Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.18 12:07

Forex Weekly Outlook October 20-24The US dollar was on the back foot against most currencies as volatility spiked and big moves provided opportunity and risk. US housing and inflation data, A rate decision in Canada and UK GDP are the lead events on our FX calendar. Here is an outlook on the major events for this week.

Weak US retail sales sent stock markets down and triggered a sell off of the dollar. The best jobless claims in 14 years and some other OK figures could not lift the greenback, especially after FOMC member Bullard suggested to continue QE on lower inflation expectations. Weakness in other regions didn’t really help the greenback. In the euro-zone, German business confidence went negative, the German government cut forecasts and yields spike in peripheral bond markets as if it were 2012. In the UK, inflation is at a 5 year low and not all unemployment figures shine. The crash in oil prices contributed to 5 year high for USD/CAD but this didn’t last too long. The kiwi enjoyed a rise in milk prices. The yen enjoyed the risk off environment. All in all, currencies made big moves.

- US inflation data: Wednesday, 12:30. U.S. consumer prices declined for the first time in nearly 1-1/2 years in August, dropping 0.2%, following a 0.1% rise in July. Meanwhile, Core prices remained unchanged in August indicating muted inflation pressures. Economists expected CPI to remain unchanged while core CPI to rise 0.2%. If this trend continues the Fed may postpone the intended rate hike. CPI is expected to remain unchanged, while core CPI is predicted to gain 0.2%.

- Canadian rate decision: Wednesday, 14:00. The Bank of Canada maintained the interest rate at 1% at the last BOC meeting held in September. BOC Governor Stephen Poloz said exports are gaining traction posting the biggest merchandise trade surplus in almost six years, which is a positive sign for the coming months, however business investment remains rather muted. Poloz declined to comment on whether he would raise rates before the U.S. Federal Reserve. Rat s are expected to remain at 1.0%.

- Glenn Stevens speaks: Wednesday, 9:00. RBA Governor Glenn Stevens is scheduled to speak in Sydney Limits. He may talk about the need to cool down bank lending to the housing market. Investment finance reached double-digit rates, nearly half the flow of new approvals. Stevens talks about the need to intervene by using macro-prudential tools such as limiting the proportion of a property’s value that could be borrowed and extra stress tests on banks. Mr Stevens said the right type of risk-taking is good provided it’s clear who bears it. The economy needs an efficient allocation of savings, liquidity services provided to the community, payment services to be provided and and risk to be priced properly for those who wish to bear it.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing initial claims for unemployment benefits plunged to a 14-year low last week, reaching 264,000 from 287,000 posted in the week before. The four-week moving average of claims, continued to improve falling 4,250 to 283,500, also the lowest level since 2000.The US economy continues to move ahead with growth rate expectations of 3% in the third quarter. A rise of 269,000 is forecasted this week.

- UK GDP data: Friday 8:30. UK growth data in the second quarter showed the economy has emerged from six years of muted growth and returned to its pre-crisis peak. Gross domestic product (GDP) expanded by 0.8% in the second quarter following the same rise in the first quarter. On an annual basis, growth was 3.1% higher than measured in the same period last year. The upward trend in the UK economy raises expectations for a rate hike but Governor Mark Carney recently suggested it would be tied to improved data on wage growth to prevent damaging consumer spending and domestic growth. UK economy is expected to expand by 0.7% in the third quarter.

- US New Home Sales: Friday, 14:00. US new-home sales surged in August to the highest level in more than six years, reaching an annualized pace of 504,000 from 412,000 in July. The one-month surge was the biggest since January 1992 indicating the housing recovery is gaining traction. Economists expected a much smaller figure of 432.000. Purchases increased in three of four U.S. regions, led by a 50% expansion in the West. US new-home sales is expected to reach an annual growth rate of 473,000.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.19 14:33

EUR/USD forecast for the week of October 20, 2014, Technical AnalysisThe EUR/USD pair broke out during the course of the week, climbing above the 1.28 handle. However, we could not keep the gains from that move, and we turned back around to form a massive shooting star. That shooting star suggests that the market is going to drop down to the 1.25 level yet again, and as a result we think that ultimately this market will break down below that level and head to the 1.20 level given enough time. On the other hand, if we can break above the 1.30 level, we would be buyers.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.19 14:59

Weekly outlook: October 20 - 24The dollar gained ground against the euro and the yen on Friday as upbeat U.S. economic reports eased concerns over the outlook for the recovery, after a week of volatile trading, fuelled by fears over a slowdown in global growth.

