Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.10 18:47

Forex Weekly Outlook October 13-17UK inflation data, Mario Draghi and Janet Yellen’s speeches, US Retail sales, Unemployment and manufacturing data are the major events on our calendar for this week. Here is an outlook on the main market movers coming our way.

Last week, despite continuous positive US data, the FOMC minutes defied expectations for a possible rate hike in the near future, sending the dollar down. The minutes revealed a debate on the necessary normalization period, which the hawks considered too long. Fed minutes also showed that some policymakers feared a stronger dollar will generate downward pressure on inflation and that global economic growth is on a downward trend. Will the dollar continue to decline?

- UK inflation data: Tuesday, 8:30. The annual inflation rate in the UK declined from 1.6% to 1.5% in August, amid lower prices of petrol, food and non-alcoholics drinks. Meanwhile, core inflation, excluding food, alcohol, tobacco and energy, edged up1.9%. However the low inflation bides well with consumer’s purchasing power due to a slow wage growth. UK inflation is expected to decline to 1.4% this time.

- Eurozone German ZEW Economic Sentiment: Tuesday, 9:00. German investor confidence declined to a 21 month low of 6.9 in September following a 8.6 reading in August amid stronger political tensions in Europe. Analysts expected an even lower figure of 5.2. This was the lowest reading since December 2012. German economy slowed down in the third quarter which may weaken growth in the second half of the year. German investor confidence s expected to plunge to 0.2.

- UK Employment data: Wednesday, 8:30. U.K. unemployment rate fell to the lowest level in six years, indicating continued strength in the labor market. Likewise, U.K. jobless claims dropped 37,200, far better than the 30,000 decline estimated by economists. That pushed the total below 1 million for the first time since September 2008. The number of workers rose by 74,000 to 30.6 million. Despite the slow growth in wages, Bank of England Governor Mark Carney is confident that job market growth will eventually boost salaries. U.K. jobless claims are expected to decline further by 34,200 now.

- Mario Draghi speaks: Wednesday, 7:00, 18:00. ECB President Mario Draghi will speak in Frankfurt at two occasions. He may talk about the ECB’s efforts to raise inflation to normal levels and the planned QE. Market volatility is expected.

- US retail sales: Tuesday, 12:30. U.S. retail sales gained 0.6% in August amid a buying spree of automobiles and a range of other goods. Economists expected a 0.3% increase as in July. Meanwhile core sales expanded 0.3% exceeding expectations for a 0.2% rise. Consumer sentiment also soared, hitting a 14-month high in September. However lack of real wage growth may weigh on retail sales in the future but the third quarter looks promising. Retail sales are expected to decline by 0.1% , while core sales are predicted to rise 0.2%.

- US PPI: Tuesday, 12:30. Wholesale prices in the U.S. remained changed in August from the previous month, held back by a plunge in energy costs as well as indicating low inflation in the production pipeline. In the last 12 months, wholesale prices increased 1.8%. The PPI excluding food and energy inched 0.1% from the prior month. Producer prices are predicted to gain 0.1% this time.

- US Unemployment Claims: Thursday, 12:30. Fewer Americans filed claims for unemployment benefits last week, reducing the average number of applications to the lowest level in eight years reaching 287,750. Applications declined 1,000 to 287,000 last week, suggesting employers keep their workers, expecting continued economic growth including expansion in hiring. The number of people receiving benefits has also fallen steadily to just 2.38 million in the week ended Sept. 27. Jobless claims are expected to reach 286,000 this week.

- US Philly Fed Manufacturing Index: Thursday, 14:00. Manufacturing activity in the Philadelphia area declined in September to 22.5 from 28 in August which was the highest since March 2011. Economists expected a slightly higher reading of 22.8. Despite the fall in September, the survey reflects continued growth in the region’s manufacturing sector as many indicators for future manufacturing conditions reflect general optimism about growth in activity and employment over the next six months. Manufacturing activity in the Philadelphia area is anticipated to decline further to 19.9.

