Forum on trading, automated trading systems and testing trading strategies

Indicators: Trade Sessions Indicator

newdigital, 2014.01.28 07:42

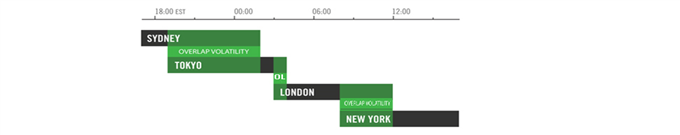

FX 24 Hours per Day (based on dailyfx article)

- The Forex Market trades 24 hours a day 5 days a week

- The greatest amount of volatility happens during market open overlap.

- Forex traders can enter and exit trades at any time during the global business day

The 24 hour 5 day access afforded to Forex traders has many unique advantages not available to traders in other markets. Forex traders’ 24 hour access to the market allow them to manage trades any time in the face of impending risks, take advantage of global trading opportunities whenever they arise, and trade during market time overlaps.

Divided in to four trading sessions; Sydney, Tokyo, London/Europe and

New York, traders have their pick of trading times to meet fit their

schedules. However, when sensitive global markets are rocked by

overnight news or the latest “flavor” of financial crisis, Forex traders

can be comforted that they can exit a trade or enter 24 hours a day, 5

days a week. Unlike their stock trading brethren who have to sit idly by

while economic releases or other high impact news rocks the market,

Forex traders can reduce risk by exiting positions without having to

wait for an opening bell.

When the phrase “Money never sleeps” was created, the Forex market could have been the inspiration. Spanning across the globe through a vast network of interconnected banks, the Forex market provides many trading opportunities that happen around the clock. A scheduled interest rate announcement at 12 AM ET in Australia can be traded as easily as the US interest rate announcement at 2pm ET because the Forex market doesn’t close. Forex traders are not restricted by time when it comes to trading opportunities that happen after the equity markets have closed.

Trade Session Overlaps provide volatility and liquidity

In addition, Forex traders can take advantage of the volatility

generated during times when major markets overlap. The most volatile

Forex market conditions occur when the Sydney and Tokyo equity trading

sessions overlap, the Tokyo/London overlap, and the London/New York

overlap. By not being restricted by a closing or opening bell, Forex

traders can place trades during these very liquid and volatile market

times. Remember that market volatility is a trader’s life blood. The

search for liquidity and volatility end here with the 24-hour/5 day a

week Forex market. Traders can manage risk with time restrictions, take

advantage of trading opportunities at any time and trade during trade

session overlaps.

The source code in the market session indicator is almost the same as the source code of Indicator of Trading Sessions - indicator for MetaTrader 4 by Igor Kim.

This source code has inherited two problems. First the indicator doesn't handle the session opening bar correctly if it happens to be the highest or lowest of the session.

Code modification provided courtesy of Aaron Lee. The modification includes the open bar exception.

Second if a session starts before midnight and ends after midnight the rectangle will be drawn incorrectly.

Code modification provided courtesy of MQL Comments. The modification correctly draws the rectangle for the expanded session which crosses the midnight hour.

My changes: Handle Sunday, Monday, Tuesday to Friday, and Saturday each as a special case. This code skips painting rectangles on Saturday and Sunday with exception given to the expanded session which crosses the midnight hour.

Insert logic to extend rectangles which have a time span past the midnight hour based on external variable for each session.

Insert logic to handle a gap correction. We defined a gap time span. If the gap time span is 3 days and 1 hour, numeric value 262800 then skip painting of rectangle.

One indicator draws boxes, other indicator draws horizontal lines.There is no correction for the daylight savings time.

Thanks to all the contributors.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Market Sessions:

The indicator displays Market Sessions. (Tokyo, London and New York. Sydney and Berlin not added).

Author: Osiris