USD/JPY was up 0.53% to 106.88 late Friday, while EUR/USD slid 0.38% to 1.2759.

The US Dollar Index, which tracks the performance of the greenback against a basket of six major currencies, was up 0.33% to 85.31, but still ended the week lower, its second consecutive weekly decline.

The greenback was boosted after a report showed that the University of Michigan’s consumer sentiment index unexpectedly rose to 86.4 in October, the most since July 2007.

Another report showed that housing starts rose more than expected last month, bolstering the outlook for the sector.

The data reinforced expectations that the Federal Reserve will raise interest rates in the second half of 2015.

The dollar fell against the other major currencies on Wednesday, touching a one month low against the yen and a three week trough against the euro amid a selloff sparked by fears that slower global growth would act as a drag on the U.S. economy.

Dovish comments by central bank officials on Friday also helped ease investor jitters over slowing growth in major economies.

Bank of England chief economist Andy Haldane that rates could remain lower for longer and warned that global economic conditions have worsened.

On Thursday, European Central Bank official Ewald Nowotny said the bank still has leeway for more action to address slowing inflation in the euro area and added that quantitative easing would start as soon as December.

The dollar was also higher against the Swiss franc on Friday, with USD/CHF rising 0.37% to 0.9459. The pound was little changed, with GBP/USD at 1.6092 in late trade.

In the week ahead, China and the U.K. are to release preliminary data on third quarter economic growth, while the euro zone is to release preliminary data on private sector activity.

The U.S. is to release data on consumer inflation, as well as reports on both existing and new home sales.

Monday, October 20

- Germany’s Bundesbank is to publish its monthly report.

- Canada is to release data on wholesale sales.

- The Reserve Bank of Australia is to publish the minutes of its latest policy meeting, which contain valuable insights into economic conditions from the bank’s perspective.

- China is to release what will be closely watched data on third quarter gross domestic product and separate reports on industrial production and fixed asset investment.

- Switzerland is to report on the trade balance, the difference in value between imports and exports.

- The U.K. is to produce data on public sector borrowing.

- The U.S. is to release private sector data on existing home sales.

- Japan is to release a report on the trade balance.

- Australia is to publish data on consumer price inflation, which comprises the majority of overall inflation.

- The BoE is to release the minutes of its latest policy meeting.

- Canada is to release data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity.

- The U.S. is to produce data on consumer prices.

- Later in the day, the Bank of Canada is to announce its overnight rate and publish its rate statement. The announcement is to be followed by a regularly scheduled press conference.

- RBA Governor Glenn Stevens is to speak at an event in Sydney; his comments will be closely watched.

- New Zealand is to release data on consumer prices.

- Australia is to publish private sector data on business confidence.

- China is to release the preliminary reading of its HSBC manufacturing index.

- The euro zone is to publish preliminary data on private sector activity, while Germany and France are to also to publish data on private sector growth.

- The U.K. is to report on retail sales and also release private sector data on mortgage approvals and industrial order expectations.

- The U.S. is to publish its weekly report on initial jobless claims.

- New Zealand is to release data on the trade balance.

- The Gfk think tank is to release its report on German business climate.

- The U.K. is to release preliminary data on third quarter GDP growth.

- The U.S. is to round up the week with a report on new home sales.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.21 06:54

2014-10-21 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - GDP]- past data is 7.5%

- forecast data is 7.2%

- actual data is 7.3% according to the latest press release

if actual > forecast (or actual data) = good for currency (for CNY in our case)

[CNY - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

China GDP Rises 7.3% On Year In Q3

China's gross domestic product expanded 7.3 percent on year in the third quarter of 2014, the government said on Tuesday - topping expectations for an increase of 7.2 percent but slowing from 7.5 percent in Q2.

On an annualized quarterly basis, GDP was up 1.9 percent - also beating forecasts for 1.8 percent and down from 2.0 percent in the previous three months.

The government also said that industrial production climbed 8.0 percent on year in September, beating expectations for 7.5 percent and up from 6.9 percent in August.

Retail sales climbed an annual 11.6 percent, just shy of forecasts for 11.7 percent and down from 11.9 percent in the previous three months.

