- How important Risk Reward ratio is?

- if some EA is loosing money continuously , how to inverse that EA such that the loss convert into profit

- Ideal stop loss & take profit on each trade

Neither. Expectation = %W × Rw - %L × Rl. They are both equally important.

If you increase the RR you lower the %W. Usually by the same percent.

Forum on trading, automated trading systems and testing trading strategies

Food for thought and brainstorming

Simon Gniadkowski, 2013.03.14 23:13

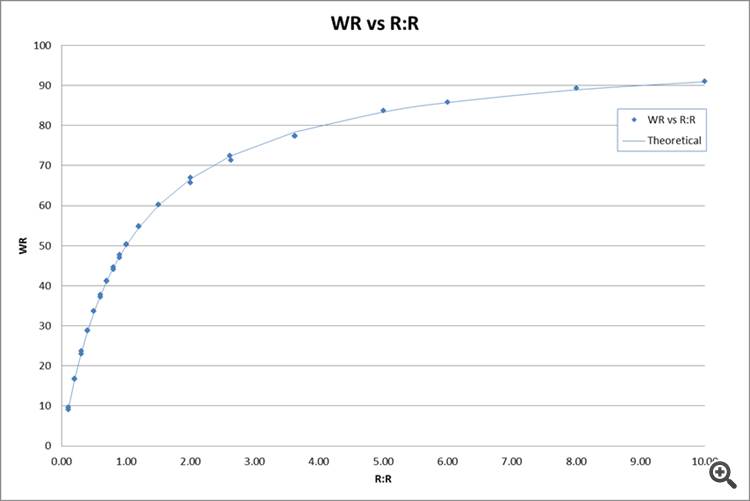

Take a look at this chart, it shows the relation between Win rate (WR) and Risk:Reward (R:R), in this case the spread was 0 and uses a simulated coin toss with an even number of Long and Short trades taken at random with no attempt to predict the direction of the market. You will see for a 50:50 R:R scenario the WR is 50%.

You said TP and SL are 40 pips, did you mean 40 pips or 40 points ? Yo need a figure that is at last 10 times the spread or the spread will play a big part in your results.

No.

As win rate en risk reward is closely correlated in most trading systems. What do you want?

Do you want to loose 9 times to get that 1 big reward. It also can happen it takes 2 times 9 losses to get it.

Or do you want to win 9 out of 10 and take 1 big hit. It also can happen you take 2 big hits in 10 trades.

So the best solution as always when risk is involved. Diversify. Instead of putting all money in 1 setup, split the capital allocation in 3 or if possible 5 of the same with a different RR/WR ratio.

The ride will be much more smooth and therefor more easy to sustain.

Off course this assumes a profitable trading system. Risk reward ratio is just one aspect. It is certainly not the "key" to a profitable trading system.

No.

As win rate en risk reward is closely correlated in most trading systems. What do you want?

Do you want to loose 9 times to get that 1 big reward. It also can happen it takes 2 times 9 losses to get it.

Or do you want to win 9 out of 10 and take 1 big hit. It also can happen you take 2 big hits in 10 trades.

So the best solution as always when risk is involved. Diversify. Instead of putting all money in 1 setup, split the capital allocation in 3 or if possible 5 of the same with a different RR/WR ratio.

The ride will be much more smooth and therefor more easy to sustain.

Off course this assumes a profitable trading system. Risk reward ratio is just one aspect. It is certainly not the "key" to a profitable trading system.

From psihological point of view it is better to win more times with low RR, than to win only few times with high RR.

But if you master winrate and RR then you are big winner :)

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use