) and move the price to the set stop losses

by intentionally knocking them down. This is called client sweeping....... And when approaching takeprofits they also turn around.

You should set "virtual" stop losses only in your terminal by an Expert Advisor or a script (without sending an order to a broker right away).

and by stealth technology (i.e. invisible to brokers). Also, takeprofits should not be revealed to brokers in advance as well.

You should not give them your cards in their hands and the possibility to calculate your mathematical expectation..........

For severe cases of paranoia, you can put pauses instead of stops.

A stop is definitely identified as a loss (although there are exceptions, a stop at breakeven).

But to put stops as protection, have taught us since the days when the Internet was very unstable and cuts in connection were not uncommon (by the way, then you could close a position by phone, also an anachronism from the days when everything was done by phone).

But now that stops have become part of strategies, small but never triggered stops are a sign of accurate entry. Large but always achievable profits are a sign of correct exit.

My manual TS was also without stops, trades are always profitable, but waiting for a drawdown will make you gray hair :)

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Personally, I don't put any stops at all in manual trading, but I can withstand serious drawdowns thanks to diversification techniques.

Nevertheless, I would like to talk about the strategy of setting stops.

I wonder what kind of a smart guy taught most traders to place stops behind the nearest highs and lows?

When I first tried trading it seemed silly to me. Although at that time collecting stops was not fashionable.

Now this concept is so common that it clearly draws typical stop patterns.

Not only big players, but also ordinary traders gather stops of proficient beginners.

So in my opinion it is complete retardation to place stops behind the nearest extremums))

Stops are better placed either below the levels, or below the stop loss limit for a particular position.

Note that when setting stops by level, we should carefully consider the number of points of false breakouts of levels which occurred during the last six months, and set the appropriate stops.

Some may think my post is taking away traders' bread with me. But in fact, the vast majority of the meat on stops goes to banks, not traders. When this shop closes, experienced traders will earn a lot more and easier.