Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.26 19:33

Forex Weekly Outlook Dec 29- Jan 2 ( based on forexcrunch article)We end 2014 with US CB Consumer Confidence and Unemployment Claims

and open 2015 with US ISM Manufacturing PMI. Join our weekly outlook

with the main market movers to impact Forex trading. Happy 2015!

Last week, the final revision to US GDP in Q3 came out better than

expected, crossing the 4% growth rate for the second consecutive

quarter. US economy expanded 5% between July and September, beating the

preliminary estimate of 3.9% and the median forecast of 4.3%. The

strong expansion indicates the US economy will close 2014 on a strong

note. More positive data was released from the US labor market with a

continued decline in the number of initial unemployment claims, noting

the US job market continues to improve with increased hiring and fewer

dismissals. Will the US economy continue to expand in 2015?

- US CB Consumer Confidence: Tuesday, 15:00. U.S. consumer confidence declined in November to a five month low of 88.7 after posting 94.5 in October. Consumer’s confidence regarding current-business conditions and short-term outlook dropped considerably. Analysts expected confidence to rise to 95.9. Economists expect consumer sentiment will reach 94.6 in December.

- US Unemployment Claims: Wednesday, 13:30. The number of new applications for unemployment benefits declined last week to its lowest level since early November, indicating the job market continues to demonstrate strength. Initial jobless claims dropped by 9,000 to a seasonally adjusted 280,000. Economists expected claims to reach 290,000. The less volatile four-week moving average fell 8,500 to 290,250 indicating companies seek to hold on to their workers and hire new ones. The number of weekly claims is expected to reach 287,000 this week.

- US ISM Manufacturing PMI: Friday, 15:00. The U.S. manufacturing sector lost momentum in November, reaching 58.7 after a 59 points reading in the prior month. Economists expected a lower figure of 57.9. New Orders Index increased to 66, from October’s reading of 65.8; the Production Index reached 64.4%, down from the previous reading of 64.8; and the Employment Index declined to 54.9, compared to the precious reading of 55.5. Lower energy prices gave a boost to the manufacturing sector, increasing consumer’s demand and the continued strength of the Us labor market also contributes to growth. Manufacturing PMI is forested to reach 57.6 this time.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.27 11:59

Gold Price 2015: Forecasts And Predictions

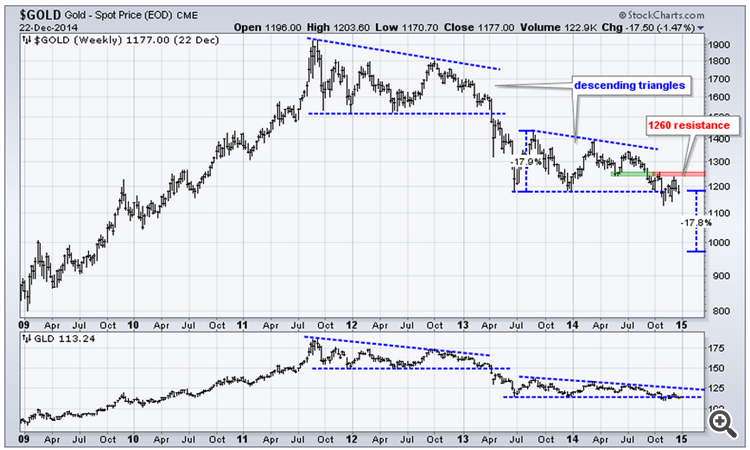

The key theme on the gold price chart are the two trading ranges since

gold’s all time highs. One trading range started end of 2011 and lasted

till early 2013, the second one is still in play. In technical terms,

both trading ranges took the form of a descending triangle.