- US Building Permits: Friday, 12:30. The number of permits issued for privately-owned housing units reached a seasonally adjusted annual rate of 998,000 in August following the revised July rate of 1,057,000. Economists expected a total of 1,040,000. Single-family permits in August reached 626,000, 0.8% below the revised July figure of 631,000. Authorizations of units in buildings with five units or more were at a rate of 343,000 in August. The number of permits is expected to grow to 1.04 million.

- Janet Yellen speaks: Friday, 12:30. Federal Reserve Chair Janet Yellen is scheduled to speak in Boston. Yellen may shed more light on the FOMC minutes released last week and the gloomy growth outlook despite positive US economic data. Market volatility is expected.

- US Prelim UoM Consumer Sentiment: Friday, 13:55. The preliminary September reading of University of Michigan’s consumer sentiment soared to 84.6, the highest since July 2013, following 82.5 in the final August reading. Despite consumers’ fears of a slowdown in employment growth, anticipations were high on wage expansion. Consumer expectations jumped to 75.6 from the 71.3 reading last month and above a forecast of 73.0. Consumer sentiment s expected to reach 84.3 this time.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.12 20:23

Forex - Weekly outlook: October 13 - 17The dollar gained ground against most of the other major currencies on Friday amid fears over global growth, but the dollar index snapped a 12-week winning streak as the traditional safe haven yen ended the week higher.

EUR/USD was down 0.48% to 1.2628 late Friday, while GBP/USD slid 0.26% to 1.6074.

Market sentiment was hit by fears that Germany, the euro zone’s largest economy is being dragged into a recession after recent data indicated unexpected weakness in manufacturing and exports.

Data released on Thursday showed that German exports fell 5.8% in August, and this followed weak industrial output figures on Tuesday.

Earlier in the week, the International Monetary Fund cut its forecasts for global growth in 2014 and 2015 and warned that global growth may never reach its pre-crisis levels ever again.

The fund revised down its growth forecasts for the euro area’s three largest economies Germany, France and Italy.

Steep declines in commodity-price declines also fuelled fears that the global economy is slowing. Brent crude oil prices ell to their lowest level for nearly four years on Friday.

USD/JPY was down 0.17% to 107.64 late Friday, and ended the week with losses of 1.97%.

The US Dollar Index, which tracks the performance of the greenback against a basket of six major currencies, ended the week down 1% at 85.92. The move ended a 12-week rally that saw the index gain more than 8% since early July.

The dollar weakened on Wednesday after the minutes of the Federal Reserve’s September meeting showed that some officials were concerned over the impact of the stronger dollar on global growth and the outlook for U.S. inflation.

"Some participants expressed concern that the persistent shortfall of economic growth and inflation in the euro area could lead to a further appreciation of the dollar and have adverse effects on the U.S. external sector," the minutes said.

The commodity linked dollars ended Friday broadly lower, with AUD/USD tumbling 1.10% to 0.8684 in late trade, off the two week highs of 0.8897 struck in the previous session.

NZD/USD lost 0.64% to trade at 0.7812, while USD/CAD eased up 0.14% to 1.1198.

In the week ahead, investors will be awaiting U.S. data on retail sales and industrial production for fresh indications on the strength of the economic recovery. Tuesday’s ZEW report on German economic sentiment will also be closely watched.

Monday, October 13

- Markets in Japan are to remain closed for a national holiday.

- China is to release data on the trade balance.

- Markets in Canada are to remain closed for the Thanksgiving holiday, while U.S. markets will be closed for Columbus Day.

- Australia is to release private sector data on business confidence.

- Switzerland is to report on producer price inflation.

- The U.K. is to produce data on consumer price inflation, which accounts for the majority of overall inflation.

- The ZEW Institute is to release its closely watched report on German economic sentiment, a leading indicator of economic health.

- The euro zone is to publish data on industrial production.

- Australia is to release a private sector report on consumer sentiment, as well as official data on new vehicle sales.

- China is to release data on producer and consumer prices.

- The U.K. is to publish data on the change in the number of people employed and the unemployment rate, as well as data on average earnings.

- The U.S. is to release data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity. The country is also to report on producer prices and manufacturing activity in the New York region.

- New Zealand is to publish private sector data on manufacturing activity, while Australia is to release a report on inflation expectations.

