Forum on trading, automated trading systems and testing trading strategies

How to get opening and current price information according to position interpretation?

Vladimir Karputov, 2020.12.28 11:21

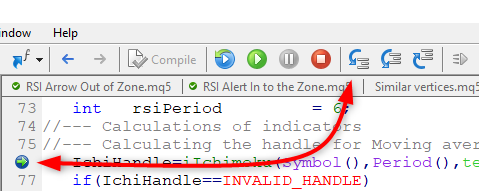

Remember the rule: the indicator handle MUST be received ONCE! This is done in OnInit () !!!

So the reason why its not opening trades is because of position misinterpretation right?

The challenge i am having is of adding Ichimoku on the same window with RSI. Could you help on that as well?

So the reason why its not opening trades is because of position misinterpretation right?

The challenge i am having is of adding Ichimoku on the same window with RSI. Could you help on that as well?

I told you the first mistake. Until you fix the first mistake, there is no point in discussing anything.

I have made quite a number of changes on the algorithm.

I have restructured it and corrected this as well

[Remember the rule: the indicator handle MUST be received ONCE! This is done in OnInit () !!!]EA compiles with no errors but still does not run in the strategy tester.

I have made quite a number of changes on the algorithm.

I have restructured it and corrected this as well

[Remember the rule: the indicator handle MUST be received ONCE! This is done in OnInit () !!!]EA compiles with no errors but still does not run in the strategy tester .

Never spare ink. Always handle possible errors - if an error is received, you will see it immediately. Use step-by-step debugging -

this is the foundation of testing.

Example of correct processing (for iRSI)

//--- create handle of the indicator iRSI handle_iRSI=iRSI(m_symbol.Name(),Inp_RSI_period,Inp_RSI_ma_period,Inp_RSI_applied_price); //--- if the handle is not created if(handle_iRSI==INVALID_HANDLE) { //--- tell about the failure and output the error code PrintFormat("Failed to create handle of the iRSI indicator for the symbol %s/%s, error code %d", m_symbol.Name(), EnumToString(Inp_RSI_period), GetLastError()); //--- the indicator is stopped early return(INIT_FAILED); }

Never spare ink. Always handle possible errors - if an error is received, you will see it immediately. Use step-by-step debugging -

this is the foundation of testing.

Example of correct processing (for iRSI)

I had created the handle for RSI (stand-alone), but then i had to create the handle for ichimoku on RSI, thats where i had to use ichimoku handle as applied price for RSI.

So that you can see your mistake - first do as I said: do the defense and check. When you catch an error, you will see a description of your error in the terminal log.

I have coded an EA which trades the Ichimoku of RSI.

It is compiling no errors, no warnings but its not running any trade even on the strategy tester.

In case i missed a certain line of algorithm or did something wrong, may you assist.

1st of all the images that you have displayed makes no sense. As stochastic/rsi and ichimoku cloud does not match based on their values.

Also you have applied them in a single indicator window that will not do any kind of changes in your code neither you can make sense of two indicators that have entirely different values to each other.

E.g:

RSI/Stochastic has value range between 0-100 and can be marked in indicator window, based on that you can trade or make any trading system.

Ichimoku Cloud has value based on the chart you apply that indicator, the indicator will have values relevant to the instrument prices not between the range of 0-100. Doesn't matters if you apply them in indicator window with any combination of other indicator. They are not going to make sense.

So you might consider changing your approach regarding the system you are trying to build or use some other indicators and use the indicators in correct way.

I have coded an EA which trades the Ichimoku of RSI.

It is compiling no errors, no warnings but its not running any trade even on the strategy tester.

In case i missed a certain line of algorithm or did something wrong, may you assist.

//Executing strategy here bool buycondition = (currentTenkansen<15 && priorTenkansen<=15) //Tenkansen line has touched level 15 && (myRSIValue<15); //while RSI line is below level 15 bool sellcondition = (currentTenkansen>85 && priorTenkansen>=85)//Tenkansen line has touched level 85 && (myRSIValue<85); //while RSI line is above level 85

These two cases are always true, because the value of sen band is always greater than these values.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

I have coded an EA which trades the Ichimoku of RSI.

It is compiling no errors, no warnings but its not running any trade even on the strategy tester.

In case i missed a certain line of algorithm or did something wrong, may you assist.