Are the attachments EA's and are they free to use.

Thanks

I hope, this clause will help traders to avoid some mistakes.

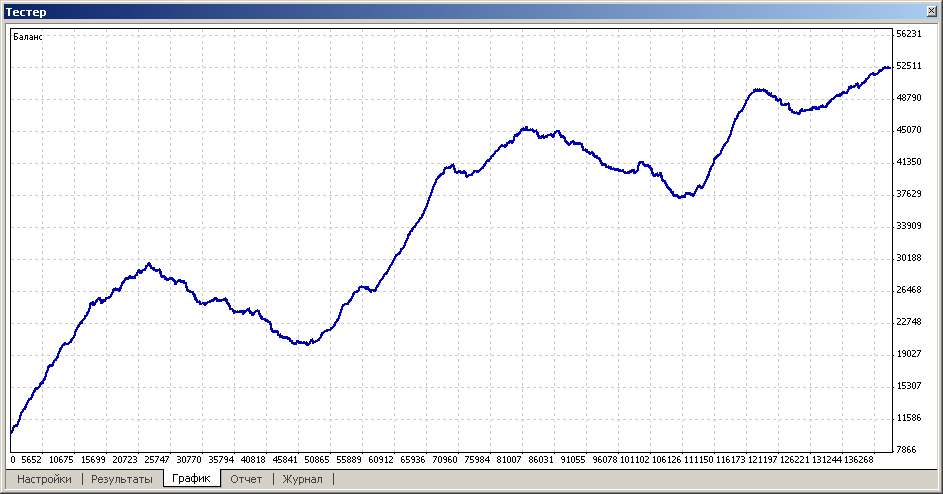

I have tested the system (first one) on the same time period and the same currency but I have got completely different results.

I guess it may happened because we used different data.

Where can I download 1M EURUSD data you used and get the same results in tests?

Thank you for your reply.

Да, я тоже думаю, что это зависит от данных.

Более 'пушистые' исторические данные, а также меньший спред

дают лучшие результаты.

Однако, в реальной торговле всё равно будет убыток.

Дилеры не станут терпеть убытки из-за несовершенства техники

и просто закроют счёт.

Извините за плохой английский.

Yes, I too think, that it depends on data.

More "fluffy" historical data, as well as smaller спред yield the best results.

However, all will be equal actual commerce the loss.

Dealers not begin to incur losses because of imperfection of technics and will

simply close the account.

Excuse for bad English.

The data I have used give absolutely opposite results than you described.

(I mean downward straight line when using only the 0,1 lot in all transactions)

I would like to test it on the same data as you did and then compare the data.

Could you write here the link to the data you used with so fantastic results on tests.

(I understand that so fantastic results are not possible in real trading, but even in tests it is strange to be so different the results of the same strategy in the same time period)

Да, я тоже думаю, что это зависит от данных.

Более 'пушистые' исторические данные, а также меньший спред

дают лучшие результаты.

Однако, в реальной торговле всё равно будет убыток.

Дилеры не станут терпеть убытки из-за несовершенства техники

и просто закроют счёт.

Извините за плохой английский.

Yes, I too think, that it depends on data.

More "fluffy" historical data, as well as smaller спред yield the best results.

However, all will be equal actual commerce the loss.

Dealers not begin to incur losses because of imperfection of technics and will

simply close the account.

Excuse for bad English.

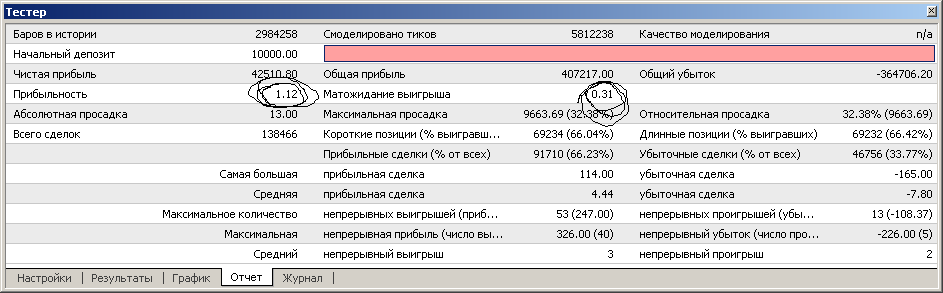

Попробуйте протестировать программы на данных с 1999 года при

минимальном спреде, желательно не более 2 пунктов по указанным

в статье финансовым инструментам.