Fixed asset investment jumped 16.1 percent on year, also missing expectations for 16.3 percent and down from 16.5 percent in the three months prior.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5: 13 pips price movement by CNY - GDP news event

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video October 2014

newdigital, 2014.10.22 07:20

Video: Equities Soar but Dollar, Euro, Yen Show Little ’Risk’ Response

- The S&P 500 posted its biggest rally in 12 months and volatility measures further caved

- Yet, the strong sentiment implied in this equities swell wasn't shared by FX and other markets

- Event risk ahead turns the focus on monetary policy for the Dollar, Euro and Pound Want to develop a more in-depth knowledge on the market and strategies?

Following its worst weekly tumble in over two years, US equities have

extended their recovery to a fourth session and the best single-day

climb in 12 months. Alongside, a drop in volatility measures, this looks

like the makings of a recovery in investor sentiment. That said, there

was little of the S&P 500 and Dow exuberance seen in other asset

classes. Is the surge in equities a false harbinger or will it just take

time for other markets to catch up? FX traders moving forward will have

to assess broader sentiment trends against monetary policy forecasts as

the economic docket fills out with key event risk. We look at both

themes and their market influence in today's Trading Video.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.22 11:53

Trading the News: U.S. Consumer Price Index (CPI) (based on dailyfx article)

- U.S. Consumer Price Index (CPI) to Slow for Third Consecutive Month.

- Core Rate of Inflation to Hold at Annualized 1.7% for Second Month.

A further slowdown in the U.S. Consumer Price Index (CPI) may spark a bearish dollar reaction (bullish EUR/USD) as the majority of the Federal Open Market Committee (FOMC) remain in no rush to normalize monetary policy.

What’s Expected:

Why Is This Event Important:

Even though the Fed is widely expected to conclude its quantitative

easing (QE) program at the October 29 meeting, subdued price growth may

encourage the FOMC to retain the zero-interest rate policy (ZIRP) for an

extended period of time in order to promote a stronger recovery.

Easing input costs along with the slowdown in private-sector consumption

may spur a weak CPI print, and the EUR/USD may face a larger correction

over the near-term should the fundamental development drag on interest

rate expectations.

Nevertheless, the ongoing recovery in the labor market paired with the

pickup in economic activity may show an unexpected uptick in price

growth, and a stronger-than-expected inflation report may generate

another wave of USD strength as market participants boost bets for

higher borrowing costs.