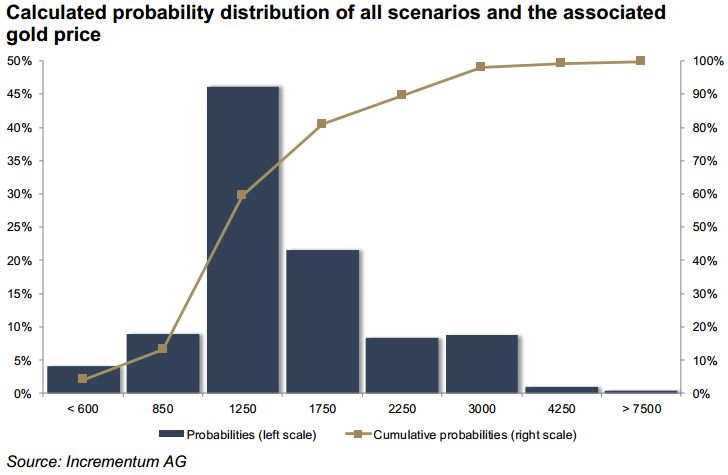

Earlier this year, gold analyst Ronald-Peter Stoeferle released its gold

price model for 2015 and beyond. Based on weighted probabilities, his

model shows a long-term gold price of USD 1,515 per ounce. The

distribution of gold price expectations remains positively skewed as

evidenced by the following chart. Therefore, should there be a deviation

from the currently widely expected path towards stabilization of the

central banks’ balance sheet, significant upside potential for the gold

price would result.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.29 19:21

Gold Lower as Markets Digest Greek Vote (based on foxbusiness article)

Gold edged lower on Monday, giving up some of the previous session's sharp short-covering gains, but uncertainty over the prospect of fresh elections in Greece kept the metal underpinned near $1,200 an ounce.

European shares and periphery euro zone bonds tumbled after the Greek parliament rejected the government's presidential candidate, setting the stage for an election that the anti bailout Syriza could win.

Spot gold was down 0.2 percent at $1,192.50 an ounce by 1415 GMT, after a gain of 1.8 percent on Friday, when it had touched $1,199, its highest since Dec. 22 and its biggest one-day jump in 2-1/2 weeks.

Bullion's rise came in thin market conditions due to the Christmas and year-end holidays and it was unclear whether the last session's gains would be maintained when trading picked up again.

"Friday's sharp move was a typical non liquidity move, so naturally enough it gives back a bit today," Saxo Bank's head of commodity research Ole Hansen said. "We are less than 1 percent away from where we finished a year ago, and I do not think we will sway much away from current prices."

"(The news from Athens) raises the risk of Grexit (Greek euro exit) once again - not the best climate for Europe to begin the new year," he added. "That could provide some support, although we need traders willing to put on risk and they are currently missing."

U.S. gold futures for December delivery were down $2.20 an ounce at $1,193.10.

Bearish sentiment in the bullion market was evident in SPDR Gold Trust, the world's largest gold-backed exchange-traded fund. The fund's holdings fell 0.08 percent to 712.30 tonnes on Friday, a six-year low.

Demand for the metal was soft overnight in Asia, the primary market for physical gold dealing.

"The premium on the Shanghai Gold Exchange was rather uninspiring, trading between par and $1 above spot for most of the day," MKS said in a note.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.27 12:03

Gold rebound coming in 2015: George Gero during a CNBC interview for “Futures Now” (based on cnbc article)

According to George Gero of RBC Capital Markets, gold is set to reverse its trend in 2015. During a CNBC interview for “Futures Now” he observed: “The decline from the $1,900s down to the $1,150s is a major decline, and it was reflected by all the funds fleeing gold and running into better-performing assets, whether it’s equities or debt, and that’s been continuing. In 2014, gold hasn’t been helped by the dollar’s rally. The greenback has shown serious strength against other currencies, which has reduced gold’s attractiveness. After all, since gold is priced in dollars, an increase in the value of a dollar means a decrease in the value of an ounce of gold. Additionally, since people buy gold to hedge against potential inflation, ebbing inflation fears dull gold’s appeal.”

Gero acknowledges that the sell off in crude is anti-inflationary—so the people that have been looking for inflation haven’t really found it. But he adds that “now you’re going to see some changes based on all the stimulus in Europe, in China and in Japan.Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.30 06:12

Gold and Silver Prices in 2015 (based on moneymorning article)

Precious metals haven't grabbed dramatic headlines like oil and gas have.

But their story is no less exiting. And the metals remain a fundamentally critical part of the global economic and strategic landscape.

Indeed, gold and silver took roller coaster-like rides throughout the year, both screeching towards their respective price lows before bouncing, albeit cautiously, ahead.

With the benefit of hindsight and the value of foresight, it's time to look at how gold and silver acted in 2014, and what we can do to profit in 2015.