Например, на данных Альпари можно получить такой результат:

Try to test programs on data since 1999 at minimal spread, it is desirable no more

than 2 items on the financial tools specified in clause.

For example, on data Alpari it is possible to receive such result:

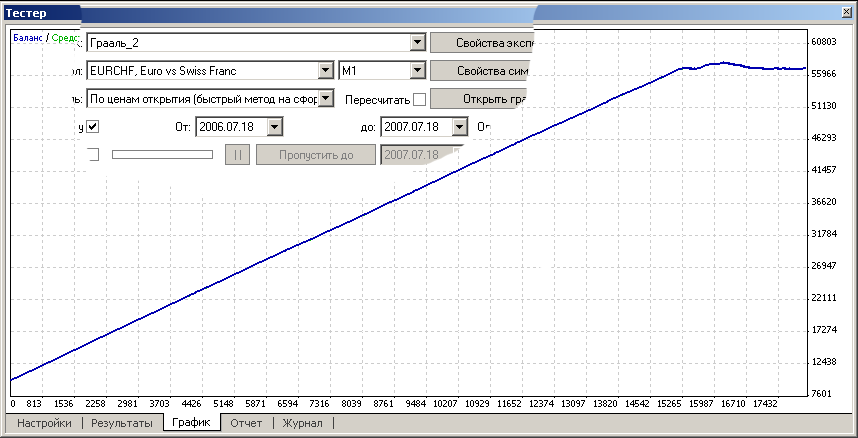

Вот результат Грааль_2 на данных Альпари. Легко заметить, что в последней истории результаты хуже. Это значит, что дилинговый центр уменьшил необоснованный разброс цен.

Here result Грааль_2 on data Alpari. It is easy to notice, that in last history results are worse. It means, that dealing the center has reduced unreasonable disorder of the prices.

The period of data from alpari http://www.alpari.co.uk/en/dc/databank.html is from 2004.06.

Here is result of grail 1 on the 2 pips spread from 2004.06 to 2007.06

As you can see the curve is straight downward.

I do not have idea why it is so.

At the beginning there is upward and about 19097 transaction it is horizontal line.

It is different from your results. Do you have any idea why?

And another question where could you find 1M data from 1999? (On alpari both EURUSD and EURCHF are form 2004. 06)

I have tested on 1M data from alpari on MIG server (standard spread on MIG is 2 pips).

The period of data from alpari http://www.alpari.co.uk/en/dc/databank.html is from 2004.06.

Here is result of grail 1 on the 2 pips spread from 2004.06 to 2007.06

As you can see the curve is straight downward.

I do not have idea why it is so.

1. Я использовал данные http://www.alpari-idc.ru/ и их торговые условия.

2. Торговые условия MIG могут отличаться от условий Alpari, например, минимально допустимая дистанция при модификации.

3. В данной теме чудес не бывает. Если точно воспроизвести условия на разных компьютерах, то и результаты будут одинаковыми.

1. I used data http://www.alpari-idc.ru/ and their trading conditions.

2. Trading conditions MIG can differ from conditions Alpari, for example, minimally admissible distance at modification.

3. In the given subject matter of miracles does not happen. If precisely to reproduce conditions on different computers also results will be identical.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

New article My First "Grail" has been published:

Examined are the most frequent mistakes that lead the first-time programmers to creation of a "super-moneymaking" (when tested) trading systems. Exemplary experts that show fantastic results in tester, but result in losses during real trading are presented.

The word "grail" is now often used among modern programmers ironically. It means for them the impossibility to create a "universal" program for all occasions. As to programming in MQL4, this word means impossibility to create an expert that would give fantastic effects in the real trading.

In reality, forex is the reflection of a complex conglomerate of phenomena - economic and industrial relations, human characters, politics. Moreover, and this is even more important, it cannot be simply formalized. Experienced traders recommend to enter the market only if there are three to five or even more signs indicating the possible trend.

At the same time, the regularities determined by now cannot completely provide a deep basis for market forecasting with high probability of success. The contradictory prognoses made by leading analysts of eminent banks and financial organizations confirm this. All analysts, without any exception, can very well interpret the events that have already happened, but only a few of them can give a sequence of really confident prognoses.

Author: Сергей Ковалев