How To Trade This Event Risk

Bearish USD Trade: Headline & Core Inflation Continue to Undershoot

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in the opposite direction

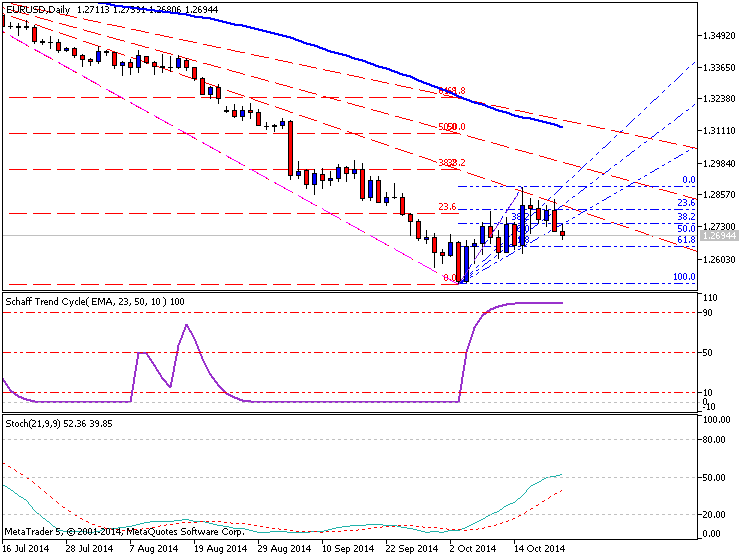

EUR/USD Daily Chart

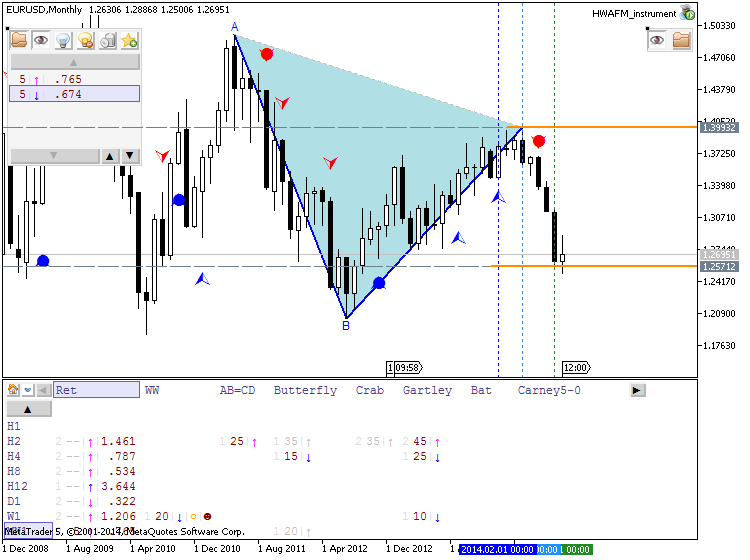

EUR/USD Monthly Chart

- Failure to retain the bullish RSI momentum raises the risk for a further decline in EUR/USD.

- Interim Resistance: 1.2900 (61.8% retracement) to 1.2940 (38.2% expansion)

- Interim Support: 1.2460 (78.6% retracement) to 1.2500 Pivot

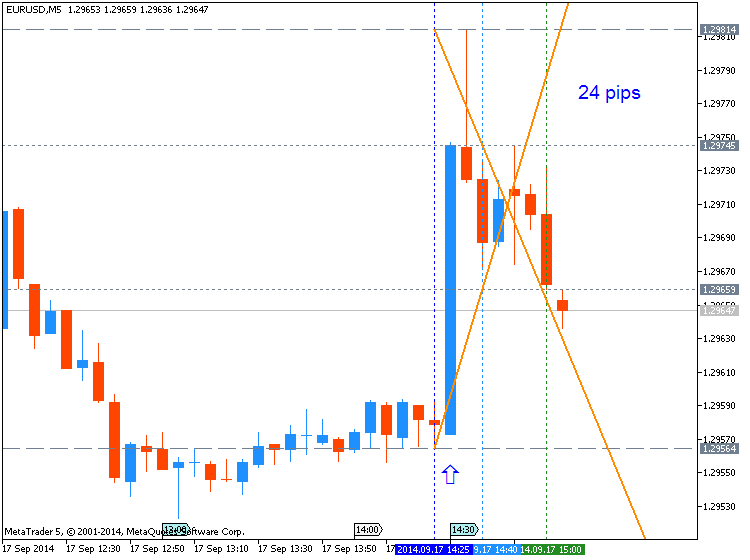

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| AUG 2014 |

9/17/2014 12:30 GMT | 1.9% | 1.7% | +1 | -93 |

August 2014 U.S. Consumer Price Index

EURUSD M5 : 24 pips price movement by USD - CPI news event

The U.S. Consumer Price Index (CPI) slowed more-than-expected in August, with the headline reading slipping to 1.7% from 2.0% in July, while the core rate of inflation unexpectedly narrowed to 1.7% to mark the slowest pace of growth since March. Even though the Fed argues inflation expectations remain firmly anchored, subdued price growth may continue to delay the normalization cycle as Chair Janet Yellen remains in no rush to abandon the zero-interest rate policy (ZIRP). Despite the limited market reaction to the weak CPI print, the greenback regained its footing during the North America trade, with the EUR/USD dipping below the 1.2850 region and closing the day at 1.2864.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

