I'm sorry, I didn't really understand the point.

maybe you type too much? :peace

I am with you that not every thing written in a book by some one called a Traders Guru should be correct, we must do our own research to validate any trading rule that we read here or there.

For instance every traders guru will tell you to "Avoid Martingale Methods" and if you asked him to give you an alternative method that grantee some profits he will tell you that he will not show you anything that work better, not because he have a secret method and he don't want to show it in public, but because he really don't have any good alternative method, any system can win/loss like any martingale system and even worse as it is very hard to separate random from non-random motion on the chart.

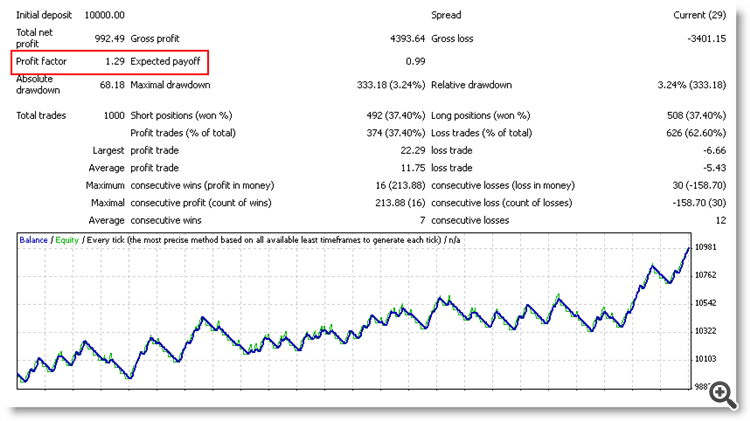

Also any system can when with or without martingale and the funny thing that they can give you the same profit factor!, take a look to this expert back test without martingale with a profit factor of 1.29

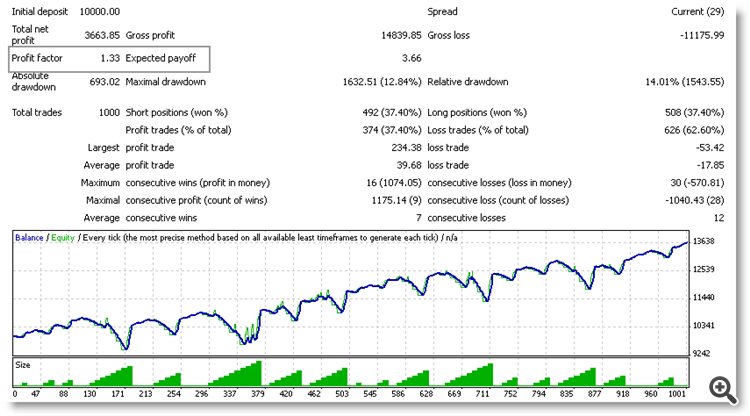

Here is the same EA back-test but with Martingale and profit factor of 1.33!

the question now is "SHOULD I TRADE WITH OR WITHOUT MARTINGALE?"....

If you asked any traders guru about portfolio trading he will tell you to "Trade Uncorrelated Securities" but if you asked him to tell you what is those uncorrelated securities you won't have an answer, because the reality is that "It is All One Joint Casino" or at least that is what my researches proved for me.

Sometime a go I made a research to find uncorrelated FOREX pairs and to do so I build my study in three steps:

1- I build a currency data base and made sure that my data is of good quality.

2- I build and an index to measure correlation between FX. pairs ranked from -5 t0 +5.

3- I build another index to give me the percent of the amount of time in which the correlation exist.

After several days of back testing my database I got out with one conclusion, which is "80% of the currencies pairs that I tasted is highly correlated to each other to a degree that make trading uncorrelated ones unprofitable".

I know that someone might read this and disagree but that is what I got. you can't trade the same securities from the same market and think that you diversify your portfolio at the same time, there is a principle in Cycle Theory called Commonality will prevent this from happening.