- The euro zone is to publish revised data on consumer prices for September.

- Canada is to release data on manufacturing sales and foreign securities purchases.

- The U.S. is to release the weekly report on initial jobless claims as well as data on industrial production and manufacturing activity in the Philadelphia region.

- Canada is to release data on consumer prices.

- The U.S. is to round up the week with reports on building permits and housing starts, as well as a preliminary report on consumer sentiment.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.12 20:26

EUR/USD weekly outlook: October 13 - 17The euro declined against the dollar on Friday amid concerns the European economy is floundering and may require fresh stimulus measures from the European Central Bank.

EUR/USD hit 1.2790 on Thursday, the pair’s highest level since September 24, before subsequently consolidating at 1.2629 by close of trade on Friday, down 0.48% for the day but still 0.91% higher for the week.

The pair is likely to find support at 1.2582, the low from October 6, and resistance at 1.2790, the high from October 9.

Market sentiment was hit by fears that Germany, the euro zone’s largest economy is being dragged into a recession after recent data indicated unexpected weakness in manufacturing and exports.

Data released on Thursday showed that German exports fell 5.8% in August, and this followed weak industrial output figures on Tuesday.

Earlier in the week, the International Monetary Fund cut its forecasts for global growth in 2014 and 2015 and warned that global growth may never reach its pre-crisis levels ever again.

The fund revised down its growth forecasts for the euro area’s three largest economies Germany, France and Italy.

Steep declines in commodity-price declines also fuelled fears that the global economy is slowing. Brent crude oil prices fell to their lowest level for nearly four years on Friday.

The dollar weakened after the minutes of the Federal Reserve’s September meeting released Wednesday showed that some officials were concerned over a slowdown in global growth and the impact of the stronger dollar on the U.S. inflation outlook.

"Some participants expressed concern that the persistent shortfall of economic growth and inflation in the euro area could lead to a further appreciation of the dollar and have adverse effects on the U.S. external sector," the minutes said.

The minutes prompted investors to trim back expectations for an earlier-than-expected hike in U.S. interest rates.

On Friday, Fed Vice Chairman Stanley Fischer said weaker-than-expected global growth could prompt it to slow the pace of eventual interest rate hikes.

The US Dollar Index, which tracks the performance of the greenback against a basket of six major currencies, ended the week down 1% at 85.92. The move ended a 12-week rally that saw the index gain more than 8% since early July.

In the week ahead, investors will be awaiting U.S. data on retail sales and industrial production for fresh indications on the strength of the economic recovery. Tuesday’s ZEW report on German economic sentiment will also be closely watched.

Monday, October 13

- Markets in the U.S. will be closed for Columbus Day.

- The ZEW Institute is to release its closely watched report on German economic sentiment, a leading indicator of economic health.

- The euro zone is to publish data on industrial production.

- The U.S. is to release data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity. The country is also to report on producer prices and manufacturing activity in the New York region.

- The euro zone is to publish revised data on consumer prices for September.

- The U.S. is to release the weekly report on initial jobless claims as well as data on industrial production and manufacturing activity in the Philadelphia region.

- The U.S. is to round up the week with reports on building permits and housing starts, as well as a preliminary report on consumer sentiment.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.14 13:17

2014-10-14 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - German ZEW Economic Sentiment]- past data is 6.9

- forecast data is 0.2

- actual data is -3.6 according to the latest press release

if actual > forecast (or actual data) = good for currency (for EUR in our case)

[EUR - German ZEW Economic Sentiment] = Level of a diffusion index based on surveyed German institutional investors and analysts. It's a leading indicator of economic health - investors and analysts are highly informed by virtue of their job, and changes in their sentiment can be an early signal of future economic activity.

==========

German Oct ZEW Economic Sentiment Worse Than Forecast; Lowest Since 2012

Germany's investor confidence deteriorated for the tenth successive month in October, turning negative for the first time since late 2012, as the economic situation is expected to worsen further.

The ZEW Indicator of Economic Sentiment dropped to -3.6 from 6.9 in September, the Mannheim-based Centre for European Economic Research/ZEW said. It was far worse than the zero reading forecast by economists.

The latest score was the first negative since November 2012, when the print was -15.7.