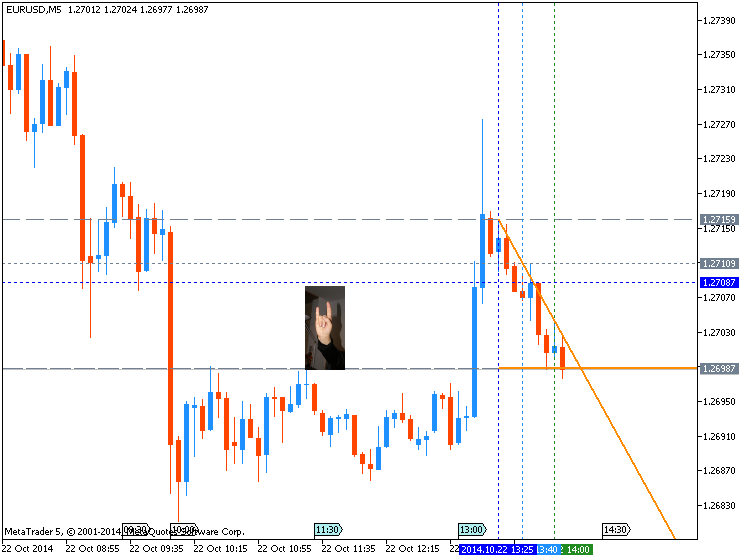

EURUSD M5: 38 pips price movement by USD - CPI news event

This is very famous pattern namely Sign of the horns

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.23 06:28

2014-10-23 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]- past data is 50.2

- forecast data is 50.2

- actual data is 50.4 according to the latest press release

if actual > forecast (or actual data) = good for currency (for CNY in our case)

[CNY - HSBC Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

==========

China Manufacturing PMI Rises Slightly In October - HSBC

China's manufacturing sector continued to expand at a slightly accelerated pace in October, the latest survey from HSBC Bank revealed in Thursday's preliminary reading with a PMI score of 50.4.

Now at a three-month high, the October score is up marginally from 50.2 in September.

A score above 50 signals expansion in a sector, while a reading below means contraction.

"Domestic as well as external demand showed some signs of slowing although both remained in expansion territory. Disinflationary pressures intensified, as both the input and output price indices declined further. Meanwhile both employment and inventory indices improved," said Hongbin Qu, Chief Economist, China & Co- Head of Asian Economic Research at HSBC.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5: 7 pips price movement by CNY - HSBC Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.23 09:48

2014-10-23 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - French Manufacturing PMI]- past data is 48.8

- forecast data is 48.6

- actual data is 47.3 according to the latest press release

if actual > forecast (or actual data) = good for currency (for EUR in our case)

[EUR - French Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

==========

French Private Sector Contracts At Fastest Pace In 8 Months

The French private sector contracted at the sharpest rate in eight months in October, flash survey data from Markit Economics showed Thursday.

The composite output index fell to 48 in October from 48.4 in September. This was the lowest reading since February, albeit indicative of a moderate rate of contraction overall.

The services Purchasing Managers' Index slid to 48.1 from 48.4 in September. The index was forecast to fall marginally to 48.3.

Likewise, the manufacturing PMI dropped to 47.3 in October from 48.8 a month ago. The reading was forecast to ease to 48.5.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5: 19 pips price movement by EUR - French Manufacturing PMI news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on bearish ranging between 1.2583 support and 1.2886 resistance levels.

H4 price is on bullish ranging between 1.2705 support and 1.2839 resistance:

W1 price is on bearish: market rallyf as secondary trend is just started with 1.2500 as a key support level.

MN price: bearish - Chinkou Span line is crossing the price on open bar together with 1.2571 support level which is ready to be broken on open bar too. If Chinkou Span line will break MN price from above to below on close monthly bar so we may see the bearish market condition for this pair for the next months of this and next year. I just hope it will not be start on this November.

If D1 price will break 1.2583 support level so the primary bearish will be continuing (good to open sell trade for example)

If D1 price will break 1.2886 resistance - we may see the secondary market rally inside primary bearish (good to counter-trend trading systems)

If not so we may see the ranging market condition within bearish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-10-20 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German PPI]

2014-10-20 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - Current Account]

2014-10-20 10:00 GMT (or 12:00 MQ MT5 time) | [EUR - German Buba Monthly Report]

2014-10-20 14:00 GMT (or 16:00 MQ MT5 time) | [USD - FOMC Member Powell Speech]

2014-10-21 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - GDP]

2014-10-21 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - Industrial Production]

2014-10-21 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Existing Home Sales]

2014-10-22 12:30 GMT (or 14:30 MQ MT5 time) | [USD - CPI]

2014-10-23 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2014-10-23 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - French Manufacturing PMI]

2014-10-23 07:30 GMT (or 09:30 MQ MT5 time) | [EUR - German Flash Manufacturing PMI]

2014-10-23 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - Manufacturing PMI]

2014-10-23 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

2014-10-24 14:00 GMT (or 16:00 MQ MT5 time) | [USD - New Home Sales]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movement

SUMMARY : bearish

TREND : bearish

Intraday Chart