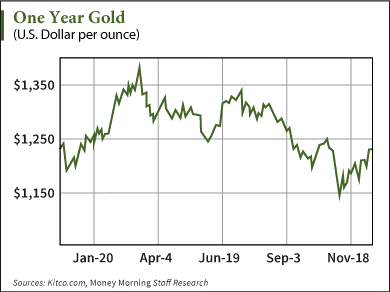

As you follow along with the graph, note that gold started out with a bang, bottoming around $1,195 December 19, 2013, then surging upward 12% to $1,390 by mid-March. It then headed back to the $1,300 level, and meandered sideways between $1,250 and $1,350 until mid-year.

The U.S. dollar began a strong climb from July onwards, likely in anticipation of the Fed ending its asset purchase program in October, as it ultimately did.

By November the SPDR Gold Trust ETF, the largest gold ETF, saw its gold holdings at six-year lows. Gold had become almost universally hated, which may well have marked the bottom.

And then it embarked on a new rise…

One of the biggest positives is how gold held up over the recent months: as oil prices plunged 27% from early November into mid-December, gold climbed by 7%.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.31 05:47

Gold Climbs Above $1,200; Silver Rises (based on blogs.barrons article)

Gold finished higher Tuesday after notching small losses the day before.

Gold for February delivery rose 1.6% to $1,200.40. Silver for March delivery rose 3.2% to $16.28.

Concerns about Greece’s fast-approaching elections amid a looming deadline related to the country’s debt bailout were helping gold, along with weakness in the U.S. dollar.

However, while gold is up for the week, it will still need to rise at least 0.2% tomorrow to not end 2014 in the red.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.02 10:06

Gold continues to shine as the best safe haven (based on smh.com.au article)

Gold has retained its status as a safe-haven investment, despite the rising strength of the US dollar and turmoil elsewhere in commodity markets.

The price has remained stable in 2014 and what's more, experts believe that the long-term outlook for the precious metal is well supported over the coming year. The price of gold ended 2014 almost unchanged on 12 months ago, closing on Wednesday at around $US1,184 ($1,449.48) an ounce after starting the year at $US1,205. Fears of a crash in the price were overblown.

Goldman Sachs has now set its long-term forecast for the price of the yellow metal at $US1,200 an ounce for the next three years.

The investment bank estimates that this is the break-even price for the majority of gold miners once all costs such as exploration, management and mine repairs are included.

As such, the price of gold may well fall below $US1,200 in the year ahead, but lower prices would force loss-making miners out of business and reduce supply, helping prices to recover eventually.

Mark Bristow, chief executive of FTSE 100 miner Randgold Resources, has said: "The [gold-mining] industry is clearly stuffed at $US1,140 and it will be a bloodbath at $US1,000."

Hunter Hillcoat, from broker Investec's natural resources team, has set a price forecast of $US1,150 an ounce for next year. The Investec team sees a resurgence in the US dollar, rising interest rates and falling inflation as challenges for the year ahead.

The price of gold has an inverse relationship with the world's reserve currency, the US dollar. A fundamental shift in American monetary policy last year has removed the main driving factor behind the price of gold during the past decade.

As the price of gold has fallen from a peak of $US1,900 in May 2011, investors have reduced their exposure. Holdings in gold exchange-traded funds, which allow investors to buy shares in a fund that tracks the gold price, have fallen in the past 12 months.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video January 2015