The current conditions index of the survey plunged to 3.2 from 25.4 in the previous month. Economists had forecast a reading of 15 for the month.

"Geopolitical tensions and the weak economic development in some parts of the Eurozone, which is falling short of previous expectations, are a source of persistent uncertainty. These factors are tarnishing growth expectations in Germany," ZEW President Clemens Fuest said.

"Disappointing figures concerning incoming orders, industrial production, and foreign trade have likely contributed to the growing pessimism among financial market experts."

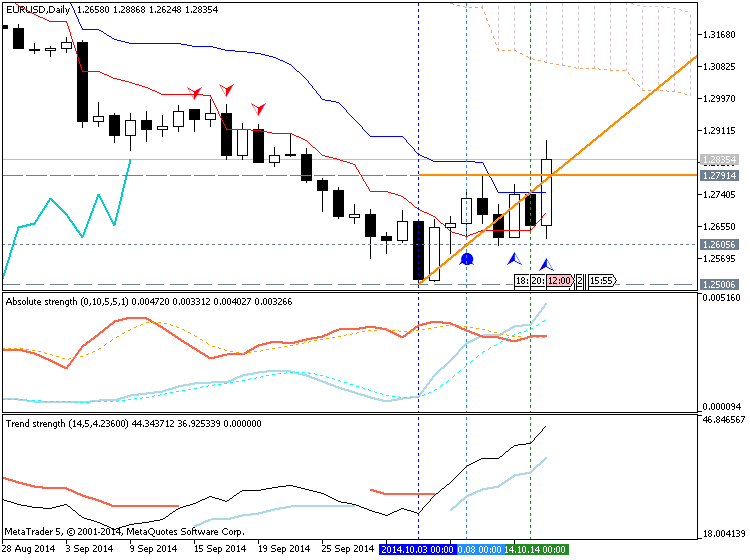

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5: 36 pips price movement by EUR - German ZEW Economic Sentiment news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.14 19:20

EUR/USD Bear Flag in Focus Amid Growing Risk for Euro-Zone Recession (based on dailyfx article)

- EUR/USD Bear Flag Remains in Play Even as Germany Cuts 2014,201 GDP Forecast.

- GBP/USD Bearish RSI Momentum Continues to Take Shape as U.K. CPI Disappoints.

- Looks as though a bearish flag pattern is taking shape in EUR/USD as it carves a string of higher-lows even as Germany cuts its 2014 growth forecast to 1.2% from an initial forecast of 1.8%.

- Will look for a continuation of the long-term bearish trend once the Relative Strength Index (RSI) breaks the near-term upward momentum.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.15 06:07

EUR/USD Technical Analysis: Waiting to Re-Enter Short Trade (adapted from dailyfx article)

- EUR/USD Technical Strategy: Flat

- Support: 1.2615, 1.2507, 1.2332

- Resistance:1.2783, 1.2958, 1.3100

The Euro recovered against US Dollar as expected after putting in a bullish Piercing Line candlestick pattern. A daily close above the 23.6% Fibonacci retracementat

1.2783 exposes the 38.2% level at 1.2958. Alternatively, a turn below

the 14.6% Fib expansion at 1.2615 clears the way for a challenge of the

23.6% threshold at 1.2507.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.15 15:13

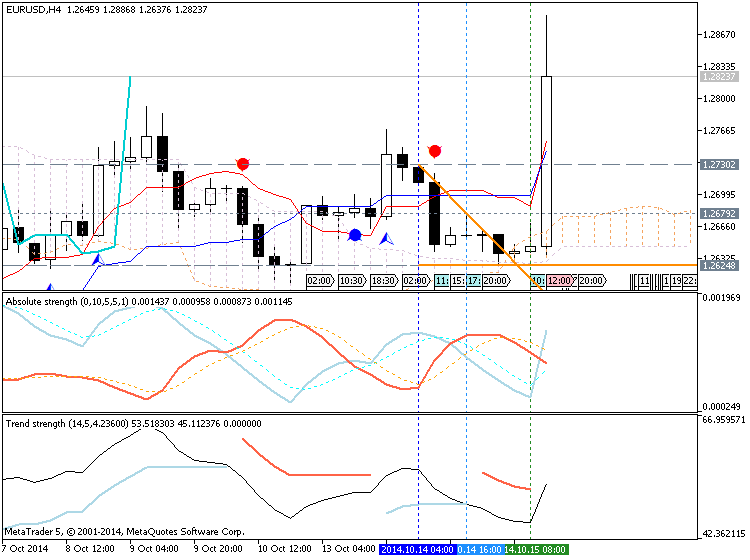

2014-10-15 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Retail Sales]- past data is 0.6%