Take a good look to this schedule (+5, -77 means Highly positive correlated pairs 77% of time, -1, 13 means week negative correlated pairs 13% of time)

At the above schedule you will find a lot of +5 or -5 correlated pairs for 75% or more of time, but you will NOT find any +1/-1 correlated pairs for 75% or more of time.

What I want to say is that there is nothing called building a diversified currency portfolio because "That's all the Market is ....One Joint Casino".

I am with you that not every thing written in a book by some one called a Traders Guru should be correct, we must do our own research to validate any trading rule that we read here or there.

For instance every traders guru will tell you to "Avoid Martingale Methods" and if you asked him to give you an alternative method that grantee some profits he will tell you that he will not show you anything that work better, not because he have a secret method and he don't want to show it in public, but because he really don't have any good alternative method, any system can win/loss like any martingale system and even worse as it is very hard to separate random from non-random motion on the chart.

Also any system can when with or without martingale and the funny thing that they can give you the same profit factor!, take a look to this expert back test without martingale with a profit factor of 1.29

Here is the same EA back-test but with Martingale and profit factor of 1.33!

the question now is "SHOULD I TRADE WITH OR WITHOUT MARTINGALE?"....

If you asked any traders guru about portfolio trading he will tell you to "Trade Uncorrelated Securities" but if you asked him to tell you what is those uncorrelated securities you won't have an answer, because the reality is that "It is All One Joint Casino" or at least that is what my researches proved for me.

Sometime a go I made a research to find uncorrelated FOREX pairs and to do so I build my study in three steps:

1- I build a currency data base and made sure that my data is of good quality.

2- I build and an index to measure correlation between FX. pairs ranked from -5 t0 +5.

3- I build another index to give me the percent of the amount of time in which the correlation exist.

After several days of back testing my database I got out with one conclusion, which is "80% of the currencies pairs that I tasted is highly correlated to each other to a degree that make trading uncorrelated ones unprofitable".

I know that someone might read this and disagree but that is what I got. you can't trade the same securities from the same market and think that you diversify your portfolio at the same time, there is a principle in Cycle Theory called Commonality will prevent this from happening.

Take a good look to this schedule (+5, -77 means Highly positive correlated pairs 77% of time, -1, 13 means week negative correlated pairs 13% of time)

At the above schedule you will find a lot of +5 or -5 correlated pairs for 75% or more of time, but you will NOT find any +1/-1 correlated pairs for 75% or more of time.

What I want to say is that there is nothing called building a diversified currency portfolio because "That's all the Market is ....One Joint Casino".

It's a very interesting post. Can you share your methodology in more details so it will be possible to reproduce your experiment ?

No offense, but now we only have to believe and accept your statements (which can certainly be exact).

The problem of the martingale is the increased risk. You talked about the profit factor moving from 1.29 to 1.33, which is almost not significant. But did you check the drawdown ? From 3.24% to 12.84%, it's not a minor difference, though it's still reasonable. But from my experience there is always a moment when your martingale will blow out your real account.

"High risk equal High return while Low risk equal Low return".......the word return here might mean gains or losses.

The reason that the Dis Martingale back test look much less risky is the lot-size was fixed to 0.01 from the beginning of the test until the end, that is why return was only 992$, if we increased the lot-size we will make more profit and draw-down will increase too

Take a look to the next example where I risk only 0.01 fixed lot size:

Profit Factor is 1.85 , Maximum DD is 3.13% or $315 but return is $559 or 5.59%

If 0.01 lot lead to $315 DD then 0.15 lot will lead to about $5000 DD (= 50% / 3.13 *0.01) but profit will boost 15 times also , take a look to the back-test result with 0.15 fixed lot-size.

As you can see profit jumped to a new level but risk also jumped to an extreme, because high risk will mean always high gain/loss and vice verse.

So now what is the difference between using fixed lot and Martingale?

