Machine learning in trading: theory, models, practice and algo-trading - page 2462

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Ask the topic, let's talk.

Well here is a topic for your discussion.....

As said above, the information fed to the input of the NS is of great importance. For example I use Delta, OI and RealVolume because I think that this information is of direct importance for a working instrument, be it Si or RTS index. The main thing is that we take the values from the market in which we work. I tried to take this information from the Chicago Mercantile Exchange to work with Moex, but it was a dead end, so we take it from the exchange we work on. The question is, what other information is relevant for the Moscow Exchange market? Well probably the options section, namely the smile parameters of weekly options for all instruments used. Okay, What else can be useful for the quality of the network outside of the training section?

Well here is a topic for your discussion.....

As stated above, the information fed to the input of the NS is very important. For example I use Delta, OM and RealVolume, because I think that this information is directly important for the working instrument, whether it is Si or RTS index. The main thing is that we take the values from the market in which we work. I tried to take this information from the Chicago Mercantile Exchange to work with Moex, but it was a dead end, so we take it from the exchange we work on. The question is, what other information is relevant for the Moscow Exchange market? Well probably the options section, namely the smile parameters of weekly options for all instruments used. Okay, What else could be useful for quality networking outside of the training section?

Add price to the underlying asset. If steel companies - steel quotes from the London Stock Exchange, oil, gas, etc.

Add the price of the underlying asset. If metallurgical companies - steel quotes from the London Stock Exchange, oil, gas, etc.

Doubtful all this, I think it will not work...

Delta, OI and RW do not work, and still they all shove them into the NS

Why do you think so? There is a proof or at least a logical inference and then I will tell you how I use them!

There is a proof - the absence of at least one confirmed case of systematic earnings on these three indicators.

A waste of time.

For the youngest I will explain on my fingers very simply - if there is not a single confirmed case of the existence of mermaids, then the most rational solution would be to admit that they do not exist

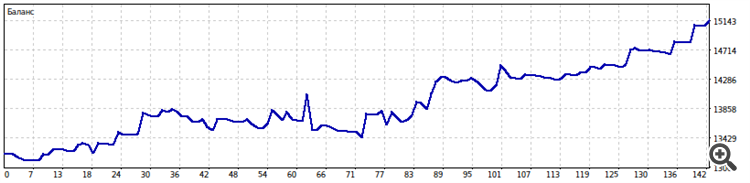

I'm not going to lie that the curve is not perfect but it does exist and looks quite interesting!!!! And you say that such evidence doesn't exist, so here it is!!!!

Yeah,150 deals isn't much,but still...I'm not going to lie that the curve is not perfect but it does exist and looks quite interesting!!!! And you say that such evidence doesn't exist, so here it is!!!!

The tester?