newdigital, 2015.01.03 07:47

Jim Rogers 2015 Forecast Buy Gold , Bull Market will come

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

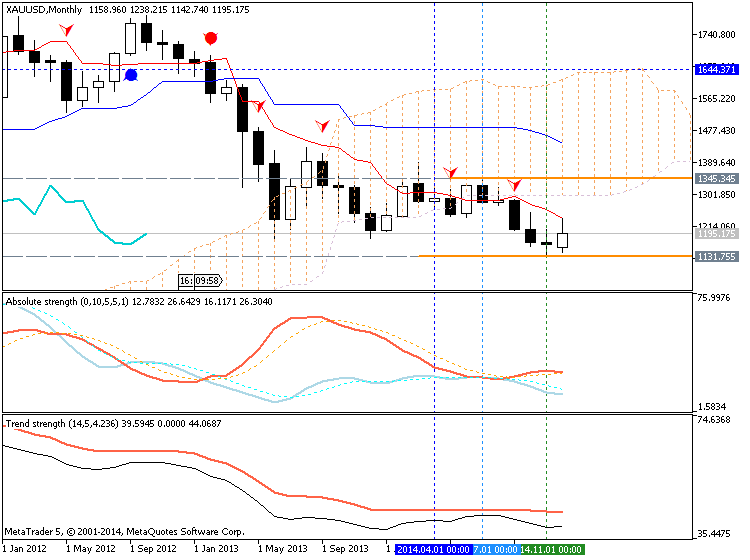

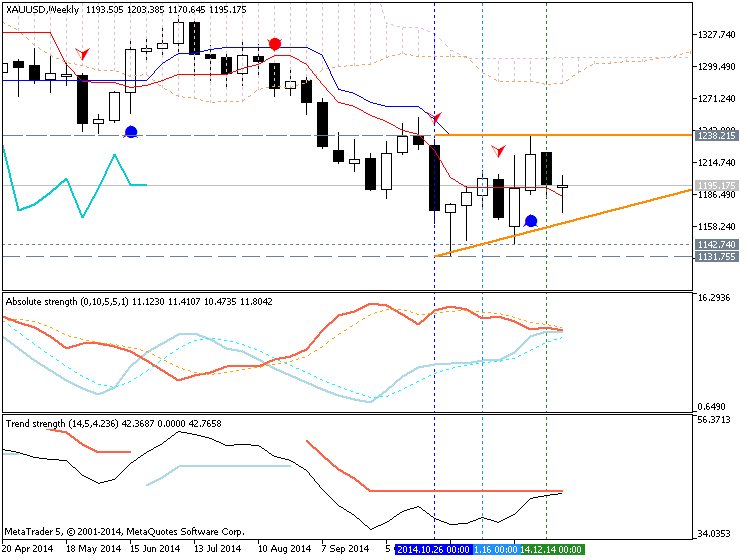

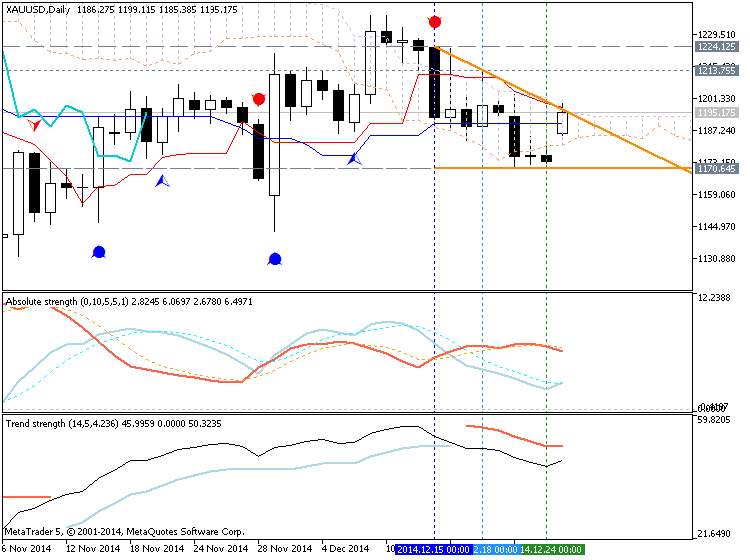

D1 price is on ranging market condition with primary bullish:

W1 price is on primary bearish with secondary ranging between 1131.75 support and 1238.21 resistance levels.

MN price is on bearish with ranging between 1131.75 support and 1345.34 resistance levels.

If D1 price will break 1170.64 support level so the primary bearish will be started

If D1 price will break 1224.12 resistance level so we may see the bullish without secondary ranging

If not so it will be the ranging within the bullish market condition.

UPCOMING EVENTS (high/medium impacted news events which may be affected on XAUUSD price movement for this coming week)

2014-12-30 15:00 GMT (or 17:00 MQ MT5 time) | [USD - CB Consumer Confidence]

2014-12-31 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2014-12-31 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Unemployment Claims]

2015-01-01 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Manufacturing PMI]

2015-01-02 15:00 GMT (or 17:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on XAUUSD price movement

TREND : rangingSUMMARY : bullish