Machine learning in trading: theory, models, practice and algo-trading - page 186

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Because it is frozen.

I'm sorry, but as the question, so is the answer.

I do not understand the humor, because to make a decision, the value of the classifier's output must be compared with something, for example, with a threshold value. And since in your formulation of the problem the comparable values for some reason are unknown, and only those that are not needed for the classification are known, it would be a good idea to make clarifications.

I have completed many days of calculations (models on 6 selected predictors (out of 114) for forex).

Here is the title picture. Distribution of regression accuracy (counted by L1 norm: sum of absolute error values ) on validation for the models that were selected as the best (by the same measure) on the test boxes.

Each box has 99 values, each of which is metric 1 - sum(abs(X-Y))/sum(abs(X-mean(X)) on a unique validation sample. Analogous to R^2, I see, yes.

A total of 8908 models turned out... For all the instruments and targets under study.

An average error reduction of 0.2% (only). But it is significant... A unique validation sample was generated for each model.

All studies I want to publish. That's where the MO evaluation of the model goes next, and so on to the logical end. If I publish (not in MQL), I'll give a link to some people I communicate with here or I'll post it in my profile.

And in the same place. This is a much more interesting picture from a practical point of view. The relation between model's expectation on test blocks (inside crossvalidation) and on validation.

Here we must immediately check if the positive correlation is significant (since negative correlation cannot be reasonably explained at all) and if there are positive values of MPO on validation. Well, you can see for yourself.

The 99 points are models.

This is a good example of why 99% of naive traders lose...

And this branch is a good, clear example of the fact that machine learning in trading, is only a theory...

I have completed many days of calculations.

I follow your research, very informative, thank you for posting. But it seems to me that even though you successfully solve such complex problems, you skip preparatory tasks and it spoils the result. Namely, you ignore the selection of predictors.

You took 114 predictors, then somehow selected 6, and after training the models you can conclude which goal is better. But this result is just a local maximum. You can say not globally that "eurusd is better predicted by 16 bars ahead", but only that "the set of 114 predictors: (pre1, pre2, pre3,...) using gbm best predicts price direction through 16 bars".

If you take neuronics instead of gbm the best target will be different. If you take the other 114 predictors, the best target will be different again. Your 114 predictors are such an important base that the whole further course of the experiment depends on it, and you just took them from the ceiling without any preparation.

About half a year ago SanSanych has posted a file with his predictors. The peculiarity of these predictors is that most of models in rattle have some small error on them, and the error does not increase on new data. You can train models on any segment, and do an oos test on the remaining data and see that nothing has deteriorated. It's the predictors and the target are so related that the models find the only possible relationship between them on any bars.

I'm trying to replicate that. I use more than 10 000 initial predictors (indicators with different parameters and lags from mt5) and learn to select them so that they have the only possible connection with the target. I think that the ability to find such correlated predictors and the target is a true bullet for the grail.

In MQL5 there is recently available Expert Advisor generator, when you select a list of necessary indicators and a ready Expert Advisor with code is created immediately. This Expert Advisor has 20 indicators and there are no machine learning models (all we have are importance coefficients, assigned to each indicator).

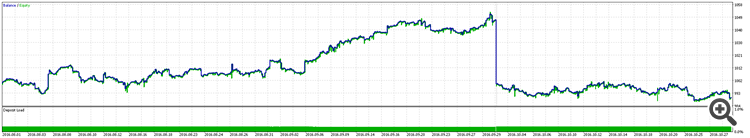

(eurusd h1)

(eurusd h1)

I just added my custom code for the fitness function of genetics, including some criteria, so that the target and indicators are considered closely related in my opinion. It turned out like this:

The first 2/3 is backtest (sample), the last third is fronttest (oos). There after 2/3 of the time is not a flush, but the balance is reset to the initial one for the oos test. Having such a poor set of options and simply adding the "crude and unfinished criteria of predictor and target dependence", we obtain a good result, although not a great one, but not a loss. 51% of successful trades at oos. Isn't that great? But it is possible to take 20000 indicators instead of 20, add some machine learning model and remove the 10000 iteration limit of mt5 genetics and we'd have even a profitable Expert Advisor.

And this thread is a good, clear example of the fact that machine learning in trading, is only a theory...

Yes in trading theory can not be in principle, or rather theory is about the fact that it is impossible to earn, the efficient market, etc., all taken into account in the price, exchange mechanism ..., that is, to trade to play roulette.But the statistics and machine learning, which became more accessible recently thanks to different math-packages and libraries, allows you to really see WHY it is so sad with the standard TA, not scientists, but simple traders, a week having messed around in R-studio or Matlab.

If MO in trading is "only theory", which in general is partially true, then TA is not even a theory, but in general a mare's nonsense, like astrology or voodoo.

But many here know that it is still possible to make money, an effective market is not just by the will of God, but because some have learned how to get and process information better than most. In my opinion the most significant obstacle for trader is an illusion of simplicity of this type of business, as if the official will get money for his signature, here on this forum not once sounded something like "you do not need to create a hadron collider to trade" ...

But it turns out you do....

I follow your research, very informative, thank you for posting. But it seems to me that even though you successfully solve such complex problems, you skip preparatory tasks and it spoils the result. Namely, you ignore the selection of predictors.

You took 114 predictors, then somehow selected 6, and after training the models you can conclude which goal is better. But this result is just a local maximum. You can say not globally that "eurusd is better predicted by 16 bars ahead", but only that "the set of 114 predictors: (pre1, pre2, pre3,...) using gbm best predicts price direction through 16 bars".

If you take neuronics instead of gbm the best target will be different. If you take the other 114 predictors, the best target will be different again. Your 114 predictors are such an important base that the whole further course of the experiment depends on it, and you just took them from the ceiling without any preparation.

About six months ago SanSanych posted a file with his predictors. Their peculiarity is that most models in rattle have a small error on them, and at the same time the error does not grow on new data. You can train models on any segment, and do an oos test on the remaining data and see that nothing has deteriorated. It's the predictors and the target are so related that the models find the only possible relationship between them on any bars.

I'm trying to replicate that. I use more than 10 000 initial predictors (indicators with different parameters and lags from mt5) and learn to select them so that they also have the only possible connection with the target bar. I think that the ability to find such correlated predictors and the target is a true bullet for the grail.

In MQL5 there is recently available Expert Advisor generator, when you select a list of necessary indicators and a ready Expert Advisor with code is created immediately. This Expert Advisor has 20 indicators and there are no machine learning models (all we have are importance coefficients, assigned to each indicator).

I just added my custom code for the fitness function of genetics, including some criteria, so that the target and indicators are considered closely related in my opinion. It turned out like this:

(eurusd h1)

The first 2/3 is backtest (sample), the last third is fronttest (oos). There after 2/3 of the time is not a flush, but the balance is reset to the initial one for the oos test. Having such a poor set of options and simply adding the "crude and unfinished criteria of predictor and target dependence", we obtain a good result, although not a bad one, but not a loss. 51% of successful trades on oos. Isn't that great? Well, you could take not 20 indicators but 20000 and add some machine learning model and remove the limit of 10000 iterations from mt5 genetics and even a profitable Expert Advisor would appear.

Advise where to find an advisor (robot) which would open a deal at a given time and then close the deal at a given time.

For example, opened a trade at 12:59, and would close it at 13:59, regardless of the result - profit or loss all the same.