- forecast data is -0.1%

- actual data is -0.3% according to the latest press release

if actual > forecast (or actual data) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level. It's the primary gauge of consumer spending, which accounts for the majority of overall economic activity

==========

U.S. Retail Sales Fall More Than Expected In September

Retail sales in the U.S. fell by more than anticipated in the month of September, according to a report released by the Commerce Department on Wednesday, with the decrease partly reflecting the recent drop in gas prices.

The report said retail sales dropped by 0.3 percent in September after climbing by 0.6 percent in August. Economists had been expecting sales to edge down by just 0.1 percent.

Excluding a pullback in auto sales, retail sales dipped by 0.2 percent in September compared to a 0.3 percent increase in the previous month. Ex-auto sales had been expected to rise by another 0.3 percent.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5: 87 pips price movement by USD - Retail Sales news event

- Recommendation for long: watch D1 price to break 1.2791 resistance for possible buy trade

- Recommendation to go short: watch D1 price to break 1.2500 support for possible sell trade

- Trading Summary: bearish

It is breakout going on for H4 timeframe, and 1.2791 resistance level is going to be broken on D1 timeframe. I mean - if someone opened buy stop order at 1,2791 so this person already got good profit.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.16 06:04

EUR/USD consolidation continues (adapted from dailyfx article)

- EUR/USD has traded in a sideways to higher range since finding support near 1.2500 at the start of the month

- Our near-term trend bias is higher in the euro while over 1.2605

- The 61.8% retracement of the 2012/2014 advance (polarity) at 1.2785 needs to be overcome to set off a more important correcttive move higher

- Early next week is the next minor turn window in the rate

- A close under 1.2605 would warn the downtrend has resumed ahead of schedule

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| EUR/USD | 1.2605 | 1.2645 | 1.2645 | 1.2700 | 1.2785 |

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on bearish ranging between 1.2500 support and 1.2791 resistance levels.

H4 price is on bullish correction:

W1 price is on bearish for trying to break 1.2500 key support level.

MN price: bearish - Chinkou Span line crossed the price on open bar together with 1.2571 support level to be broken on open bar too. If Chinkou Span line will break MN price from above to below on close monthly bar so we may see the bearish market condition for this pair to be up to the end of next years for example :) I just hope it will not be start on this November.

If D1 price will break 1.2500 support level so the primary bearish will be continuing (good to open sell trade for example)

If D1 price will break 1.2791 resistance - we may see the secondary market rally inside primary bearish (good to counter-trend trading systems)

If not so we may see the ranging market condition within bearish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-10-14 06:45 GMT (or 08:45 MQ MT5 time) | [EUR - French CPI]

2014-10-14 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - German ZEW Economic Sentiment]

2014-10-15 01:30 GMT (or 03:30 MQ MT5 time) | [CNY - PPI]

2014-10-15 01:30 GMT (or 03:30 MQ MT5 time) | [CNY - CPI]

2014-10-15 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - ECB President Draghi Speech]

2014-10-15 12:30 GMT (or 14:30 MQ MT5 time) | [USD - PPI]

2014-10-15 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Retail Sales]

2014-10-15 18:00 GMT (or 20:00 MQ MT5 time) | [EUR - ECB President Draghi Speech]

2014-10-16 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - CPI]

2014-10-16 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

2014-10-16 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Philly Fed Manufacturing Index]

2014-10-17 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Building Permits]

2014-10-17 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2014-10-17 13:55 GMT (or 15:55 MQ MT5 time) | [USD - UoM Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movement

SUMMARY : bearish

TREND : bearish

Intraday Chart