It's a very interesting post. Can you share your methodology in more details so it will be possible to reproduce your experiment ?

No offense, but now we only have to believe and accept your statements (which can certainly be exact).

"High risk equal High return while Low risk equal Low return".......the word return here might mean gains or losses.

The reason that the Dis Martingale back test look much less risky is the lot-size was fixed to 0.01 from the beginning of the test until the end, that is why return was only 992$, if we increased the lot-size we will make more profit and draw-down will increase too

Take a look to the next example where I risk only 0.01 fixed lot size:

Profit Factor is 1.85 , Maximum DD is 3.13% or $315 but return is $559 or 5.59%

If 0.01 lot lead to $315 DD then 0.15 lot will lead to about $5000 DD (= 50% / 3.13 *0.01) but profit will boost 15 times also , take a look to the back-test result with 0.15 fixed lot-size.

As you can see profit jumped to a new level but risk also jumped to an extreme, because high risk will mean always high gain/loss and vice verse.

So now what is the difference between using fixed lot and Martingale?

I'm sorry, I didn't really understand the point.

maybe you type too much? :peace

“Cut

the losers and ride the winners” is not good advice for trading the Forex. Also it was meant to be encouraging to develop your own new system that might go against mainstream.

OK when I will have enough time I will post this study here as an article.

Hey I would welcome your findings. I also would want to find out if you are doing something a little DIFFERENT from the standard Martingale trading? There is a lot of negative attitudes towards this type of trading. But its a person like you who might discover that one little thing that makes it worth it. So hang in there and look under all the rocks. You might find a diamond. In any case, I would love to see any and all result posted if you care to share them.

Best Regards

David

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

What if the world is wrong ?

When it comes to trading the Forex, I must ask, “what if the world is wrong”?

All the nice little phrases that seem to roll off your tongue with an elegant twist of secret knowledge may in fact be more harmful than helpful. Consider just this one little tid bit of knowledge that probably has cost traders millions of dollars in losses but if ignored may have created new wealth.

Ready for it? “Cut the losers and ride the winners”. Really? The people who use or pass this phrase along must have never traded the Forex.

If you have ever sat in front of your monitor with a knot in your stomach and gripping a pen tightly in your hand until your fingers were numb then you would know that the above statement is just not possible to incorporate in trading the Forex.

Within one second, (yes one second NOT one minute) you can be sitting there facing doom and financial death knowing that your account is distant for closure by the Forex Broker because of margin calls, only to see a spike in price that takes you out of the pits of financial despair into the presence of huge profits and before your eyes can focus, TP is triggered.

If you had cut the losers in this case then your account was at a lost and you were truly finished with trading because of lack of funds. On the other side of this emotional roller coaster lies the opposite, “ride the winners”.

Once again as you site in front of your monitor watching the prices move deeper and deeper into profits that you believe will never end, your mind begins to wonder towards the holidays and admiration from the rest of the Forex community as the, “Worlds Best Trader”. You imagine emails flooding your inbox from around the world from people and companies wanting interviews about your incredible trading skills. However, once again within that one second, (yes, yes, yes, one second NOT one minute) you see that spike and now you go from ecstasy to panic.

“Ride the winners and cut the losers”, impossible! I would replace that phrase with something of more value. “ When you enter the market, you must believe in your system.” Ha! This phrase does not roll off your tongue nor does it rhyme in any fashion but it is the best information that I could pass along. I cannot tell you how many times during a trade that I reexamined my method again and again with sweaty palms and then told myself, “Believe in your system, it has not failed yet”. Many times I would have lost 1000’s if I had not held on during those terrifying seconds. But later my system proved itself again and triggered the TP.

In closing I will tell each and every trader of any skill set, if you are trading then you must know exactly why you are entering the trade and exactly why you are exiting the trade and you must follow your system without deviation during trading. If you want to change or reevaluate system then walk away and do it with a clear head.

Once again I must ask, “what if the world is wrong”?